Life insurance companies use height and weight charts, also known as build charts, to determine an applicant's rate class and premium amount. These build charts are used to calculate an individual's body mass index (BMI), which is an indicator of body fat, muscle, and bone. While BMI is a common way to determine whether someone is overweight, it can be skewed for very tall or short people, resulting in higher BMIs for tall individuals and lower BMIs for short individuals. As a result, height can play a significant factor in determining life insurance rates and eligibility. Some life insurance companies have maximum height requirements, typically around 6'10 , above which they may

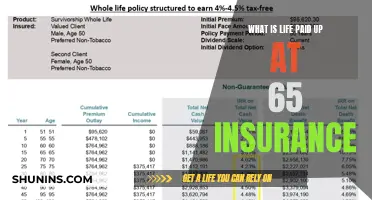

| Characteristics | Values |

|---|---|

| Height-to-weight ratio | Determines if you qualify for life insurance and what price you'll pay |

| Height-and-weight charts | Used by insurance companies to determine your rate class and premium amount |

| BMI | A key metric used by insurers to determine if someone is overweight |

| Minimum height requirement | Around 4'8" |

| Maximum height requirement | About 6'10" |

| Minimum weight requirement | Varies based on height, e.g., 85 pounds at 5'0" |

| No height and weight requirements | Some companies, such as Aetna and Royal Neighbors of America, have no build charts |

What You'll Learn

- Life insurance companies use height and weight to determine your overall health

- Height and weight are used to calculate your body mass index (BMI)

- Being too tall can negatively impact your rating and life insurance rates

- Some companies may deny you coverage if you're too tall

- There are no height and weight chart guidelines for some life insurance products

Life insurance companies use height and weight to determine your overall health

The height-to-weight ratio is a critical factor in the underwriting process. Insurance companies have weight limits based on height, and if you're too heavy or don't weigh enough, they might decline you or charge a higher premium. This is because being overweight or underweight can lead to other, more serious, health conditions, such as high blood pressure, heart disease, and stroke – all of which are risk factors for a life insurance company.

One of the key metrics used by life insurers is a height and weight table, which helps determine an applicant's rate class and premium amount. Based on a person's height and weight, the company can then determine their body mass index (BMI), which is an indicator of body composition, including bone, muscle, and fat. This, in turn, can help determine whether or not a person is truly overweight. While BMI is a common way to determine whether someone is overweight, it has some limitations. For example, it can provide skewed results for people who are very tall or very short, as the formula squares the height, resulting in higher BMIs for tall people and lower BMIs for short people.

Each insurance company will have its own unique height and weight charts, also called "build charts," which are used during the underwriting process to help determine an applicant's life insurance class and, ultimately, their rate. These build charts tend to be more forgiving than BMI, and in some cases, a person who is obese by BMI standards can still qualify for competitive rates.

Firefighter Life Insurance: Is It Possible?

You may want to see also

Height and weight are used to calculate your body mass index (BMI)

Height and weight are used by life insurance companies to determine your overall health and life expectancy. Your height-to-weight ratio is a critical factor that life insurers use to assess your eligibility and the price you will pay for coverage. This is often referred to as a "build chart".

Based on your height and weight, the insurer can determine your body mass index (BMI), which is an indicator of your body's bone, muscle, and fat composition. This, in turn, can help determine whether or not you are overweight. A BMI over 25 is typically considered overweight, while a BMI over 30 indicates obesity.

While BMI is a common way to assess weight categories, it has some limitations. For example, it can provide skewed results for very tall or short people, as the formula squares your height, resulting in higher BMIs for taller individuals and lower BMIs for shorter ones. As a result, being on the taller side can negatively impact your rating and life insurance rates. Additionally, BMI does not distinguish between muscle and fat, so individuals who are muscular may be mistakenly labelled as overweight or obese.

Life insurance companies use height and weight charts or build charts during the underwriting process to determine your life insurance class, which then sets your rate. These build charts vary by company, and some may be more forgiving than the BMI calculation. In some cases, a person who is obese by BMI standards can still qualify for competitive rates with certain insurers.

While height and weight are important factors, they are just one part of the puzzle in determining risk for life insurance companies. Other factors, such as medical history, lifestyle, and blood tests, are also considered in the underwriting process.

Whole Life Insurance: Understanding Employee Benefits and Coverage

You may want to see also

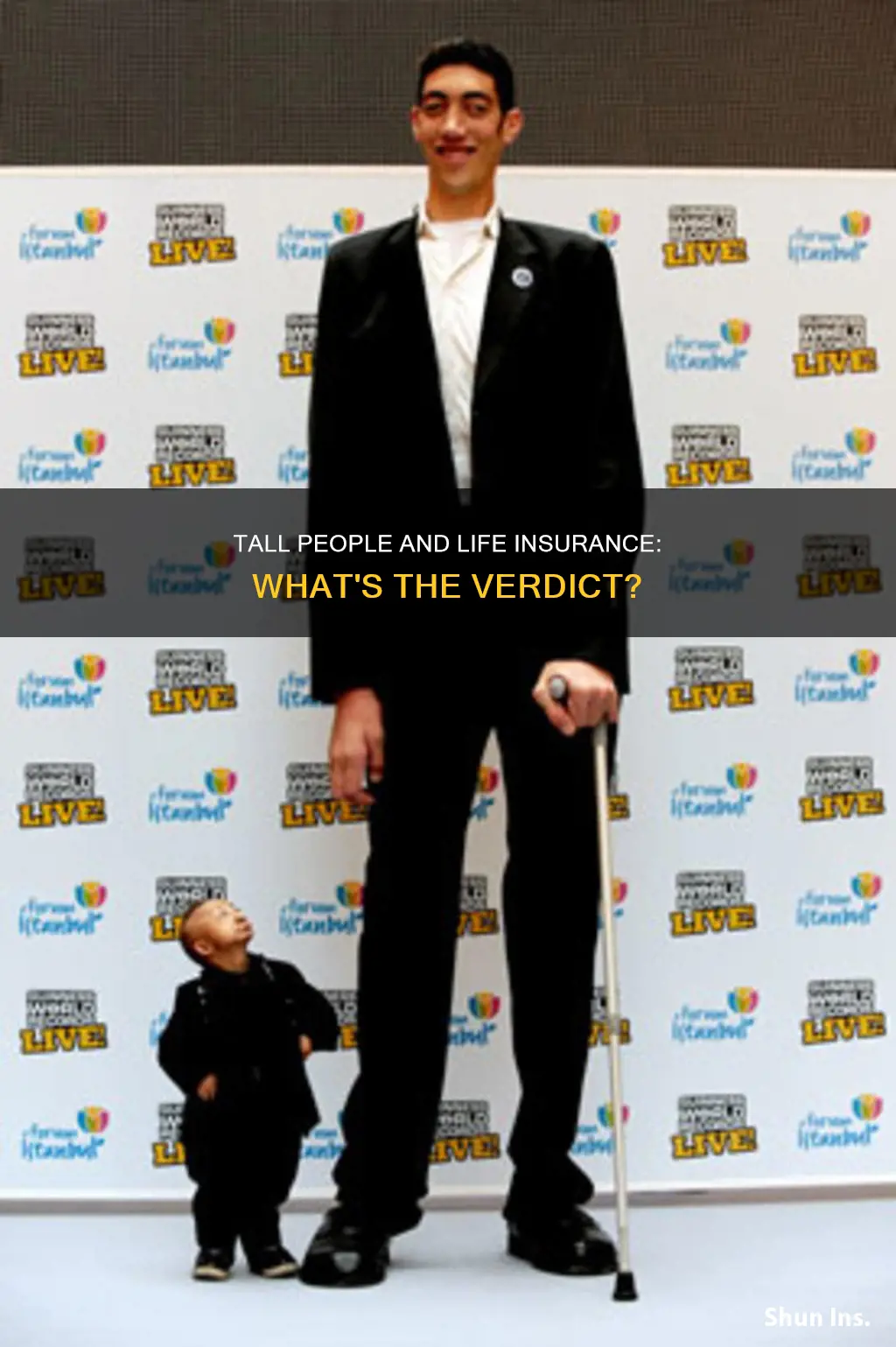

Being too tall can negatively impact your rating and life insurance rates

Life insurance companies use height and weight charts, also known as "build charts", to determine your life insurance health class and rates. These build charts are used during the underwriting process to assess your overall health and the risk of insuring you. While the specific charts vary by company, they generally determine your body mass index (BMI) or a similar metric.

BMI is calculated using a formula that squares your height, which results in taller people having higher BMIs. This means that, even with the same weight, a taller person may be considered overweight or obese according to their BMI. Since being overweight or obese is associated with an increased risk of health issues such as high blood pressure, heart disease, and stroke, this can lead to higher insurance rates for taller people.

Additionally, some life insurance companies have minimum height requirements, typically around 4'8", and maximum height limits, usually around 6'10". If you are outside of these height ranges, you may be denied coverage or charged higher rates.

It's important to note that build charts are not the only factor in determining life insurance rates, and other aspects of your health and lifestyle are also considered. Different insurance companies may also have different height and weight guidelines, so it's worth shopping around to find the most favourable rates for your specific circumstances.

Merrill Lynch: Life Insurance Options and Opportunities

You may want to see also

Some companies may deny you coverage if you're too tall

It is possible for life insurance companies to deny you coverage if you are too tall. Height plays a significant role in determining your overall health and, consequently, your life expectancy. Insurance companies use height and weight charts, also known as "build charts," to assess your health during the underwriting process. These build charts help determine your life insurance class, which then sets your insurance rate.

While the specific height limits vary by company, a maximum height of around 6'10" is commonly used. If you exceed this height, you may be denied coverage or charged a higher premium. This is because taller people tend to have higher BMIs, which can lead to higher insurance rates or even denial of coverage.

Additionally, height-to-weight charts may not always account for taller individuals accurately. As a result, being very tall can negatively impact your insurance rating and rates. However, some insurance companies use unisex or gender-specific build charts, which can provide more flexibility for taller individuals.

It is important to note that not all life insurance companies use build charts, and some may be more accommodating of taller individuals. Shopping around and comparing policies from multiple insurers can help you find the best option for your specific needs and circumstances.

Life Insurance: Cheap, But Why?

You may want to see also

There are no height and weight chart guidelines for some life insurance products

While height and weight are important factors in determining life insurance eligibility and rates, there are indeed some life insurance products that do not have height and weight chart guidelines. These products are typically whole life insurance policies with minimal coverage amounts, usually $50,000 or less. For example, Aetna life insurance plans and Royal Neighbors of America final expense insurance have no build chart requirements.

When applying for life insurance, your height and weight are assessed to determine your overall health and life expectancy. This is because insurance companies want to know the risk they will be taking on if they offer you a policy. Your height and weight can indicate whether you are overweight or obese, which are linked to various health conditions and increased risk of premature death. However, it's important to note that being outside of the height and weight guidelines does not necessarily mean you won't qualify for a policy, but it may result in higher rates.

Life insurance companies use height and weight charts, also known as "build charts," during the underwriting process to determine your rate class. These build charts vary by company, and some may be more favourable than others depending on your height and weight. Additionally, some companies use separate charts for males and females, while others use a unisex chart.

It's worth noting that height and weight are just one part of the puzzle in determining risk for life insurance companies. Other factors, such as medical history, lifestyle, and blood tests, are also considered in the underwriting process. Therefore, if your height and weight fall outside the guidelines, there may still be options available, such as applying for a policy with a different insurer or choosing a no-exam policy.

Income Protection: Life Insurance for Peace of Mind

You may want to see also

Frequently asked questions

Yes, it is possible to be denied life insurance if you are too tall. The maximum height for life insurance is typically around 6'10".

Life insurance companies use height and weight charts, also known as build charts, to assess an applicant's overall health and life expectancy. These charts help determine an applicant's rate class and premium amount.

Life insurance companies use height and weight charts during the underwriting process to determine an applicant's body mass index (BMI) and life insurance class. BMI is calculated using height and weight and is an indicator of body fat, muscle, and bone.

No, each life insurance company has its own unique height and weight charts, which may differ slightly. It is important to shop around and compare policies from multiple insurers to find the best fit for your situation.

If you are denied life insurance due to your height, there are still options available. You can consider applying for a no-exam policy, which does not require a medical examination. You can also work on losing weight and reapplying for a policy, as being overweight can also impact your eligibility. Additionally, you may want to explore alternative options such as group life insurance through your employer or accidental death and dismemberment insurance.