Borrowing against your life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it is important to understand the specifics of this process before making any decisions. Firstly, you can only borrow against a permanent life insurance policy, such as whole life insurance or universal life insurance, which has a cash value component. This option is not available for term life insurance policies, which are generally cheaper and do not accumulate cash value. When borrowing against your life insurance, you are essentially using the policy's cash value and death benefit as collateral with the insurance company, and the loan amount is typically limited to a certain percentage of the policy's cash value. While life insurance loans offer advantages such as a simple approval process, flexible repayment schedules, and lower interest rates compared to personal loans or credit cards, there are also risks involved. Unpaid loans can reduce the death benefit for your beneficiaries and may even cost you your policy if the loan amount exceeds the policy's cash value. Additionally, there can be tax implications if the policy lapses before the loan is fully repaid. Therefore, it is crucial to carefully consider the pros and cons before deciding to borrow against your life insurance policy.

| Characteristics | Values |

|---|---|

| Can you borrow against life insurance? | Yes, if the plan has a cash value |

| Types of life insurance you can borrow against | Permanent life insurance policies, including whole life insurance and universal life insurance |

| Types of life insurance you cannot borrow against | Term life insurance |

| Pros of borrowing against life insurance | No formal approval process, not recognised by the IRS as income, does not affect your credit score, quick access to cash, flexible repayment schedule |

| Cons of borrowing against life insurance | May lose your life insurance plan if you are unable to make monthly loan payments, reduced death benefit if the loan is not paid back before the policy owner passes, may have to pay taxes if the policy lapses |

| How much can you borrow? | Up to 90% of the policy's cash value |

| How soon can you borrow? | Once there is enough cash value built up to cover the desired loan amount |

What You'll Learn

Borrowing against life insurance for an FHA loan: pros and cons

Borrowing against your life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it is important to understand the pros and cons before making a decision.

Pros

- Borrowing against your life insurance policy can provide quick access to cash, especially if you need money fast.

- There is no formal approval process or credit check required, as the value of the plan is technically yours.

- Life insurance loans will not affect your credit score.

- Life insurance loans are generally tax-free, as long as the policy stays active.

- Interest rates for life insurance loans are typically lower than those for personal loans or credit cards.

- There is no strict repayment schedule for life insurance loans, allowing for flexible repayment.

Cons

- If you are unable to make timely loan payments, you may lose your life insurance plan.

- If the loan is not repaid before the policyholder passes away, the beneficiary will only receive a reduced death benefit.

- If the life insurance policy lapses, you may have to pay taxes on the borrowed amount.

- Borrowing against your life insurance policy can reduce the death benefit for your beneficiaries.

- You may end up paying more money in the long run due to interest accumulation.

- There is a risk of a lapse in coverage if the interest accumulates and exceeds the policy's cash value.

Before deciding to borrow against your life insurance policy for an FHA loan, it is important to carefully consider the pros and cons and seek advice from a financial advisor or estate planning attorney to understand the potential tax implications and impact on your loved ones.

Renewing Your Massachusetts Life Insurance License: A Step-by-Step Guide

You may want to see also

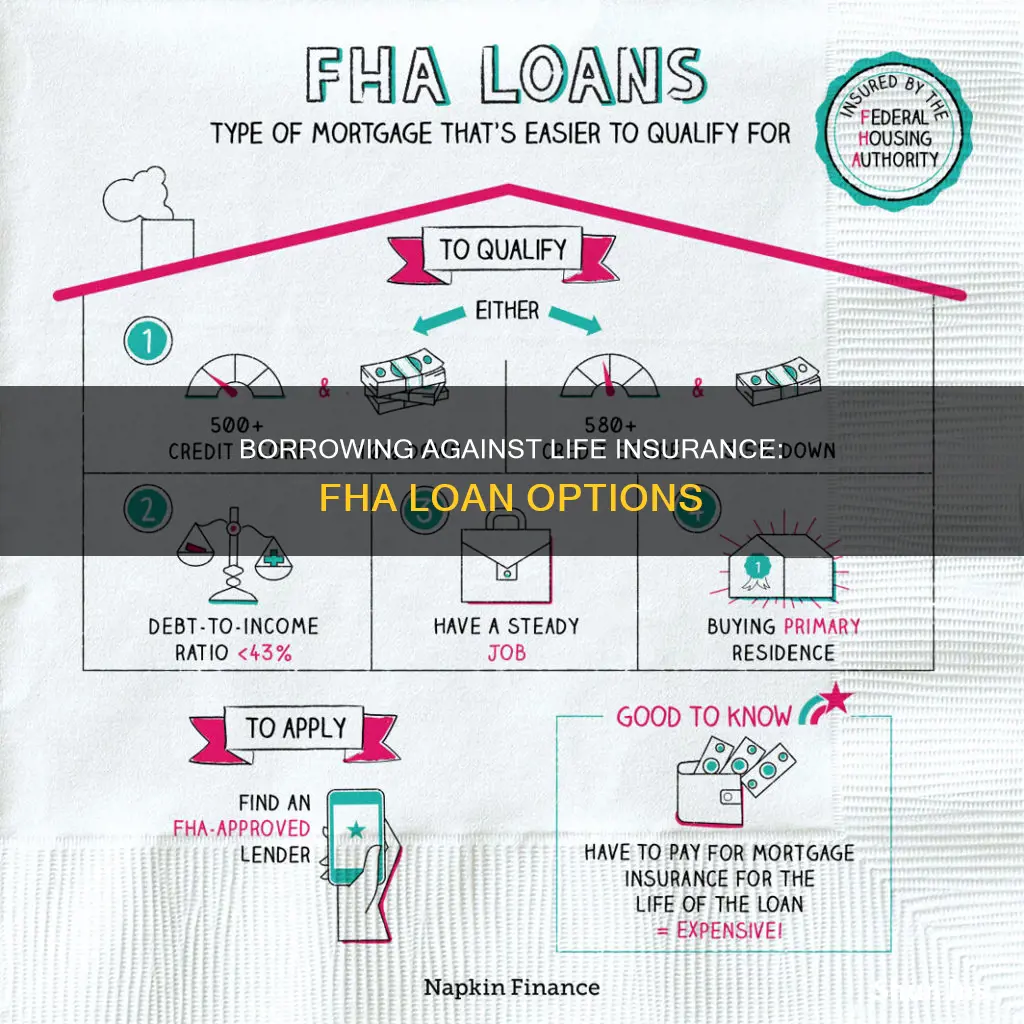

What is an FHA loan?

An FHA loan is a Federal Housing Administration loan, which is a type of mortgage. The FHA is a government agency under the US Department of Housing and Urban Development (HUD). FHA loans are insured by the FHA, meaning that lenders are protected against loss if the borrower defaults on their loan. This insurance makes it easier for borrowers to get approval from banks, as the bank does not bear the default risk.

FHA loans are designed to help low- to moderate-income families attain homeownership. They are particularly popular with first-time homebuyers, as they have low minimum credit score requirements and lenient down payment requirements. The minimum down payment for an FHA loan is 3.5% of the purchase price, and applicants may have a credit score as low as 500.

FHA loans are only available for primary residences and cannot be used for investment properties or second homes. The property must be owner-occupied within 60 days of closing and must meet certain minimum standards.

FHA borrowers must pay two types of mortgage insurance premiums: an upfront premium and a monthly premium. The upfront premium is typically 1.75% of the loan amount, and the monthly premium ranges from 0.15% to 0.75% of the loan amount annually.

FHA loans also have limits on the amount that can be borrowed, which vary by region. In 2024, the limits range from $498,257 in low-cost areas to $1,149,825 in high-cost areas.

Life Insurance and Drug Overdose: What's Covered?

You may want to see also

How to borrow against a life insurance policy

Borrowing against a life insurance policy can be a quick and easy way to get cash in hand when you need it. However, there are a few specifics to know before borrowing.

Firstly, it's important to note that you can only borrow against a permanent life insurance policy, such as a whole life insurance or universal life insurance policy. These policies are more expensive than term life insurance but have no predetermined expiration date. If sufficient premiums are paid, the policy will be in force for the lifetime of the insured. While the monthly premiums are higher than term life insurance, the money paid into the policy that exceeds the cost of insurance builds up a cash value that can be borrowed against.

To borrow against your life insurance policy, you will need to have built up enough cash value in your policy. The amount of time this takes will depend on the structure of your policy, but it can take several years. Once you have sufficient cash value, you can request a loan from your life insurance company. There is no approval process or credit check, and you can use the loan for any reason. The limit for borrowing is typically set at 90% of the policy's cash value, and interest rates are usually between 5% and 8%.

It's important to note that if you don't repay the loan, it will reduce your death benefit, and if the loan amount exceeds the policy's cash value, your policy could lapse. This means you would lose your coverage and may owe taxes on the amount borrowed. Therefore, it's crucial to consider the pros and cons of borrowing against your life insurance policy before taking out a loan.

Usaa Life Insurance: Annual Fee or Free?

You may want to see also

Life insurance policy loans: pros and cons

Borrowing against a life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it is important to understand the pros and cons before making a decision.

Pros

- No formal approval process: There is no credit check or income verification required, as the value of the plan is technically yours.

- Quick access to funds: It doesn't take long to access your loan funds.

- Flexible repayment schedule: There is no required monthly payment, and you can pay off the loan at your own pace.

- No impact on credit score: Life insurance loans do not affect your credit score.

- Lower interest rates: Interest rates for life insurance loans are generally lower than those for personal loans and credit cards.

- Tax-free: Life insurance loans are generally not considered taxable income.

Cons

- Reduced death benefit: If the loan is not repaid before the policyholder's death, the beneficiary will receive a reduced death benefit.

- Interest owed: You will owe interest on the loan, which can accrue and increase the loan balance over time.

- Risk of losing insurance coverage: If the loan balance increases above the cash value, your policy could lapse and be terminated by the insurance company.

- Potential tax implications: If the policy lapses or is terminated before repayment, you may owe income tax on the cash value received beyond the premiums paid.

Leaving Life Insurance: Minor Children's Benefits Explained

You may want to see also

Borrowing against life insurance: tax implications

Borrowing against your life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it's important to understand the tax implications before making any decisions. Here are some key points to consider:

Tax Implications of Borrowing Against Life Insurance:

- Tax-Free Loan: In most cases, the loan itself is not considered taxable income by the IRS. This means you won't have to pay taxes on the amount you borrow as long as the policy remains active and in force.

- Interest Charges: Life insurance companies will charge interest on the loan balance. If you don't make interest payments, the interest will accrue, increasing the total amount you owe. This could lead to a higher risk of your policy lapsing.

- Reduced Death Benefit: If the loan is not repaid before the policyholder's death, the insurance company will deduct the outstanding loan balance and any accrued interest from the death benefit paid to the beneficiaries.

- Policy Lapse: If your policy lapses due to non-payment of premiums or excessive loan balance, you may owe taxes on the amount you borrowed. This is because the tax structure of the policy changes, and you may need to pay taxes on any investment gains or interest earned.

- Taxable Gain: The taxable amount is calculated as the gain realized, which is the cash value of your policy minus the net premium cost (total premiums paid minus distributions received). This represents the investment gains, which may be subject to taxation if the policy is surrendered or lapses.

- Financial Risk: Borrowing against your life insurance policy can be risky. If you're unable to make timely loan payments or keep up with premiums, you may lose your life insurance coverage or reduce the death benefit for your beneficiaries.

- Consult a Professional: Before making any decisions, it's essential to consult a financial advisor or tax professional to understand the specific tax implications for your situation. The information provided here is general in nature and may not cover all potential scenarios.

Finding a Life Insurance Agent: Where to Start?

You may want to see also

Frequently asked questions

You can borrow against a permanent life insurance policy that has a cash value component. This includes whole life insurance and universal life insurance. Term life insurance policies do not have a cash value component, so you cannot borrow against them.

Borrowing against your life insurance policy means taking out a loan from your life insurance company, using your policy's cash value and death benefit as collateral. Interest rates for life insurance loans are generally lower than those for personal loans and credit cards, and there is no formal approval process or credit check required. However, if you are unable to repay the loan, it may reduce your death benefit or cause you to lose your policy.

Borrowing against your life insurance policy can provide quick access to cash without affecting your credit score or requiring a strict repayment schedule. Additionally, life insurance loans are generally not recognized as income by the IRS, so you won't have to pay taxes on them. However, if you are unable to make timely loan payments, you may lose your life insurance policy, and your beneficiaries will receive a reduced death benefit if the loan is not repaid before your death.

The amount you can borrow depends on the cash value of your policy and the rules set by your insurer. Typically, you can borrow up to 90% of your policy's cash value.