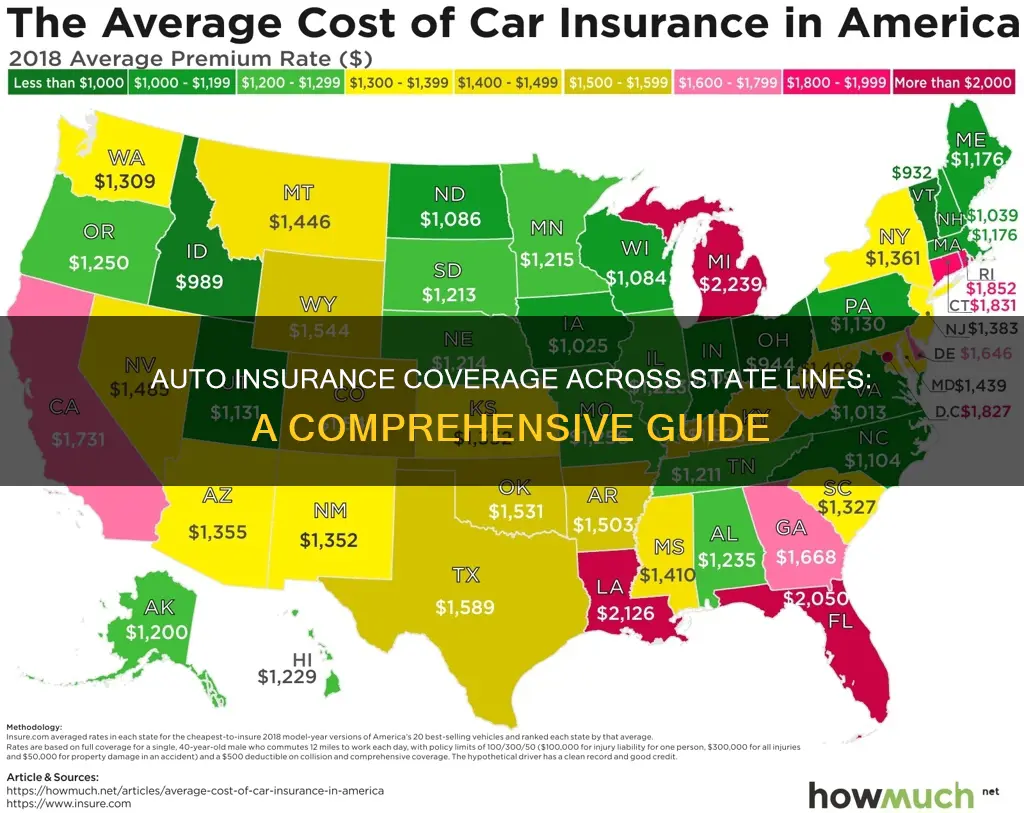

Auto insurance companies generally cover drivers across all states in the US, but there are some exceptions. If you're driving across the border to Mexico, for instance, you'll need a new, temporary policy to cover you there. Additionally, if you're permanently relocating to another state, you'll need to update your insurance policy with your new address. It's also worth noting that auto insurance laws vary by state, so the minimum amount of coverage required may differ depending on where you live.

| Characteristics | Values |

|---|---|

| Car insurance coverage in other states | Car insurance policies generally cover temporary trips to other states in the U.S. |

| Car insurance coverage in other countries | Car insurance policies generally do not cover trips to other countries. |

| Car insurance for college students studying out of state | Depends on the laws of the state. |

| Car insurance for part-time residents | Car insurance is required in the state where the person spends most of their time. |

| Car insurance for military personnel | Most states allow military personnel to keep their car insurance and registration in their home state. |

What You'll Learn

Does car insurance cover you in another state?

If you're taking a short trip to another state, your car insurance will typically cover you. This includes vacations, interstate road trips, and driving across state borders for work or school. Your policy will adhere to the laws of the state you're in, which is important if you have minimum coverage insurance or if you're in a state with different at-fault or no-fault laws. This is known as a "broadening clause".

However, if you're permanently relocating to another state, you'll need to update your insurance policy with your new address. This is because your insurance premium is calculated, in part, based on where your car is garaged, or where it spends most of its time. If you have multiple vehicles kept in different states, you'll likely need separate insurance policies for each vehicle.

Your American car insurance will typically cover you in Canada, but not in Mexico. If you're driving to Mexico, you'll need to purchase a short-term Mexican auto insurance policy.

Claiming Auto Insurance: A Step-by-Step Guide

You may want to see also

Does car insurance cover international travel?

When travelling abroad, it's important to know whether your car insurance will cover you in the country you're visiting. In general, U.S. auto insurance will cover you when driving in Canada and Mexico, but not in other countries. If you're planning to drive outside of North America, you'll need to purchase separate coverage.

Before your trip, it's a good idea to review your current auto insurance policy to understand its coverage limitations when driving abroad. You can also contact your insurance agent to compare policies and find the best option for your trip. Additionally, if you plan to rent a car, consider purchasing rental car insurance, which is a type of temporary insurance that covers the rental vehicle during your trip. This can often be purchased directly from the rental car company or through a credit card company.

International rental car insurance is highly recommended when renting a car abroad to protect yourself from potential damages or accidents. When purchasing this insurance, carefully review the policy to understand what is covered and any exclusions or limitations. Some countries may have specific insurance requirements, so it's important to research the regulations and requirements of your destination country.

If you're moving abroad, GEICO Financial Services GmbH can assist with international insurance for cars, motorcycles, and personal property. They can also help arrange marine transit insurance if you're shipping your vehicle overseas.

In terms of health insurance, Medicare and Medicaid typically do not provide coverage outside of the United States. If you have insurance through your employer or the Health Insurance Marketplace, coverage may vary depending on your plan. Contact your insurance provider to understand if your plan includes international coverage and how to proceed with claims.

Travel insurance is another option to consider if you're seeking medical coverage for an international trip. It can provide protection against unexpected illnesses or injuries during your travels, including emergency medical evacuation and repatriation. Additionally, some travel credit cards may offer limited medical coverage, but stand-alone travel medical insurance may be necessary for more comprehensive protection.

Vehicle Insurance: Per Person or Car?

You may want to see also

What if you live in multiple states?

If you live in multiple states, you will need to register and insure your car in the state where you are a resident. Each state has its own definition of what constitutes a resident, so the requirements for registering your vehicle will depend on the state you are living in part-time. For example, Arizona requires drivers to register their car with the Arizona DMV if they live in the state for more than seven months per year, while in Arkansas, it's only six months.

If you have multiple vehicles kept in different states, you will likely need separate insurance policies for each vehicle based in the states where they are garaged. If you have a vehicle that travels with you between houses, you will only need one policy. This is commonly called the "snowbird exception". For example, if you split your time between Ohio and Arizona and keep your car in the state where you're currently residing, you will have an Arizona policy for the fall and winter months and an Ohio policy for the spring and summer months.

If you are a member of the military, the rules are a little different. Service people declare residency in the state to which they intend to return after deployment, and almost all states make registration exceptions for active-duty military. As long as your vehicle registration is current in your declared home state, you do not usually need to register in the state in which you are stationed.

College students who bring a car to school in a different state may need to purchase a standalone policy in the state where they keep their car. This depends on the laws of the state. For example, students going to college in Idaho are allowed to maintain out-of-state registration, while Connecticut students are not.

Business Auto Insurance: What You Need to Know

You may want to see also

What if you're a college student?

If you're a college student, you may be able to stay on your parents' car insurance policy, as long as you haven't moved out permanently and their home remains your permanent residence. This is often the most cost-effective and convenient option for students. However, it's important to note that some states and insurers may require you to get your own policy if you're an out-of-state student.

If you're taking a car to college, the decision to stay on your parents' policy or get your own insurance may depend on factors such as the ZIP code where the car will be parked and whether you're living on or off-campus. Some states have specific requirements for out-of-state students, so it's essential to check with your insurer and clarify the regulations in your state.

If you decide to stay on your parents' policy, you'll be covered when driving their cars, and they'll be covered when driving yours. Additionally, you'll be covered during school breaks when you return home. Staying on your parents' policy can also result in cost savings, as you split the cost of certain coverages.

On the other hand, if you've fully moved out and keep your car at your own residence, you'll typically need to purchase your own insurance policy. In this case, you may be able to take advantage of student discounts offered by some insurance companies, such as the good student discount for maintaining a certain grade point average.

It's worth noting that car insurance laws vary from state to state, so it's always a good idea to consult with your insurance provider to understand the specific requirements and options available to you as a college student.

Georgia Drivers: Avoid Underinsurance

You may want to see also

What if you're in the military?

Auto insurance can be complicated for military personnel and veterans. There are unique situations that require special insurance, such as insuring stored vehicles or ensuring coverage during a PCS move. However, there are also many companies that offer special discounts for both veterans and active-duty service members.

If you are in the military and stationed in another state, most states allow you to continue coverage from your home state. However, this may not be the case if you are facing a permanent change of station (PCS) and will be spending 20 weeks or more at a new location. In such cases, you may need to purchase new coverage in the state where you are stationed. It is important to check with your insurance company to ensure you have adequate coverage.

Some companies, such as USAA and Geico, specialize in providing auto insurance for military personnel and offer various discounts. Geico, for example, offers a Military Discount of up to 15% on the total insurance premium for those on active duty, retired from the military, or a member of the National Guard or Reserves. They also offer Emergency Deployment Discounts and insurance discounts for certain military-related organizations.

Additionally, there are discounts available for storing your vehicle while on active duty, keeping your car on a military base, or enrolling in a service academy. Many agencies also offer discounts for federal employees. It is worth comparing competing insurance rates to find the best coverage and price for your specific needs.

Furthermore, if you are about to be deployed and need to store your vehicle, several companies offer rate assistance for stored vehicles. Some insurance providers will allow you to cancel your policy and reinstate it upon your return without any penalties. It is also recommended to leave a spare set of keys with a trusted individual in case of emergencies while you are overseas.

If you are heading overseas and need coverage for your vehicle in another country, several insurance agencies offer full protection for vehicles outside the United States. These companies can also assist with shipping your vehicle and handling the necessary registration and paperwork. Overseas car insurance is typically more expensive than domestic coverage, but it provides peace of mind.

Combining your insurance policies can also result in multiple-policy discounts, helping you save money.

Auto Insurance Claims: Yearly Average

You may want to see also

Frequently asked questions

No, not all auto insurance companies cover all states. For example, Nationwide auto insurance is available in 46 states and Washington, D.C. but not in Alaska, Hawaii, Louisiana, or Massachusetts.

Yes, if you move to a new state, you will likely need to get a new auto insurance policy. You should update your insurance company as soon as you know you are moving.

Yes, your car insurance will cover you if you are driving in another state. Your insurance policy will adhere to the laws of the state you are in.

It depends on the country and your insurance company. Your car insurance will likely cover you in Canada, but not in Mexico. Check with your insurance company before you travel.