Buying a home is a significant financial commitment, and new homeowners may wonder if they need mortgage life insurance to protect their investment. Mortgage life insurance, also known as mortgage protection insurance, is a type of insurance policy that pays off the remaining balance on your mortgage loan if you die. While this can prevent your family from losing their home, it has limited advantages and serious drawbacks due to its lack of flexibility and high premiums. This paragraph introduces the topic of mortgage life insurance and whether it is worth purchasing, which will be further explored by examining its benefits, limitations, and alternatives in the following paragraphs.

| Characteristics | Values |

|---|---|

| Purpose | To pay off the remaining balance on your mortgage when you die |

| Who it covers | Co-borrowers |

| Who receives the payout | The mortgage lender, not your family |

| Payout amount | The balance of your mortgage, or partial balance if that’s what you chose |

| Premium | Stays level over the course of the policy |

| Length of policy | Coincides with the number of years you have to pay off your mortgage |

| Where to buy | Through your mortgage lender, a private insurance company, or a life insurance provider |

| Underwriting | Not required |

| Medical exam | Not required |

| Riders | Living benefits, return of premium |

What You'll Learn

Mortgage protection insurance vs. term life insurance

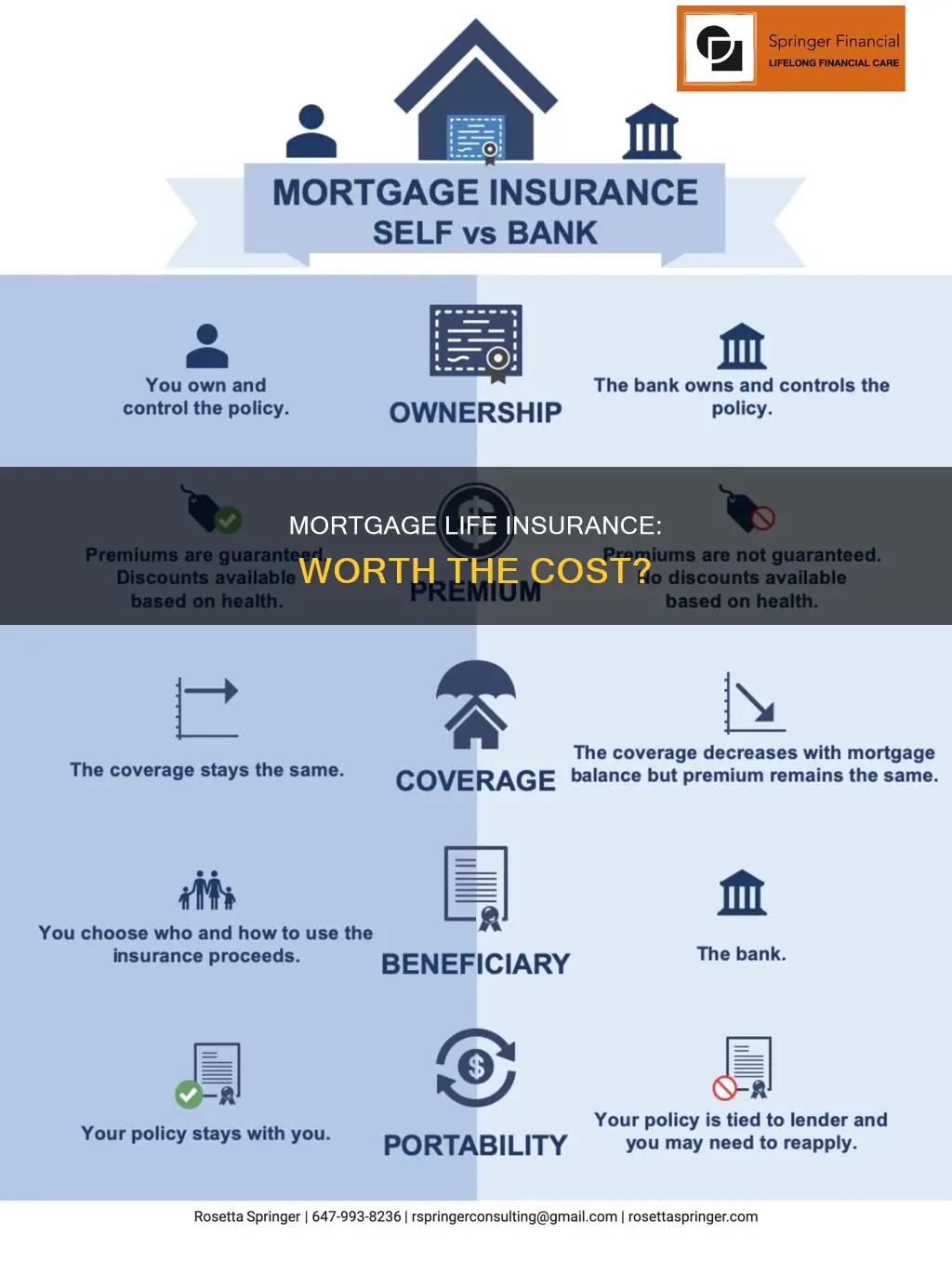

Mortgage protection insurance and term life insurance are both designed to protect your mortgage in the event of your death. However, there are some key differences between the two types of policies.

Mortgage protection insurance, also known as mortgage life insurance, is a type of insurance that is designed to pay off your mortgage in the event of your death. The policy is usually sold by the mortgage lender or an affiliated insurance company, and the lender is the beneficiary of the policy. This means that the death benefit is paid directly to the lender, not to your family. The premium on a mortgage protection insurance policy stays the same over time, but the payout decreases as you pay off your mortgage.

Term life insurance, on the other hand, offers more flexibility. With a term life insurance policy, you can choose the coverage amount and policy length to match your mortgage or other financial responsibilities. The payout from a term life insurance policy goes to your chosen beneficiary, who can use the money as they see fit, such as paying off the mortgage, covering final expenses, or paying for future education costs. Term life insurance policies typically require a medical exam and take health into account when determining the premium, so they may be more affordable for healthy individuals.

One advantage of mortgage protection insurance is that it does not require a medical exam and may be a good option for those with health issues who cannot qualify for term life insurance. However, term life insurance is generally considered the better option due to its flexibility and lower cost.

Mortgage protection insurance may be worth considering if you are unable to qualify for term life insurance due to health issues. In this case, getting competitively priced life insurance with a pre-existing condition can be challenging. Mortgage protection insurance can provide coverage for your mortgage, ensuring that your family will not have to worry about mortgage payments if something happens to you.

However, it is important to compare quotes from different companies and read the fine print of the policy before purchasing mortgage protection insurance. The coverage may vary depending on the cause of death, and the financial strength of the insurance company should also be considered.

Life Insurance Proceeds: Taxable in South Africa?

You may want to see also

Pros and cons of mortgage protection insurance

Mortgage protection insurance is a policy that pays off the remainder of your mortgage when you die. It is also known as mortgage life insurance. While it can keep your family from losing the home, it has limited advantages and serious drawbacks. Here are some pros and cons:

Pros

- Convenience: Mortgage protection insurance aligns with your loan balance and pays the lender directly.

- No medical exam: Policies are typically guaranteed, so you’re not required to take a life insurance medical exam to qualify for coverage. This can be beneficial if you are in poor health or have a poor medical history.

- Peace of mind: An MPI policy can provide you and your family with a sense of security.

Cons

- Lack of flexibility: Mortgage protection insurance pays the lender, so your family won’t have the freedom to spend the money as they like.

- Declining payout: While premiums stay the same, the payout decreases as you pay down your mortgage.

- Higher premiums: Premiums for MPI are often much higher than term life insurance.

- Might not be the best use of your money: If your mortgage is nearly paid off or you paid for the home with sale proceeds from another home, paying for an MPI policy might not make the most financial sense.

Straight Life Insurance: Cash Value or Not?

You may want to see also

Who gets the life insurance payout?

When it comes to mortgage life insurance, the payout goes directly to the mortgage lender to pay off the remaining mortgage balance. This means that your loved ones won't receive any money from the policy. This is in contrast to traditional life insurance policies, where the beneficiary, typically a family member, receives the death benefit and can choose how to spend the money.

With mortgage life insurance, the lender is the beneficiary of the policy, not your spouse or another chosen individual. This type of insurance is designed specifically to pay off your mortgage in the event of your death, and the death benefit is used to wipe out the remaining balance. The policy's premiums remain level during the term, but the payout decreases as your mortgage balance decreases.

While mortgage life insurance provides peace of mind that your mortgage will be paid off, it lacks the flexibility offered by other types of life insurance. Your loved ones won't have the freedom to use the death benefit for other financial needs, such as final expenses, education costs, or paying off other debts. Additionally, finding accurate quotes for mortgage life insurance can be challenging, as many insurers don't offer quotes online.

Changing Life Insurance Tax Laws: Who Benefits?

You may want to see also

How do premiums work?

The premium costs of mortgage life insurance are based on several factors, including the remaining balance of the mortgage loan, the time left on the loan, and the policyholder's age. For instance, a young person under 30 with a $300,000 loan balance can expect to pay under $50 a month, while a person near 60 years old with the same loan balance can expect to pay several hundred dollars a month. The average MPI premium is higher than a life insurance policy for the same balance. This is because MPI premiums do not take health into account when determining pricing. For adults in good health, MPI can be more expensive than a term life insurance policy for the same coverage.

The premiums on mortgage life insurance policies may only be fixed for the first five years, after which they could increase at any time. In contrast, term life insurance policies typically have fixed premiums for the duration of the policy, usually 30 years, with no surprise price increases.

Mortgage life insurance premiums can be paid separately or rolled into the borrower's regular monthly mortgage payment.

Beneficiary Life Insurance: Who Benefits and How?

You may want to see also

What happens when I pay off my mortgage?

When you pay off your mortgage, your mortgage life insurance policy will end. This is because the sole purpose of mortgage life insurance is to pay off the remaining balance on your mortgage in the event of your death.

Mortgage life insurance is typically offered by banks and lenders during the mortgage application process, or shortly after. The length of the policy coincides with the number of years you have to pay off your mortgage. The premiums remain level during the term, but the policy's value decreases as your mortgage decreases.

Mortgage life insurance is not always the best option. It is often more expensive than term life insurance and offers less flexibility. With mortgage life insurance, the death benefit goes directly to the lender, whereas with term life insurance, the death benefit goes to the beneficiary, who can then choose how to spend the money.

Term life insurance can be used to pay off a mortgage, as well as other debts and liabilities. It is also more flexible in terms of coverage amount and policy length.

Therefore, if you have paid off your mortgage, you may want to consider alternative types of insurance, such as term life insurance, which can provide more comprehensive coverage for your loved ones.

Critical Illness: Is Life Insurance Enough?

You may want to see also

Frequently asked questions

Mortgage life insurance, also known as mortgage protection insurance, is a type of insurance policy that pays off the remaining balance on your mortgage when you die. The beneficiary of the policy is typically the mortgage lender, not your family or loved ones. This means that the death benefit is used to wipe out the rest of your mortgage, and your family won't receive any money directly.

Some advantages of mortgage life insurance include guaranteed policy acceptance, no underwriting or medical exam required, and peace of mind that your family can keep the house if you pass away. However, there are also several drawbacks. Mortgage life insurance often comes with higher premiums compared to term life insurance, and the payout decreases as you pay down your mortgage. Additionally, your family won't have the flexibility to use the death benefit for other financial needs, such as final expenses or education costs.

Term life insurance offers more flexibility, as it allows your beneficiaries to use the payout for any purpose, including paying off the mortgage or covering other financial responsibilities. With term life insurance, you can choose the coverage amount and policy length, and the premiums and death benefits are typically level for the term of the policy. In contrast, mortgage life insurance may have higher premiums for the same coverage amount, and the payout can only be used to pay off the mortgage.

Mortgage life insurance is not a requirement, and it is up to the individual to decide whether to purchase it. However, it is important to consider the limitations and drawbacks of mortgage life insurance before making a decision. For many people, term life insurance may be a better option as it offers more flexibility and control over how the payout is used.