If you're considering selling your life insurance policy, you'll be pleased to know that it is possible to do so. A life insurance policy is your personal property, so you can sell it just as you would anything else. However, there are some important things to consider before making a decision. For instance, life settlement companies, which are companies that buy life insurance policies, must be licensed, and it's important to beware of scams. In addition, there are certain eligibility requirements for selling your policy, such as policy age and value. It's also worth noting that selling your policy will have an impact on your beneficiaries, and there may be tax implications. Therefore, it's recommended to consult with a financial advisor or estate planning attorney before making any decisions.

| Characteristics | Values |

|---|---|

| Can I sell my life insurance policy? | Yes |

| Who can I sell my life insurance policy to? | Life settlement companies such as Coventry or Abacus Life Settlements |

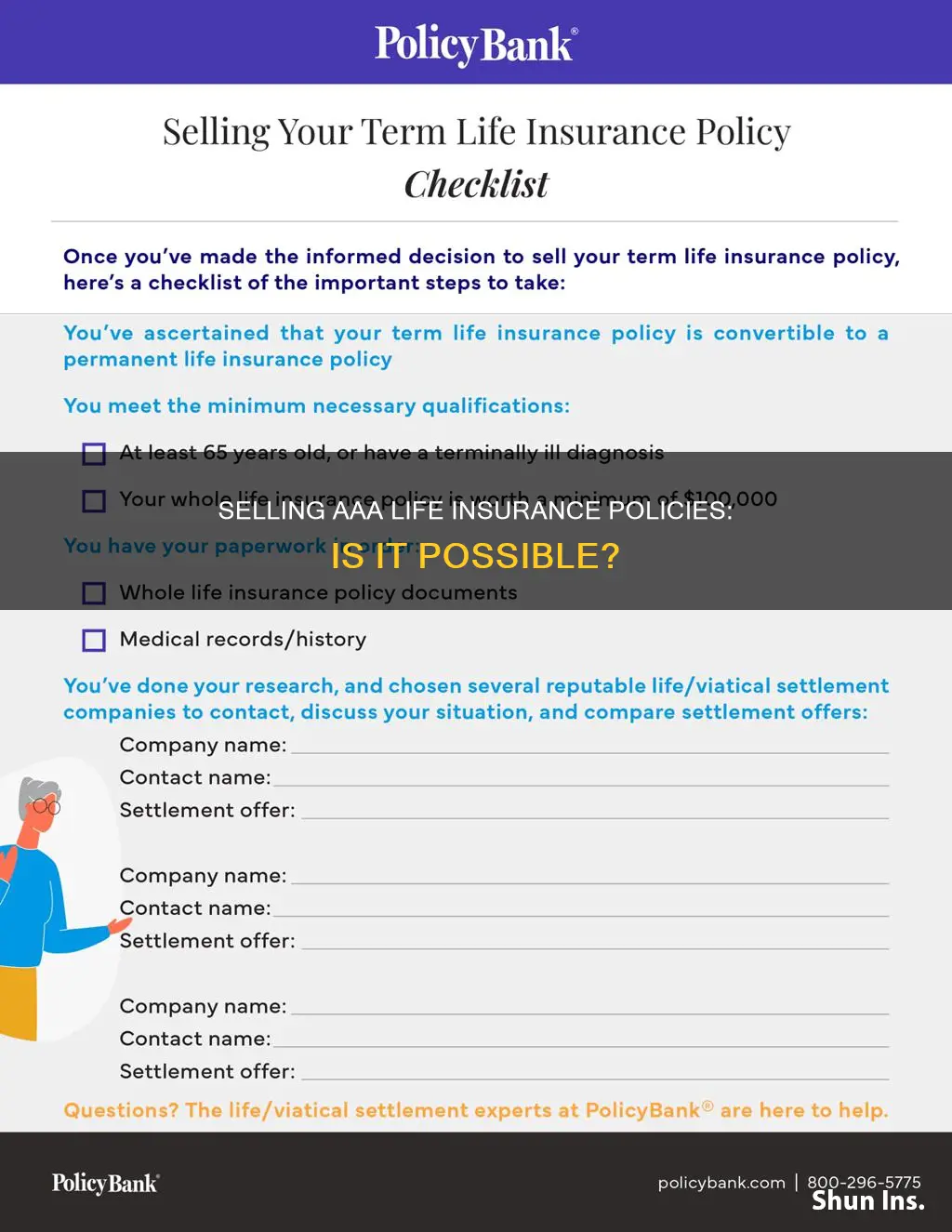

| What is the process of selling my life insurance policy? | Application, Documentation, Appraisal, Offer, Closing |

| What is the timescale of selling my life insurance policy? | 60-120 days |

| What is the average life settlement? | 20% of the policy's face value |

| What is the cash settlement range? | 40-70% of the policy's face value |

| What is the minimum policy value to sell? | $100,000 - $150,000 |

| What is the minimum age to sell? | 65 years old |

| Do I have to pay tax on the money I get from selling my life insurance policy? | Yes |

| Will selling my life insurance policy affect my eligibility for Medicaid and other public assistance? | Yes |

| Will selling my life insurance policy affect my creditors? | Yes |

What You'll Learn

Life insurance policy as personal property

A life insurance policy is considered personal property. As such, it can be sold, much like any other item you own. However, there are several things to consider before selling your life insurance policy.

Firstly, life settlement companies, which are companies that buy life insurance policies, must be licensed. In Texas, for example, life settlement companies must be licensed with the Texas Department of Insurance, and one can check a company's license by calling 800-252-3439. As with any financial transaction, it is important to beware of scams.

Secondly, life settlement companies are primarily interested in purchasing high-value policies from older policyholders. Typically, you will need to be over the age of 65 and have a policy worth at least $100,000 to sell your life insurance policy. Additionally, life settlement companies will often pay more if you have a health condition that reduces your life expectancy.

When you sell your life insurance policy, the life settlement company will take over the policy and pay the premiums. This means that you will no longer have to make payments, but it also means that your family will not receive the life insurance benefits upon your death. Therefore, it is important to carefully consider the implications of selling your life insurance policy before making a decision.

Another thing to keep in mind is that you might have to pay taxes on the money you receive from selling your life insurance policy. Additionally, the money from the sale could disqualify you from receiving Medicaid and other forms of public assistance. Furthermore, the money may not be exempt from creditors.

If you are considering selling your life insurance policy, it is recommended to familiarise yourself with life settlement transactions and associated regulations. You can check with your state's insurance authority for more information about the process, licensing requirements, and potential scams. You can also decide whether to use a broker, which can provide assistance and handle negotiations but will charge a fee for their services.

In conclusion, while a life insurance policy is considered personal property and can be sold, it is important to carefully consider the implications and potential consequences before making a decision.

Life and Health Insurance Exam: Tough Test?

You may want to see also

Life settlement companies

Some examples of life settlement companies include:

- Coventry First LLC

- Abacus Settlements, LLC

- Apex Settlement Group LLC

- Berkshire Settlements, Inc.

- CCA Settlements, LLC

- Eagil Life Settlements, LLC

- FairMarket Life Settlements Corp.

- Life Capital Group, Inc.

- Life Equity LLC

- LifeTrust, LLC

- Lighthouse Life Solutions, LLC

- Magna Life Settlements, Inc.

- Maple Life Financial, LLC

When you sell your life insurance policy to a life settlement company, you will receive a lump sum payment that is generally more than the policy's cash surrender value but less than the net death benefit. The amount you receive will depend on factors such as your age, health, and policy terms and conditions. The life settlement company will then take over your policy, pay any future premiums, and receive the death benefit when the insured person dies.

It is important to note that selling your life insurance policy has financial and legal implications. For example, the money you gain from the sale may be subject to taxes and debt collection, and it may affect your eligibility for certain public assistance programs. Therefore, it is recommended to consult a financial advisor, attorney, or accountant before deciding to sell your life insurance policy.

Financial Advisors: Life Insurance Payment Structures Explained

You may want to see also

Policy value, age, and health

Policy Value

Life settlement companies are mainly interested in buying high-value policies. Most companies look for policies with a death benefit of at least $100,000. The higher the death benefit, the higher the offer will be.

Age

You'll probably need to be over the age of 65 to sell your policy. The older you are, the more your policy is worth to life settlement companies. This is because, as you age, your life expectancy decreases, and the likelihood of the insurance company having to pay out your policy increases.

Health

Life settlement companies will pay more if you have a health condition that reduces your life expectancy. The appraisal of your policy will consider the opinion of medical experts regarding your health. The worse your health, the higher the offer will be.

New York Life: Insurance, Retirement, and Financial Services

You may want to see also

No premiums or death benefit

If you sell your life insurance policy, you will no longer be responsible for making premium payments. The life settlement company will take over your policy and pay the premiums. However, it is important to note that your family will not receive the life insurance benefits. The life settlement company becomes the beneficiary of the policy and will receive the death benefit when you pass away.

When you sell your life insurance policy, the life settlement company will pay you a portion of its value. After that, they will take care of all future premium payments. While this can provide you with some cash, it is important to consider the implications for your family's financial security. They will not receive the death benefit, which is usually intended to provide financial support in the event of your death.

Before selling your life insurance policy, it is crucial to weigh your options carefully. Consider whether there are alternative ways to generate cash or reduce expenses. Review the terms of your policy, as some policies may allow you to withdraw money or take out a loan against the policy's cash value. Additionally, you may have the option to adjust the death benefit or convert your term life insurance to a whole life policy.

It is also important to be aware of the potential tax consequences of selling your life insurance policy. A portion of the settlement may be considered taxable income, and the rules regarding taxation can be complex. Consult a tax professional to understand the specific tax implications for your situation.

Furthermore, the money you gain from selling your policy may impact your eligibility for certain public assistance programs, such as Medicaid. The funds may also be subject to debt collection and may not be exempt from creditors. These are important factors to consider when deciding whether to sell your life insurance policy.

Who Can Be My Life Insurance Beneficiary?

You may want to see also

Tax and public assistance implications

The proceeds from selling your life insurance policy may be subject to taxation. In the US, the sale of a life insurance policy is a taxable event, and the characterisation of gains is determined by the guidelines set out in IRS Revenue Ruling 2009-13 and the Tax Cuts and Jobs Act (TCJA) of 2017. The amount of the proceeds that exceed the cost basis is generally taxed as ordinary income. However, it is important to consult a tax professional to understand the specific tax consequences of selling your policy.

In addition to tax implications, selling your life insurance policy may also impact your eligibility for public assistance programs. The extra income from the sale may disqualify you from receiving Medicaid and other financial assistance programs such as supplementary social security benefits, food stamps, or Medicaid. Therefore, it is crucial to consider the potential loss of these benefits when deciding whether to sell your life insurance policy.

The tax and public assistance implications of selling your life insurance policy can be complex, and it is always recommended to seek professional advice from a financial advisor, attorney, or accountant to fully understand the consequences of such a transaction. They can help you evaluate the pros and cons of selling your policy and explore alternative options that may better suit your needs.

Roth IRA Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, you can sell your life insurance policy. A life insurance policy is your personal property, so you can sell it just like anything else you own.

Companies that buy life insurance policies are called life settlement companies. These companies must be licensed, and you should beware of scams.

First, decide whether to use a broker. Then, complete an application and grant the settlement company permission to obtain information about your policy and health. Next, the settlement company underwriters will gather information about your policy and medical history. After reviewing this information, the underwriters will determine the market value of your policy. Finally, the settlement company will make you an offer, which you can choose to accept or decline.

The amount of money you can get for selling your life insurance policy depends on several factors, including your age, health, and policy value, and the current market conditions. On average, you can expect to receive 20% of the policy's face value.

Yes, there are several alternatives to selling your life insurance policy. These include using the cash value of the policy, converting to a whole life insurance policy, seeking an accelerated death benefit, changing the beneficiary, or reducing the death benefit.