Asking a friend for proof of auto insurance is a reasonable request, especially if they will be driving your car or vice versa. In fact, in some states, it is mandatory to list all household members of driving age on your auto insurance policy. It is also a good idea to ask for proof of insurance when borrowing a friend's car, as you should know the auto insurance status and history of any car you borrow. Additionally, if your friend lives with you and has their own car, you can combine policies and share a joint car insurance policy, which can help save money by dividing the costs of auto insurance coverages. Proof of insurance is essential and can be requested by police, the department of motor vehicles, and employers. It is also necessary when registering a new vehicle or renewing a driver's license.

What You'll Learn

When is proof of insurance needed?

Proof of insurance is needed in several situations. For example, if you are pulled over by the police or are involved in a road accident, you may need to show proof of insurance. You will also need to show proof of insurance when buying a car or registering a vehicle with the DMV. In addition, if you are registering for a new vehicle, renewing your license, or applying for a new auto insurance policy, you will need to provide proof of insurance.

If you are pulled over by the police, it is usually acceptable to show an electronic copy of your proof of insurance. However, there are a few exceptions. For example, New Mexico does not recognize electronic copies during traffic stops. Therefore, it is always good to keep a copy of your proof of insurance in your glove compartment or work bag for easy access.

Furthermore, if you are unable to provide proof of insurance, you could face fines or even jail time, depending on the state. Generally, you can contest a ticket by mailing a copy of your proof of insurance or by attending a court hearing and providing evidence that you were insured on the date of the incident.

Vehicle Insurance: Valid in Scotland?

You may want to see also

What information does proof of insurance provide?

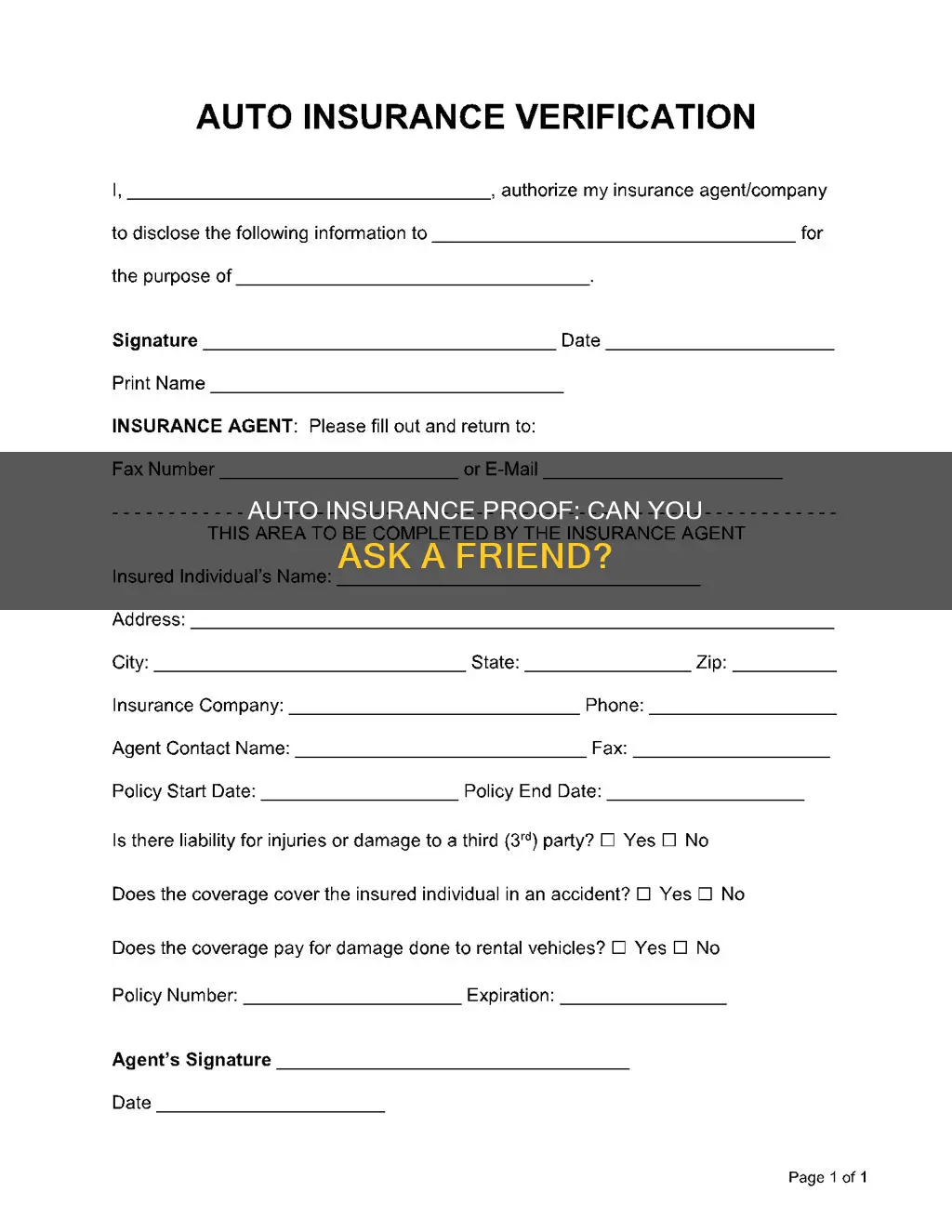

Proof of insurance is a car insurance document that provides basic information about the insurance policy. This includes the insurance company's name and address, the effective date and expiration of the policy, the policy number and National Association of Insurance Commissioners (NAIC) number, the policyholder's name, and the insured vehicle's year, make, model, and vehicle identification number (VIN). This information is usually provided on an insurance ID card or letter, which can be accessed physically or electronically.

Proof of insurance indicates that the policyholder is carrying at least the state-required minimum amount of auto insurance coverage. However, it typically does not state the exact types of coverage, such as collision and comprehensive insurance, or the policy limits. Therefore, it is important to have a physical copy of the proof of insurance, even if an electronic version is also available, as it provides quick and easy access to the necessary information in the event of an accident or traffic stop.

In addition to the standard proof of insurance, some drivers may need an SR-22 form, also known as a certificate of financial responsibility, which is required in certain states after serious moving violations or a suspended license. This form certifies that the driver meets the state's minimum auto liability requirements.

Stolen Vehicle: Insurance Contact?

You may want to see also

How to obtain proof of insurance

Proof of insurance is a document that shows you have the car insurance coverage required to legally drive in your state. It is provided by your insurer and proves you have an active insurance policy that meets state requirements. It is used when you're pulled over, in an accident, leasing a vehicle, or otherwise requested to show it.

There are a few ways to obtain proof of insurance:

- Mobile app: Many major insurance companies offer the ability to access proof of insurance through their mobile app.

- Card: You will usually receive a printed card by mail from your insurance company.

- Paper printout: You can request the form via email or find it in your company's online portal.

- Email or fax: Depending on the insurance company, you may receive immediate proof of insurance via email or fax once you make your first premium payment.

It's important to always have proof of insurance available when driving. In addition to traffic stops and accidents, you may need to provide proof of insurance when registering a vehicle, obtaining a vehicle inspection sticker, or getting a driver's license. If you're unable to show proof of insurance when requested, you may face fines or other penalties.

BMW Gap Insurance: What You Need to Know

You may want to see also

Why is proof of insurance necessary?

Proof of insurance is necessary for several reasons. Firstly, it helps to protect you financially in the event of an accident. If you're hit by an uninsured driver, you could be responsible for your own medical bills and car repair costs. Having insurance and proof of it can help cover these expenses.

Secondly, most states in the US require drivers to have automobile liability insurance and to carry proof of this when driving. This is to ensure that drivers meet the minimum insurance requirements and can cover any potential damages or injuries caused by an accident. Failure to provide proof of insurance when requested by law enforcement can result in fines, suspension of your license or registration, or even jail time, depending on the state.

Additionally, proof of insurance is not just needed for driving. It may also be required when registering a vehicle, buying a new car, or filing an insurance claim. In some cases, employers may also request proof of auto insurance from employees who drive for work-related purposes.

Overall, having proof of insurance is essential to demonstrate financial responsibility and ensure that you are compliant with state requirements. It can provide peace of mind and help protect you from unnecessary costs and legal consequences.

Gap Insurance: Legal for Military?

You may want to see also

What to do if you can't show proof of insurance?

Failing to provide proof of insurance is not the same as driving without insurance. While both are serious issues, the latter is considered a more severe offence. If you are pulled over by the police and are unable to show proof of insurance, you may be ticketed and face fines or even jail time, depending on the state. However, this is not the same as driving without insurance, which can result in heftier fines, license suspension, and even jail time.

If you are ticketed for failing to provide proof of insurance, you can contest the ticket by mailing a copy of your proof of insurance to the relevant authority handling your case, or by attending the court hearing with proof that your insurance was valid at the time you were pulled over. While the charges could be dismissed, you may still have to pay a fine or court fees. It is important to respond to all correspondence if you receive a ticket for not providing proof of insurance. Failing to do so may result in some states revoking or suspending your license and registrations if you cannot prove you are insured.

To avoid this situation, it is advisable to keep a copy of your proof of insurance in your glove compartment, work bag, or on your phone for easy access. Additionally, it is worth noting that most states in the US accept digital copies of proof of insurance, with New Mexico being the only state that does not recognise electronic copies during a traffic stop.

California Auto Insurance: Out-of-State Policies

You may want to see also

Frequently asked questions

Yes, you should be able to show proof of auto insurance to your friend. It is important to carry your proof of insurance with you at all times when driving.

Proof of insurance is documentation that proves your insurance policy is legitimate and up-to-date. It includes information such as the names of those insured under the policy, vehicle information, the policy number, and effective and expiration dates.

You will receive proof of insurance from your insurance company after purchasing a policy. They may provide it immediately via fax or email, or you may receive it electronically or by mail.

If you are unable to provide proof of insurance, your friend may not allow you to borrow their car or let you drive their vehicle. It is important to always keep your proof of insurance with you, as you could receive a ticket or fine if you are unable to show it when requested.