Life insurance is a crucial financial tool that provides peace of mind and financial security for individuals and their loved ones. However, the process of obtaining life insurance can be complex, especially for those facing health challenges or advanced age. In certain situations, individuals may wonder if they can acquire life insurance while in a hospital, and if so, what options are available to them. It is important to understand the factors that influence insurability, the types of policies offered, and how to navigate the application process effectively.

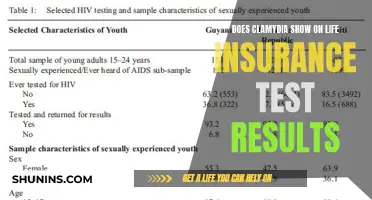

| Characteristics | Values |

|---|---|

| Can you get life insurance while in hospital? | Yes |

| What is the qualifying age? | 50-85 years |

| Are there any health questions or medical exams required? | No |

| Can you be denied coverage? | No |

| Can you get life insurance with a pre-existing condition? | Yes |

| Does the cost of life insurance increase with a pre-existing condition? | Yes |

| Can Medicaid take life insurance after death? | Yes, if you are 55 or older |

What You'll Learn

- Hospitals can offer whole life insurance policies to patients aged 50-85 without a medical exam

- Medicaid can take life insurance proceeds after death if you are 55 or older

- Guaranteed issue life insurance is a type of whole life insurance policy that doesn't require a medical exam

- Pre-existing conditions such as anxiety and depression can make it harder and more expensive to get life insurance

- Hospital indemnity insurance helps cover out-of-pocket expenses related to hospital stays and surgeries

Hospitals can offer whole life insurance policies to patients aged 50-85 without a medical exam

No medical exam life insurance does not require potential policyholders to undergo any medical exams before getting a policy, which speeds up the process of acquiring life insurance coverage. This type of life insurance may be available in the form of term or whole life insurance policies, with the latter providing coverage for the entire life of the policyholder. While whole life insurance tends to be more expensive, the death benefit is certain, and the plan may accumulate cash value in a separate savings account.

It is important to note that life insurance without a medical exam may be more costly than traditional life insurance policies. Additionally, the policyholder must still be within a certain age range to qualify, and their coverage may be limited. However, no medical exam life insurance can provide peace of mind and long-lasting support for individuals and their families.

Life Insurance and Syphilis Testing: What's the Connection?

You may want to see also

Medicaid can take life insurance proceeds after death if you are 55 or older

Life insurance is a contract between an individual and a life insurance company to transfer the financial risk of a premature death to the insurer in exchange for a specified amount of premium. While life insurance is beneficial to the majority of people, there are complicated rules associated with the program that make it confusing as to whether or not Medicaid will take your life insurance after death.

Medicaid can take away life insurance proceeds after you pass away if you are 55 years old or older. This is what they label as "estate recovery", and if Medicaid put down money for you to be within an assisted living facility, then the state program will then require your estate to pay back those funds. You can also expect Medicaid to try and recover other funds from your estate such as any debt from hospital bills, prescriptions, and home-based services.

There are ways to help protect your life insurance policy proceeds from being taken by Medicaid. The most advantageous option is to make sure that your estate is not the beneficiary of your life insurance policy. The Medicaid program will seek to take money from your estate, and this cannot be conducted if you choose to change the beneficiary of your policy. Therefore, instead of listing your estate as a life insurance beneficiary, list any individual or individuals that you wish to receive your life insurance policy proceeds.

Cancer Survivors: Getting Life Insurance After Recovery

You may want to see also

Guaranteed issue life insurance is a type of whole life insurance policy that doesn't require a medical exam

Guaranteed issue life insurance is a type of whole life insurance policy that provides coverage without requiring a medical exam or health questionnaire. This type of policy is designed for individuals who may otherwise have difficulty obtaining traditional life insurance due to serious health issues or pre-existing conditions. While guaranteed issue life insurance offers a valuable safety net for those with health concerns, it typically comes with a higher price tag than standard policies.

With guaranteed issue life insurance, individuals can obtain coverage without undergoing a medical examination or providing detailed health information. This type of policy is often referred to as "guaranteed life insurance" or "guaranteed acceptance life insurance." It is particularly beneficial for those with serious health problems, as it helps them secure coverage despite their medical history.

The qualifications for guaranteed issue life insurance vary based on age and location. Generally, individuals must be between 50 and 80 years old to be eligible. Additionally, these policies usually include a waiting period before the benefits take effect, typically lasting 2 to 3 years. During this waiting period, if the policyholder passes away due to non-accidental causes, the beneficiary will not receive the death benefit but will be refunded the paid premiums with interest.

While guaranteed issue life insurance offers a valuable solution for those with health issues, it is important to consider the pros and cons. On the positive side, these plans provide coverage for individuals who might otherwise be denied. They save time by eliminating the need for medical exams and health questions. The death benefit can also be scaled to meet the policyholder's needs, usually ranging from $2,000 to $25,000.

However, there are some drawbacks to consider. Guaranteed issue life insurance policies are typically more expensive than standard term or whole life policies due to the higher risk assumed by the insurer. The benefits also come with an initial waiting period, and if the policyholder passes away during this period (from non-accidental causes), the beneficiaries will not receive the death benefit.

In conclusion, guaranteed issue life insurance is a valuable option for individuals with serious health concerns who want to ensure their loved ones are provided for. While it offers a safety net, it is important to weigh the pros and cons and explore various insurers to find the best coverage for your specific needs.

Health Insurance: High Costs and Life Changes

You may want to see also

Pre-existing conditions such as anxiety and depression can make it harder and more expensive to get life insurance

When it comes to life insurance, the younger and healthier you are, the cheaper your premium will be. As a result, pre-existing health conditions like anxiety and depression can make it harder and more expensive to get life insurance.

Life insurance companies factor in illnesses of all types when assessing applicants, potentially leaving those with pre-existing conditions facing higher premiums. The specific impact on your coverage options and costs will depend on the frequency, severity, treatment, and diagnosis details of your condition.

If your anxiety or depression impacts your school or work, or if you have had frequent medication changes, you may end up paying a higher premium. In very serious cases, you may not be eligible for traditional coverage. However, non-disclosure of your condition will lead to an even worse situation, where you pay for insurance but your beneficiaries may not receive the benefits.

If you are taking anti-depressants or anti-anxiety medication, you will need to disclose this when applying for life insurance. Like other pre-existing conditions, your insurance provider will want to know about the stability and treatment of your condition. If you are actively treating your mental health condition with medication or seeking help from a mental health professional, you may have to provide further details.

Life insurance companies typically categorise depression into the following three categories, which influence how they rate you:

- Mild depression: Up to one type of medication and no history of hospitalisations.

- Moderate depression: Those who take more than one medication and consult a psychiatrist.

- Severe depression: Those who have suicidal ideation or have attempted suicide in the past.

Similarly, anxiety disorders are also considered in the underwriting process if someone has been professionally diagnosed. The severity of the diagnosis and the course of treatment will impact your eligibility for life insurance and the premium rates you will pay.

If you have a pre-existing mental health condition, insurers may focus on the following factors to determine your risk:

- Recent improvements or worsening of symptoms.

- Drug and/or alcohol consumption levels.

- Whether your condition affects daily activities.

- Medication and/or hospitalisations related to your mental health condition.

- Severity and regularity of symptoms.

- Prior suicide attempts.

While pre-existing conditions like anxiety and depression can make obtaining life insurance more challenging and costly, it is still possible to secure coverage. Being honest about your mental health history and shopping around for different insurers can help you find the right policy for your needs.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

Hospital indemnity insurance helps cover out-of-pocket expenses related to hospital stays and surgeries

Hospital indemnity insurance is a type of supplemental insurance that can help you avoid massive medical debt. It is an insurance plan you can purchase in addition to your health insurance plan. You pay a monthly premium, and if you end up spending time in the hospital, you receive a fixed benefit amount paid directly to you to help cover expenses.

Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays. Depending on the plan, hospital indemnity insurance gives you cash payments to help you pay for the added expenses that may come while you recover. Typically, plans pay based on the number of days of hospitalization.

Even if your medical insurance covers most of your hospitalization, you can still receive payments from your hospital indemnity insurance plan for extra expenses while recovering. The payments go directly to you, so you can use these emergency funds to pay for costs not covered by your health insurance, health insurance deductibles, copays and coinsurance, childcare expenses while you are in the hospital, or cost-of-living expenses as you recover.

Hospital indemnity insurance payouts are sent directly to you as the policyholder. That's unlike health insurance, which contracts with providers and pays them directly. A hospital indemnity insurance payment could be used for anything, though people often use the benefits for deductibles, coinsurance, transportation, medications, rehabilitation or home care costs. You can also use the money to pay for some expenses incurred as you recover, such as groceries and childcare.

In general, most plans pay for hospitalizations with or without surgery. For higher monthly premiums, some hospital indemnity plans may cover other hospitalization-related services such as emergency room visits.

Gun Ownership: Impact on Life Insurance Rates

You may want to see also

Frequently asked questions

Yes, you can get life insurance while in the hospital. There are options for people who are in the hospital or a nursing home and need a whole life insurance policy. You can get a guaranteed acceptance whole life insurance policy with no health questions or medical exam required to qualify.

Yes, it is possible to get life insurance with a pre-existing condition, but the details matter, and each answer will depend on your specific health situation. Age and health are the two most important factors that life insurance companies use to determine insurability and cost.

Hospitals cannot directly come after your life insurance. However, if you are enrolled in Medicaid, they can take away your life insurance proceeds after you pass away if you are 55 or older. This is called "estate recovery," where the Medicaid program takes money from your proceeds to pay back the program for any benefits you received during your lifetime.