Life insurance is a tool that helps reduce the risk of financial troubles for your loved ones after your death. While it is a valuable safety net, you may find yourself wanting to cancel your policy. This could be due to a variety of reasons, such as a change in your financial situation, dissatisfaction with the policy or provider, or simply not needing the coverage anymore. Whatever the reason, it's important to understand the process and the potential consequences of cancelling your life insurance policy.

| Characteristics | Values |

|---|---|

| Reasons to cancel | Financial situation has changed, making the premiums unaffordable; secured a better policy; no longer need the coverage |

| When to cancel | During the "free look" period (typically 10-30 days) for a full refund; if your mortgage is nearly paid off; if your biggest financial obligations are settled; if you have accumulated significant savings in your retirement fund |

| How to cancel | Contact your insurance company by phone or in writing; stop premium payments (especially for term life insurance); surrender permanent life insurance policy for its cash value; perform a tax-free exchange; take a life settlement |

| Alternatives to cancelling | Switch to paid-up status; lower your death benefit; pay with dividends; use the cash value to pay premiums |

What You'll Learn

Cancelling during the cooling-off period

The cooling-off period is the minimum number of days during which you can cancel a newly purchased insurance policy without penalty. The length of the cooling-off period varies depending on the type of insurance and how it was purchased.

In the case of life insurance, the cooling-off period is generally 30 days. This period typically begins from when the policy begins or when you receive your policy documents, whichever is later.

During the cooling-off period, you have the right to cancel the insurance policy and obtain a refund of any premiums paid. However, the insurer may deduct a small amount to cover the days when the policy was in force, as well as a small administration fee.

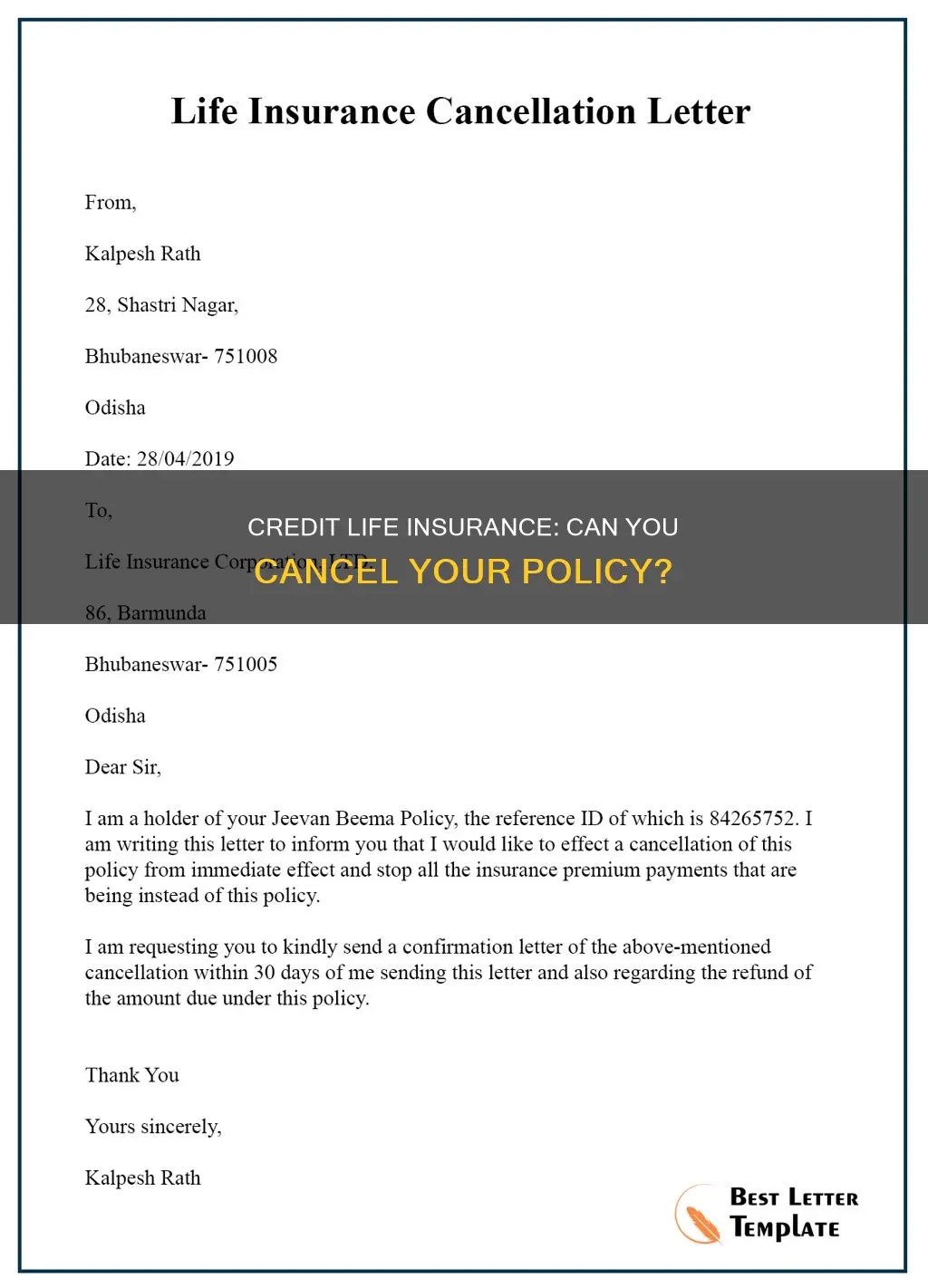

If you wish to cancel your life insurance policy during the cooling-off period, you should contact your insurer as soon as possible. This can be done by writing or sending an email to the insurance company, stating your intention to cancel the policy. The deadline for cancellation is based on when the letter or email was sent, not when it is received.

It is important to note that the right to cancel during the cooling-off period does not apply to travel insurance that lasts less than a month. Additionally, there may be no cooling-off period for certain types of insurance, such as single-trip travel insurance or short-term life insurance purchased face-to-face.

Life Insurance Payments: Tax Write-Off or Not?

You may want to see also

Cancelling a term life insurance policy

Understanding the Reasons and Timing

Before cancelling your term life insurance policy, it's important to evaluate your reasons and timing. Ask yourself if you still need coverage. For example, if your family is financially independent, your mortgage is paid off, and you have no significant debts, you may no longer need the policy. Additionally, consider if you are changing your investment strategy or struggling to afford the premiums. It's also crucial to review other financial obligations, such as credit card debts, and future commitments like college tuition.

Cancelling During the Free Look Period

If you've recently purchased the policy, you are likely within the "free look" period, which typically lasts 10 to 30 days, depending on your state. During this time, you can cancel your policy without any financial penalty and receive a full refund of any premiums paid. Contact your insurance company by phone or in writing to inform them of your decision to cancel during this period.

Stopping Premium Payments

One of the most effective ways to cancel your term life insurance policy is to stop making premium payments. You can do this by discontinuing the checks or ending any automatic payments you have set up. By doing so, you will trigger a grace period, usually lasting 30 days, during which you can make up missed payments and keep your policy active if you change your mind. If you let the grace period expire, your insurance coverage will end.

Contacting Your Insurance Provider

It's recommended to call your insurance carrier directly to confirm the cancellation and ensure there are no further obligations on your part. Many insurers offer forms or online options to finalize the cancellation process. You can also send a letter to your insurance company notifying them of your cancellation. Some insurers may allow you to submit your notice online, so check their website for specific instructions.

Exploring Other Options

Before cancelling your term life insurance policy, consider exploring alternative options. If you're thinking of cancelling due to affordability, you may be able to reduce the policy's face amount, which can lower your premium payments while still providing some level of coverage. Additionally, check the terms of your policy, as many term policies include a conversion rider that allows you to switch to a permanent policy without a new medical exam if you decide you need lifelong coverage.

Understanding the Consequences

Keep in mind that cancelling your term life insurance policy means you won't receive any payout, as term life insurance does not accumulate cash value over time. If you decide to purchase life insurance again in the future, your rates will likely be higher due to your increased age and possible changes in health.

Finding Your Life Insurance License: Quick and Easy Steps

You may want to see also

Cancelling a whole life insurance policy

Understanding the Process

Surrendering the Policy

When you surrender a whole life insurance policy, you have the right to receive a payout from the cash value that has accumulated. However, this amount may be reduced by surrender charges, especially if you haven't held the policy for a long period. Surrender fees can be significant in the early years of the policy, potentially eliminating any cash value. Over time, these fees decrease, but it's crucial to understand that surrendering the policy prematurely may result in a lower cash value than expected.

Tax Implications

There may be tax implications when cancelling a whole life insurance policy. Any amount received from surrendering the policy that exceeds the total premiums paid may be subject to income tax. Additionally, if you've borrowed against the policy, the outstanding loan balance, including accrued interest, will be treated as taxable income.

Alternative Options

Before cancelling your whole life insurance policy, consider exploring alternative options:

- Using the cash value to pay premiums: You may be able to use the accumulated cash value to cover your premium payments or mortality costs, depending on the policy type. However, this approach can reduce the death benefit for your beneficiaries and may lead to a lapse in coverage if the cash value is depleted.

- Tax-free exchange (1035 exchange): This option allows you to surrender your current life insurance policy and roll over the cash value into a new policy or an annuity without paying income taxes. It's important to follow the insurance company's instructions to avoid any mistakes that could result in tax consequences.

- Viatical or life settlement: If you have a terminal illness or are over 65, you may be able to sell your life insurance policy to a third party. A viatical settlement is typically for those with a life expectancy of less than two years, while a life settlement is for those in reasonably good health. The buyer will offer a lump sum payment, and the policy's death benefit will go to them upon your passing.

When to Cancel

There are several situations in which cancelling your whole life insurance policy may be appropriate:

- You no longer need coverage: If your family is financially independent and can manage without the death benefit, life insurance may no longer be necessary.

- Changing investment strategies: You may find that the investment options offered by your current policy are not as competitive as other financial vehicles, such as annuities or mutual funds.

- Affordability: If you're struggling to afford the premiums, consider exploring the alternatives mentioned above or reducing the coverage amount to lower your premium payments.

- Switching policies or companies: If you've found a new policy that better suits your needs, ensure that the new policy is in force before cancelling your existing one to avoid any gaps in coverage.

In conclusion, while you can cancel your whole life insurance policy at any time, it's important to carefully consider the financial implications and explore alternative options before making a final decision. Cancelling a whole life insurance policy can have a significant impact on your financial strategy and the benefits provided to your loved ones.

Life Insurance: HSBC's Comprehensive Coverage for Peace of Mind

You may want to see also

Cancelling a mortgage life insurance policy

If you decide to cancel your mortgage life insurance policy, here are the steps you can follow:

Understand the Consequences:

Before cancelling your policy, it is important to understand the implications. Mortgage life insurance is designed to provide a lump sum to pay off your mortgage in the event of your death, ensuring your family can continue living in the family home. Cancelling this policy means removing that safety net, so it is crucial to consider alternative arrangements or other sources of funds that can be used to pay off the mortgage if needed.

Review Your Policy Details:

Before initiating the cancellation, carefully review the terms and conditions of your mortgage life insurance policy. Pay close attention to any specific requirements, restrictions, or penalties associated with cancelling the policy. Understanding these details will help you make an informed decision and avoid unexpected fees or consequences.

Contact Your Insurance Provider:

Get in touch with your insurance company to inform them of your decision to cancel the policy. You can do this by calling their customer service line or sending them a written notification. They will guide you through their specific cancellation process and any necessary paperwork.

Stop Premium Payments:

One of the most effective ways to cancel a term life insurance policy is to stop paying the premiums. Contact your bank to cancel any automatic payments or direct debits set up for the insurance premiums. This will ensure that the policy lapses and is no longer in effect.

Confirm the Cancellation:

After taking the necessary steps to cancel the policy, it is always a good idea to confirm the cancellation directly with your insurance provider. Contact them to ensure that all the required steps have been completed and that there are no further obligations on your part. This will give you peace of mind and help you avoid any potential lapses in communication.

Remember, it is important to carefully consider your decision to cancel mortgage life insurance and explore all available options before proceeding. If your circumstances have changed, you may want to consider reducing the coverage or shopping around for a better deal instead of cancelling the policy altogether.

Life Insurance Checks: Impact on Social Security?

You may want to see also

Cancelling due to financial hardship

Cancelling credit life insurance due to financial hardship is a valid reason to let a policy lapse. If you are experiencing financial hardship, you may no longer be able to afford the premiums on your life insurance policy. Before cancelling your policy, it is important to understand the potential consequences and explore alternative options.

If you have a term life insurance policy, you can simply stop paying the premiums, which will eventually cause the policy to lapse. However, if you have a permanent life insurance policy, the process is more complex. Permanent life insurance policies often include a cash value component, and cancelling the policy may result in surrender charges and other financial implications.

Before cancelling your policy, consider the following options:

- Contact your insurance agent to discuss reducing the policy's face amount or coverage amount. This may lower your premium payments and make the policy more affordable.

- Use the cash value of the policy to cover your premium payments. This option is typically available for permanent life insurance policies and can help you keep the policy active during financial difficulties. However, it may reduce the death benefit for your beneficiaries.

- Explore a tax-free exchange, also known as a 1035 exchange. This allows you to swap your current life insurance policy for a similar insurance product, such as an annuity or another life insurance policy, without paying taxes.

- Consider selling your life insurance policy through a viatical or life settlement, especially if you are facing a terminal illness or are older. However, this option may result in a substantially smaller sum of money compared to the policy's death benefit.

It is important to carefully review the terms and conditions of your policy, understand the financial implications, and consult with a financial advisor or insurance expert before making any decisions.

Life Insurance Options for Diabetics: What You Need to Know

You may want to see also

Frequently asked questions

Yes, you can cancel your life insurance policy at any time, but you may have to pay a surrender fee if you have a whole life policy.

The simplest way to cancel your life insurance policy is to cancel the direct debit with your bank. Most banks allow you to do this online. Make sure you are cancelling the correct direct debit by checking the direct debit reference, which usually matches your policy number.

You will only get a refund if you cancel within the cooling-off period, which is usually 10 to 30 days from the start of the policy.