Yes, you can cancel the auto-renewal of private health insurance. However, the process and refund amount vary depending on the insurance provider and the time of cancellation. Most providers offer a free-look period, usually between 15 to 30 days, during which you can cancel your policy and receive a full or partial refund. After this period, you may still cancel your policy, but the refund amount will depend on the number of days you have been covered. It is important to carefully review the terms and conditions of your policy before cancelling, as some providers may have specific requirements or penalties for cancellation.

| Characteristics | Values |

|---|---|

| Can you cancel auto-renewal of private health insurance? | Yes |

| When is the deadline to pick a new plan? | 15 January (for a 1 January effective date, the deadline is 15 December in most states) |

| What happens if you don't want auto-renewal? | Contact your insurance company or log into your application on healthcare.gov or your state's exchange |

| When does auto-renewal happen? | On or around 16 December |

| When is the deadline to cancel a health insurance policy? | Any time, but you may only get a refund if you cancel within six months of the policy purchase |

What You'll Learn

Cancelling auto-renewal

Understanding Auto-Renewal

Before you decide to cancel the auto-renewal of your private health insurance, it is important to understand how it works. In most cases, health insurance policies have an automatic renewal feature to ensure continuous coverage for their customers. This means that unless you actively choose to cancel or change your plan, your current policy will be renewed for the next year. The auto-renewal date typically falls shortly after the deadline for selecting a new plan, which is usually around mid-January.

Reasons to Cancel Auto-Renewal

There are several valid reasons why someone might choose to cancel the auto-renewal of their private health insurance:

- Changes to the Policy: Health insurance companies often make changes to their offerings from one year to the next, which may result in you being enrolled in a different plan than the one you initially chose. These changes could include adjustments to coverage amounts, monthly prices, deductibles, or out-of-pocket maximums.

- Limited Options for Cancellation: Once your current plan has been auto-renewed, your opportunity to switch to another plan is limited. In the early years of the Affordable Care Act (ACA) implementation, auto-renewals took place with several weeks of the annual signup period left. Now, open enrollment ends in mid-January in most states, giving you less time to make changes.

- Potential for Negative Surprises: You might assume that if your current plan is no longer offered or if it changes significantly, the insurance company will notify you. However, this is not always the case. While you will be informed of the impending auto-renewal and potential plan changes, these notifications can sometimes be overlooked or missed among other mail.

- Involuntary Switch to a Different Policy: Your health insurance provider has the authority to auto-enroll you in a different plan if your current plan is discontinued. They are required to choose a plan as close as possible to your previous one, but it might not align with your preferences or needs.

- Cost Changes: Even if you are enrolled in the same plan as last year, health insurance plans are subject to annual changes. Monthly prices can increase, and the highest allowable out-of-pocket maximums tend to rise each year. These changes can significantly impact your financial obligations.

- Missed Opportunities: The health insurance market is dynamic, and new options are constantly emerging. By cancelling auto-renewal, you can explore more competitive plans, such as generous gold-level plans that may cost less than silver-level plans in certain states. Additionally, a new option known as the expanded bronze plan, which may be free depending on your income, has also entered the market.

- Surprise Changes: Changes in your ZIP code or the departure of your current insurance company could lead to unexpected adjustments. For example, you could be assigned to a more expensive company or plan, or your insurance company might cancel and replace your plan with a similar but not identical option.

- Loss of Discounts: If you auto-enroll without updating your income and household information, you may miss out on generous subsidies that you are entitled to. Additionally, if you are receiving advance credit payments on your premium based on outdated information, you might end up owing money to the government.

Steps to Cancel Auto-Renewal

If you decide to cancel the auto-renewal of your private health insurance, here are the steps you should follow:

- Contact Your Healthcare Provider: Confirm that you are signed up for auto-renewal and find out the specific plan you are being enrolled in. You can do this by calling your health insurance company or the federal government's enrollment help center.

- Understand Your Monthly Premium Discount: Calculate your monthly subsidy amount or use an online subsidy calculator to determine your expected costs.

- Compare Available Plans: Compare your auto-enrolment plan with other health insurance options to make an informed decision. You can use online comparison tools or consult an independent, licensed health insurance agent to explore on-marketplace, off-marketplace, and non-ACA options.

- Cancel Your Auto-Enrolment: If you decide to cancel, contact your insurance company or log into your application on the appropriate government website. Select the option to stop coverage and confirm the cancellation with your insurance provider. Keep in mind that cancelling without selecting a new plan will leave you without health insurance, and you may not be able to sign up for new coverage until the following year unless you experience a qualifying event.

Salvage Vehicle: Insurance Reporting

You may want to see also

Getting a refund

Timing of Cancellation

The timing of your cancellation request plays a significant role in determining if and how much of a refund you'll receive. Most health insurance policies have a "free-look period," which is typically the first 15 to 30 days after purchasing the policy. During this period, you can cancel the policy without penalty and receive a full refund. However, some companies may subtract certain charges, such as stamp duty, medical checkup fees, and insurance risk charges, on a prorated basis.

If you cancel after the free-look period, you may only be eligible for a partial refund, and the amount will depend on the time elapsed since purchasing the policy. The longer you've had the policy, the lower the refund percentage will be.

Claims and Usage

Another crucial factor in determining your refund eligibility is whether you've made any claims during the policy term. In most cases, to receive a refund, your policy must have a claim-free history. If you've made claims, you can still cancel the policy, but you may not be entitled to a refund.

Insurance Company Policies

Each insurance company has its own policies and procedures for refunds. Be sure to carefully review the terms and conditions of your specific insurance provider. Contact their customer support or refer to their website for detailed information on their refund policies.

Special Circumstances

In some cases, you may be eligible for a refund due to special circumstances, such as if your insurance company is no longer operating or if they have made significant changes to your plan. Additionally, certain government programs or regulations, such as the Affordable Care Act, may require insurance companies to provide refunds under specific conditions.

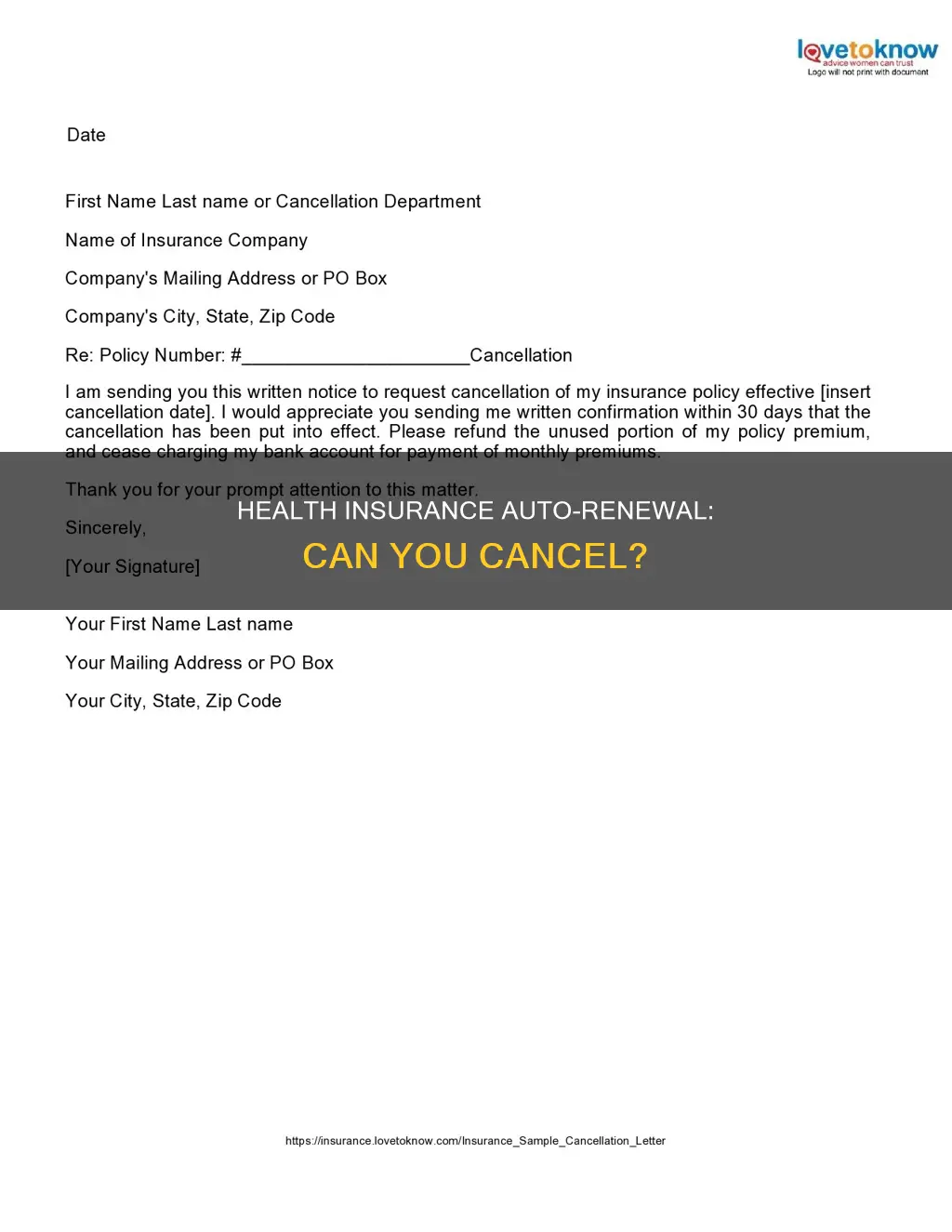

Steps to Request a Refund

To request a refund, follow these steps:

- Contact your insurance company's support team and inform them of your intention to cancel your policy.

- Provide your policy ID and clearly state the reason for your cancellation.

- The insurance company may try to address your concerns or propose a solution. If you're unable to reach a satisfactory resolution, initiate the cancellation process.

- The insurance company will inform you of the applicable terms and conditions and process your refund accordingly.

- The refund will typically reflect in your bank account within a specified timeframe, such as 7 to 10 working days.

Cigna Insurance: Primary in Auto Accidents?

You may want to see also

Cancelling before the free-look period ends

Cancelling your private health insurance before the free-look period ends is a straightforward process. A free-look period is a legally mandated timeframe that allows you to review and cancel your insurance policy without penalty. This period typically lasts between 10 to 30 days, depending on your state's laws. To cancel, you can call your insurance company or log into your application on the relevant website and select the option to stop coverage.

It is important to note that cancelling your insurance policy outside of the free-look period may result in penalties and the loss of your premium refund. Therefore, reviewing your policy and ensuring it meets your needs during the free-look period is crucial. You can also use this time to compare your policy with other available plans to determine if you are getting the best deal.

If you decide to cancel your policy during the free-look period, be sure to notify your insurance provider immediately and understand the steps required to obtain a full refund. Cancelling your auto-renewal will stop your current insurance plan from automatically enrolling you for the next year.

By taking these steps, you can effectively cancel your private health insurance before the free-look period ends and avoid any unwanted charges or commitments.

College Kids: Vehicle Insurance Dependants?

You may want to see also

Cancelling after the free-look period ends

If you cancel your health insurance policy after the free-look period ends, you will not receive a full refund of your premium. The amount of money you get back depends on how long your policy has been active for. The sooner you cancel after the free-look period, the more money you will get back. Here is a general guide to how much you can expect to be refunded:

- If you cancel within 1 month of the free-look period ending, you will get 75% of your premium back.

- If you cancel within 3 months of the free-look period ending, you will get 50% of your premium back.

- If you cancel within 6 months of the free-look period ending, you will get 25% of your premium back.

- If you cancel after 6 months, you will not be refunded.

It is important to note that these refund percentages are not fixed and may vary between insurance companies. Also, you will only be eligible for a refund if you have not made any claims during the policy term.

To cancel your policy, you will need to inform your insurer of your decision. They will likely ask you to fill out a cancellation form, where you will need to include your policy details and the reason for cancellation. After receiving your request, the insurer may try to provide a solution to your problem. If you are still not satisfied, the cancellation process will be initiated. The insurer will then deduct the relevant charges from your premium and send you the remaining amount.

Gap Insurance: Money-Back Guarantee?

You may want to see also

Contacting your insurer

If you need to cancel the auto-renewal of your private health insurance, you'll need to get in touch with your insurer. Here are some detailed and direct instructions on contacting your insurer:

- Confirm your auto-renewal status: Before taking any steps to cancel, it's essential to confirm whether you are indeed signed up for auto-renewal. Contact your current healthcare provider by calling the phone number on your insurance card. They will be able to verify if your plan is set for auto-renewal and provide details about the specific plan.

- Understand the process: Different insurers may have varying procedures for handling auto-renewal cancellations. Visit your insurer's website or check your policy documents to understand their specific process. Look for a customer support section or contact page on their website, which should provide multiple channels for communication, such as email, phone, or live chat.

- Reach out through multiple channels: If your insurer offers multiple contact options, consider using more than one to increase your chances of a timely response. For example, you can send an email and follow up with a phone call if you don't receive a reply within a reasonable timeframe.

- Provide necessary information: When contacting your insurer, be prepared to provide relevant information such as your policy number, personal details, and the reason for your request. This information will help them locate your policy and assist you effectively.

- Follow up and confirm: After making your cancellation request, don't forget to follow up with your insurer to ensure that the changes have been processed successfully. Ask them to confirm that auto-renewal has been deactivated and request a written confirmation for your records.

- Be mindful of deadlines: Keep in mind that there may be specific deadlines for cancelling auto-renewal. Check your policy documents or inquire about any applicable deadlines to ensure you don't miss the opportunity to opt out.

- Explore alternative options: If you're considering cancelling due to dissatisfaction with your current plan, it's worth exploring alternative options with your insurer. They may be able to offer you a different plan that better suits your needs or provide guidance on customizing your coverage.

- Understand the consequences: Cancelling auto-renewal means that you will need to actively renew your policy to maintain coverage. Be aware that failing to renew manually could result in a lapse in coverage, which may have consequences for your future insurance options and costs.

Remember to review your policy carefully and understand the implications of cancelling auto-renewal. By following these steps and maintaining open communication with your insurer, you can effectively manage your private health insurance coverage.

Buy Auto Insurance Without Talking to Anyone

You may want to see also

Frequently asked questions

You can cancel your auto-renewal by contacting your insurance company and informing them of your decision. You may also need to fill out a cancellation form and provide your policy details and reason for cancellation.

You can cancel your auto-renewal at any time. However, to receive a refund, you must cancel within the "free-look period", which is usually 15-30 days after purchasing your policy.

If you cancel after the free-look period, you may only receive a partial refund, or no refund at all, depending on how long you have held the policy.

After receiving your cancellation request, your insurer will likely contact you to discuss your reason for cancelling and may attempt to find a solution. If you are still determined to cancel, they will then initiate the cancellation process and send you an official cancellation confirmation.