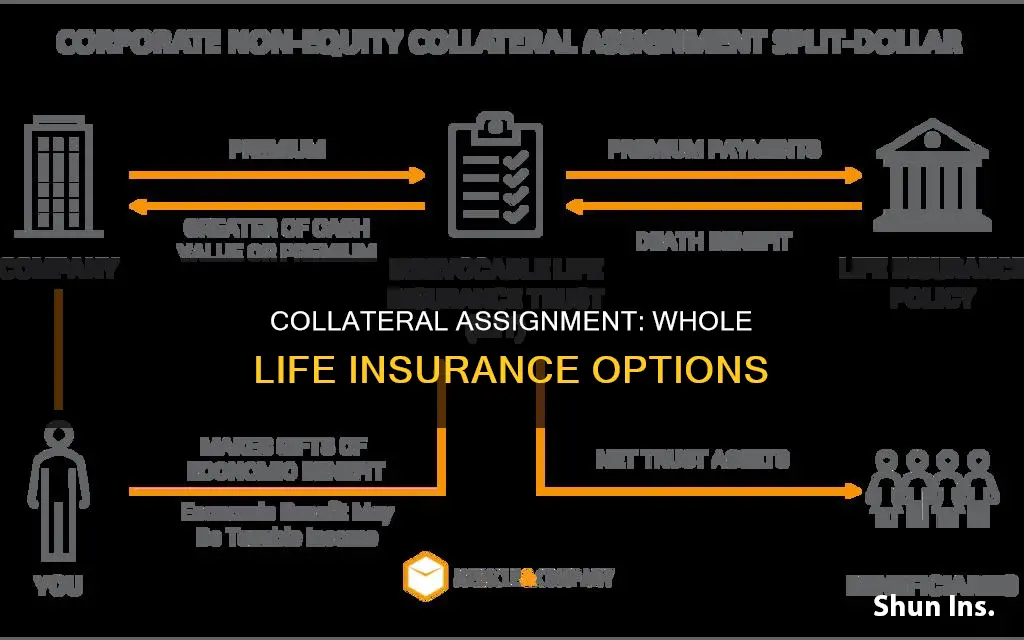

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. This means that if the borrower dies before the loan is repaid, the lender can claim the outstanding loan balance from the death benefit of the insurance policy. The collateral assignment of life insurance is a common requirement for business loans, and lenders may even require the borrower to take out a life insurance policy to be used for this purpose. This arrangement provides the lender with security and peace of mind, knowing that if the borrower defaults, they can reclaim the amount owed from the death benefit.

| Characteristics | Values |

|---|---|

| What is a collateral assignment of life insurance? | A method of securing a loan by using a life insurance policy as collateral. |

| Who is the collateral assignee? | The lender or financial institution that holds the rights to a portion or the entire death benefit of a policy as security under a collateral assignment life insurance agreement. |

| What is the collateral? | The collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt. |

| Who can be the collateral beneficiary? | An entity designated to receive specific benefits from a life insurance policy under a collateral assignment. |

| Who is the assignor? | The person who is selling or gifting the policy. |

| Who is the assignee? | The individual or individuals who receive the policy. |

| What is the advantage of a collateral assignee over a beneficiary? | You can specify that the lender is only entitled to a certain amount, namely the amount of the outstanding loan. That would allow your beneficiaries to still be entitled to any remaining death benefit. |

| What is the collateral assignment used for? | To secure funding for business or other ventures. |

| What are the requirements for collateral assignment? | Lenders generally require an active life insurance policy with cash value. |

| What is the collateral assignment process? | 1. Know the requirements 2. Fill out a life insurance application 3. Fill out a collateral assignment form 4. Sign and submit the form 5. Apply for the loan |

| What are the pros of collateral assignment? | It may be an affordable option; you will not need to place personal property as collateral; you may find lenders who are eager to work with you. |

| What are the cons of collateral assignment? | The amount that your beneficiaries would have received will be reduced if you pass away before the loan is paid off since the lender has first rights to death benefits; you may not be able to successfully purchase life insurance if you are older or in poor health; if you are using a permanent form of life insurance as collateral, there may be an impact on your ability to use the policy's cash value during the life of the loan. |

| What types of life insurance can be used for collateral assignment? | Both term and permanent life insurance policies may be used as collateral, though some lenders may not accept term life policies since they don't have cash value. |

| What is the difference between collateral assignment and absolute assignment? | Collateral assignment is temporary and revocable, with the policyholder retaining ownership and control over the policy. Absolute assignment is permanent and irrevocable, with full ownership and control transferred to the assignee. |

What You'll Learn

Collateral assignment of life insurance: pros and cons

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. This means that if you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy. Any remaining funds from the death benefit would then be disbursed to the policy's designated beneficiaries.

Pros

Using life insurance as collateral can be an affordable option, especially if your life insurance premiums are less than your payments would be for an unsecured loan with a higher interest rate. It also means you won't need to place personal property, such as your home, as collateral. Instead, if you pass away before the loan is repaid, lenders will be paid from the policy's death benefit, with any remaining payout going to your named beneficiaries.

Collateral assignment may also be a good option if your credit rating is not high, as lenders will be more likely to offer you favourable terms because they can rely on your policy's death benefit to pay off the loan if necessary. Life insurance is generally considered a good choice for collateral, so you may find lenders eager to work with you.

Cons

The main drawback of using life insurance as collateral is that the amount your beneficiaries would receive will be reduced if you pass away before the loan is paid off, as the lender has first rights to the death benefits.

You may also struggle to purchase life insurance if you are older or in poor health. If you are using a permanent form of life insurance as collateral, there may be an impact on your ability to use the policy's cash value during the life of the loan. If the loan balance and interest payments exceed the cash value, it can erode the policy's value over time.

Additionally, if you default on the loan or fail to keep up with premium payments, you risk losing your life insurance policy, meaning your beneficiaries may not receive the money you had planned for them.

Life Insurance at 65: What You Need to Know

You may want to see also

How to apply for collateral assignment

Applying for a collateral assignment of life insurance involves using your life insurance policy's death benefit as loan collateral. This means that if you can't repay what you owe, the lender has the right to collect the collateral amount from your policy.

- Know the requirements: Before applying, it is crucial to understand the life insurance collateral requirements. Lenders typically require an active life insurance policy with cash value. This means that a term life insurance policy may not be eligible. However, specific criteria can vary across lenders. If you need to purchase a new life insurance policy for the collateral assignment, be sure to research and obtain quotes from multiple insurance companies to make an informed decision.

- Fill out a life insurance application: Choose a policy that satisfies the lender's loan conditions and apply for life insurance. As mentioned earlier, you will likely need life insurance with cash value. Consult with the lender to ensure that the policy you are approved for qualifies for a life insurance collateral assignment before finalising the contract.

- Fill out a collateral assignment form: Once you have signed your life insurance contract and made your initial premium payments, complete a collateral assignment form provided by your insurance company. This form will require you to fill in your lender's contact information so that they can be designated as the collateral assignee for the duration of your loan.

- Sign and submit the form: After completing the collateral assignment form, both you and your lender must sign it. Your insurance company may offer electronic versions of the documents and e-signature options to streamline the process.

- Wait for confirmation: Wait for your bank to confirm that your insurer has designated them as the collateral assignee. Once you receive this confirmation, proceed to apply for your chosen loan. Don't forget to include any relevant life insurance policy information on the loan application.

It is important to remember that using your life insurance policy as collateral may impact your beneficiaries if you default on the loan or pass away with an outstanding balance. In such cases, the death benefit payout that your beneficiaries receive could be reduced.

Annuities and Life Insurance: What's the Connection?

You may want to see also

What types of life insurance are eligible for collateral assignment?

When it comes to collateral assignment, you can use either of the two main types of life insurance: term or permanent.

Term life insurance policies can be used as collateral, but they need to have a term length that is at least as long as the term of the loan. For example, if you have 20 years to pay off the loan, the term insurance must also be at least 20 years. Many lenders don't accept term life insurance as collateral because it does not accumulate cash value.

Permanent life insurance, which includes subcategories such as whole life, universal life, and variable life, is often preferred by lenders due to its cash value. This cash value can be accessed and used as loan payment if the borrower defaults. When using a permanent policy, the death benefit must meet the lender's terms.

While you can generally use any type of life insurance policy for collateral assignment, depending on the lender's requirements, some types of permanent life insurance may not be accepted. For example, final expense insurance, which tends to have lower coverage amounts, may not be sufficient to secure a loan.

Life Insurance: Building Generational Wealth Protection

You may want to see also

How does collateral assignment of life insurance work?

A collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt. It is a common requirement for business loans, and lenders may even require you to get a life insurance policy to be used for collateral assignment.

Collateral assignment of life insurance allows you to specify the amount of your death benefit your lender receives if you pass away during your loan's term. It is a conditional assignment appointing a lender as an assignee of a policy. The lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

Know the requirements

Find out if your lender will accept collateral assignment of an existing permanent or term life insurance policy. If so, confirm that your current policy's death benefit amount is sufficient collateral for the loan. If the lender requires that you get a new life insurance policy for the collateral assignment, you may need to shop around for life insurance with a death benefit amount that's sufficient loan collateral.

Apply for life insurance

If you're buying a new life insurance policy, you'll apply with the insurer. Once you're approved, double-check with your lender that the policy you've qualified for meets their loan requirements.

Complete the collateral assignment form

Once your first life insurance premium is paid, you can proceed with completing a collateral assignment form via your insurer. On the form, you'll need to provide your lender's contact information so they can be added as the death benefit collateral assignee until your loan is repaid. The form also requires signatures from both the assignor (you) and assignee (your lender).

Proceed with your loan application

Once your bank can confirm they're the collateral assignee for your life insurance policy, you can proceed with your loan application.

Collateral assignment of life insurance may make sense if you're shopping for a secured loan and don't want to put up your house, car, or other personal property as collateral. Secured loans tend to have lower interest rates than unsecured loans, so you can borrow money at a lower cost. It can be an easier way to secure funding to start a business or pay for major expenses (such as hospital bills).

Life Insurance Proceeds: Tax-Free or Not?

You may want to see also

When does collateral assignment of life insurance make sense?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. It makes sense in several situations.

Firstly, a collateral assignment can be useful if you want to access funds without putting your assets, such as your car or house, at risk. If you already have a life insurance policy, assigning it as collateral can be a simple process. Additionally, your credit rating may not be high, making it challenging to find favourable loan terms. Since the lender can rely on the policy's death benefit for repayment if needed, they may be more inclined to offer you better terms despite your low credit score.

Secondly, collateral assignment can be advantageous if you're seeking a secured loan but don't want to use your house, car, or other personal property as collateral. Secured loans generally offer lower interest rates than unsecured loans, allowing you to borrow money at a lower cost. This option can be particularly useful if you're starting a business or facing significant expenses, such as hospital bills.

Thirdly, collateral assignment can be considered if you're a business owner with a substantial death benefit component in your life insurance policy. In this case, borrowing against a large portion of the death benefit can help fund your business ventures.

Lastly, collateral assignment can be relevant if you have medical expenses that your insurance doesn't cover. By securing a loan with your life insurance, you can obtain the necessary funds to pay for these expenses.

It's important to remember that a collateral assignment may impact your beneficiaries if you default on the loan or pass away with an outstanding balance, as it could reduce the death benefit payout they receive. Therefore, it's recommended to consult a financial advisor to explore all your options and understand the risks involved.

Life Insurance: Completing the Process and Securing Peace of Mind

You may want to see also