Liability car insurance is a type of insurance coverage that is mandatory in most states. It covers damage to another person's property or injuries caused by the policyholder in an accident. Liability insurance is divided into two categories: bodily injury liability and property damage liability.

Bodily injury liability covers medical costs for the other party, including emergency care, ongoing medical expenses, and legal expenses. Property damage liability covers the cost of repairs to the other party's property, such as their vehicle, buildings, or fences.

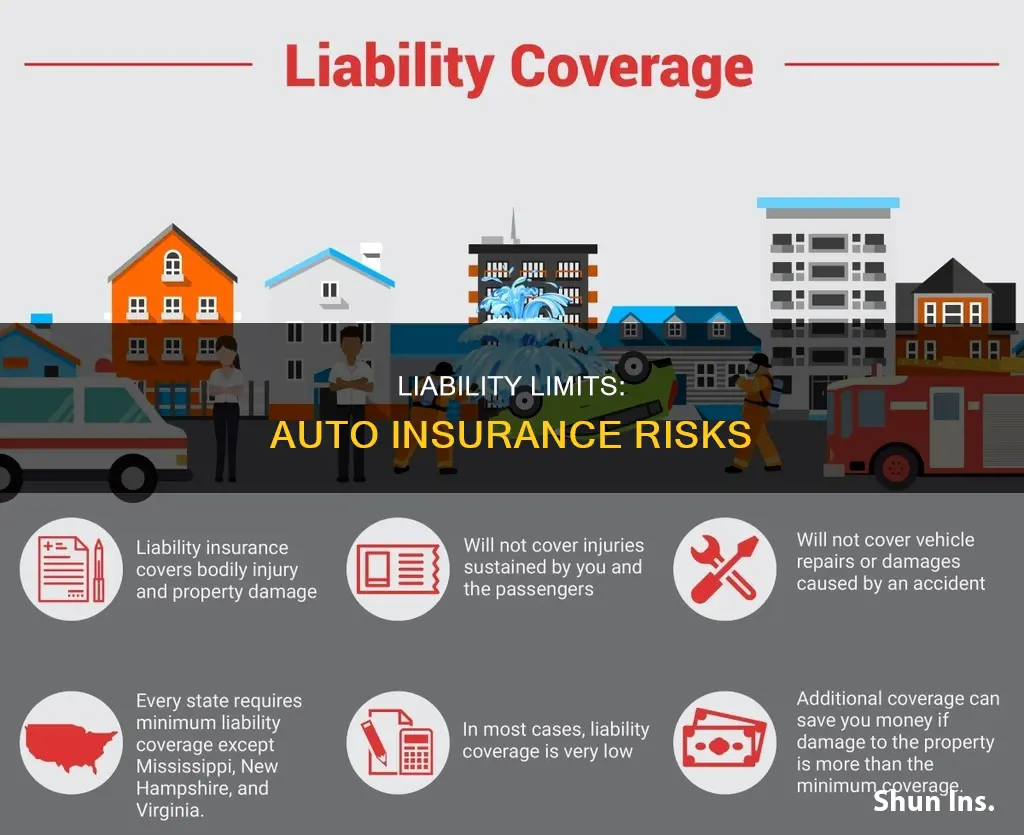

While liability insurance is essential, it is important to note that it does not cover damage to the policyholder's vehicle or their injuries. To protect against these risks, additional coverage, such as collision insurance and comprehensive insurance, is necessary.

The cost of liability insurance varies depending on factors such as the state, age, driving history, and credit score. It is generally recommended to purchase liability coverage that meets or exceeds the state's minimum requirements to ensure adequate financial protection in the event of an accident.

| Characteristics | Values |

|---|---|

| What is liability insurance? | A type of car insurance that covers injury and damage you cause in a car accident. |

| What does liability insurance cover? | Bodily injury liability and property damage liability. |

| What does bodily injury liability cover? | Emergency medical expenses, ongoing medical expenses, and related legal expenses. |

| What does property damage liability cover? | Damage to other people's vehicles, buildings, homes, businesses, fences, mailboxes, and other structures. |

| What doesn't liability insurance cover? | Damage caused by intentional acts, damage to vehicles insured on your policy, and injuries to passengers in your vehicle. |

| How much does liability insurance cost? | The national average cost of minimum coverage auto insurance in the US is $644 per year, while full coverage costs an average of $2,314 per year. |

| How to calculate the amount of liability insurance you need | Consult a licensed insurance professional to determine how much coverage you need. |

What You'll Learn

Bodily injury liability coverage

The coverage limit for bodily injury liability is typically split into two categories: the maximum amount paid per person in an accident and the maximum amount paid for one accident. The average coverage limits are $30,000 per person and $60,000 per accident, but these limits can vary by state and insurance provider. It is important to note that bodily injury liability coverage does not pay for your own injuries or those of your passengers; separate coverage, such as personal injury protection or medical payments coverage, is needed for that.

When determining how much bodily injury liability coverage you need, it is generally recommended to have a limit that is equal to or higher than your net worth. This provides adequate protection for your assets in the event of a costly accident. Additionally, it is essential to review your state's minimum coverage requirements, as they can vary. For example, in Kentucky, the minimum requirement is $25,000 per person and $50,000 per accident.

Gap Insurance: Getting a Refund

You may want to see also

Property damage liability coverage

The coverage limit for property damage liability varies depending on the state and your chosen insurance provider. The average coverage limit is $25,000 per accident, but it's important to note that this may not be sufficient in all cases. If the cost of damages exceeds your coverage limit, you will be responsible for paying the remaining amount out of pocket. Therefore, it's crucial to carefully consider your needs and choose an appropriate coverage limit.

When determining how much property damage liability coverage you need, ask yourself questions like: Do you own a home or other expensive items? Do you usually drive in high-traffic areas? Are there a lot of luxury vehicles in your area? If you answered yes to any of these questions, you may want to consider increasing your coverage limit.

Additionally, it's worth noting that property damage liability coverage does not include damage to your own vehicle. To cover repairs to your car, you will need to add collision coverage to your policy.

Florida: Selling Auto Insurance with a 440 License

You may want to see also

The cost of liability insurance

Additionally, the cost of liability car insurance varies based on factors such as the state in which the driver lives, their age, the type of car they drive, their driving history, and their credit-based insurance score. The national average cost of minimum car insurance, which typically includes liability coverage, is $488 per year, while full coverage costs an average of $2,314 per year.

It's important to note that liability insurance only covers damages to others and their property in the event of an accident. It does not cover damages to the policyholder's own vehicle or injuries they may sustain.

How to Switch Auto Insurance After an At-Fault Accident

You may want to see also

The difference between liability and full coverage

Liability insurance is a mandatory part of car insurance in most states. It covers injury and damage caused by the policyholder in a car accident, along with the cost to defend or settle lawsuits brought against them because of the accident. It does not cover the policyholder's own injuries or damage to their vehicle.

Full coverage insurance, on the other hand, is not a specific type of policy but a term used to describe a policy that combines liability insurance with comprehensive and collision coverage. It covers damage to the policyholder's own vehicle, whether in an accident or due to natural disasters or vandalism. It also covers damage caused by natural disasters or vandalism.

Liability insurance is typically the cheapest option and is ideal for those whose vehicles have a low value or who own their vehicles outright. However, it is important to note that liability insurance will not cover the policyholder's own expenses in the event of an accident. If you want your own medical bills and repair costs to be covered, you will need to purchase additional coverage.

Full coverage insurance, while more expensive, offers more financial protection. It is a good idea if you want peace of mind and can afford the higher premium. It is also required if you lease or finance your car.

Vehicle Ownership: Insurance Costs After Paying Off Loans

You may want to see also

What liability insurance doesn't cover

Liability insurance covers damage and injuries sustained by a third party in an accident where you are at fault. However, there are certain scenarios where liability insurance does not apply.

Liability insurance does not cover any damage to your own vehicle or property. So, if you are at fault for an accident, you will need to pay for repairs to your car, as well as any medical expenses you incur, out of your own pocket. This also applies to any family members living in the same household. To cover these costs, you will need to take out additional insurance, such as collision coverage for vehicle repairs and personal injury protection or health insurance for medical expenses.

Liability insurance also does not cover any damage caused by intentional acts, nor does it cover criminal prosecution.

Canceling Auto Insurance: Fee or Free?

You may want to see also

Frequently asked questions

Liability insurance covers the costs of damage to another person or their property in the event of an accident where you are at fault. It does not cover damage to your own vehicle or your own injuries.

There are two types of liability insurance: bodily injury liability and property damage liability. Bodily injury liability covers the costs of the other person's injuries, including medical bills, pain and suffering, rehab costs, and lost wages. Property damage liability covers the costs of damage to the other person's property, such as their car, mailbox, or other physical structures.

If you are found liable for another party's damages and don't have enough liability coverage, you could be facing serious financial costs. For example, an ambulance ride can cost around $1000 and a simple ER checkup can be upwards of $3000. A totaled car can result in at least $25,000 worth of damage. If you don't have any liability insurance, you will be responsible for all these costs. That's why most states require drivers to carry a minimum amount of liability coverage.

The amount of liability coverage you need depends on your financial situation and comfort level with risk. At a minimum, you should have enough liability coverage to meet the legal requirements in your state. However, it is generally recommended to have higher liability limits to protect your assets in the event of a lawsuit. As a guideline, you should consider having enough liability insurance to cover your net worth.

The cost of liability insurance varies depending on factors such as your location, age, driving history, and credit score. The more coverage you purchase, the higher your premium will be. The national average cost of minimum car insurance, which typically includes liability insurance, is $488 per year, according to NerdWallet's June 2024 rate analysis.