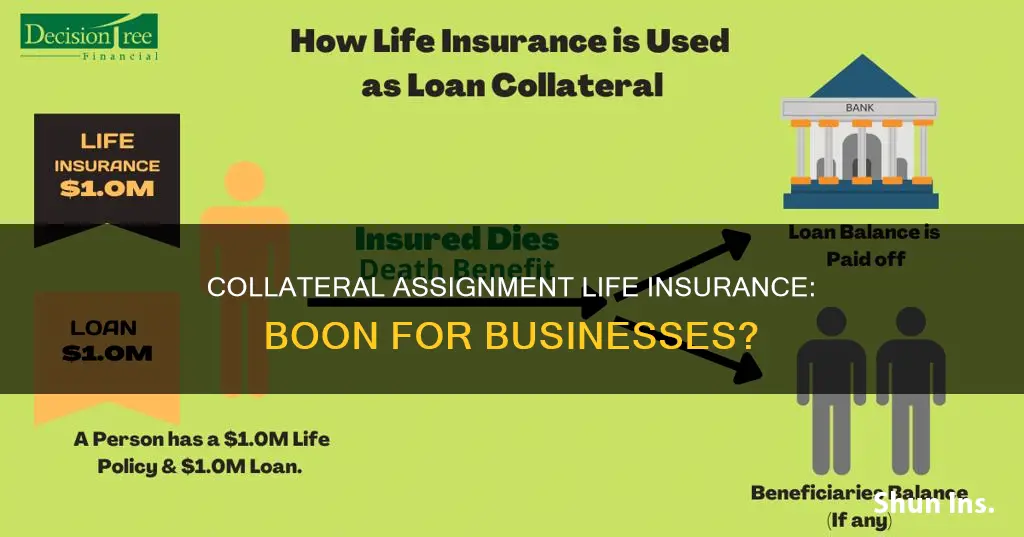

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. This allows businesses to use their life insurance policy as collateral when applying for a loan. In this case, the collateral is the life insurance policy's face value, which could be used to pay back the amount owed in case of the borrower's death during the loan term. The collateral assignment of life insurance may be a good option for businesses looking to secure funding without putting their assets at risk.

What You'll Learn

Lenders' requirements for collateral assignment

Collateral assignment of life insurance is a common requirement for business loans. Lenders may require you to obtain a life insurance policy to be used for collateral assignment. This is because it guarantees repayment if the borrower dies or defaults.

Lenders will require that the borrower of a business loan using life insurance as collateral must be the policy owner, who may or may not be the insured. The policy must remain current for the life of the loan, with the owner continuing to pay all necessary premiums.

The lender will be appointed as the primary beneficiary of the benefit, used as collateral for the loan. The lender can cash in the insurance policy and recover what is owed if the borrower is unable to pay. The lender is only entitled to the amount of the outstanding loan, with any remaining death benefit going to the policy's beneficiaries.

The collateral assignment may be against all or part of the policy's value. If the loan is repaid before the borrower's death, the assignment is removed, and the lender is no longer the beneficiary of the death benefit.

The type of life insurance policy that can be used for collateral assignment depends on the lender's requirements. Term life insurance policies may not be accepted by lenders because they do not have cash value. A permanent life insurance policy with a cash value is often preferred by lenders as it provides a source of funds if the borrower defaults.

To apply for a collateral assignment of life insurance, you will need to understand the lender's requirements and complete a collateral assignment form, which must be signed by both the assignor (you) and the assignee (the lender).

Self-Insuring Life Insurance: A Viable Option for Employers?

You may want to see also

Applying for collateral assignment

Applying for a collateral assignment of life insurance involves using your life insurance policy's death benefit as loan collateral. This means that if you can't repay what you owe, the lender has the right to collect the collateral amount from your policy. Here are the steps to apply for a collateral assignment:

- Understand the requirements: Find out if your lender will accept the collateral assignment of an existing permanent or term life insurance policy. Confirm that your current policy's death benefit amount is sufficient collateral for the loan. Some lenders may require you to get a new life insurance policy for the collateral assignment, in which case you may need to shop around for a policy that meets their requirements.

- Apply for life insurance: If you need to purchase a new life insurance policy, apply with the insurer. Once approved, double-check with your lender that the policy meets their loan requirements.

- Complete the collateral assignment form: Once your first life insurance premium is paid, proceed with completing the collateral assignment form provided by your insurer. On the form, you'll need to provide your lender's contact information so they can be added as the death benefit collateral assignee until your loan is repaid. This form requires signatures from both you (the assignor) and the lender (the assignee).

- Proceed with your loan application: After your bank confirms that they are the collateral assignee for your life insurance policy, you can proceed with your loan application.

It's important to note that you should continue to make your insurance payments on time during the loan period to avoid violating your loan contract. Also, remember that using your life insurance policy as collateral may impact your beneficiaries if you default on the loan or pass away with an outstanding balance, as it could reduce the death benefit payout they receive.

Get a Life Insurance License: PA Requirements Guide

You may want to see also

Collateral assignment form

A collateral assignment form is used to assign a lender as the primary beneficiary of a benefit to use as collateral for a loan. The form must be completed by all parties involved, including the insured, the lender, and the insurance company. Here is a breakdown of the information typically required in a collateral assignment form:

- Policy Identification: This section focuses on the insured's information, including policy numbers, the owner's full name, address, phone number, and email address.

- Assignee Information: This part includes details about the assignee, who could be an individual, corporate entity, or trust. It should contain the assignee's full legal name, address, tax ID, email address, and phone number. If the assignee is a trust, the names of all current trustees must be listed.

- Terms and Conditions: This section outlines the rights and responsibilities of the assignee and assignor. It covers the rights of the assignee, such as the right to collect proceeds from the insurer and obtain loans or advances on the policy. It may also include IRS certification to verify the taxpayer identification number.

- Signatures and Dates: All owners and assignees are required to sign and date the form after reviewing the terms and conditions. Additionally, beneficiaries may also be required to sign.

- Submission Instructions: This section provides instructions for submitting the completed assignment form, including the address, contact information, and fax number of the company that issued the policy.

It is important to note that some banks may require notarization of the form, which can extend the processing time. Once the form is submitted, it typically takes a few days to a few weeks for the insurance company to acknowledge the assignment.

Federal Employee Life Insurance: Age Limit and Benefits

You may want to see also

Setting up the loan

To set up a loan using a collateral assignment of life insurance, you will need to follow these steps:

- Review your lender's requirements: Ask your lender whether they allow a collateral assignment of life insurance and what their specific requirements are. Some lenders may only accept certain types of life insurance policies or policies from specific companies.

- Set up your life insurance coverage: If you already have a life insurance policy that meets the lender's requirements, you can use it for the collateral assignment. If not, you will need to purchase a new policy with a death benefit large enough to secure the loan.

- Fill out the collateral assignment forms: Obtain a collateral assignment form from your life insurance company and fill it out with your lender's contact details. This form will also need to be signed by both you and the lender.

- Finish setting up your loan: Once the collateral assignment is in place, complete the loan application process with your lender. They will then send you the loan funds, which will be secured by your life insurance policy.

- Pay off the loan to end the collateral assignment: Make payments according to the lender's schedule until the loan is paid off. Once the loan is fully repaid, inform your life insurance company, and they will remove the collateral assignment.

It is important to note that the exact process may vary depending on your lender and insurer, and there may be additional requirements or steps involved. Be sure to carefully review the terms and conditions of the loan and collateral assignment before proceeding.

Group Life Insurance: Covering Your Immediate Family?

You may want to see also

Ending the collateral assignment

Once the loan has been repaid in full, the collateral assignment must be removed from the policy. This is done by sending a release form from the lender to the insurance company. Upon receipt of the release, the insurance company will cancel the assignment and restore all rights in the policy to the owner.

The lender will be removed as the assignee, and the policy owner will once again be able to make changes to the policy, such as updating beneficiaries. It is important to note that the lender will only be removed as the assignee once the loan has been fully repaid. Until then, the lender has a claim to the death benefit and can use it to repay the loan if the borrower defaults.

The collateral assignment form typically needs to be signed by all parties involved, including the policy owner, the lender, and the insurance company. In some cases, a notarized signature may be required. The insurance company will then process the form and remove the lender as the assignee.

It is crucial to keep the insurance policy active and current during the loan period. This means that the policy owner must continue to pay all necessary premiums. Failing to do so could result in a lapse in the policy, which could violate the loan contract. If the policy lapses, the lender may have the right to increase the loan's interest rate or demand full repayment of the outstanding loan balance.

Once the collateral assignment is removed, the life insurance policy will continue as before, and the death benefit will be paid to the designated beneficiaries in the event of the insured's death. It is important to review and update the beneficiaries as needed to ensure that the correct individuals are listed.

Life Insurance for the Elderly: Options at 80 Years Old

You may want to see also

Frequently asked questions

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. The lender becomes the primary beneficiary of the policy and can claim the death benefit if the borrower dies or defaults before the loan is repaid.

The borrower fills out a collateral assignment form, which is signed by both the borrower and the lender, and submitted to the insurance company. The lender is added as a collateral assignee to the policy until the loan is repaid. If the borrower dies or defaults, the lender can claim the death benefit to cover the remaining loan amount. Any remaining benefit is distributed to the borrower's beneficiaries.

A collateral assignment can improve loan eligibility and help secure a loan with favourable terms. It provides lenders with collateral and reduces their financial risk, which may result in lower interest rates for borrowers. It also allows borrowers to access funding without putting their personal assets, such as their home or car, at risk.

A collateral assignment reduces the death benefits available to the borrower's beneficiaries. It also creates an additional insurance cost, as the borrower must maintain the life insurance policy during the loan period. There is also no guarantee that the borrower will qualify for life insurance, especially if they have health issues.

Alternatives include borrowing against the cash value of a life insurance policy, taking out an unsecured loan, or using other assets as collateral, such as a home, car, or investment account.