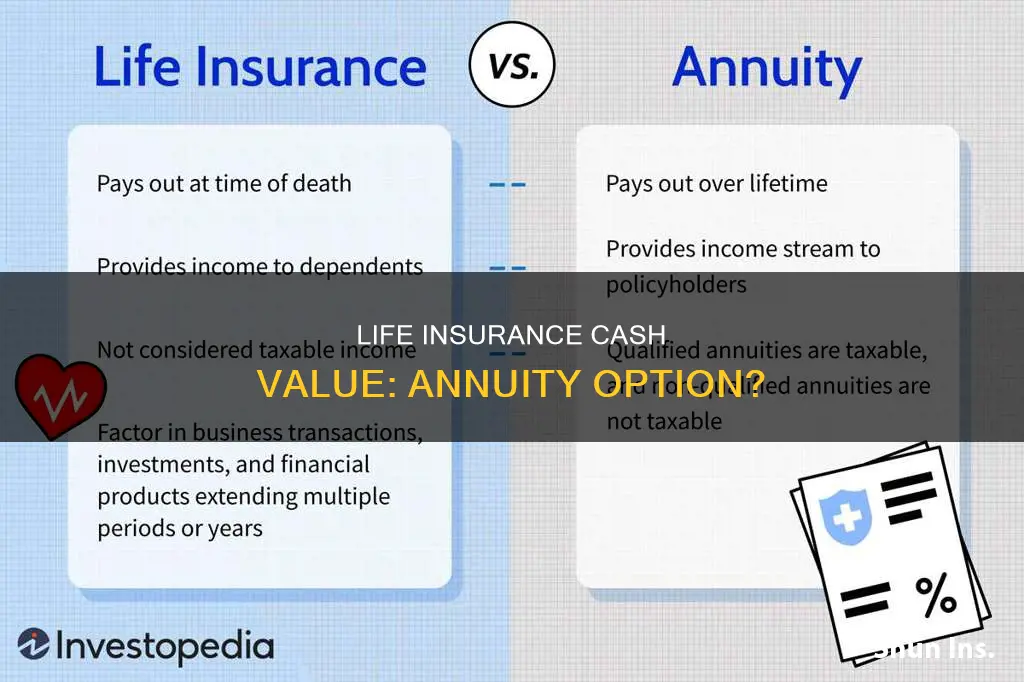

Life insurance and annuities are both insurance products that allow individuals to invest on a tax-deferred basis. While life insurance pays an individual's loved ones after they die, annuities turn payments into future income, including the option of guaranteed income for life. Some life insurance policies, such as whole life and universal life, build cash value, which can be used to save for future goals like retirement. This cash value can then be converted into an annuity, which will invest and generate income based on the cash value balance. However, it is important to carefully consider the potential consequences of accessing your cash value, as it will impact the amount available, your death benefit, and your account's growth.

| Characteristics | Values |

|---|---|

| What is cash value life insurance? | A component of some types of life insurance that functions as an investment-like savings account. |

| What types of life insurance have a cash value component? | Permanent life insurance policies such as whole life and universal life insurance. Term life insurance does not have a cash value component. |

| How does cash value life insurance work? | When you make a premium payment, it is split into three categories: the policy's cash value, the insurer's operating costs, and life insurance company fees and charges. |

| How can you access the cash value of your life insurance policy? | You can borrow against the cash value, make withdrawals, use the funds to pay premiums, or surrender or sell the policy. |

| What are the pros of cash value life insurance? | Your beneficiaries receive a tax-free death benefit. You can add riders for extra coverage. Cash value life insurance offers tax advantages. |

| What are the cons of cash value life insurance? | Cash value life insurance costs more than term life insurance and can take a long time to build up significant cash value. The cash value is usually not paid to beneficiaries, and your policy could lapse if you borrow too much. Taxes may apply if you withdraw cash value or terminate the policy. |

| Can you convert your life insurance to an annuity? | Yes, if your life insurance has cash value, you can convert it into an annuity. You give up the life insurance death benefit but gain more income and investment guarantees. |

What You'll Learn

- Permanent life insurance policies often contain a cash value component

- You can withdraw cash value from permanent life insurance by taking out a loan against your policy

- You can also withdraw a lump sum from the cash value

- The cash value of a life insurance policy can be used to convert the policy into a retirement fund

- You can sell your life insurance policy through a life settlement

Permanent life insurance policies often contain a cash value component

The cash value of a life insurance policy is a savings component that accumulates cash from premium payments. This cash value can grow over time as interest accrues and more payments are made. The rate of growth will depend on the type of permanent life insurance policy. Whole life insurance, for example, offers a fixed interest rate, while universal life insurance links growth to market interest rates.

It's important to note that accessing the cash value of a life insurance policy can have consequences for the amount of money available, the death benefit, and the growth of the account. Additionally, there may be tax implications for withdrawing or borrowing against the cash value.

Before accessing the cash value of a life insurance policy, it is recommended to consult a financial advisor to understand the potential consequences and to check with the insurance provider to determine which options are available and what requirements and costs are involved.

Life Insurance Accumulation Value: Understanding Your Policy's Worth

You may want to see also

You can withdraw cash value from permanent life insurance by taking out a loan against your policy

Permanent life insurance policies often contain a cash value component that you can access while you're alive. One way to do this is by taking out a loan against your policy. This means that you borrow money from the insurer, and the cash value of your life insurance policy acts as collateral.

There are several advantages to taking out a loan against your policy. There are no credit checks, and you can repay the funds when it's convenient. Interest rates are usually lower than those charged by other financial institutions, and there is no mandatory monthly payment. Additionally, no restrictions are placed on how you use the money, and there are no tax implications as long as the policy stays active.

However, it's important to consider the potential drawbacks. If you don't repay the loan before you die, the loan amount and any interest owed will be subtracted from the death benefit your beneficiaries receive. If the loan amount exceeds the policy's cash value, your policy may lapse, and you may owe taxes on the amount you borrowed. Taking out a loan against your policy may also reduce the death benefit, leaving less for your heirs after your death.

Before taking out a loan against your permanent life insurance policy, it's essential to weigh the pros and cons carefully and consult a financial advisor to understand all the potential consequences.

Lincoln Life Insurance: Suicide Coverage and Exclusions

You may want to see also

You can also withdraw a lump sum from the cash value

Permanent life insurance policies often contain a cash value component that you can access during your lifetime. You can withdraw a lump sum from the cash value of your life insurance policy, but there are a few things to keep in mind.

First, you can only withdraw up to the amount in your cash value account. Withdrawing more than you've paid in premiums may result in tax implications. Additionally, withdrawals may reduce your death benefit, so your beneficiaries may receive a lower payout. Withdrawals can also slow the growth of your cash value account.

Before making a withdrawal, it's important to check with your insurance provider to understand the specific rules, requirements, and costs associated with withdrawing from your policy's cash value. A financial advisor can also help you navigate the potential consequences of accessing your cash value.

It's worth noting that there are alternative ways to access your cash value, such as taking out a loan against your policy or using the funds to pay premiums. These options may have different implications for your death benefit and the growth of your cash value, so be sure to explore all your choices before making a decision.

Whole Life Insurance: Can You Cancel Your Policy?

You may want to see also

The cash value of a life insurance policy can be used to convert the policy into a retirement fund

The cash value of a life insurance policy refers to the savings component of the policy, which can be used to supplement retirement income. This is typically offered within permanent life insurance policies, such as whole life and universal life insurance. The cash value of a life insurance policy can be used to convert the policy into a retirement fund in several ways.

One way to access the cash value of a life insurance policy is by taking out a loan against the policy. This allows the policyholder to borrow money from the insurer, using the cash-accumulation account as collateral. The loan amount is based on the value of the policy's cash-accumulation account and the contract's terms, and it must be repaid with interest. However, it is important to note that the loan balance may reduce the policy's death benefit and, if left unpaid, could cause the policy to lapse.

Another way to access the cash value is by making withdrawals from the policy. Withdrawals are typically limited to the amount of cash value in the policy and may be subject to taxes and fees. Withdrawals can also reduce the death benefit and increase premiums to maintain the same level of coverage. Therefore, it is important to carefully consider the potential consequences before making any withdrawals.

Additionally, the cash value of a life insurance policy can be accessed by surrendering or cancelling the policy. This involves signing a lost policy release (LPR) and using the cash value as desired. However, surrendering the policy results in the loss of the death benefit, and the policy cannot be reinstated. Surrendering a policy may also incur taxes and fees, especially during the early years of the policy when the value is relatively low.

Finally, the cash value of a life insurance policy can be converted into a retirement fund by selling the policy through a life settlement. In this case, the policy is sold to a third party, who becomes the new owner and is responsible for paying the premiums. The seller receives a lump sum payment, which is typically higher than the cash surrender value but less than the death benefit. However, it is important to consider the potential downsides of a life settlement, such as the loss of control over the death benefit and the potential for high commissions and fees.

In conclusion, the cash value of a life insurance policy can be used to convert the policy into a retirement fund in several ways, including taking out a loan, making withdrawals, surrendering the policy, or selling the policy through a life settlement. It is important to carefully weigh the potential benefits and drawbacks of each option before making any decisions.

Child Life Insurance: Rollover Options for Parents

You may want to see also

You can sell your life insurance policy through a life settlement

The amount you receive for a life settlement depends on your age, health, and policy type. The payment will be smaller than your death benefit, so the buyer can make a profit when you pass away.

You typically need to be at least 65 or older to use a life settlement, depending on the buyer’s standards. You do not have to be terminally ill to sell your life insurance policy. A similar life insurance deal, called a viatical settlement, is only available to those with a terminal illness and a life expectancy of less than two years.

If you have a temporary term life insurance policy, you may be able to sell it if it has a convertibility option. A conversion swaps the term coverage for permanent coverage that won’t expire. If you don’t have this feature, you likely cannot sell your term policy.

Most policy owners solicit the assistance of a life settlement broker when attempting to sell their policies. Life settlement brokers contact life settlement companies to let them know that your policy is available for purchase. The broker then waits for the life settlement companies to bid on the policy. Upon receiving all of the bids, the broker lets you know which company offered the most money for your policy. Most policy owners typically sell to the company willing to pay the most money.

Life settlement companies buy your policy so they can become the beneficiary. They receive the death benefit from your policy when you pass away, not your heirs.

Life settlements do have some downsides. The biggest drawback is that you give up your life insurance coverage. Your heirs will no longer receive a death benefit when you pass away. If you change your mind later and decide you want coverage again, you'll need to apply for a new policy, which means passing health underwriting again. There’s no guarantee you will be able to buy life insurance again.

When you receive a life settlement, you owe income tax for any amount you receive above what you paid in premiums. The broker overseeing the deal could also charge considerable commissions and fees, so you could end up getting less than you expected.

Life Insurance Revolutionized: Algorithm-Led Innovations Save Lives

You may want to see also

Frequently asked questions

Cash value life insurance is a permanent life insurance policy that includes a cash value component, which can be used as an investment-like savings account. The cash value component typically earns interest or other investment gains and grows tax-deferred.

There are several ways to access the cash value of your life insurance policy. You can borrow against the cash value, make withdrawals, use the funds to pay premiums, or surrender the policy.

Yes, you can use the cash value of your life insurance to purchase an annuity. By converting your life insurance to an annuity, you give up the life insurance death benefit but gain more income and investment guarantees.