Life insurance is a crucial financial safety net for many, but what happens when you want to terminate your policy early? Whether you're considering cancelling your policy or switching to a new one, it's important to understand the implications of your decision. In this paragraph, we will explore the key factors to consider when terminating life insurance early, including the financial consequences, alternative options, and the importance of timing. By the end, you should have a clearer understanding of the process and your available choices.

| Characteristics | Values |

|---|---|

| Reasons for terminating life insurance early | Financial situation has changed, making the premiums unaffordable; secured a better policy; no longer need the coverage; changing investment strategy; switching policies or insurance companies. |

| Options for increasing coverage | Check if your individual life policy has additional purchase options (guaranteed insurability riders) that allow you to purchase additional life insurance at a later date without proving insurability. |

| Free look period | A period of time after the issuance of a life insurance policy during which you may terminate your policy with a full refund. This period typically lasts between 10 and 30 days but can vary by state and contract. |

| Surrendering permanent life insurance policies | You may receive a payout from the cash value, but this may be reduced by surrender charges and outstanding policy loans. |

| Cancelling term life insurance | Stop paying premiums or contact the insurance company directly to confirm the cancellation. |

| Cancelling employer-provided life insurance | Employer-provided life insurance policies typically terminate once you leave the employer, but some policies may be "portable" or convertible to individual policies. |

| Missed premium payments | You typically have a grace period to pay back owed premiums without the policy lapsing. If your policy has lapsed, you can seek to reinstate it, but you may need to go through a reinstatement process with a new application. |

What You'll Learn

Cancelling during the free look period

The "free look" period is a provision that allows you to terminate your life insurance policy without any financial penalty and receive a full refund of any premiums you've paid. This period typically lasts between 10 and 30 days, depending on your state's laws or the terms of your life insurance contract. It is a critical time to review your policy and ensure it meets your needs. If you decide to cancel during this period, you can do so with the peace of mind that your previous policy is still in effect.

To cancel during the free look period, contact your insurance company by phone or in writing to inform them of your decision. This period offers flexibility and allows you to reconsider your decision without facing any financial consequences. It is important to note that the free look period may vary, so be sure to review your policy documents or contact your insurance provider to confirm the exact duration of this provision.

During the free look period, you have the right to change your mind about your new policy. This period is designed to protect consumers and provide them with the opportunity to carefully review their policy and ensure it meets their needs. By law, insurance companies are required to offer this period, and it is your right to take advantage of it if needed.

If you decide to cancel your policy during the free look period, you can do so without providing any reasons or justifications. However, it is always a good idea to be courteous and inform your insurance company of your decision. You may also want to consider providing feedback on why you are cancelling, as this can help the company improve its products and services. Remember, the free look period is your right, and you should feel empowered to make the best decision for your financial needs.

In conclusion, the free look period is an important feature of life insurance policies that allows consumers to make informed decisions about their coverage. By taking advantage of this period, you can ensure that you are fully satisfied with your policy and that it meets your needs and expectations. If not, you have the right to cancel and receive a full refund of your premiums. This provision ensures that you have the flexibility and protection you need when making important decisions about your financial future.

Credit Life Insurance: What's Not Covered?

You may want to see also

Employer-provided life insurance

One of the main disadvantages of group life insurance is the lack of control. When your employment ends, your group life insurance coverage typically terminates as well. This is because the life insurance premium is usually paid directly through your paycheck. Therefore, when you stop receiving a paycheck, the premium is no longer paid, and your coverage ends.

However, it's important to note that some employer-provided life insurance policies may be "portable", which means you can choose to continue paying for the same coverage through a renewable term life policy. This option allows you to prevent a gap in coverage while you figure out your next steps. Additionally, some policies may let you convert your group coverage into a permanent individual life insurance policy when you leave your job.

If you want to port or convert your group life insurance, you'll need to act quickly. Porting your coverage usually needs to take place within 30 to 60 days of leaving your job. Your employer is required to notify you of your options and any deadlines, but it's your responsibility to meet those deadlines.

While employer-provided life insurance can be a great perk, it's important to understand its limitations. It often provides insufficient coverage and doesn't follow you through career changes. Therefore, it's recommended to have a privately owned life insurance policy in addition to any employer-provided coverage to ensure that you and your loved ones have the financial protection you need.

Life Insurance Alternatives: Exploring Other Options

You may want to see also

Getting a refund

Term Life Insurance

Term life insurance does not accumulate any cash value over time, so cancelling your policy means you won't receive a payout. However, if you cancel in the middle of your payment cycle, you might get a small refund for any unused portion of your premium.

By law, if you cancel a term life insurance policy within 30 days of purchasing it, the company must refund your money. You can also purchase a "return-of-premium rider" which ensures that all of your premiums are refunded after your term expires.

Permanent Life Insurance

Permanent life insurance policies, such as whole or universal life insurance, are designed to provide lifelong coverage and typically include a cash value component. If you decide to cancel your policy, you may receive a payout based on the cash surrender value. However, this is often reduced by surrender charges, especially if you haven't held the policy for many years.

If you have any outstanding policy loans, your surrender value will also be reduced by the balance (unpaid loan plus accrued interest). Withdrawals will also permanently reduce your policy's death benefit and cash surrender value.

Cancelling During the Free Look Period

If you've recently purchased a life insurance policy, you're likely within the "free look" period, which typically lasts 10 to 30 days. During this time, you can cancel your policy without any financial penalty and receive a full refund of any premiums paid.

Lawyers: Life Insurance Agents? Exploring Dual Careers

You may want to see also

Surrendering a permanent life insurance policy

When you surrender a permanent life insurance policy, you will receive a payout from the cash value. However, this is often reduced by surrender charges, especially if you haven't held the policy for many years. Surrender fees can be up to 35% of the cash value and are usually highest in the early years of the policy, gradually phasing out over time. Most policies also have a waiting period of at least 15 years before you can surrender them.

If you have any outstanding policy loans, the surrender value will be reduced by the balance (unpaid loan plus accrued interest). Additionally, if you made any withdrawals, this will permanently reduce the available cash surrender value.

When to surrender a permanent life insurance policy

There are several scenarios in which it may make sense to surrender a permanent life insurance policy:

- You've found a better deal: If your health has improved or you've quit smoking, for example, you may now be able to qualify for a more affordable policy.

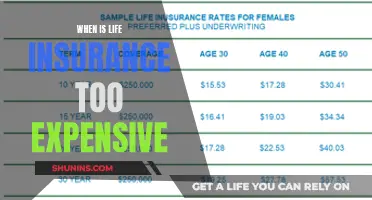

- You can't afford the premiums: Permanent life insurance is much more expensive than term life insurance, so switching to a cheaper term policy may be a better option.

- You no longer need life insurance: If no one is financially dependent on you, you may not need life insurance coverage.

- You need a large amount of cash quickly: Surrendering a cash value life insurance policy can be a way to access a large amount of cash, especially if your need for life insurance has diminished.

Pros and cons of surrendering a permanent life insurance policy

Pros

- Easy and fast: Surrendering your policy is a simple and quick process.

- Get some money back: Surrendering your policy means you'll get some money back, which is better than getting nothing if you let the policy lapse.

Cons

- Minimal return: Insurance companies will aim to give you as little money as possible.

- Surrender fees: These can be up to 35% of the proceeds and are usually highest in the early years of the policy.

- Limited options: The insurance company will give you a take-it-or-leave-it offer, with no room for negotiation.

Alternatives to surrendering a permanent life insurance policy

Instead of surrendering your permanent life insurance policy, you could consider the following alternatives:

- Using the cash value to pay the premium: Depending on the policy type, you may be able to use the accumulated cash value to cover your premium payments or mortality costs.

- Selling the policy: Selling your policy is generally a better option than surrendering it, as it can result in a return that's 4 to 11 times higher than the cash surrender value. This involves exchanging ownership of the death benefit to a third-party buyer for a lump sum payment.

- 1035 exchange: A tax-free exchange allows you to get rid of one life insurance policy and replace it with a new one without paying taxes.

Steps to surrender a permanent life insurance policy

If you decide to surrender your permanent life insurance policy, here are the steps you need to take:

- Review your life insurance policy documents: Look for information about cash surrender value, surrender charges, and other relevant terms.

- Speak with your insurer: Contact your life insurance provider's customer service to inform them of your decision and guide you through the process.

- Fill out paperwork: Your insurer will provide you with the necessary forms to complete the surrender process.

- Receive the cash surrender value: Your insurer will process your request and pay you the cash surrender value via check or direct deposit.

- Consult with a tax expert and financial advisor: Receiving a large payout could trigger tax consequences, so it's important to consult with a tax expert. A financial advisor can help you decide how to invest or save your funds.

Life Insurance Blood Tests: What Do They Uncover?

You may want to see also

Reinstating a lapsed policy

Firstly, it is important to act quickly. Most insurers have a reinstatement period, often ranging from 2 to 5 years from the date of the lapse, during which you can reinstate your policy. The sooner you act, the better your chances of a successful reinstatement.

Next, contact your insurance company or agent to discuss the reinstatement process and obtain the necessary forms. You will need to complete a reinstatement application, similar to your original insurance application, providing updated personal information and health history. Depending on how long the policy has been lapsed and the insurer's requirements, you may also need to undergo a medical exam or provide recent health records to prove insurability.

To reinstate your policy, you will likely be required to pay all the premiums due from the time of the lapse, plus any interest or penalties charged by the insurer. If your policy had a cash value and you took out loans against it, you might need to repay the loan amount or adjust the policy to meet the insurer's reinstatement requirements.

Some life insurance policies and companies have a waiting period after reinstatement before the full benefits of the policy become active again. Be sure to clarify this with your insurer. Additionally, ensure that any riders or additional benefits that were part of the original policy are still in effect or discuss their reinstatement.

Finally, always keep a copy of all documentation, payment proofs, and correspondence related to the reinstatement. This will ensure you have evidence in case of any disputes.

Remember, reinstating a lapsed policy is possible but not guaranteed. The insurer may decline reinstatement based on changes in your health, age, or other factors. Therefore, it is always best to avoid a lapse in the first place by staying vigilant about premium payments and policy terms.

Women's Life Insurance: Cheaper Premiums, Why?

You may want to see also

Frequently asked questions

Yes, you can cancel your life insurance policy at any time. However, the only way to get a full refund is to do so during the initial "free look" period, which is typically between 10 and 30 days. After this period, you may be charged a surrender fee if you cancel a permanent life insurance policy within the first 10 years.

If you miss premium payments, your policy will typically lapse at the end of a grace period. The length of this grace period depends on the type of policy and your location. In California, for example, the grace period is at least 30 days, but it may be longer. If your policy has lapsed, you can usually seek to reinstate it, but you may have to go through a reinstatement process with a new application.

Whether you get a refund when cancelling your life insurance policy depends on the type of policy and when you cancel it. Term life insurance does not accumulate any cash value, so you will not receive a payout if you cancel. However, if you cancel in the middle of your payment cycle, you may get a small refund for any unused portion of your premium. Permanent life insurance policies, on the other hand, build cash value over time, so you could receive a payout based on the cash surrender value when you cancel.

If your term life insurance policy is expiring and you still need coverage, you may be able to extend your current policy or buy a new one. Some term life insurance policies can also be converted into permanent life insurance. If you are in reasonably good health, you may be able to find an affordable policy.