Whether or not you can be covered by your aunt's auto insurance depends on a few factors. Firstly, most states and insurance companies require the registered owner of the vehicle to be the named insured on the policy. This means that if your aunt is the registered owner of the car, she would need to have a policy in her name and add you as an additional driver. Some insurance companies allow this, but it's important to check with the insurer. Alternatively, your aunt could transfer the title of the car to you as a gift, allowing you to register the vehicle and purchase insurance under your name. Another option is to reimburse your aunt for the insurance costs on her policy, or you could take out a non-owner policy, which covers a driver who does not own a vehicle but frequently drives them. It's worth noting that being added to your aunt's policy may increase her insurance costs, and in the event of an accident, she could be held financially responsible.

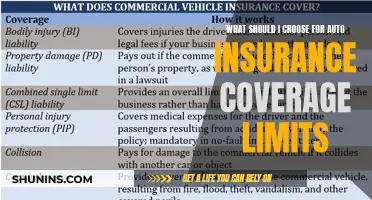

| Characteristics | Values |

|---|---|

| Can I be added to my aunt's auto insurance? | Yes, if your aunt allows it and her insurance company permits it. |

| Will my aunt's insurance rate be affected? | Yes, the rate will likely increase. |

| Can I be the primary driver on my aunt's insurance policy? | Yes, but the insurance company will likely charge the same rate as if you had your own policy. |

| Is my aunt financially responsible if I get into an accident? | Yes, she can be held financially responsible. |

| Can I insure a car that is not in my name? | No, the insurance policy would need to be in the name of the registered owner of the car. |

| Can I drive my aunt's car with my insurance? | It depends on your insurance policy. |

What You'll Learn

Can I be added to my aunt's insurance as a permissive driver?

Whether or not you can be added to your aunt's insurance as a permissive driver depends on a few factors. Firstly, a permissive driver is someone who has the express or implied permission of the policyholder to drive their vehicle. Expressed permission is verbal or written, whereas implied permission is based on past behaviour, the relationship between the people involved, or the lack of objection from the policyholder.

Permissive use is not an insurance policy but an agreement commonly found in most insurance policies. It allows unlisted drivers to have insurance coverage while driving a policyholder's vehicle. However, some policies do not include permissive use, so it is essential to review your aunt's policy and contact her insurance company to determine their specific guidelines.

If your aunt's policy includes permissive use, it is designed for out-of-the-ordinary instances when another driver borrows the vehicle for a short period. If you will be driving her car regularly or for an extended period, you should be added to her policy as a listed or named driver. There is usually no charge for adding a driver to an insurance policy, but it may result in higher premiums if you are an inexperienced driver.

To add you to her policy, your aunt will need to provide her insurance company with some basic information about you, including your full name, date of birth, Social Security number, and driving record.

Grandchild on Your Auto Insurance

You may want to see also

What happens if I get into an accident while on my aunt's insurance?

If you are driving your aunt's car and get into an accident, the first thing to do is to contact the police and document the accident. Take photos of the accident scene, injuries, and damage to the vehicle. You should also get the names and contact information of any witnesses.

In terms of insurance, if you are driving your aunt's car with her insurance, her insurance policy will come into play. This is because auto insurance policies typically apply to the vehicle and not the driver. Therefore, if you are at fault for the accident, your aunt's insurance will likely cover the damages. However, it is important to note that her insurance premiums may increase as a result. Additionally, if you are not listed on your aunt's insurance policy as a driver, the insurance company may deny coverage.

If you have your own insurance policy and are driving your aunt's car with her permission, your insurance may also provide coverage. In this case, your insurance would be considered primary coverage, and your aunt's insurance may act as secondary insurance. However, it is important to review the terms of your insurance policy, as some policies do not cover permissive drivers.

It is worth noting that insurance laws and practices can vary by state and insurance company. Therefore, it is always a good idea to consult with an attorney or insurance expert to understand your specific situation better.

Direct Auto Insurance: Affordable Coverage?

You may want to see also

Can I insure my aunt's car if she gives it to me?

If your aunt gives you her car, you will need to insure it in your name. While it is possible for someone else to insure a vehicle on your behalf, this is generally not advised.

Insurance companies require the policyholder to have an insurable interest in the vehicle, meaning that they would be impacted financially if the vehicle was damaged or destroyed. For this reason, it is usually only the owner or lienholder of a vehicle who will insure it.

If your aunt were to insure the car for you, she would be assuming a great risk. If you were to cause a serious accident, injured parties could go after your aunt's assets as the owner and policyholder. This would be the case even if you stated that you would take on the financial responsibility for any damages.

Additionally, insuring someone else's car could be considered insurance fraud, and the insurance company could deny coverage if they found out that the regular driver of the vehicle was not listed on the policy.

To get your own insurance policy, you will need to transfer the registration of the vehicle to your name. If you live with your aunt, you could also be added as a driver on her policy. However, keep in mind that insurance rates will likely increase, and your driving record and history will impact the cost of insurance.

Virginia Farm Vehicle Insurance: What's Required?

You may want to see also

Can I be on my aunt's insurance if I don't live with her?

Whether or not you can be added to your aunt's insurance policy depends on a few factors. Firstly, insurance companies vary in their policies, so it is important to check with your aunt's insurance company directly. Generally, insurance policies cover the policyholder and any licensed household members, such as a spouse or children living at home. Some insurance companies may also cover children who are away at school but return home during breaks.

In some cases, insurance policies can cover family members who do not live with the policyholder, such as aunts, uncles, cousins, and grandparents. However, this is not always the case, and there must be a valid justification for adding a non-household member to an insurance policy. For example, if you occasionally use your aunt's car, she may be able to add you to her policy as a partial or occasional driver.

It is worth noting that insurance rates may increase if you are added to your aunt's policy, and your aunt may be held financially responsible if you get into an accident. Additionally, insurance fraud may occur if you are not listed on the policy but regularly drive your aunt's car. Therefore, it is essential to understand the insurance company's guidelines and make an informed decision.

Cigna Insurance: Primary in Auto Accidents?

You may want to see also

What are the pros and cons of being on my aunt's insurance?

Being added to your aunt's insurance policy can have its benefits and drawbacks. Let's take a look at some of the pros and cons.

Pros:

- Cost savings and discounts: You may be able to access cost savings through shared premiums and potential discounts. For example, some insurance providers offer multi-driver or multi-vehicle discounts.

- Increased coverage limits and protection: By opting for higher coverage limits, you can enhance protection for your vehicle and passengers in case of an accident. This can provide peace of mind, knowing that you have sufficient financial protection for damages, medical expenses, and legal fees.

- Shared financial responsibility: With your aunt as the primary policyholder, adding you to her policy can establish shared financial responsibility in case of accidents or unexpected events. This means that there will be ample financial protection available to cover damages or injuries, benefiting both you and your aunt.

- Cost-sharing advantages: By sharing a policy, you can split the premium costs with your aunt, which can be more financially advantageous than having separate policies.

- Lower deductibles: With a shared policy, the deductible is typically applied per incident rather than per person, potentially lowering your out-of-pocket expenses in the event of a claim.

Cons:

- Impact on premiums: Your driving history and record will influence your aunt's insurance premiums. If you have a history of accidents, traffic violations, or frequent insurance claims, your aunt's premiums are likely to increase due to the insurance company perceiving you as a higher risk.

- Responsibility for accidents: If you are responsible for accidents, it could impact your aunt's coverage and rates. Insurance companies may view you as a higher risk, potentially leading to increased premiums or even denial of coverage.

- Financial responsibility and liability: Your aunt, as the policyholder, assumes a significant amount of financial responsibility and liability. In the event of an accident, especially if you are at fault, your aunt could be held financially responsible for your actions. This could potentially impact her financial standing and assets.

- Insurance fraud concerns: Insurance companies are cautious about insurance fraud when it comes to insuring someone else's vehicle. They may have concerns about your intentions and could be extra cautious about paying out claims on policies taken out by someone other than the car owner.

It is important to carefully consider these pros and cons before making a decision. Discuss the specifics with your aunt and insurance provider to understand the potential impact on coverage, premiums, and financial responsibilities.

Auto Insurance Nampa: Can-Do!

You may want to see also

Frequently asked questions

Yes, it is possible to be added to your aunt's auto insurance even if you don't live with her. However, this depends on the insurance company and the state you live in.

Yes, you can be added to your aunt's auto insurance if you live with her.

Yes, you can add your aunt to your auto insurance as a permissive driver. However, this depends on the terms of your insurance policy.

No, you cannot directly insure a car that is not in your name. However, you can be added to the owner's title or insurance policy.