People with HIV/AIDS have historically faced challenges in accessing health and life insurance due to the condition being labelled a ''pre-existing condition' and the high costs associated with treatment. However, advancements in treatment have led to some insurance companies creating tailored policies for people with HIV/AIDS. While these policies can provide financial support and improve access to healthcare services, they may also come with higher premiums and extensive application processes.

| Characteristics | Values |

|---|---|

| Access to life insurance | People with HIV/AIDS have improved access to life insurance in recent years. |

| People with HIV/AIDS may be excluded from conventional health insurance policies due to high expenses. | |

| Some insurance companies offer tailored policies for people with HIV/AIDS. | |

| People with HIV/AIDS are not legally excluded from "guaranteed issue" group life insurance policies offered by employers. | |

| People with HIV/AIDS may be denied individual term life insurance policies that require a medical review. | |

| People with HIV/AIDS may face higher premiums due to increased risk. | |

| People with HIV/AIDS may be able to obtain a graded death benefit policy or a guaranteed issue life insurance policy with a capped death benefit. | |

| Application process | People with HIV/AIDS may need to provide detailed information about their health, including CD4 count, viral load, medication, and other health conditions. |

| People with HIV/AIDS may need to obtain written statements from their doctors and HIV clinics to support their application. | |

| The application process can take one to two months, depending on how long it takes to receive the necessary documents. | |

| People with HIV/AIDS may be able to obtain life insurance through their employer or trade union without completing a medical questionnaire or disclosing their HIV status. | |

| People with HIV/AIDS should not withhold information or lie about their HIV status when applying for insurance, as this may result in cancellation of the policy. |

What You'll Learn

- People with HIV/AIDS can't be excluded from group life insurance policies offered by employers

- People with HIV/AIDS can get life insurance, but it may be very costly

- People with HIV/AIDS may be denied life insurance coverage due to being viewed as high-risk

- People with HIV/AIDS can get disability insurance coverage through a simplified issue policy or a high-risk policy

- People with HIV/AIDS can get health insurance coverage through the Affordable Care Act

People with HIV/AIDS can't be excluded from group life insurance policies offered by employers

People with HIV can be excluded from conventional health insurance policies due to the high costs associated with treating the condition. However, in recognition of the fact that many HIV-positive people now have a near-normal life expectancy, some insurance companies have started to offer tailored policies.

In the US, the Affordable Care Act (ACA) has improved access to coverage for people with HIV. No American can be denied coverage because of a pre-existing health condition, and insurers are prohibited from cancelling coverage because of mistakes made on an application. The ACA has also made health insurance more affordable and provided free or low-cost coverage through Medicaid and CHIP.

In the UK, people with HIV can take out life insurance, but their viral load, CD4 count, and other pre-existing conditions may impact the cover they can get, including premiums, the length of the policy, and the cash sum paid. In some cases, people with HIV can get group life insurance through their employer without needing to complete a medical questionnaire or disclose their HIV status.

While people with HIV can now access life insurance, they may face higher premiums or be unable to get coverage at all if they go directly to a mainstream insurer. Specialist insurance advisers and brokers can help people with HIV find the right coverage for their needs.

Gun Ownership: Impact on Life Insurance Rates

You may want to see also

People with HIV/AIDS can get life insurance, but it may be very costly

People living with HIV or AIDS can get life insurance, but it may be very costly. In the past, HIV/AIDS was considered a death sentence, and people with the condition were excluded from all but the most basic life insurance coverage. However, in recognition of the fact that HIV/AIDS is now a manageable chronic condition, some insurance companies have started to offer life insurance policies to people living with HIV. For example, in 2015, Prudential Financial Inc., one of the largest life insurers in the US, announced that it would offer traditional individual policies to eligible people living with HIV. This was the first such offering by a major American insurer. Since then, other companies have followed suit, and people with HIV now have more options for life insurance coverage.

That being said, life insurance for people with HIV/AIDS can still be very expensive. People with HIV/AIDS are often excluded from conventional health insurance policies due to the substantial expenses the condition incurs. Insurers consider individuals with HIV/AIDS to be high-risk and may deny them coverage or charge very high premiums. The cost of life insurance for people with HIV/AIDS can also depend on various factors, including their viral load, CD4 count, and other pre-existing conditions. Additionally, the process of applying for life insurance with HIV/AIDS can be complex and may involve detailed questions about one's health and medical history.

People with HIV/AIDS may need to shop around and compare options from different insurance companies to find the right policy at a reasonable cost. They may also need to provide medical records and answer health questions to show that they are otherwise healthy despite having HIV/AIDS. It is important to note that lying about one's HIV status during the application process could result in the insurance policy being cancelled or claims being denied.

While life insurance for people with HIV/AIDS can be costly and challenging to obtain, it is possible to find coverage. Those seeking life insurance with HIV/AIDS should be proactive and start the process early, as it may take time to find a suitable policy at an affordable cost.

Supplemental Child Life Insurance: Adult Children's Eligibility

You may want to see also

People with HIV/AIDS may be denied life insurance coverage due to being viewed as high-risk

People with HIV/AIDS have historically been excluded from life insurance coverage due to the high mortality rate and substantial expenses associated with the condition. However, recent advancements in treatment have prompted some insurers to recognise that HIV/AIDS is no longer a death sentence, and that people living with HIV can have a near-normal life expectancy. As a result, some companies are now offering life insurance policies specifically tailored for people with HIV/AIDS.

Despite these advancements, people with HIV/AIDS may still face challenges in obtaining life insurance coverage. They may be denied coverage or offered policies with limited benefits and higher premiums due to being viewed as high-risk by insurers. The underwriting process, which involves assessing the likelihood of death while covered, becomes more complex due to the long-term effects of HIV/AIDS drugs and the potential for the condition to progress.

To improve their chances of obtaining life insurance, individuals with HIV/AIDS should follow their doctor's instructions and develop a treatment plan. Maintaining good health and controlling the virus through medication can increase the likelihood of obtaining a standard life insurance policy at a reasonable cost. It is also important to shop around and compare options from different insurers, as some may be more willing to provide coverage at a reasonable price.

Additionally, individuals with HIV/AIDS can explore alternative options such as graded death benefit policies or guaranteed issue life insurance policies, which provide partial or capped benefits. These policies may not offer full coverage, but they can still provide financial protection for loved ones in the event of the insured's death. Overall, while people with HIV/AIDS may face challenges in obtaining life insurance, advancements in treatment and changing perceptions are improving access to this important form of financial protection.

Life Insurance and Mental Illness: What's Covered?

You may want to see also

People with HIV/AIDS can get disability insurance coverage through a simplified issue policy or a high-risk policy

People with HIV/AIDS can face challenges when seeking disability insurance coverage due to their condition being classified as a pre-existing condition, which is often excluded from conventional policies. However, it is not impossible for them to obtain disability insurance. Here are two ways that individuals living with HIV/AIDS can obtain disability insurance coverage:

Simplified Issue Policy

When applying for disability insurance, individuals typically undergo a medical exam during the underwriting phase, which includes blood or urine tests that can detect HIV or AIDS. A simplified issue policy bypasses the medical exam, but applicants must still complete a health questionnaire, which may include questions about their HIV status. While lying about one's HIV status may seem tempting, doing so could lead to claim denials in the future. Even with a simplified issue policy, there is no guarantee that a medical exam will be waived if the insurer deems the applicant's health profile too risky. If approved, individuals may receive limited coverage and pay higher premiums.

High-Risk Policy

Some insurers offer disability insurance to individuals with HIV/AIDS through high-risk policies. These policies tend to be significantly more expensive than conventional disability insurance policies but can be crucial for financial planning, especially for those in higher-income careers, such as lawyers or doctors, who have substantial student loan debts and high incomes to replace if they become unable to work.

It is important to note that purchasing disability insurance early is beneficial, especially for those in high-risk communities with an elevated risk of contracting HIV. By locking in premiums at a younger age, individuals can secure lower rates throughout their working lives. Additionally, some insurers may reject applicants who are using pre-exposure prophylaxis (PrEP) to prevent HIV, so it is advisable to obtain insurance before starting this medication.

Life Insurance: Splitting Benefits for Families Fairly

You may want to see also

People with HIV/AIDS can get health insurance coverage through the Affordable Care Act

People with HIV and AIDS have historically faced barriers to obtaining private health insurance, with many insurers excluding HIV/AIDS as a pre-existing condition. However, recent advancements in treatment have led some insurance companies to create tailored policies for people with HIV/AIDS.

In the United States, the Affordable Care Act (ACA) has played a significant role in improving access to health insurance for people with HIV/AIDS. Here are some of the ways the ACA has helped:

Improving Access to Coverage

The ACA ensures that no American can be denied health insurance coverage due to a pre-existing health condition, such as HIV. Insurers are also prohibited from cancelling or rescinding coverage due to mistakes on an application, and they can no longer impose lifetime caps on insurance benefits. These changes have removed barriers to coverage for people with HIV/AIDS and given them access to the care they need.

Broader Medicaid Eligibility

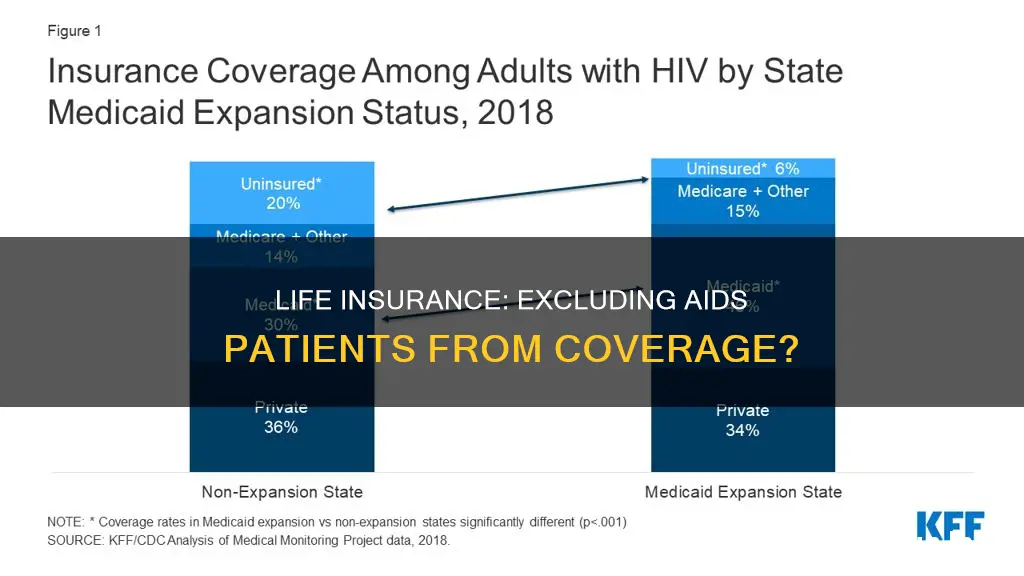

Under the ACA, states have the option to expand Medicaid eligibility to include individuals with incomes at or below 138% of the Federal poverty line, including single adults without children who were previously ineligible. This expansion is particularly important for gay, bisexual, and other men who have sex with men (MSM), who are the population most affected by the HIV epidemic. In states that have opted for Medicaid expansion, people with HIV can access life-extending care and treatment before the disease damages their immune system, rather than having to wait for an AIDS diagnosis to become eligible for Medicaid.

More Affordable Coverage

The ACA created the Healthcare.gov Marketplace, which helps consumers compare different health plans and find out what savings they may qualify for. The ACA also provides financial assistance for low- and middle-income individuals and families in the form of tax credits that lower monthly premiums and out-of-pocket costs.

Lower Prescription Drug Costs for Medicare Recipients

The ACA closed the Medicare Part D prescription drug coverage gap, known as the "donut hole." Now, Medicare enrollees living with HIV/AIDS can better afford their medications, as they will pay no more than 25% of the cost of their covered medications.

Ensuring Quality Coverage

The ACA helps all Americans, including those with or at risk for HIV, access quality coverage and care. Most new health insurance plans must cover recommended preventive services, including HIV testing for individuals aged 15 to 65 and other ages at increased risk, without additional cost-sharing. The ACA also covers pre-exposure prophylaxis (PrEP) for HIV-negative adults at high risk, including medications, clinic visits, and lab tests.

Enhancing the Capacity of the Healthcare Delivery System

The ACA has expanded the network of community health centers, providing preventive and primary care services to millions of Americans, regardless of their ability to pay. It has also increased the healthcare workforce serving underserved communities, with more doctors, nurses, and other healthcare providers receiving loan repayment and scholarships through the National Health Service Corps.

Primerica Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Frequently asked questions

No, people with HIV/AIDS are not excluded from life insurance. However, due to the high costs associated with the condition, many insurance companies consider HIV/AIDS a pre-existing condition and often exclude it from conventional health insurance policies.

People with HIV/AIDS may face challenges such as discrimination, lack of awareness, and limited access to service centres, counselling centres, and specialised care.

People with HIV/AIDS may qualify for term and whole life insurance, final expense insurance, and group life insurance.

Insurance companies consider factors such as the applicant's age, gender, health, and lifestyle. They may also request detailed information about the applicant's treatment history, viral load, CD4 count, and any additional chronic conditions or medications.

Maintaining a healthy lifestyle, avoiding smoking or risky habits, and adhering to prescribed treatment plans can improve the chances of approval at an affordable rate. Working with an independent broker can also help in comparing options from multiple insurers.