Getting life insurance for a child with autism can be challenging, but it is not impossible. The options available depend on several factors, including the child's age, the severity of their condition, and their ability to function independently. Some insurance companies may decline coverage for children with autism under a certain age, typically around eight years old, as medical professionals may not yet have a clear prognosis for the child's future development. However, it is still possible to obtain life insurance for a child with autism by working with a high-risk life insurance agency or by adding the child as a rider to the parent's policy.

| Characteristics | Values |

|---|---|

| Difficulty of getting life insurance for children with autism | Yes, it can be challenging to get life insurance for children with autism. |

| Need for an agent | Working with an agent who specializes in high-risk life insurance can make the process easier. |

| Factors determining rates and approval | The insurer will consider the child's place on the autism spectrum, the presence of other pre-existing conditions, and how autism affects their day-to-day activities. |

| Medical records and exam | The insurer will review the child's medical records and may require a medical exam. |

| Rating or risk profile | The insurer will assign a rating or risk profile to the child, which will impact the rates. Higher ratings mean higher rates. |

| Age of the child | Some insurers prefer to wait until the child is around eight years old, as medical professionals can better predict the child's prognosis at this age. |

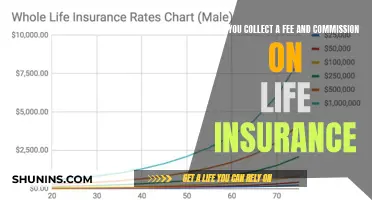

| Type of life insurance | Term life insurance is not available for minor children. Only whole life insurance or child riders are options for children. |

| Availability of individual policy for the child | Due to the nature of the disorder, some life insurance companies may be apprehensive about approving an individual policy for a child with autism. |

| Need for complete medical history | To get an individual policy, it is important to have a complete medical history and be upfront with the insurance company. |

| Child rider option | Parents can add a child rider to their own life insurance policy to cover their child with autism. Some companies do not ask about the child's medical history for this option. |

What You'll Learn

Life insurance options for a child with autism

Overview

Autism Spectrum Disorder (ASD) is a complex condition that affects each individual differently, and this extends to the realm of life insurance as well. While it is challenging to secure life insurance for a child with autism, it is not impossible, and several options are available to provide financial protection for the future.

Option 1: Individual Policy

The first option is to obtain an individual policy for your child. This option offers the advantage of having a policy that will remain in place even during adulthood, as long as the premiums are paid. However, it is important to note that not everyone will qualify for this type of policy, as life insurance companies may be hesitant to approve coverage for children on the autism spectrum. To increase the chances of success, it is crucial to be transparent and provide a comprehensive medical history to the insurance professional.

Option 2: Child Rider on Parent's Policy

The second option is to add your child as a rider on your own life insurance policy. This option has its pros and cons. One benefit is that some carriers do not ask for the child's medical history, and this rider can also cover other children in the household. Additionally, some companies allow you to convert the rider into an individual policy when the child reaches a certain age. This option is also cost-effective, making it a good choice for those with limited alternatives.

However, the downside is that the coverage amount is typically small, and not all companies will allow the conversion of the rider into an individual policy, which could leave your child without coverage in their 20s.

Factors Affecting Insurance Rates

When considering life insurance for a child with autism, it is important to understand the factors that influence insurance rates. Insurance companies will take into account the child's position on the autism spectrum, the presence of any intellectual or psychiatric limitations, muscular ailments, daily functioning, and any other major health problems. They will also consider the medications the child is taking.

Additionally, age, occupation, family medical history, tobacco and alcohol use, and physical health are all factors that contribute to the overall insurance rate.

Case Studies

To illustrate the process, consider the following case studies:

Case Study 1: A 23-year-old female was diagnosed with autism at age 8. Her parents attempted to purchase life insurance for her immediately but were denied. With no other physical or mental problems, they later reapplied, and she received a Standard rating as her autism had not developed into any other issues.

Case Study 2: A 25-year-old male was diagnosed with Asperger's at age 10 and suffered from depression at age 20. He took antidepressants for a year and recovered. His initial application resulted in a substandard rating due to his history of depression. However, after obtaining a note from his therapist confirming his improved condition, he reapplied and received a better rating.

Professional Guidance

Navigating the complexities of life insurance for a child with autism can be challenging, and it is recommended to seek professional guidance. Working with a knowledgeable insurance advisor can help you make an informed decision and increase the chances of finding the most suitable coverage options.

U.S.AA. Life Insurance: Drug Testing and Policy Details

You may want to see also

The challenges of underwriting for a child with autism

Underwriting life insurance for a child with autism can be challenging due to the unique nature of the disorder and the wide range of symptoms and functioning levels associated with it. Here are some of the key challenges faced by underwriters when evaluating applications for children with autism:

Variable Symptoms and Severity:

Autism Spectrum Disorder (ASD) presents differently in each individual, with varying symptoms and severity levels. Underwriters need to consider the specific symptoms and their impact on the child's daily life, including social communication, interaction, and repetitive behaviours. The child's place on the autism spectrum, from mild to severe, plays a crucial role in determining insurability and rates.

Pre-existing Conditions and Comorbidities:

Children with autism may also have other pre-existing conditions or comorbidities, such as intellectual disabilities, psychiatric disorders, or physical impairments like cerebral palsy or seizures. Underwriters must carefully evaluate these additional factors, as they can significantly influence the child's overall health and prognosis.

Impact on Daily Activities:

The ability to perform daily activities is an important consideration for underwriters. They will assess the level of assistance the child requires with activities of daily living (ADLs) such as feeding, bathing, and dressing, as well as contributory activities of daily living (IADLs) such as cooking, driving, and housecleaning. Higher levels of independence and functionality are generally viewed more favourably.

Medical History and Medications:

Underwriters will request detailed medical information, including the child's diagnosis history, medications, and any related medical conditions. They may also require a medical examination to assess the child's current health status. This information helps them understand the child's overall health and the potential impact on their life expectancy.

Age of Diagnosis and Prognosis:

The age at which the child was diagnosed with autism and the subsequent prognosis are important factors. Insurers often prefer to wait until a child is around eight years old, as it allows for a more accurate assessment of the child's condition and future development. Applications for younger children may be declined initially, but it is worth reapplying as the child gets older.

High-Risk Classification:

Life insurance for children with autism is often considered high-risk, and underwriters will use table ratings to determine premiums. Table ratings typically mean that premiums will be higher than standard rates, and the specific rating will depend on the child's individual circumstances. Finding affordable coverage can be challenging, and working with a high-risk life insurance specialist is recommended.

Limited Coverage Options:

Obtaining standard life insurance coverage for children with autism can be difficult. Some insurers may decline coverage or offer limited options, especially for younger children. Parents may need to explore alternative routes, such as adding their child as a rider to their own policy or seeking guaranteed issue coverage, which often comes with higher costs and limitations.

In summary, underwriting life insurance for a child with autism involves a comprehensive evaluation of the child's medical history, current health status, functioning level, and potential future prognosis. The variable nature of ASD and its impact on daily life presents unique challenges for underwriters. Working with a knowledgeable agent who specialises in high-risk life insurance and understands the complexities of autism can be beneficial for families navigating this process.

Physician Life Insurance: A Necessary Safety Net

You may want to see also

How to get life insurance for a child with autism

Getting life insurance for a child with autism can be challenging, but it is possible. Here are some steps to help you get life insurance for your child with autism:

Understand the Challenges:

It can be difficult to obtain life insurance for a child with autism due to the nature of the disorder. Life insurance companies may be hesitant to approve a policy, and the cost of coverage may be higher. Additionally, there may be limited options available, and the process can be complex.

Consult a Reputable Advisor:

Connect with a reputable insurance advisor who has experience in this area. Look for someone who understands the unique considerations of insuring a child with special needs and can put your family's needs ahead of personal gain. Be cautious of advisors who claim that a child with autism is uninsurable due to pre-existing conditions; there may still be options for obtaining coverage.

Gather Medical Information:

Have your child's medical history readily available. Insurance companies will consider factors such as the age of diagnosis, the severity of autism, any co-occurring conditions, and the impact on daily activities. Be prepared to provide detailed information and assessments to the insurance company.

Explore Different Options:

There are a few options available for insuring a child with autism:

- Individual Policy: This option provides your child with their own policy, which cannot be cancelled as long as premiums are paid. However, not everyone may qualify, and it is subject to underwriting and case-by-case consideration.

- Rider on Parent's Policy: Adding your child as a rider to your own policy can be a cost-effective option, and some carriers do not ask about the child's medical history. However, the coverage amount may be relatively small, and not all companies allow conversion of the rider into an individual policy when the child becomes an adult.

- Guaranteed Issue Life Insurance: This option guarantees acceptance, but it is typically the most expensive form of life insurance and has limitations on the death benefit payout. It may be considered a last resort if other options are not available.

Compare Different Carriers:

Shop around and compare different insurance carriers, as their criteria for insuring individuals with autism may vary. Some insurers may be more open to reviewing applications from children with autism, while others may have specific requirements or restrictions.

Understand the Cost of Care:

Calculate the approximate cost of care for a child or adult with autism. This will help you determine how much of your life insurance benefits should be allocated to your child's care.

Consider a Special Needs Trust:

In addition to life insurance, consider setting up a Special Needs Trust. This can help your child receive governmental benefits and ensure they are provided for even after you are gone. Consult an attorney with experience in this area to guide you through the process.

OCD and Life Insurance: Impact and Implications

You may want to see also

The cost of care for a child with autism

One of the major costs for families with a child with autism is education. Public schooling in the United States is legally required to offer special education, but there are also private schools that cater specifically to children with autism. These private schools can range in price from $15,000 to $100,000 or more, depending on the type of care needed, location, and schooling. Medical costs are another significant expense, with annual healthcare costs for autistic individuals increasing with age: $6,467 for ages 0-5, $9,053 for ages 6-17, and $13,580 for ages 18 and above. Therapy costs, such as speech, occupational, and physical therapy, can also add up, with Applied Behavior Analysis (ABA) therapy costing around $46,000-$47,500 per year.

The financial burden of autism can be eased through grants, scholarships, and support from organizations like Hope For Three. Additionally, life insurance can provide financial support for the long-term care needs of a child with autism. While it may be challenging to obtain life insurance for a child with autism, it is not impossible. Working with an agent who specializes in high-risk life insurance can increase the chances of finding a suitable policy.

Life Insurance: Cashing in While Still Alive?

You may want to see also

Life insurance for parents of a child with autism

Life insurance is a crucial financial product for parents of children with autism to consider. It can provide financial security and peace of mind, ensuring that their child's needs will be taken care of, even in their absence. Here are some important things to know about life insurance for parents of a child with autism:

- The Importance of Life Insurance: As a parent of a child with autism, you play a vital role in providing for your child's daily needs and ensuring their well-being. Life insurance can help ensure that your child continues to receive the necessary care and support if something happens to you. It can provide funds for their ongoing care, therapy, education, and other expenses.

- Special Considerations: When considering life insurance, it's important to think about the specific needs of your child with autism. This includes the cost of their current and future care, any potential medical or therapeutic interventions they may require, and the possibility of them becoming financially independent. These factors will influence the amount of coverage you need and the type of policy that best suits your situation.

- Available Options: There are several options available for life insurance for parents of children with autism. You can purchase a traditional life insurance policy on yourself, ensuring that your child is the beneficiary. This can provide them with financial support upon your passing. Another option is to set up a Special Needs Trust, which can help manage the funds for your child's care and maintain their eligibility for government benefits.

- Impact on Your Child's Benefits: If you name your child with autism as the direct beneficiary of your life insurance policy, it could affect their eligibility for public assistance programs such as Medicaid or Supplemental Security Income (SSI). To avoid this, consider setting up a Special Needs Trust or consulting with a special needs attorney to explore other options, such as naming a trustee or a different beneficiary.

- Working with Specialists: When shopping for life insurance, consider working with agents or brokers who have experience in high-risk life insurance or special needs planning. They can help you navigate the complexities of finding coverage, understand the legal and financial considerations, and compare options from different insurance carriers.

- Comparing Quotes: Don't hesitate to get quotes from multiple insurance companies. Each carrier has its own underwriting guidelines, and by comparing options, you may find more favourable rates and coverage terms.

- Timing of Application: The timing of your application can also be a factor. Some insurance companies may prefer to wait until your child is older, as the prognosis and understanding of their condition become clearer with age. If your child was declined coverage at a younger age, it may be worth reapplying later.

- Additional Riders: If you or your child qualifies for life insurance, you may also want to consider adding riders to the policy. For example, a critical illness rider can provide a cash benefit to cover treatment costs, while a long-term care rider can help pay for care in a long-term facility if needed.

In conclusion, life insurance is an essential tool for parents of children with autism to secure their child's future. By understanding the available options, seeking specialist advice, and carefully planning, you can ensure that your child's needs are provided for, even in your absence.

Euthanasia and Life Insurance: What's the Connection?

You may want to see also

Frequently asked questions

Yes, a child with autism can get life insurance. However, it can be challenging to find a provider. It is recommended that parents buy life insurance on themselves and add a child rider, which can later be converted to a standalone permanent life insurance policy for the child.

Many life insurance companies require filling out a medical questionnaire about the child. Some insurers prefer to wait until the child is around eight years old, as by then medical professionals can better predict the child's prognosis.

Final expense life insurance may be an option. This provides a cash payout to the family to cover final expenses or other costs after the child's death. It features a graded death benefit, meaning the payout will be lower if the policyholder dies within the initial years of the policy.