Missouri's auto insurance rates are higher than the national average. The average cost of car insurance in Missouri is $1,698 per year, according to thezebra.com. This is 11% higher than the national average. The cost of full coverage car insurance in Missouri is about $1,469 annually. The state's average annual premium for state minimum liability-only coverage is $650, which is higher than the national average of $573. Missouri drivers pay an average of $165 per month or $1,984 per year for full coverage car insurance. The cheapest car insurance in Missouri is offered by State Farm, at $1,291 per year, while the most expensive is offered by The General, at $4,164 per year.

What You'll Learn

Missouri's insurance rates compared to other states

Missouri's average car insurance costs are higher than the national average. The average cost of car insurance in Missouri is $2,586 per year for full coverage and $696 per year for minimum coverage. The national average for full coverage is $2,311, while for minimum coverage, it is $640.

The average cost of car insurance in Missouri is $1,984 per year, according to a 2023 rate analysis by CarInsurance.com. This is $377 more than the national average of $1,607. However, Missouri's insurance rates are not the highest in the country. For example, the average cost of car insurance in California is $176 per month, while in Washington, D.C., it is $155 per month.

Several factors influence the cost of car insurance in Missouri. These include the state's regulations, the number of uninsured drivers, and the likelihood of natural disasters such as tornadoes and hail storms. Urban areas with higher traffic congestion and theft rates can also drive up insurance costs.

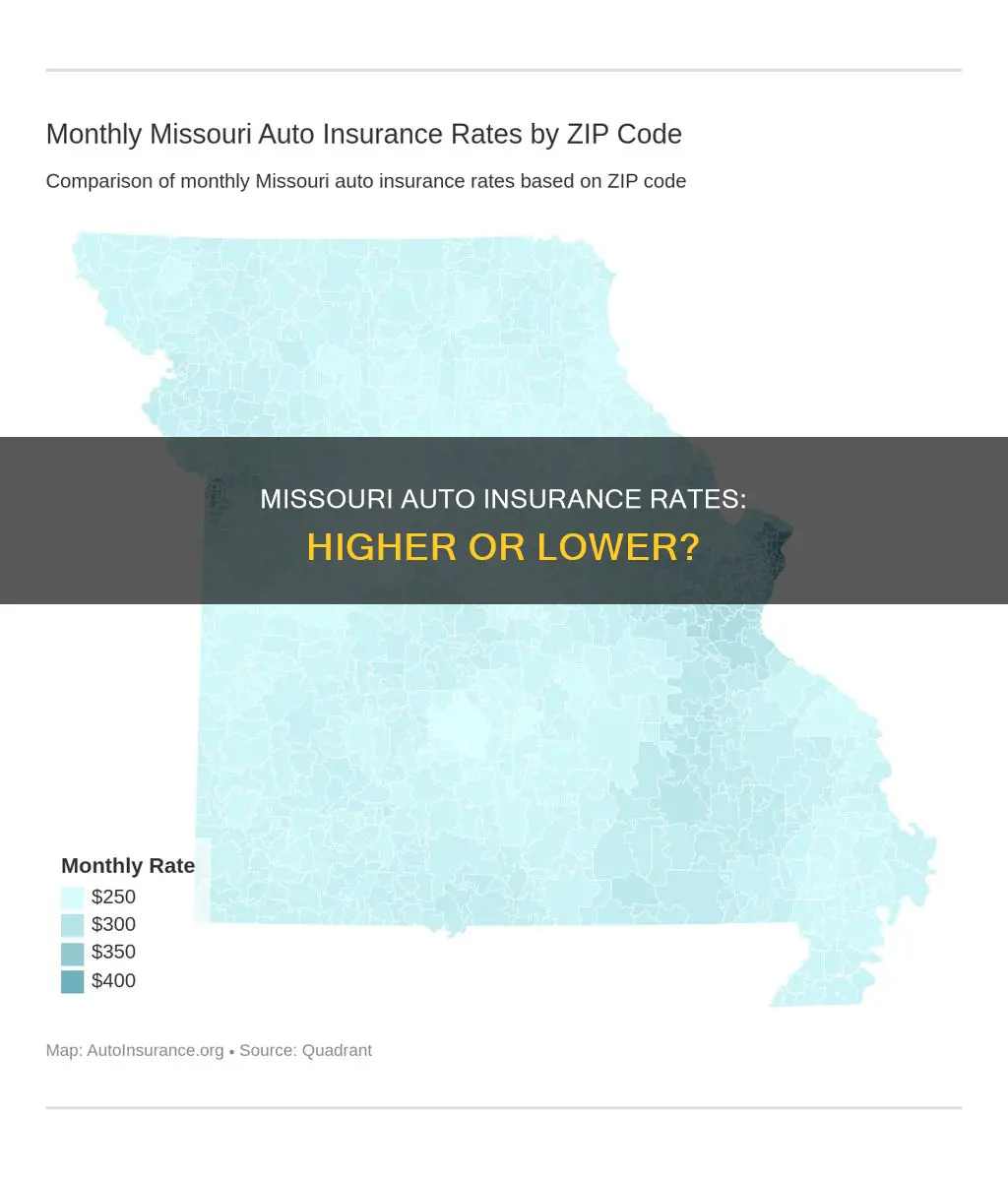

The cost of car insurance in Missouri also varies depending on the city. For example, the average annual rate for full coverage in Columbia is $1,248, while in St. Louis, it is $2,207. The most expensive city in Missouri for car insurance is Glasgow Village, with an average annual rate of $2,843. In contrast, Lebanon has the cheapest car insurance in the state, with an average annual rate of $1,687.

When compared to other states, Missouri's insurance rates are relatively moderate. However, it is important to note that insurance rates can vary significantly depending on individual factors such as age, gender, driving record, and credit score.

Auto Insurance Rebates: Who Benefits?

You may want to see also

The cheapest insurance companies in Missouri

Missouri car insurance rates are higher than the national average. Full coverage costs around $159 per month, which is 3% less expensive than the country as a whole. Minimum coverage in Missouri is 11% cheaper than the national average, at $57 per month.

The cheapest car insurance company in Missouri is American Family, at $1,396 per year on average, or $116 per month. However, the cheapest option for most consumers will be State Farm, which has an average annual premium of $1,291. USAA is the cheapest option at $746 per year, but it is only available to military members, veterans, and their families.

For minimum coverage, Progressive has the cheapest rates in Missouri at $310 per year, on average.

Maryland: No-Fault or At-Fault Insurance?

You may want to see also

The most expensive insurance companies in Missouri

However, it is important to note that these rates may not be directly comparable, as they are based on different driver profiles and factors such as driving record, age, gender, and location can significantly impact insurance rates.

Drivetime: Gap Insurance Options

You may want to see also

How to save money on car insurance in Missouri

The average cost of car insurance in Missouri is $2,586 per year for full coverage and $696 per year for minimum coverage. This is higher than the national average, so it's understandable that you'd want to save money where you can. Here are some tips to help you do that:

- Factor in insurance costs when buying a new vehicle: Consider the cost of insurance before you buy a new vehicle. Some cars are more expensive to insure due to upgraded features, theft rates, repair and replacement costs, etc.

- Shop around: Compare quotes from different insurance companies to find the most affordable rate for your coverage needs.

- Ask about potential discounts: See which discounts you might qualify for to lower your premium. Common discounts include safe driving, low mileage, and paperless billing.

- Keep a clean driving record: Maintaining a driving record free of accidents and traffic violations can help you secure and maintain low insurance rates.

- Maintain a good credit score: Insurance companies often consider drivers with higher credit scores to be more responsible, and so charge them lower premiums.

- Explore usage-based insurance options: Consider enrolling in telematics programs that track your driving habits and adjust the premiums based on your behaviour. These programs can help safe drivers and those who don't drive often save on insurance.

- Consider raising your deductible: Choosing a higher deductible can lower your premiums, but ensure you can afford the out-of-pocket cost if you need to file a claim.

- Review your coverage types and levels: Assess your coverage needs periodically to avoid overpaying for insurance. This should be done annually, but is especially important after significant life changes such as marriage or paying off your car.

- Get a safer parking space: Due to Missouri's unpredictable weather, it's recommended that you keep your car in a safe, covered space. If you have a garage, show this to your insurance company and they may add you to their list of safe drivers, which often gets lower insurance rates.

- Complete a driving improvement course: These courses help drivers improve their driving skills and judgment on the road, reducing the chances of getting into an accident and, therefore, claiming.

- Check insurance costs before buying a car: Expensive cars have higher insurance premiums. Before buying a car, check the annual car insurance premium to avoid an additional financial burden, especially if you're taking out a loan to buy the car.

- Select advanced payment options: You can select annual or bi-annual payment options to get special discounts from car insurance companies. Advanced payment options make you a safer customer for the company as they don't have to worry about monthly follow-ups for your premium.

Credit Checks: Auto Insurance's Hard Pull

You may want to see also

The factors that affect car insurance rates in Missouri

There are several factors that affect car insurance rates in Missouri. Some of these factors are within the control of the driver, while others are not. Here are the key factors that influence car insurance rates in the state:

- Location and Demographics: The location where the car is garaged and driven plays a significant role in insurance rates. Urban areas, such as Kansas City and St. Louis, tend to have higher insurance rates due to increased traffic, higher rates of vandalism and theft, and a greater likelihood of accidents. The population density and specific demographics of an area can also impact rates, with higher-risk areas generally having higher premiums.

- Driving Record: A driver's history significantly affects insurance rates. Accidents, traffic violations, and DUIs can increase rates substantially. Conversely, maintaining a clean driving record and being accident-free for several years can lead to lower premiums and accident-free savings.

- Age, Gender, and Marital Status: Age is a critical factor, with younger and older drivers often facing higher premiums due to higher accident risks. Teen drivers pay the most, while rates start to decrease after age 25. Gender also influences rates, with male drivers, especially those under 25, typically paying more than females. Being married can lead to lower rates, as married drivers are seen as more financially stable and less likely to take risks.

- Vehicle Type and Age: The make, model, and age of a vehicle are essential considerations. Safer vehicles with better safety ratings and lower theft rates often have lower insurance rates. In contrast, luxury vehicles, sports cars, and models that are more susceptible to damage or theft generally have higher premiums.

- Credit History: In most states, credit history is a factor in determining insurance rates. Drivers with poor credit scores tend to pay more, as insurers associate lower credit scores with higher-risk behaviours. Maintaining good credit can positively impact insurance costs.

- Mileage and Usage: The amount and type of driving impact insurance rates. Those who drive more miles, especially for business or long commutes, will usually pay more. Insurance companies may offer discounts for driving fewer miles or participating in usage-based insurance programs that monitor driving behaviour.

- Coverage Levels and Deductibles: The chosen insurance coverage levels and deductibles will affect the monthly cost. Higher deductibles typically lead to lower monthly payments, while adding additional coverage options will increase the premium.

- State Requirements: Missouri's minimum coverage requirements and specific insurance categories mandated by the state will influence the overall cost of insurance for drivers.

Auto Insurance: Who Else is Covered?

You may want to see also

Frequently asked questions

The average cost of car insurance in Missouri is $1,698 per year, according to 2021 data. However, other sources state that the average cost is $1,984 per year or $1,469 per year. The cost of car insurance depends on various factors, including age, location, driving history, and credit score.

Several factors influence the cost of car insurance in Missouri, including state regulations, the number of uninsured drivers, the risk of natural disasters, and urban congestion. Personal factors, such as age, driving record, credit history, vehicle type, and location, also play a significant role.

State Farm offers the cheapest average insurance rate in Missouri, with an annual premium of $1,291, according to some sources. However, USAA offers the lowest rates for military members, veterans, and their families, with an average annual premium of $802.