If you're a beneficiary of a life insurance policy, the payout, or death benefit, is typically tax-free. However, there are some exceptions. For example, if the payout has accumulated interest, taxes are usually due. If the policyholder names their estate as a beneficiary, taxes may also apply, depending on the estate's value. Additionally, if the insured and the policy owner are different people, there may be taxes involved. To avoid paying taxes on a life insurance payout, you can use strategies such as transferring ownership of the policy or creating an irrevocable life insurance trust (ILIT).

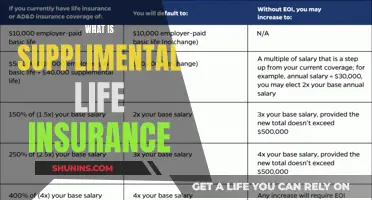

| Characteristics | Values |

|---|---|

| Are life insurance payouts taxed? | In most cases, life insurance payouts are not taxed. |

| Are there exceptions? | Yes, there are some exceptions. |

| What are the exceptions? | - If the policy accrued interest. |

- If the policyholder names the estate as a beneficiary.

- If the insured and the policy owner are different individuals. | | How to avoid paying taxes on a life insurance payout? | - Use an ownership transfer.

- Create an irrevocable life insurance trust (ILIT).

- Keep the gift tax exemption in mind. |

What You'll Learn

- Taxation on interest accrued by the policy

- Taxation when the policyholder names the estate as a beneficiary

- Taxation when the insured and the policy owner are different people

- How to avoid taxation by using an ownership transfer?

- How to avoid taxation by creating an irrevocable life insurance trust (ILIT)?

Taxation on interest accrued by the policy

Term Life Insurance

Term life insurance does not accrue interest as it does not include any financial tools such as earned interest or accumulated cash value.

Permanent Life Insurance

Permanent life insurance usually earns interest, except for final expense insurance. Whole and universal life insurance and their variations almost always provide financial tools and benefits such as gaining interest over time. A portion of the premiums is put into an accumulated cash value account, separate from the face value of the policy. As this amount increases over time, it also earns interest.

Modified Endowment Contracts

If the policy is a modified endowment contract (MEC), taxes are different. In this case, withdrawals are treated as last-in-first-out (LIFO). This means that all withdrawals are considered taxable income until they equal the total interest earned on the contract.

Payout Structure

The payout structure can also impact the taxation of interest accrued by the policy. If the beneficiary chooses to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments could be taxed.

Life Insurance and Hair: What's the Connection?

You may want to see also

Taxation when the policyholder names the estate as a beneficiary

Naming the estate as the beneficiary of a life insurance policy is a common mistake. This is because it subjects the policy to the probate process and increases the estate's value, which could result in high estate taxes for heirs.

According to the Internal Revenue Service (IRS), the value of life insurance proceeds is included in the gross estate if the proceeds are payable to the estate or to named beneficiaries if the policyholder had any "incidents of ownership" in the policy at the time of their death. Incidents of ownership include the legal right to change beneficiaries, borrow against the policy, surrender or cancel the policy, or select beneficiary payment options.

To avoid estate taxes, the policyholder can transfer ownership of the life insurance policy to another person or entity, such as an irrevocable life insurance trust (ILIT). However, the new owner must pay the premiums, and the transfer is irrevocable. Additionally, if the policyholder dies within three years of the transfer, the proceeds will still be included in the estate and taxed accordingly.

It is important to note that even if the policyholder transfers ownership, the proceeds may still be subject to gift taxes if the policy's cash value exceeds the gift tax exclusion, which is $17,000 for 2023.

Life Insurance: Private Health Info's Post-Mortem Impact

You may want to see also

Taxation when the insured and the policy owner are different people

Taxation on life insurance policies can be complex, and it's always best to consult a tax professional for advice. However, here is some information on taxation when the insured and the policy owner are different people.

In most cases, life insurance proceeds are not considered taxable income for the beneficiary. However, there are some instances where the beneficiary can be taxed. One such instance is when the insured and the policy owner are different people. In this case, the beneficiary may be taxed on the payout. This is because the IRS could view the death benefit as a gift from the policy owner to the beneficiary, triggering a gift tax if the amount exceeds the annual exclusion limit. To avoid this complication, financial advisors often suggest that only two parties be involved in the policy, with the insured and the policy owner being the same person.

Another scenario where the beneficiary may be taxed is if the beneficiary is not named in the policy, and the life insurance benefits go into a taxable estate. In this case, the first $11.7 million is not taxed at a federal level, but anything above this amount is subject to estate tax. State regulations vary, but they generally have a lower chance of exemption.

It's important to note that the taxation of life insurance proceeds can depend on various factors, including the type of policy, the relationship between the insured and the beneficiary, and the specific state regulations. Consulting a tax professional can help individuals navigate these complexities and ensure they are compliant with the law.

Warren Buffett's Whole Life Insurance Philosophy Explained

You may want to see also

How to avoid taxation by using an ownership transfer

Life insurance proceeds are typically not taxed, but there are certain situations where taxes could come into play. One way to avoid this is by transferring ownership of the policy. Here's how:

Choose a Competent Adult/Entity as the New Owner

The new owner can be the policy beneficiary. They will then be responsible for making all premium payments. It is important to note that you will give up all rights to make changes to the policy in the future.

Obtain the Proper Forms

Contact your insurance company to obtain the proper assignment or transfer of ownership forms.

Obtain Written Confirmation

Make sure to obtain written confirmation from your insurance company as proof of the ownership change.

Timing is Important

According to the IRS's three-year rule, gifts of life insurance policies made within three years of death are still subject to federal estate tax. Therefore, it is crucial to plan ahead and ensure that the transfer occurs at least three years before the insured's death.

Be Aware of Gift Taxes

If the current cash value of the policy exceeds the gift tax exclusion, gift taxes will be assessed and will be due at the time of the original policyholder's death. For 2022, the gift tax exclusion is $16,000, and for 2023, it is $17,000.

By following these steps, you can effectively transfer ownership of a life insurance policy and potentially avoid taxation on the proceeds. However, it is always recommended to consult with a tax professional or an estate planning attorney to ensure you are making the best decisions for your specific situation.

Life Insurance: Pyramid Scheme or Legit Business?

You may want to see also

How to avoid taxation by creating an irrevocable life insurance trust (ILIT)

Life insurance death benefits are typically tax-free, but there are exceptions. To avoid your mother's life insurance payout being taxed, you could consider setting up an irrevocable life insurance trust (ILIT). Here's how to avoid taxation by creating an ILIT:

Understand the role of an ILIT

An ILIT is a trust created during the insured's lifetime that owns and controls a term or permanent life insurance policy. The trust can also manage and distribute the proceeds paid out upon the insured's death, according to their wishes. ILITs are often used to minimise estate taxes and avoid gift taxes.

Know the parties involved

The parties in an ILIT are the grantor (who typically creates and funds the trust), the trustee (who manages it), and the beneficiaries. It's important for the grantor to avoid any incident of ownership in the life insurance policy.

Be aware of the three-year lookback period

If the grantor transfers an existing life insurance policy to the ILIT, there is a three-year lookback period in which the death benefit could be included in the grantor's estate. To avoid this, set up the ILIT first, have the trustee sign the policy application, and make sure the trust is designated as the original owner when the policy is issued.

Understand the tax implications

The ILIT will have its own federal tax identification number and must file annual state and federal income tax returns. While the grantor is alive, the ILIT usually has no taxable income. When the grantor dies, the death benefits are not taxed because the ILIT is considered a separate legal entity.

Notify the beneficiaries

The trustee must notify the trust beneficiaries of their rights regarding each gift the grantor makes to the trust and maintain records of such "Crummey" notices. The trustee must also work with the beneficiaries to help them understand these notices, especially if they elect to exercise any of their rights.

Consider the costs

Setting up and maintaining an ILIT may require professional fees and the filing of a gift tax return. There may also be costs associated with transferring an existing policy to an ILIT, as this is considered a gift and could use up a portion of the grantor's gift tax exemptions.

By following these steps, you can help ensure that your mother's life insurance payout is not taxed and that the benefits are distributed according to her wishes.

Benefits of Multiple Life Insurance Policies for You

You may want to see also

Frequently asked questions

Yes, if you receive the life insurance payout in instalments, any interest that accrues on those payments is taxable. However, the principal death benefit is not taxed.

If your mother's estate is the beneficiary of her life insurance policy, the death benefit may be subject to estate taxes. In 2024, the federal estate tax ranges from 18% to 40%, depending on how much of the estate is over $13.61 million.

If your mother has a cash value life insurance policy, such as whole or universal life insurance, and the withdrawal or loan amount is more than the total amount of premiums paid, the excess can be taxed.