Life insurance policies can be a source of worry for people filing for bankruptcy. In the US, about 57% of people have a life insurance policy, and it's natural to want to protect your family's interests. If you're filing for Chapter 7 bankruptcy, you might be wondering if you can discharge life insurance loans. The answer depends on several factors, including the type of life insurance policy you have, the timing of the loan, and the state laws where you live.

| Characteristics | Values |

|---|---|

| Can you discharge life insurance loans in Chapter 7 bankruptcy? | Depends on state law and whether the loan value is above $12,625 |

| How long do you have to wait after Chapter 7 bankruptcy to get life insurance? | 1-2 years |

| What happens to your life insurance policy after Chapter 7 bankruptcy? | If you can't pay your premiums, your policy will likely be terminated |

| Do you need to report life insurance proceeds to your bankruptcy trustee? | Yes |

What You'll Learn

Life insurance and Chapter 7 bankruptcy exemptions

Life insurance and its proceeds are considered assets in a Chapter 7 bankruptcy filing. This means that they are part of the "bankruptcy estate", which is used to pay off your debts. However, there are certain exemptions that can be applied to life insurance, allowing you to protect it from liquidation.

The availability and specifics of these exemptions depend on the state in which you live. Some states allow you to choose between state exemptions and federal exemptions, while others require you to use state exemptions. These exemptions can vary significantly between states. For example, in Pennsylvania, life insurance proceeds may be exempted if the beneficiary is the decedent's child, spouse, or dependent relative. In contrast, New Jersey exempts proceeds from life insurance if the policy expressly prohibits them from being used to satisfy the beneficiary's creditors.

Under federal exemptions, you can exempt up to $12,625 of the cash value of a whole life insurance policy. Additionally, if you are the beneficiary of a life insurance policy, the proceeds may be exempt if the insured person could claim you as a dependent and if the insurance payments are reasonably necessary to support you and your dependents.

It is important to note that you must disclose any life insurance policies and proceeds during bankruptcy proceedings. Failure to do so can result in sanctions, including dismissal of your case or denial of discharge.

How to Get Life Insurance for Your Uncle

You may want to see also

Creditors and life insurance proceeds

When it comes to creditors and life insurance proceeds, there are a few key points to consider. Firstly, it depends on whether you are the policyholder or the beneficiary. If you are the beneficiary of a life insurance policy and the insured person dies, the insurance proceeds you receive could affect your bankruptcy case. It is important to note that life insurance payments received within 180 days of filing for bankruptcy are considered part of your bankruptcy estate. This means that creditors could potentially claim these proceeds to satisfy the debts of the policyholder.

However, if you are the beneficiary, there are certain protections in place. Life insurance proceeds are typically exempt from the insured person's creditors and will pass directly to the named beneficiaries. This is because life insurance policies often contain beneficiary designation provisions that prioritise the payment of death benefits outside of the probate process. In these cases, creditors generally cannot make a direct claim against the policy proceeds.

On the other hand, if you are the policyholder, creditors may have a claim to the life insurance policy under certain circumstances. This includes situations where the policyholder has outstanding debts, such as unpaid loans, credit card debts, or medical bills. Additionally, in some jurisdictions, estate taxes may be considered a claim against the life insurance policy if the policyholder's estate exceeds the applicable tax exemption threshold. It is also important to note that child or spousal support obligations, as well as court judgments or legal settlements, may take precedence over the beneficiary designation and allow creditors to claim a portion or all of the life insurance proceeds.

To summarise, while life insurance proceeds are generally protected from creditors, there are specific situations where creditors may have a valid claim. These situations vary depending on the jurisdiction and the specific circumstances of the case. Consulting with a legal professional can help clarify the laws and protections relevant to your specific situation.

Life Insurance: Opting Out of Employer-Provided Coverage

You may want to see also

Whole life insurance and bankruptcy

Whole life insurance functions as both an insurance and an investment product. While there is an insurance component that will provide proceeds in the event of a death, there is also an investment portion. Part of your monthly premium is invested, building up a cash value. Should the insured survive the term of the insurance policy, the accrued proceeds are distributed to the insured.

Therefore, a whole life insurance policy is an asset with monetary value in a debtor's bankruptcy. The federal exemptions allow a debtor to exempt up to $12,625 of the cash value of a whole life insurance policy. The chapter of bankruptcy will determine what a trustee will do if there is any non-exempt equity in a whole life insurance policy.

Chapter 7 Bankruptcy

If the "cash surrender value" (CSV) of your policy is $20,000, then, under the federal exemptions, there is $7,375 of non-exempt equity. In Chapter 7 bankruptcy, the trustee will most likely require you to liquidate the entire policy and turn over the $7,375 to distribute to your creditors.

Chapter 13 Bankruptcy

If you filed for Chapter 13 bankruptcy, then you will have to allocate at least $7,375 in your bankruptcy plan to unsecured creditors. This amount would be in addition to any secured creditors, such as your mortgage company.

Obtaining Life Insurance After Bankruptcy

The negative impact of filing for bankruptcy will diminish over time. If you have recently received a discharge, you will probably face more hurdles than someone whose discharge is a few years old. The chapter you file for will also affect your ability to obtain a new policy. Typically, if you have filed for Chapter 7, you will be required to wait at least a year before most insurance companies will approve your application. Sometimes the wait is two years from the date of your discharge.

Because Chapter 13 is a reorganization, necessitating payments to your creditors, there is typically no restriction to being approved for a new life insurance policy during your bankruptcy proceeding. However, you can expect to be offered higher premiums than someone who is not currently in bankruptcy.

Life Insurance Proceeds

Life insurance proceeds are likely to be considered part of your bankruptcy estate if you are entitled to them as a result of a death that occurred:

- Before you filed for Chapter 7

- Within six months after you filed for Chapter 7

State law will determine the amount of the life insurance proceeds exemption you'll get to claim or if you can use the federal exemptions.

How Children Can Secure Life Insurance for Their Parents

You may want to see also

Term life insurance and bankruptcy

Term life insurance policies do not have a cash value. They are strictly insurance policies that pay out a fixed, guaranteed death benefit to the beneficiary when the insured person dies.

When you file for bankruptcy, all your assets are included in your bankruptcy estate. In Chapter 7 bankruptcy, the trustee can liquidate (sell) the assets in your estate and use the proceeds to pay your debts. However, exemption laws allow you to claim some of your property as exempt from liquidation. The trustee cannot take or sell exempt assets.

Term life insurance policies are not assets and are safe from creditors. They have no cash value and are therefore unlikely to be worth anything until they pay out. As a result, you can almost certainly keep a term life insurance policy in bankruptcy. You will need to list it as an asset in your bankruptcy forms, but it is unlikely to have any value.

If you receive money from a term life insurance policy after someone dies and you have recently filed or will soon file for bankruptcy, you need to report the proceeds to your bankruptcy trustee.

If you are applying for a new term life insurance policy after declaring bankruptcy, your rates may be higher as bankruptcy suggests you may struggle to pay your policy premiums. You will also have to wait until your bankruptcy has been discharged before applying for most policies.

Life Insurance and Debt: Can It Be Garnished in Texas?

You may want to see also

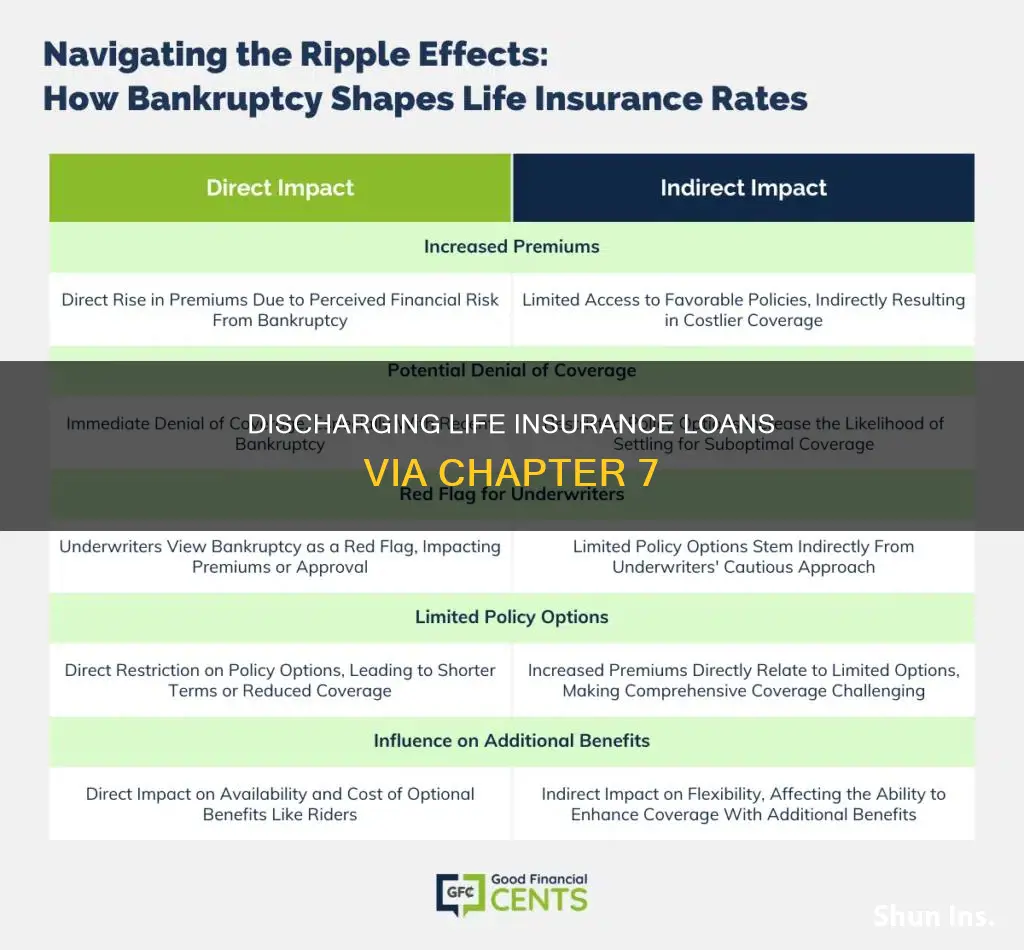

Life insurance rates after bankruptcy

Life insurance rates may increase after bankruptcy, as insurance providers will consider you a higher risk. The impact of bankruptcy on your insurance rates depends on how recently you filed for bankruptcy, the type of bankruptcy you filed for, and the laws in your state.

Chapter 7 Bankruptcy

If you have filed for Chapter 7 bankruptcy, you will likely need to wait at least a year, and sometimes two years, after your bankruptcy has been discharged before insurance providers will approve your application. During the bankruptcy proceedings, insurers will generally decline your application.

Chapter 11 and Chapter 13 Bankruptcy

If you have filed for Chapter 11 or Chapter 13 bankruptcy, you may be able to obtain some life insurance coverage before your bankruptcy has been discharged. This is because these types of bankruptcy suggest that you will be able to repay your debts. However, you will generally need to show proof of financial stability, including regular income, a repayment plan, and an improved credit history.

State Laws

State laws vary regarding life insurance proceeds and bankruptcy. For example, in Pennsylvania, proceeds from life insurance may be exempt from bankruptcy if the beneficiary is the decedent's child, spouse, or dependent relative. In New Jersey, proceeds from life insurance are exempt from bankruptcy if the policy expressly prohibits proceeds from being used to satisfy the beneficiary's creditors. Federal law allows an exemption of up to $12,625 in the loan value of a life insurance policy.

Tips for Improving Your Insurance Rates After Bankruptcy

To improve your chances of securing more affordable insurance rates after bankruptcy, it is important to demonstrate financial stability. This could include showing that you have a consistent income and holding stable assets, such as a house or car, which can justify the life insurance coverage you are seeking. Working with an experienced broker can also be advantageous, as they can compare policies from multiple insurers to find the best rates for your specific circumstances.

Globe Life Insurance: A Good Option for Seniors?

You may want to see also

Frequently asked questions

It depends on the type of life insurance policy you have and the type of bankruptcy you've declared. If you have a term life insurance policy, it typically does not accumulate cash value, meaning it cannot be used to repay your creditors. If you have a whole life insurance policy or another type of permanent life insurance policy, it likely does accumulate cash value, and this cash value can be used to repay your creditors.

If your policy is left in place under the terms of your bankruptcy agreement and you can still afford to pay the premiums, your policy will remain in place. Your loved ones will still be entitled to receive the death benefit in the event of your death.

If you are unable to pay your monthly life insurance premiums, your life insurance policy issuer is likely to terminate the policy. If you have a whole life insurance policy, your policy typically has a cash value that grows over time. If you are unable to make payments, it's possible the accumulated cash value can cover your premiums for some time. If not, your policy will end, and your beneficiaries will not receive a death benefit in the event of your death.

You can apply for a new policy during or after bankruptcy, but it will be more difficult. Insurers will examine your credit score and may offer you higher premiums as a result. You might also need to wait — if you filed for Chapter 7, for example, you might need to wait a year or two before an insurer will offer you a policy.