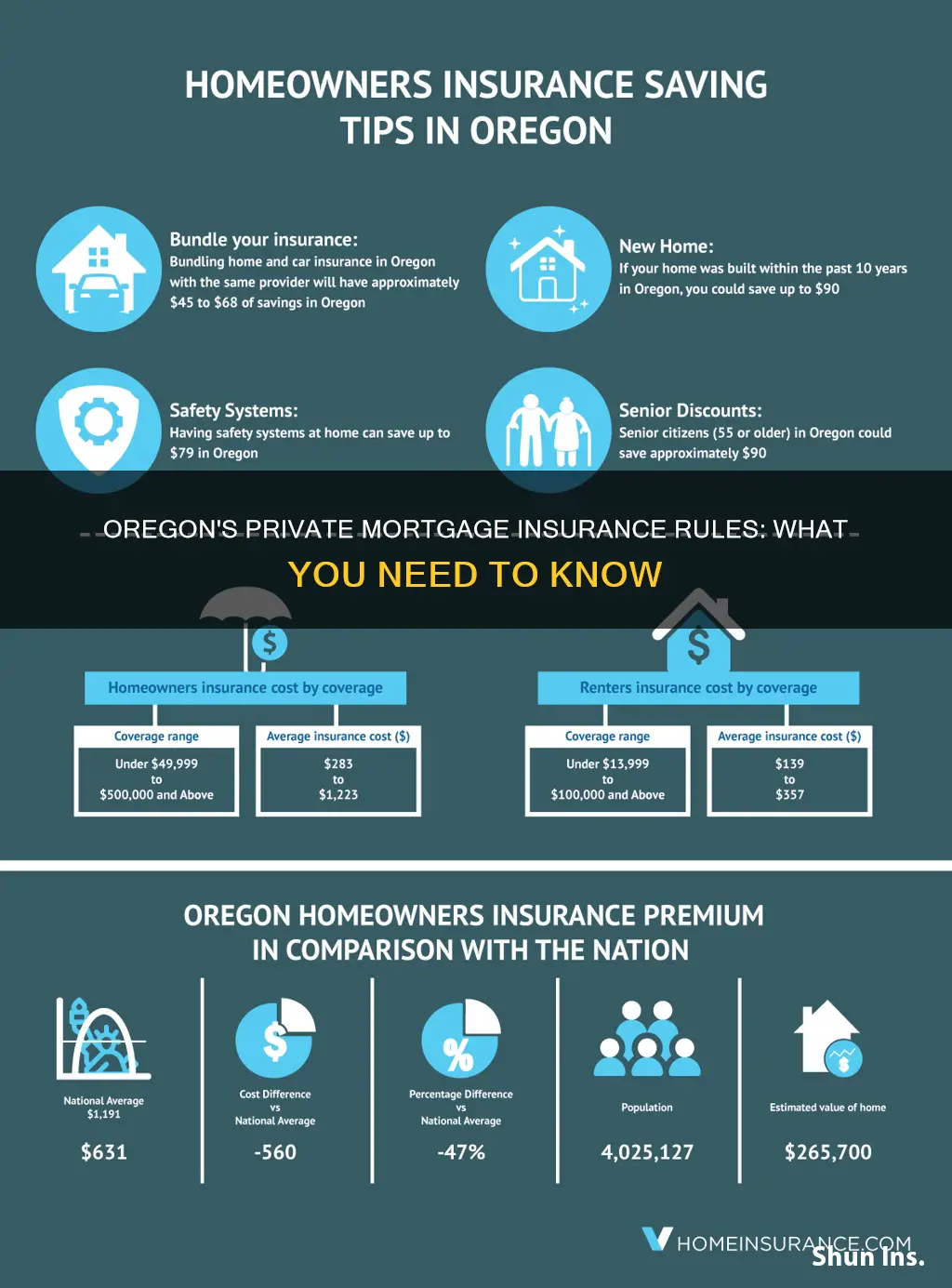

In Oregon, there are no insurance-related requirements for home buyers. However, if you're going to use a mortgage loan to buy a home, you'll need a homeowner's insurance policy to cover the property against major damage or destruction. This is a common requirement across the mortgage industry.

Homeowner's insurance is not required if you plan to pay cash when buying a home in Oregon. Nevertheless, it is still a wise investment, especially when you consider the relatively low annual cost of these policies.

| Characteristics | Values |

|---|---|

| What is Private Mortgage Insurance? | A specialized type of insurance policy that compensates lenders for losses resulting from borrower default. |

| When is it required? | When the down payment on your home is less than 20% of the value of your home. |

| Who chooses the insurer? | The lender. |

| Who pays the premium? | The buyer. |

| Can it be cancelled? | Yes, in Oregon, it is possible to cancel private mortgage insurance when you’ve paid your balance down to a certain level. |

| How much does it cost? | The cost can vary based on several factors, including the loan-to-value ratio, the type of home loan, etc. The cost can range from around 0.3% to 1.5% of the original loan amount per year. |

What You'll Learn

- Private mortgage insurance (PMI) is an insurance policy that protects the lender in the event that the borrower is unable to repay their mortgage loan in full

- PMI is usually required when the down payment on a home is less than 20% of the home's value

- PMI can be cancelled when the mortgage balance reaches 80% of the home's original or current appraised value

- There are several financing strategies available that could help borrowers avoid PMI entirely

- PMI does not protect the borrower and they can still lose their home through foreclosure

Private mortgage insurance (PMI) is an insurance policy that protects the lender in the event that the borrower is unable to repay their mortgage loan in full

Private mortgage insurance (PMI) is a type of insurance that protects the lender in the event that the borrower is unable to repay their mortgage loan in full. It is usually required when the down payment on a home is less than 20% of the value of the home. PMI can be beneficial for the borrower as it allows them to buy a house sooner without having to save up for a large down payment. The cost of PMI can vary depending on factors such as the loan-to-value ratio and the type of home loan. It is typically paid as a monthly premium and represents a small percentage of the borrower's monthly mortgage payment. PMI can be cancelled once the mortgage balance reaches a certain level, usually when it reaches 80% of the home's original or current appraised value.

In the state of Oregon, while there are no specific insurance-related requirements for home buyers, PMI is typically required by lenders when the down payment is less than 20% of the home's value. This is to protect the lender in case the borrower defaults on the loan. The cost of PMI in Oregon can vary but typically ranges from around 0.3% to 1.5% of the original loan amount per year. It is important to note that PMI only protects the lender and does not provide any coverage for the borrower in case of default.

Unicare Private Insurance: What You Need to Know

You may want to see also

PMI is usually required when the down payment on a home is less than 20% of the home's value

Private mortgage insurance (PMI) is a type of insurance that compensates lenders in the event of borrower default. It is usually required when the down payment on a home is less than 20% of the home's value. In such cases, lenders typically require borrowers to purchase PMI to protect against losses if the borrower fails to make payments on their home loan.

PMI is intended to protect the lender, not the borrower, and is usually paid as an additional monthly fee on top of the mortgage payment. The cost of PMI can vary depending on factors such as the borrower's credit score, the amount of the down payment, and the chosen insurer. Typically, PMI premiums range from $30 to $70 per month for every $100,000 borrowed. While PMI allows borrowers to purchase a home with a smaller down payment, it also increases the overall cost of the loan.

In Oregon, as in other states, PMI is usually applied to conventional home loans that account for more than 80% of the property value. Federal Housing Administration (FHA) loans have mortgage insurance provided by the government, and it cannot be cancelled. On the other hand, in Oregon, PMI can typically be cancelled when the mortgage balance reaches 80% of the home's original or current appraised value.

There are several strategies to avoid paying PMI, such as lender-paid mortgage insurance, where the borrower accepts a higher interest rate in exchange for the lender paying the PMI. Another option is a piggyback loan, where a second mortgage is taken out to cover 10% of the home's purchase price, effectively resulting in a 20% down payment and eliminating the need for PMI. Additionally, certain loan programs, such as those for first-time homebuyers or specific professions, may offer loans without the requirement for PMI.

EmblemHealth: Private Insurance, Public Benefits

You may want to see also

PMI can be cancelled when the mortgage balance reaches 80% of the home's original or current appraised value

In Oregon, Private Mortgage Insurance (PMI) can be cancelled when the mortgage balance reaches 80% of the home's original or current appraised value. This is applicable to conventional home loans.

PMI is an insurance policy that compensates lenders for losses resulting from borrower default. It is usually applied to conventional home loans that account for more than 80% of the property value. It is important to note that PMI is different from governmental mortgage insurance, which is provided by the Federal Housing Administration (FHA) for FHA loans.

PMI allows borrowers to buy a house sooner without having to save up for a 20% down payment. It also has a relatively small impact on monthly payments. The cost of PMI can vary based on factors such as the loan-to-value (LTV) ratio and the type of home loan.

In Oregon, it is possible to cancel PMI when the borrower has paid down their balance to a certain level. While PMI can provide benefits to borrowers, it is important to be aware of strategies to avoid paying PMI, such as taking on a slightly higher mortgage rate or combining two loans so that neither accounts for more than 80% of the property value.

Blue Cross Blue Shield Massachusetts: Private Insurance Explained

You may want to see also

There are several financing strategies available that could help borrowers avoid PMI entirely

There are several financing strategies available that could help borrowers in Oregon avoid private mortgage insurance (PMI) entirely. Here are some options:

Lender-Paid Mortgage Insurance (LPMI)

With LPMI, the lender covers the cost of your mortgage insurance, but you'll pay a higher interest rate in return. While you're still paying for PMI in the form of interest, this strategy can help you avoid monthly PMI premiums. However, LPMI cannot be cancelled, even if your mortgage balance drops below 80% of your home's value.

Piggyback Loans or 80-10-10 Loans

Piggyback loans, also known as 80-10-10 loans, are a type of financing where you take out two mortgages simultaneously. The first mortgage covers 80% of the home's purchase price, and the second mortgage covers 10%, while you contribute the remaining 10% as a down payment. This structure helps you avoid PMI by ensuring that no single loan exceeds 80% of the property value.

Government-Backed Loans

Government-backed loans, such as Veterans Affairs (VA) loans, do not require PMI. VA loans are available to current and former military service members and eligible spouses. While there is a one-time funding fee, VA loans offer significant benefits, including no down payment requirement and often more favourable interest rates compared to conventional loans.

Special First-Time Homebuyer Programs

Some lenders and banks offer special programs for first-time homebuyers that feature low down payment requirements and no PMI. For example, Bank of America's Affordable Loan Solution mortgage requires just a 3% down payment and does not include PMI. These programs may have income limits and require homeownership counselling or education.

State or Local Homebuyer Assistance Programs

Many state and local governments, as well as some non-profit organisations, offer assistance programs for first-time homebuyers. These programs can include grants, tax credits, subsidised loans, or down payment assistance. By taking advantage of these programs, you may be able to reach the 20% down payment threshold and avoid PMI.

Ambetter: Private Insurance or Public Option?

You may want to see also

PMI does not protect the borrower and they can still lose their home through foreclosure

Private mortgage insurance (PMI) is a type of insurance that compensates lenders for losses resulting from borrower default. It is usually required when homebuyers take out a conventional loan with a down payment of less than 20% of the purchase price.

PMI does not protect borrowers from foreclosure. If a borrower with PMI falls behind on their mortgage payments, they can still lose their home. While PMI can help borrowers qualify for a loan that they may not otherwise be eligible for, it does not prevent foreclosure or a decrease in their credit score.

PMI is purchased by the buyer to protect the lender and is not the same as homeowner's insurance, which covers repairs or replacements to the home and its contents in the event of damage. Borrowers typically pay a monthly premium for PMI, which is added to their mortgage payments. The cost of PMI depends on several factors, including the size of the mortgage loan, the down payment amount, and the borrower's credit score.

In Oregon, homebuyers tend to have questions about PMI, as it can affect the size of monthly payments and overall borrowing costs. While PMI can make it possible to buy a house sooner, it is important to understand that it does not protect borrowers from foreclosure.

Kaiser Permanente: Private Insurance, Public Good?

You may want to see also

Frequently asked questions

Private mortgage insurance (PMI) is a type of insurance policy that compensates lenders for losses resulting from borrower default. It is usually applied to conventional home loans that account for more than 80% of the property value.

The cost of private mortgage insurance in Oregon can vary based on several factors, including the loan-to-value (LTV) ratio and the type of home loan. The cost typically ranges from around 0.3% to 1.5% of the original loan amount per year.

Yes, in Oregon, it is possible to cancel private mortgage insurance when you've paid your balance down to a certain level, typically when the mortgage balance reaches 80% of the home's original or current appraised value.