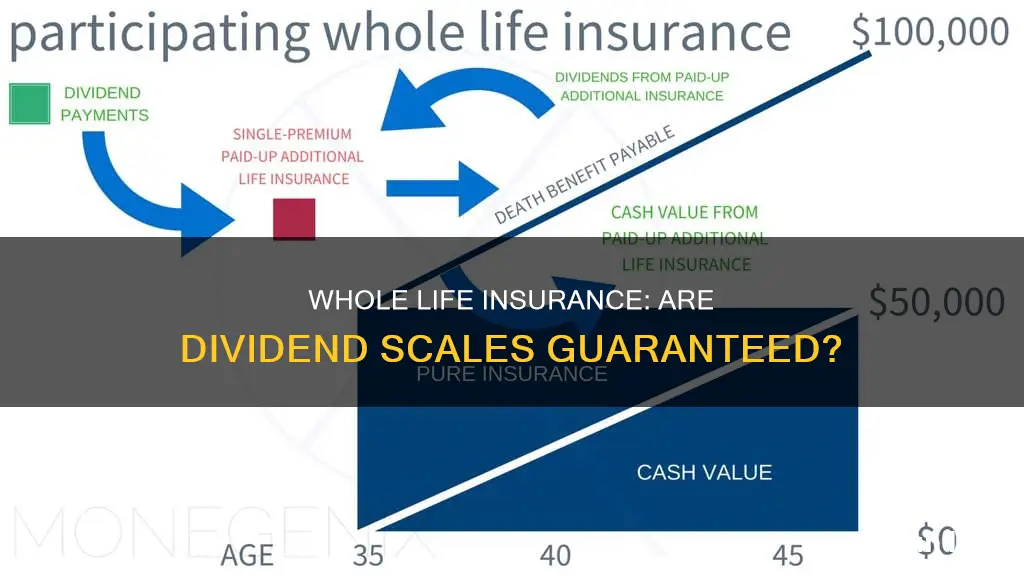

Whole life insurance is a permanent life insurance policy that offers lifelong coverage, a death benefit, and the potential to earn dividends based on the insurer's performance. Dividends are not guaranteed but are paid out annually if the insurer has strong financial performance. The dividend amount depends on factors such as the insurer's investment returns, the number of claims paid out, and operational costs. Policyholders can use dividends in several ways, including receiving them as cash, using them to pay for premiums, or purchasing additional insurance. It is important to carefully review the details of a whole life insurance policy before purchasing it, as dividend scales may vary.

What You'll Learn

Dividends are not guaranteed and depend on the insurer's performance

The dividend amount is determined by the insurer's board of directors, taking into account the company's financial performance, expenses, and cash reserves. It is important to note that the dividend payout is not guaranteed and can vary from year to year. The amount of the dividend is usually displayed as a percentage of the policy value. For example, a 0.5% dividend on a $100,000 whole life policy would result in a $500 dividend payment.

Policyholders have several options for using their dividends. They can choose to receive the dividend as a cash payment, use it to pay future premiums, purchase additional insurance coverage, or pay down policy loans. The choice depends on the policyholder's financial goals and circumstances.

When considering a dividend-paying whole life insurance policy, it is important to review the insurer's history of dividend payments and select a company with a strong track record of consistent dividend payouts. Additionally, policyholders should be aware that dividends may be taxable in certain situations, such as when the dividend amount exceeds the total premiums paid or when the dividends are left in the policy to earn interest.

Overall, while dividend-paying whole life insurance policies offer the potential for additional income, it is important to remember that dividends are not guaranteed and are dependent on the insurer's financial performance. Policyholders should carefully review the terms of their policy and consider seeking advice from a financial professional to make the most informed decisions regarding their dividends.

Life Insurance: AmFam's Comprehensive Coverage for Peace of Mind

You may want to see also

Dividends can be withdrawn as cash or reinvested

Dividends from whole life insurance policies can be withdrawn as cash and reinvested. Dividends are usually paid out annually and are based on the insurer's financial performance. They are not guaranteed and depend on factors such as investment returns, expenses, death rates, and the number of policy cancellations.

When withdrawing dividends as cash, the insurance company will send a check or transfer the funds directly to your bank account. This option provides flexibility as the funds can be used for anything, such as discretionary spending or reinvestment in other investment vehicles.

Another option is to leave the dividends in a savings account with the insurer, where they will earn interest at a specified rate. This option offers liquidity and convenience, as you can withdraw the funds at any time without having to manage the money yourself.

It is important to note that while dividends from life insurance policies are generally not subject to income tax, taxes may apply if withdrawals exceed total payments into the policy. Therefore, it is essential to carefully consider the tax implications when deciding how to withdraw and utilize your dividends.

Fidelity Life Insurance: Physical Exam Requirements and Details

You may want to see also

Dividends are not subject to income tax

Dividends from whole life insurance policies are generally not subject to income tax. This is because the Internal Revenue Service (IRS) considers them a return of premiums paid, rather than a profit. In other words, they are treated as a refund for overpayment of the premium.

However, it is important to note that if you leave your dividends in your policy to earn interest, this interest income may be taxable if it exceeds the amount you have paid in premiums. Therefore, it is typically more financially beneficial to take the dividends as cash and reinvest them elsewhere, where they can earn a higher return.

When evaluating insurance policies, it is important to investigate how dividends are calculated and whether they are guaranteed. Additionally, individuals should consider how they plan to handle the dividend income. The favourable tax treatment means that reinvesting the dividends elsewhere is often the best option.

Unlocking Loan Options with Life Insurance Policies

You may want to see also

Dividends can be used to purchase additional insurance

The additional insurance purchased with dividends will be the same type of life insurance as the original policy. The insurance company will calculate the additional amount of coverage that the dividend money can purchase, based on the policyholder's age. There is no extra premium, and the policyholder will not have to take another life insurance medical exam. These paid-up additions can even generate dividends of their own.

Dividends can also be used to purchase one-year term life insurance. The amount of coverage that can be purchased will depend on the policyholder's age and the amount of dividend money available. This option can be useful if the policyholder has a small, short-term need for additional life insurance.

Skydiving: Is Your Northwestern Life Insurance Valid?

You may want to see also

Dividends can be used to pay down policy loans

Dividends from whole life insurance policies can be used to pay down policy loans. This can be done by asking the insurer to put the dividends toward the policy loan balance. This can help the policyholder pay off their loan without using their regular income.

Whole life insurance policies offer lifelong coverage, a death benefit, and a cash value component. Policyholders can use dividends for nearly anything, and in many cases, they are not taxable. Dividends are not guaranteed but may be paid out if the insurer has strong financial performance. Dividends are based on the insurer's financial performance, including investment returns, the number of claims paid out compared to premiums paid in, and operational costs.

Whole life insurance policies can be eligible for dividends. If you buy a whole life insurance policy, find out whether it's “participating” or “non-participating." Only participating policies can get dividends. A participating policy charges a higher premium and, in return, pays regular dividends to the policyholder. Non-participating policies do not pay dividends, and their premiums are usually lower than those of participating policies.

There are several other ways to use whole life insurance dividends:

- Receiving dividends in cash: The insurance company sends a check or ACH payment to the policyholder's personal bank account.

- Reducing future premium payments: The insurance company automatically applies any dividends to reduce future premiums.

- Leaving the dividends with the insurance company to collect interest: The dividend is retained by the insurance company and earns interest in a dividend accumulation account.

- Buying paid-up additional life insurance: Using dividends to purchase small amounts of completely paid-up additional life insurance.

Life Insurance and Social Security Survivor Benefits: What's the Link?

You may want to see also

Frequently asked questions

No, dividends are not guaranteed. They are based on the insurer's financial performance and are declared at the discretion of the board of directors.

Dividend payouts are calculated using a formula known as the dividend scale, which takes into account factors such as the death rate among policyholders, expenses, and investment performance. The calculation is unique to each policyholder and is based on factors such as age, policy size, type, and premiums paid.

Dividends are typically paid out annually on the policy's anniversary date. They are not guaranteed but are usually paid out if the insurer has strong financial performance.

Once paid out, policyholders can choose to receive the dividends as cash, use them to pay premiums, purchase additional insurance, or let them accumulate interest. The choice depends on the policyholder's financial goals and circumstances.