It is possible to get life insurance if you have an implantable cardioverter-defibrillator (ICD), but it can be challenging. ICDs are devices implanted inside the body to monitor for very rapid or chaotic heartbeats that may cause cardiac arrest. They are similar to pacemakers but can also send electrical shocks to the heart to restore a normal heart rhythm. As ICDs are used for individuals at risk of sudden cardiac arrest, insurance companies consider them high-risk. This means that bigger insurance companies often turn down applications for life insurance from people with ICDs. However, there are specialist insurance companies that cater to high-risk individuals, and these are the best option for people with ICDs. It is also important to work with an insurance agent with experience in this area, as they will know which companies are most likely to offer coverage. People with ICDs will likely have to pay higher premiums for life insurance.

| Characteristics | Values |

|---|---|

| Difficulty of getting life insurance with an ICD | It is more difficult to get life insurance with an ICD, as it is considered a high-risk factor by insurance companies. |

| Necessity of working with an agent | It is recommended to work with an agent or agency that specializes in finding coverage for individuals with pre-existing medical conditions, as they will know which companies are more likely to approve your application. |

| Application process | It is not advisable to send out multiple applications, as this can negatively impact your chances of approval. Working with an agent can help increase your chances of approval and getting decent rates. |

| Underwriting questions | When applying for life insurance with an ICD, insurance companies will typically ask questions about your gender, date of birth, the reason for ICD implantation, any complications or issues with the ICD, current medications, tobacco use, and other major health problems. |

| Life insurance options | Guaranteed issue life insurance policies are available for individuals with ICDs, but these policies have higher premiums and smaller death benefits compared to traditional life insurance. |

| Improving chances of approval | Improving your overall health, timing your application appropriately, and working with a professional agent can all increase your chances of getting life insurance approval with an ICD. |

What You'll Learn

Getting life insurance approval with an ICD

An implantable cardioverter-defibrillator (ICD) is a device placed inside the body, usually under the collarbone, and attached to the heart. It monitors for irregular beats that may cause cardiac arrest and can send electrical pulses to the heart to restore a normal heart rate.

As ICDs are used to treat serious heart conditions, individuals with these devices are considered high-risk by insurance companies, and it is more difficult to obtain life insurance approval. However, it is still possible to get life insurance with an ICD, and there are steps you can take to improve your chances of approval.

Work with an expert

The best first step is to find an independent insurance agent or agency that specializes in finding coverage for individuals with pre-existing medical conditions. These experts will know which companies are most likely to approve your application and can help you navigate the process. Working with an experienced agent can increase your chances of getting decent rates and avoiding common pitfalls.

Questions to expect

When applying for life insurance with an ICD, insurance companies will ask a series of questions to assess your risk. These may include:

- Your gender and date of birth

- The reason for your ICD implant (e.g., fibrillation, congenital disease, heart block)

- The date of your ICD implant

- Any complications or issues you've experienced since the implant

- Any heart-related episodes since the implant

- Current medications

- Tobacco use

- Other major health problems

Improve your overall health

In addition to working with an expert, you can improve your chances of approval by focusing on your overall health. Life insurance companies determine insurability by calculating mortality risk, which includes overall health, age, lifestyle, and family history. Maintaining a healthy body and lifestyle can improve your chances of approval and may result in lower premiums. Regular check-ups for both your health and your ICD are ideal.

Timing is key

If your ICD was recently implanted (less than 3-6 months), insurance companies may require a waiting period before approving coverage. This is because most issues with ICD implants manifest within the first few months.

What to expect

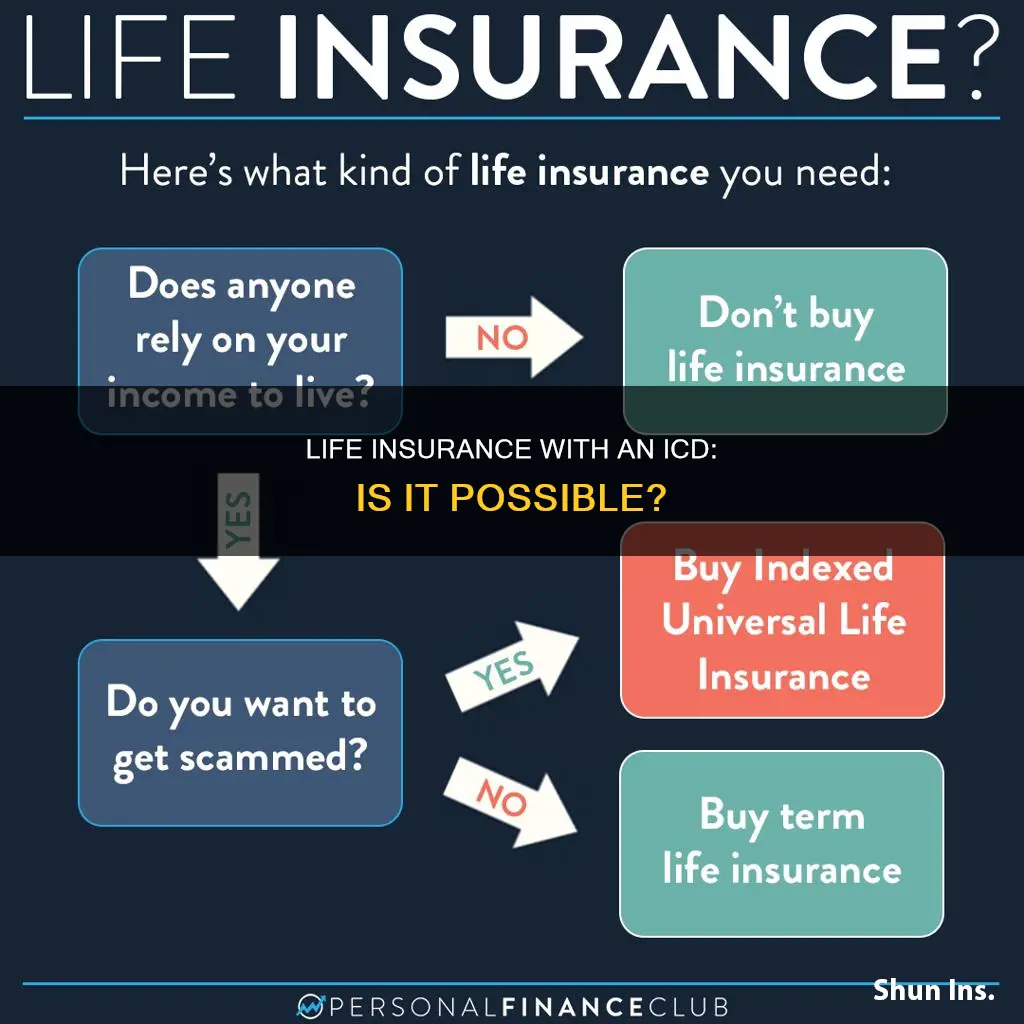

While traditional life insurance policies offer a choice between term or whole life insurance, individuals with ICDs often do not have this option. Instead, you will likely receive quotes from insurers that specialize in high-risk cases, with higher rates than traditional life insurance.

As a last resort, you can also consider a guaranteed issue policy, which does not require medical underwriting and cannot be denied or rejected as long as premiums are paid. However, these policies typically have much smaller death benefits, ranging from $10,000 to $25,000, and higher premiums.

Pennsylvania Life Insurance: Overage Tax Implications

You may want to see also

What is a defibrillator?

A defibrillator is a device that applies an electric charge or current to the heart to restore a normal heartbeat. If the heart rhythm stops due to cardiac arrest, a defibrillator may help it start beating again. A sudden cardiac arrest is fatal unless treated right away with cardiopulmonary resuscitation (CPR) and a defibrillator.

There are different types of defibrillators, including automated external defibrillators (AEDs), which can be found in many public spaces and can be used by untrained people in an emergency. There are also implantable cardioverter defibrillators (ICDs), which are small devices surgically placed in the chest. ICDs are preprogrammed to automatically detect cardiac arrest or a life-threatening arrhythmia and send an electric charge to correct it or restart the heart. Some ICDs can also act as pacemakers, sending low-energy electrical pulses to help the heart beat at a normal rhythm.

Defibrillators can lower the risk of sudden death among people with a known arrhythmia or a high risk of a life-threatening arrhythmia due to causes such as genetic diseases, heart failure, or a prior cardiac arrest. They can be life-saving devices for people who are at high risk of a life-threatening heart rhythm and need to have a defibrillator on them at all times.

The use of a defibrillator is known as defibrillation. During defibrillation, the defibrillator briefly stops the heart muscle to allow the heart to generate an electrical impulse and start a normal rhythm. Defibrillation can be a lifesaver for someone in cardiac arrest, but it is not a guarantee of survival. Even with defibrillation, cardiac arrest is often fatal, and survivors usually require different types of therapy to recover.

Canceling Globe Life Insurance: A Step-by-Step Guide

You may want to see also

Why work with an insurance agent?

An insurance agent is a licensed professional who sells insurance policies to clients on behalf of one or more insurance companies. They can either work independently or for an insurance company. Working with an insurance agent can be beneficial for several reasons:

Expertise and Guidance

Insurance agents are knowledgeable about different types of insurance policies, such as term life insurance or whole life insurance, and can guide you in selecting the most suitable option for your needs. They can explain the features, benefits, and limitations of various policies, helping you make an informed decision.

Simplified Process

The process of purchasing insurance can be complex, especially for first-time buyers. Insurance agents handle the communication with insurance companies, update you on the progress of your application, and facilitate the completion of necessary steps, such as medical examinations or providing additional documentation. This saves you time and effort in navigating the insurance landscape on your own.

Advocacy and Customization

Insurance agents act as advocates for their clients. They work to find the best insurance rates and policies that match your unique circumstances, including health conditions, lifestyle choices, and financial situation. Independent agents, in particular, can help you compare policies from multiple insurers and tailor the coverage to your specific needs.

Access to Insurance Companies

Insurance agents often have established relationships with insurance companies, giving you access to a wider range of options. They understand the underwriting process, can answer your questions about the policies, and advocate on your behalf with the insurers. This access can result in more favourable rates and terms for your insurance coverage.

Regulatory Compliance

Insurance agents are well-versed in the regulations and requirements of the insurance industry. They ensure that you receive accurate and timely information about the policies, helping you comply with legal and financial standards. This reduces the risk of fraud or misrepresentation, protecting you and your loved ones.

Commission-based Model

Most insurance agents work on a commission basis, earning a percentage of the premiums on the policies they sell. This means their success is tied to finding you the best coverage at the most competitive rates. While this may influence their recommendations, it also ensures they are motivated to secure favourable terms for their clients.

Cancer and Life Insurance: What You Need to Know

You may want to see also

Questions for underwriting

When applying for life insurance, the insurance company first evaluates your risk of death and assigns a cost to the policy accordingly. The lower the risk you present to the insurer, the lower you can expect your premiums to be.

- When was the ICD implanted?

- What was the reason for the ICD implant?

- What are the details of the heart disease?

- Have there been any complications from the ICD?

- Do you still have continued symptoms since the ICD was implanted? If yes, what are the details?

- What are your current medications?

- Have you used any tobacco products in the last 5 years?

- Do you have any other major health problems?

In addition to the answers to the questions above, it is also important to know the amount of coverage desired and the plan of protection.

The insurance underwriter will also consider both your health history and lifestyle information, so your application will likely cover some or all of the following:

- Family medical history

- Personal medical history

- Prescription history

- Current and previous doctors’ contact information

- Motor vehicle report

- Occupation (which helps assess occupational hazards)

- Hobbies (some activities, like scuba diving, are associated with increased mortality)

- International travel plans (travel to war zones or areas with high rates of infectious disease can be a risk)

Red Flags for Underwriters

While every life insurance company has its own criteria for the underwriting process, most share the same general underwriting guidelines regarding "red flags." These risk factors may lead the insurer to limit the amount of coverage offered, increase the life insurance rate, or reject an application altogether. Key among them are smoking habits and a medical history that includes a serious or life-threatening illness. Other such items that may impact your insurability include:

- Obesity: Generally, body mass index (BMI) over 40 will lead insurers to request further medical information. BMI over 45 often leads to rejection of the application.

- Uncontrolled blood pressure: Most insurance companies will insure you if it is high but controlled by medication. Erratic or untreated pressure may lead to rejection.

- Travel: Insurers may reject an application if the applicant plans to travel to an unsafe or unstable region.

- Alcohol use: Above-average consumption – even 3 or 4 beers a day – will probably lead to higher premiums. Heavier drinking may lead to rejection of the application.

- Drug use: Use of drugs such as cocaine, crack, or heroin will automatically lead to rejection. Marijuana usage is handled differently among insurance carriers.

- Risky hobbies: Dangerous recreational activities such as skydiving or car racing may lead to substantially higher premiums or, in some cases, rejection of the application.

- Risky occupations: Applicants with dangerous jobs, such as pilots and police bomb technicians, may have to get coverage from specialized carriers or employer plans.

- Poor driving record: A history of reckless or impaired driving may lead some insurers to reject an application

Life Insurance: A Child Changes Everything

You may want to see also

What to expect

If you have an ICD and are looking to get life insurance, there are a few things you should know and expect. Firstly, it is important to work with an agent or agency that specializes in finding coverage for individuals with pre-existing medical conditions, as many life insurance companies will simply decline to insure individuals with an ICD. An independent agent who represents multiple life insurance carriers and has experience in the special risk market will be your best option.

- Underwriting Considerations: The insurance company's underwriter will need to evaluate your risk for life insurance. They will ask questions about your ICD, including the reason for its implantation, any complications or issues, current medications, tobacco use, and other health problems. Be prepared to provide detailed information and medical records.

- Application Process: Avoid sending out multiple applications on your own, as this can negatively impact your chances of getting approved. Work with an experienced agent who can shop your coverage to the best insurance companies specializing in high-risk cases. They will know the right companies to approach and can do so informally, without affecting your records.

- Rates and Coverage: Expect to pay higher premiums due to the increased risk associated with your medical condition. The exact rate will depend on various factors, including your age, gender, overall health, and the reason for ICD implantation. While traditional life insurance policies may offer lower rates, they might not be an option for you.

- Waiting Period: Insurance companies usually require a waiting period of at least three to six months after ICD implantation before they will issue a policy. They want to ensure that there are no complications and that your condition has improved.

- Guaranteed Issue Policies: If you cannot find coverage through the traditional route, guaranteed issue life insurance policies are an option. These policies do not require medical underwriting and provide coverage regardless of your health status. However, they come with much higher premiums and a smaller death benefit, typically ranging from $10,000 to $25,000.

- Improve Your Chances: To increase your chances of approval and potentially lower your rates, focus on improving your overall health. Maintain a healthy weight, exercise regularly, and have regular check-ups for both your general health and your ICD.

UTMA Transfers to Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

Yes, you can get life insurance even if you have a heart condition, but your options and rates will depend on several factors including your diagnosis, treatment, age, gender, and overall health.

The best types of life insurance for people with heart conditions include term life insurance, permanent life insurance, simplified issue life insurance, guaranteed issue life insurance, and group life insurance.

To get the lowest rates for life insurance with a heart condition, it is recommended to shop around with different companies and focus on improving your overall health. Maintaining a healthy weight, exercising regularly, and eating a healthy diet can help reduce your premiums.

To get life insurance with a defibrillator, it is important to work with an agent or agency that specializes in finding coverage for individuals with pre-existing medical conditions. They can help you navigate the underwriting process and find affordable options. Be prepared to answer questions about your health, including the reason for ICD implantation, any complications, medications, and tobacco use.