MetLife is a well-known insurance company that offers a range of insurance products, including life insurance. The company has a long history dating back to the 1860s and has established itself as a leading insurer in the US and worldwide. In terms of financial strength and claims-paying ability, MetLife has received strong ratings from AM Best, one of the top insurance rating organisations in the country. The company's life insurance division has been rated Superior with an A+ rating by AM Best, indicating its ability to meet insurance obligations and pay out claims. However, it's important to note that MetLife's life insurance products are typically offered as employer-provided group insurance plans rather than individual policies.

| Characteristics | Values |

|---|---|

| AM Best Rating | A+ (Superior) |

| Customer Complaint Score | 1.00 (Average) |

| Customer Service Number | 1-800-638-5433 |

| Individual Life Insurance Number | 1-800-638-5000 |

| Group Life Insurance Number | 1-800-638-6420 |

What You'll Learn

MetLife's AM Best rating

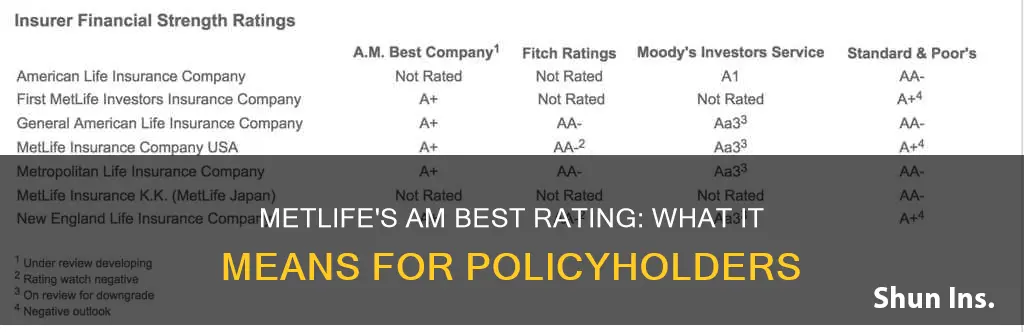

MetLife has an A+ (Superior) rating from AM Best, which is one of the nation's leading insurance-rating organisations. This rating reflects MetLife's financial strength and ability to pay out claims in the event of a death. The company's historical ability to pay out claims is further evidenced by its high scores in the 2022 and 2023 J.D. Power U.S. Group and Individual Life Insurance Studies, where it scored above the industry average.

MetLife's A+ rating from AM Best indicates that the company has a superior ability to meet its insurance obligations. This rating is the second-highest possible score, with only one other company, Thrivent, achieving a higher score of A++. MetLife's rating is a reflection of its strong financial position and its ability to pay claims.

While MetLife's AM Best rating is positive, it is important to consider other factors when evaluating the company's insurance offerings. For example, many of MetLife's insurance policies are only available through an employer, and the company has received some negative reviews from customers regarding its claims process and customer service.

Overall, MetLife's AM Best rating of A+ indicates that the company is financially stable and able to meet its insurance obligations. However, customers should also consider other factors, such as the availability of policies and the quality of customer service, when making decisions about their insurance needs.

Unlocking Loan Options with Life Insurance Policies

You may want to see also

MetLife's life insurance products

MetLife offers a wide range of life insurance products, including term, whole, guaranteed acceptance, survivor, universal, and variable universal policies. The company has a simplified issue term policy product that does not require a medical exam, only a few health questions, and can be purchased online, with coverage ranging from $10,000 to $100,000. MetLife also offers a one-year term policy for those aged 18 to 85, with a minimum coverage of $100,000.

The standard term policy products are available in 10-, 15-, 20-, and 30-year terms, with varying age restrictions. These policies are convertible to permanent products and have several rider options, including disability waiver of premium, convertible disability waiver of premium, and acceleration of death benefit.

MetLife's whole life insurance series is called the Promise Whole Life line, which includes Whole Life, Whole Life Select, and Whole Life 120, with varying premium payment periods and minimum face values. Riders available on these policies include the Enricher Rider, which allows the purchase of additional whole life insurance, and the guaranteed insurability rider.

MetLife also offers a guaranteed acceptance policy, available to those aged 50 to 75, with no medical exam or health questions, and coverage ranging from $2,000 to $25,000. Due to the nature of the policy, death claims within the first two years may result in the return of the premium paid rather than the face amount of the policy.

The company's universal life insurance products include the Legacy Advantage Survivorship, Secure Flex, Premier Accumulator, and Provider, with varying issue ages, face values, and rider options. MetLife's variable universal life product is called the Equity Advantage, with a wide range of riders available, including the children's term insurance rider and the guaranteed minimum death benefit rider.

In addition to its life insurance products, MetLife also provides dental, vision, pet, and health insurance, as well as financial products such as Health Savings Accounts (HSAs) and employer-sponsored retirement plans.

Life Insurance Ratings: Haven Life's Performance Reviewed

You may want to see also

MetLife's customer satisfaction

However, some customers have complained about unexpected delays or denials of claims, as well as poor communication and rude customer service. There are also complaints about the limited online offerings and resources, such as the inability to file a claim or pay bills online.

MetLife's customer complaint ratio of 0.13 is much lower than the median score of 1 for all insurers, suggesting that the company receives fewer complaints than other insurers. The National Association of Insurance Commissioners (NAIC) has assigned MetLife a complaint index of 0.86 for 2023, which is slightly below the industry average, indicating fewer complaints than expected for its market share.

Overall, while MetLife has received some negative feedback, its customer satisfaction ratings and complaint indexes suggest that customers are generally satisfied with the company's services.

Life Insurance: Taxable Income Reduction Strategy?

You may want to see also

MetLife's financial strength

MetLife has a longstanding history and substantial footprint in the insurance world. The company has received high third-party ratings for customer satisfaction and financial strength.

The Metropolitan Life Insurance Company and Metropolitan Tower Life Insurance Company have earned A+ (Superior) AM Best financial strength ratings. This score reflects an insurer's historical ability to pay out claims in the event of a death. AM Best's ratings are under continuous review and are subject to change.

MetLife also has solid scores from S&P and Moody's. These scores are a reflection of MetLife's financial strength and claims-paying ability.

MetLife is the largest insurer in the country and has a long history of stability. It has an A+ rating for financial strength from AM Best. The company's parent company, MetLife, Inc., is one of the largest insurance sales companies in the world, with over 90 million customers in more than 60 countries.

In 2010, MetLife acquired American Life Insurance Company, adding an international scope and increasing its customer base. In recent years, MetLife has undergone some changes, including the sale of its home and auto insurance business to Farmers Insurance in 2021. The company has also announced plans to divest itself of its US insurance business and establish a new entity called Brighthouse Financial. Despite these changes, MetLife remains a reliable and financially strong insurance provider.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

MetLife's pros and cons

MetLife's Pros

MetLife is a well-known and established insurance company with a long history, offering a wide range of insurance products, including life, health, auto, dental, disability, and small business insurance. The company has received high financial strength ratings from AM Best, S&P, and Moody's, indicating its ability to meet financial obligations and pay out claims. MetLife offers group life insurance plans with flexible coverage options, including term life, whole life, universal life, and variable universal life insurance. The company also provides extra benefits such as financial planning and grief counselling, and some policies do not require a medical exam. MetLife has an above-average customer satisfaction score in J.D. Power studies and a low customer complaint ratio.

MetLife's Cons

MetLife's insurance policies are mostly available through employer-provided group insurance plans, and not designed for individual purchase. The company's online resources and offerings are limited; customers cannot file claims or pay bills online, and the mobile app does not cater to life insurance customers. There is also limited information available online about MetLife's policy offerings, making it challenging for prospective customers to make informed decisions. Additionally, the life insurance division is expected to split from the parent company and become Brighthouse Financial, creating uncertainty about the impact on new and existing customers.

Life Insurance for APWU Retirees: What's Available?

You may want to see also

Frequently asked questions

MetLife has an A+ (Superior) rating from AM Best.

The AM Best rating reflects MetLife's financial strength and historical ability to pay out claims in the event of a death.

MetLife offers term life insurance, permanent life insurance, and group life insurance. Term life insurance includes Basic Term Life, Supplemental Term Life, and Dependent Term Life. Permanent life insurance includes group universal and group variable universal life insurance.

To file a life insurance claim with MetLife, you can call their claims center or download and fill out the claim forms, along with providing necessary documentation such as the policy and a certified copy of the death certificate.

Some advantages of MetLife life insurance include its financial strength, stability, and customer satisfaction ratings. However, there are limited online resources and information about policy offerings, and the company's life insurance division is expected to split off and become Brighthouse Financial, creating uncertainty for customers.