It is possible for there to be two car insurance policies in one household, depending on the insurance companies involved, the state, and the circumstances. Typically, it is cheaper to have household members and their vehicles on the same policy because of multi-car and married couple discounts. However, in some cases, it may be beneficial for separate policies to be taken out, such as when parents want to keep their insurance rates lower or when a specialty insurer is required.

| Characteristics | Values |

|---|---|

| Can a household have two different car insurance policies? | Yes, but it depends on the insurance companies involved, the state, and the circumstances. |

| Who needs to be listed on a car insurance policy? | Everyone in the household should be listed, except unlicensed children. All licensed drivers in the household must be listed. |

| Can you exclude specific drivers from your policy? | Yes, but this usually applies to people who don't live with you, such as a grown child who has moved out. |

| What happens if an excluded driver gets into an accident? | The insurance company may refuse to cover the claim, and you may have to pay for repairs out of pocket. |

| Is it cheaper to have separate policies or a joint policy for married couples? | It is typically cheaper to have a joint policy because of multi-car discounts and discounts for married couples. |

What You'll Learn

Two car insurance policies in one household

It is possible for there to be two car insurance policies in one household, but this depends on the insurance companies involved, the circumstances, and the state laws. Some companies do not allow this due to state laws and liability exposure. Typically, insurance companies require all licensed household members to be listed on a policy, so even with separate policies, each insurance provider will likely mandate that other household members be listed on each other's policies.

There are certain situations where two car insurance policies can be held in the same household. This includes a married couple who want to retain separate policies or a situation where a child has their own car, separate from their parents, with their own policy. In the latter case, the parents are not allowed to be on the child's policy or drive their car and vice versa. Notarized documents may be required to absolve the insurance company of responsibility for accidents and liabilities that occur when non-policyholders drive the insured car.

While it is generally cheaper to have household members and their vehicles on the same policy due to multi-car and married couple discounts, some households may benefit from having separate policies. For example, if one spouse drives a high-performance car and the other drives a minivan, separate policies may be preferable to avoid increased rates to cover the greater risk of insuring a luxury vehicle.

Insuring Your Girlfriend's Car: What You Need to Know

You may want to see also

Listing all household members on a policy

It is important to list all household members on your auto insurance policy. This includes all licensed drivers in your household, such as older children, a spouse, other family members, friends, and live-in nannies. The only exceptions are unlicensed children, who do not need to be listed.

Insurance companies use this information to analyse the risk and determine your yearly insurance premium. If an unlisted driver causes an accident, your insurance carrier might deny the claim, resulting in serious financial consequences. Furthermore, withholding this information from your insurance carrier is considered premium fraud and can be illegal.

If your child lives with you and is a licensed driver, they must be listed on your policy to be adequately covered. If your child has moved out, you do not need to list them on your policy, but they will need to obtain their own insurance. If your child does not live with you but still occasionally drives your car, you must inform your insurance company, who may or may not require you to list them as an occasional driver.

If you have a roommate who drives your car, it is recommended that you list them on your policy. However, if they only drive your car occasionally or not at all, it may not be necessary.

In general, you should include everyone in your household on your policy, as well as anyone who drives your vehicle regularly, such as a friend or neighbour.

Auto Insurance: OEM Parts Not Covered

You may want to see also

Discounts for multiple cars and married couples

Combining car insurance policies can be a great way for married couples to save money on their insurance premiums. Many insurance companies consider married couples to be safer drivers and more financially stable than their single counterparts, resulting in lower rates. Additionally, having a joint policy can make it easier to manage insurance needs and streamline the claims process.

Multi-Car Discounts

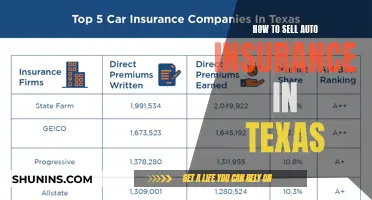

If you insure multiple cars with the same insurance company, you will likely qualify for a multi-car discount. This discount is offered by most car insurance companies and can reduce the costs of liability, collision, and comprehensive coverage by 10% to 25%. For example, GEICO offers up to a 25% discount, while State Farm offers up to a 20% discount. This type of discount is an excellent way to offset the cost of insuring multiple vehicles.

Multi-Policy Discounts

Married couples may also be eligible for bundling discounts if they combine renters or homeowners insurance with their auto insurance. As married couples typically live together, this can be a simple way to save money on their insurance premiums. Additionally, some insurance companies, such as Progressive, offer a 10% discount on car insurance for homeowners, even if they don't purchase their home insurance.

Defensive Driving Course Discount

Some insurance companies offer discounts to drivers who complete a defensive driving course. This discount may be available to both spouses if they take the course together.

Safe Driving Discount

Insurance companies may offer safe driving discounts to drivers who maintain a clean driving record for a certain period. If both spouses are safe drivers, this discount could apply to both of them.

Loyalty Discount

Insurance companies may also offer loyalty discounts to customers who have been with them for a long time. If one spouse has been with an insurer for an extended period and then adds their partner to the policy, they may both benefit from a loyalty discount.

Occupation Discount

Some insurance companies provide discounts to individuals working in specific occupations, such as teachers or healthcare professionals. If either spouse works in an eligible occupation, they could share the savings with a joint policy.

While combining car insurance policies can offer significant savings for married couples, it is important to consider individual circumstances. For example, if one spouse has a poor driving record or a significantly more expensive car, it might be preferable to maintain separate policies. Additionally, some states and insurers allow married individuals to exclude their spouse from their policy, which could be beneficial in certain situations.

Verify Auto Insurance: Active or Not?

You may want to see also

Excluding specific drivers from a policy

An excluded driver is a household member who is explicitly removed from your car insurance policy. Their name will be listed as "excluded" on your policy, and they won't be insured to drive any vehicles on your policy. This is usually done because the driver is causing a significant increase in your rates, either due to inexperience or a bad driving record. Not all states allow policyholders to exclude household members from coverage. Some states specifically don't allow named driver exclusions at all, while others may require excluded drivers to have their own auto insurance before being excluded from your policy.

When considering whether to exclude a driver from your policy, it's important to weigh the potential cost savings against the risk of that person driving your vehicle. If an excluded driver operates your car and causes an accident, your insurance company may deny coverage for any resulting damages or injuries. This could leave you financially responsible for any repairs or medical bills. Additionally, your insurance policy could be cancelled or not renewed as a result.

To exclude a driver from your policy, you will typically need to contact your insurance company and fill out and sign a driver exclusion form. However, it's important to note that not all insurance companies allow driver exclusions, and the rules for excluding drivers can vary by state and insurer. Be sure to check with your specific insurance provider to understand their policies and requirements.

It's worth mentioning that excluding a driver from your policy is different from removing them. After removing a driver from your policy, their name will be taken off, and they will no longer be considered for coverage. Excluding a driver, on the other hand, specifically denies them coverage under your policy.

Auto Insurance: Sign-Up Simplified

You may want to see also

The impact of a young driver on insurance premiums

Young drivers are likely to have a significant impact on insurance premiums, with the cost of insuring a new driver potentially exceeding the price of their first car. Insurance companies deem younger drivers to be a higher risk, and thus charge more for their premiums. This is due to a variety of factors, including:

- Lack of experience: New drivers are still getting used to driving without supervision and are more prone to making mistakes.

- Hazard assessment: Younger drivers tend to have poorer hazard recognition and avoidance skills, which can lead to accidents.

- Risk-taking: Young drivers are more likely to take risks, such as speeding, which can increase the chances of an accident.

- Accident statistics: Statistically, younger drivers are more likely to be involved in accidents, with higher claim rates and a higher proportion of serious injuries and fatalities.

The exact increase in insurance premiums will depend on various factors, including the age of the young driver, their gender, their address, and the make and model of the car. Other factors include the chosen policy type, the number of miles driven, and the driver's occupation.

While it is possible for each household member to have their own insurance policy, it is typically cheaper to have them listed on the same policy, as this allows for multi-car and couple discounts.

AIAS Gap Insurance: Protection for Your Car Loan

You may want to see also

Frequently asked questions

It depends on the insurance companies involved, the state you live in, and the circumstances. Some companies will not allow it because of state laws and liability exposure.

Yes, everyone in your household should be listed on your car insurance policy other than unlicensed children. You need to disclose all household members when applying for car insurance.

Yes, in some cases, it is possible to have two car insurance policies in the same household if you have a child with their own car and a separate insurance policy. However, it may be cheaper to have household members and their vehicles on the same policy due to multi-car and married couple discounts.

Yes, it is possible to have two car insurance policies in the same household if you have a classic car that requires a specialty insurer and you are the only driver on both policies.