Inflation is a hot topic and it's important to understand how it can affect your life insurance coverage. Inflation erodes the purchasing power of your money over time, meaning your dollar today will not stretch as far in the future. This can impact your life insurance policy, especially if you have a term life insurance plan. Term life insurance policies usually provide a fixed amount as a death benefit, which may not have the same buying power if your beneficiary receives it a few years from now. For instance, a $500,000 payout today might only be worth $411,987 in spending power in 30 years, given a 3% inflation rate. This can leave your loved ones with less financial support than you intended. However, there are ways to protect your life insurance against inflation.

What You'll Learn

- Inflation erodes the value of a life insurance payout over time

- Inflation protection is an additional feature that can be added to a policy

- Whole life insurance policies withstand inflation better than term life policies

- Inflation can cause insurance companies' investment portfolios to perform better

- Policy riders can be used to protect against inflation

Inflation erodes the value of a life insurance payout over time

The primary purpose of life insurance is to provide a safety net for anyone who relies on you financially. For example, if your salary covers the mortgage, utility bills, and school fees, a life insurance policy can cover those expenses if you die. However, if you buy a policy with today's prices in mind, it might not provide enough for your family in the future.

There are a few ways to combat this. One way is to use historical averages to calculate inflation. For example, the average annual inflation rate for the 20 years prior to the pandemic (2000 to 2019) was roughly 2%, according to data collected by the Federal Reserve Bank of Minneapolis. You can also use an inflation rate that is realistic for your specific needs, taking into account your policy type, policy length, and financial obligations.

Another way to ensure that your life insurance payout keeps up with inflation is to add a cost-of-living rider to your policy. This rider, an optional add-on when you purchase a policy, typically increases the death benefit in line with the consumer price index. As a result, your premiums will increase alongside any increases made to the coverage amount. However, not all companies offer inflation riders, and the cost may vary among insurers.

Whole life insurance policies, or universal life insurance, also tend to withstand inflation better than term life insurance policies. Whole life insurance policies can have a death benefit that grows based on the insurance provider's investment portfolio, which often keeps pace with inflation.

It's important to review your life insurance policy regularly to ensure that your coverage amount is enough to sustain your family in the future. By taking these steps, you can help protect your loved ones from the eroding effects of inflation on your life insurance payout.

U.S. Military Life Insurance: War Clause Coverage?

You may want to see also

Inflation protection is an additional feature that can be added to a policy

Inflation protection is considered desirable by policyholders but can be challenging for insurance companies. Insurers face limits on the changes in premiums they can charge individuals. To entice policyholders to accept a lower rate of insurance inflation protection, companies may offer lower increases in premium costs.

Inflation protection is an additional feature that comes at an extra cost, increasing the premium payment. When purchasing a policy, individuals may be able to choose from different inflation rate options, resulting in different premium amounts. Lower inflation rate protection plans will have lower premiums than higher inflation rate options. It is important to note that having inflation protection does not guarantee that the policyholder will never face increases in premiums.

There are several methods to achieve insurance inflation protection in long-term care insurance policies. The first option is to purchase as much daily benefit as possible, which may be more cost-efficient than a specific inflation protection rider, especially for older individuals. The second method is the guarantee purchase option (GPO) provision, which allows the policyholder to increase the daily benefit every two or three years without additional underwriting. However, this option will be more expensive at the policyholder's attained age, and insurance companies may consider a policyholder ineligible if they have rejected this offer in the past.

The third method is simple inflation protection, usually included in the cost of the premium. Premiums for such policies are typically 40% to 60% higher than those without this rider, and the daily benefit increases by 5% automatically every year. The best option for insurance inflation protection is often considered to be an automatic compound annual percentage increase in benefits, typically adding 3% to 5% to the daily benefit, compounded annually. This type of inflation rider is ideal for younger individuals in good health.

Life Insurance: Age is Just a Number

You may want to see also

Whole life insurance policies withstand inflation better than term life policies

Inflation can have a significant impact on the value of life insurance policies, and it's important to consider this when choosing a policy. Whole life insurance policies generally withstand inflation better than term life insurance policies. Here's why:

Impact of Inflation on Life Insurance

The effects of inflation on life insurance can be both direct and indirect. Inflation causes the purchasing power of money to decrease over time. This means that the death benefit payout from a life insurance policy will have less buying power in the future. For example, a $500,000 payout received from a term life insurance policy today may not be sufficient to cover the same expenses a few years from now due to the impact of inflation. Therefore, it is crucial to review your policy regularly to ensure that the coverage amount is still adequate to meet future needs.

Whole Life Insurance vs. Term Life Insurance

Whole life insurance, also known as universal life insurance, offers lifetime protection as long as the premiums are paid when due. One of the key benefits of whole life insurance is the accumulation of cash value over time. This cash value growth is guaranteed and can be accessed when needed, such as for college tuition or retirement income. Additionally, whole life insurance premiums are guaranteed to remain unchanged, even during times of high inflation. This provides the advantage of predictable budgeting, which is especially valuable during uncertain economic periods.

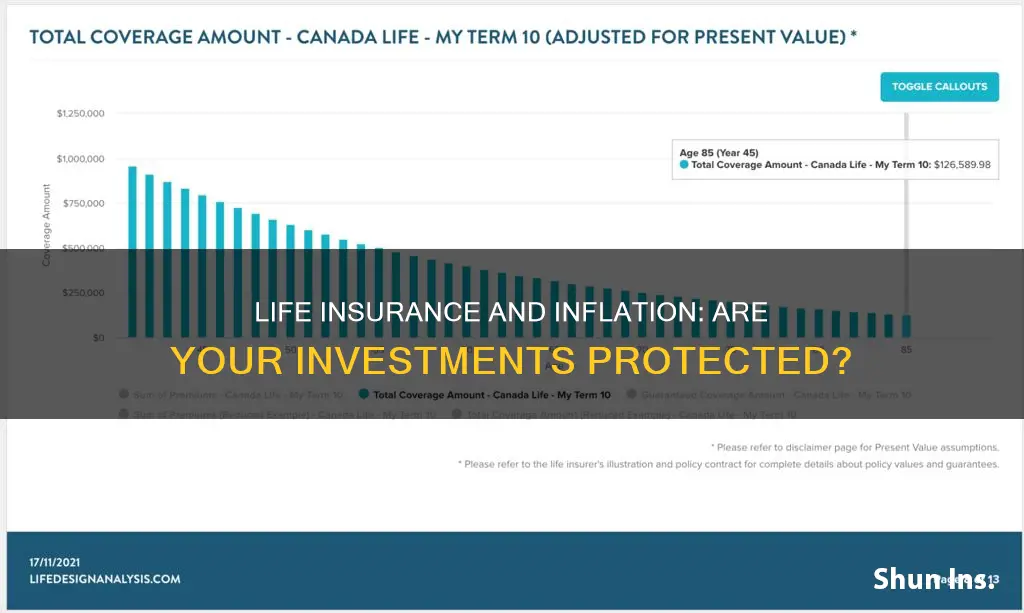

In contrast, term life insurance provides coverage for a set number of years and does not build cash value. While it is typically more affordable than whole life insurance, the death benefit remains fixed and does not increase with inflation. As a result, the purchasing power of the payout decreases over time. For example, if you purchase a 30-year term life insurance policy with a $1,000,000 death benefit, given a 3% inflation rate, the spending power of that payout would only be approximately $411,987 in today's dollars by the end of the term.

Adjusting for Inflation

To address the impact of inflation, some insurance companies offer inflation riders that can be added to a policy for an additional cost. These riders are designed to increase the death benefit over time, often linked to the Consumer Price Index (CPI). Another option is to purchase a whole life insurance policy, which can provide a death benefit that grows based on the insurance provider's investment portfolio. By choosing a whole life insurance policy and taking advantage of available riders, you can better protect your loved ones from the eroding effects of inflation on the value of your policy.

Leaving Life Insurance: Minor Children's Benefits Explained

You may want to see also

Inflation can cause insurance companies' investment portfolios to perform better

Inflation can have a significant impact on insurance companies' investment portfolios, and the effects can be both positive and negative. On the one hand, inflation can cause insurance companies' investment portfolios to perform better by increasing the returns on their investments. Here's how:

- Inflation often leads to higher interest rates, which can result in higher yields on investments such as bonds, guaranteed investment certificates (GICs), or certain equities. This means that insurance companies can earn more from their investments, potentially mitigating the impact of inflation on their pricing.

- During periods of moderate inflation, price increases can better keep up with loss trends, and portfolios may be less impacted by mark-to-market adjustments.

- Inflation can drive insurance companies to explore alternative asset classes, such as collateralized loan obligations (CLOs), leveraged loans, real estate, and infrastructure. These asset classes can provide good inflation hedges due to their exposure to real assets and their ability to adjust leases and essential services.

However, it's important to note that high inflation can also have negative consequences for insurance companies' investment portfolios:

- If inflation remains elevated, insurers may feel the pain on both sides of their balance sheets. Higher-than-expected inflation can lead to higher claim costs than what was priced into their policies, impacting their profitability.

- On the asset side, if insurance companies hold a significant amount of bonds in their portfolios, rising interest rates due to inflation can cause bond prices to fall, leading to a decrease in the market value of their investment portfolios.

- In the case of property and casualty (P&C) insurers, higher inflation can result in higher claim costs, as policies are priced today, but claims against those policies can emerge in the future when costs are higher.

- Inflation can also reduce the value of investments held by insurance companies, impacting their solvency and causing a decline in new sales and renewals of insurance products as consumers reduce their spending.

In summary, while inflation can cause insurance companies' investment portfolios to perform better due to higher interest rates and returns, it can also lead to challenges such as higher claim costs and reduced investment values. The overall impact depends on various factors, including the specific insurer, their investment portfolio, and the level of inflation they face.

How Much Life Insurance is Enough?

You may want to see also

Policy riders can be used to protect against inflation

Life insurance is an important financial product to protect your loved ones in the event of your death. However, inflation can devalue the payout from your life insurance policy over time, reducing its buying power. To combat this, you can purchase policy riders, which are optional add-ons to your insurance policy. Here's how policy riders can help protect against inflation:

Cost-of-Living Rider

A cost-of-living rider is a valuable tool to protect against inflation. This rider increases the death benefit in line with the Consumer Price Index (CPI), ensuring that the payout keeps pace with inflation. As a result, your premiums will also increase alongside any increases in the coverage amount. However, not all insurance companies offer inflation riders, and the cost may vary between insurers. This rider is particularly useful when buying a new policy to ensure your coverage remains adequate despite rising prices.

Disability Insurance Rider

Another option to consider is a disability insurance rider. This rider provides financial protection by increasing the monthly benefit payout by the inflation rate if you become disabled. It helps boost the payout available on your disability policy, ensuring your loved ones receive an adequate amount if you pass away.

Guaranteed Insurability Rider

If you have a term life insurance plan, the guaranteed insurability rider is worth considering. This rider allows you to increase the payout value of your insurance without undergoing another medical examination. It is beneficial when dealing with high inflation rates, as it provides flexibility to adjust your coverage as needed.

Accelerated Deposit Option

For those with permanent life insurance, such as a whole life insurance policy, the accelerated deposit option is available. This rider lets you contribute more to your policy, increasing its cash value faster. If you anticipate that inflation may cause your death benefit to fall short of your family's needs, you can utilise this rider to grow your policy's value.

Inflation Rider for Long-Term Care Insurance

If you have a long-term care insurance policy (LTC), you can protect it against inflation by purchasing an inflation rider. This rider will slightly increase your premiums annually, but it will significantly impact the total policy value over time.

When considering how to protect your life insurance policy against inflation, it is essential to review your policy regularly and consult with insurance experts or advisors. They can help you navigate the available options and choose the best riders to meet your unique needs.

Ethos' Whole Life Insurance Offer: Is It Worth It?

You may want to see also

Frequently asked questions

Inflation can erode the purchasing power of a policy's death benefit over time. While the nominal value remains the same, it may not provide the same level of financial protection in the future due to the rising cost of living.

Policyholders can consider options such as purchasing additional coverage, adjusting their policy's death benefit over time, or incorporating inflation-protected riders to ensure their coverage keeps pace with inflation.

Considering inflation in financial planning is crucial because it helps individuals maintain their purchasing power and achieve their financial goals. It ensures that their assets and insurance coverage remain adequate to meet future needs.

Inflation can cause insurance companies' investment portfolios to perform better. However, it can also lead to a substantial decline in new sales and renewals of insurance products as consumers reduce their spending.