Auto insurance companies will often send out a check with a brief contract after an accident. However, cashing this check can sometimes waive your right to sue or seek additional compensation for your injuries and related costs. This is because car insurance companies are trying to settle the claim and prevent a future settlement or trial.

If you have received a check from the other driver's insurance company, it is usually an indication that the insurance company believes you have a viable case and they are aware they will have to accept liability. By providing a check quickly, they are hoping to avoid a potential claim, which would save them money.

If you own your car outright and your insurance policy doesn't require you to use your check towards repairs, then the money is yours to spend however you choose. However, if you lease or finance a car, your lessor or lienholder will likely get to sign off on how you use the claims payout.

| Characteristics | Values |

|---|---|

| Who gets the check? | This depends on the type of insurance claim filed. If the claim is a liability claim, the check will go to the other driver involved in the accident. If it is a collision claim, the check will be made out to the policyholder. |

| Who owns the vehicle? | If the vehicle is leased or financed, the lienholder will likely get to sign off on how the claims payout is used. If the vehicle is owned outright, the policyholder can spend the money as they choose. |

| State laws | State laws vary, but some states, like Massachusetts, allow for direct claim payments to be made to the insured in the form of a check. |

| Medical bills | Medical bills are often not included in the initial insurance payout. |

| Waiver | Cashing the check is often seen as accepting a settlement, waiving the policyholder's right to sue or seek additional compensation. |

What You'll Learn

When the insurance company sends the check directly to an auto body shop

When an insurance company sends a check directly to an auto body shop, it is usually because they have a direct billing arrangement with the shop. This means that the insurance company will pay the repair shop directly, and you will only be responsible for paying your deductible to the mechanic. This can often speed up the repair process and make it more efficient, as the body shop can work directly with the insurance company to ensure that the estimate for the damages is accurate and covers everything needed. It also eliminates the need for you to act as a middleman between the shop and the insurance company.

There are a few things to keep in mind when dealing with this situation. First, it is important to note that you have the option to choose a different repair shop if you prefer. However, if you go with a shop outside of the insurance company's network, they will likely send you a check to cover the costs, and you will be responsible for getting it to the body shop. Additionally, if the amount of the check is incorrect or the shop discovers additional damage, you will need to communicate this to the insurance company and arrange for a new check to be sent, which can cause delays in the repair process.

Another thing to consider is that insurance companies may try to save money by only fixing some of the damages, leaving you to pay out of pocket for the rest. In this case, it may be worthwhile to get a second opinion from another shop or a trusted mechanic. It is also important to remember that you have the right to choose where your vehicle is repaired, especially if it is a unique or classic car. Insurance companies are required to take the vehicle as they find it and cover the necessary repairs, regardless of whether you caused the wreck or not.

Finally, it is worth noting that the process of getting a check from an insurance company and paying for repairs can be time-consuming and may involve multiple steps. You may need to get the lienholder or leaseholder to sign off on the check, especially if your vehicle is financed or leased. This can sometimes take weeks, especially if it is handled by mail. Overall, while having the insurance company send the check directly to the auto body shop can streamline the process, it is important to be aware of your options and rights when dealing with car repairs and insurance claims.

Insuring Teen Drivers: What You Need to Know

You may want to see also

When you have a lease or loan on your car

Additionally, the lease or loan company may require you to fix the car unless it is totaled. If your vehicle is determined to be a total loss, the lease will typically end once the valuation is completed and the insurance company pays the leasing company the car's actual cash value, minus any applicable deductible. If the total loss payment is less than what you owe on the lease, you will need to pay the difference unless you have gap insurance. On the other hand, if the insurance payout is more than what you owe, the balance should be paid to you.

It is important to note that the requirements and processes may vary depending on the state you live in, as each state has its own insurance regulations. For example, in Massachusetts, insurance companies are required to make the check payable directly to the insured individual, and it is up to them to use those funds to pay for repairs at the auto body shop of their choice. Therefore, it is recommended to check the specific laws and regulations in your state regarding insurance claim checks.

Auto Insurance: Your Rights as a Consumer

You may want to see also

When you can keep the check and not fix your car

When you receive a car insurance payout, you might be wondering if you are obligated to use that money to fix your car. The answer depends on several factors, including whether you own your car outright or are still paying off a loan or lease, and the extent of the damage to your vehicle.

If you own your car outright

If you own your car, you can technically do whatever you want with the money from a car insurance payout. This means you can keep any leftover money from your claim and are not required to spend it on repairing or replacing your vehicle. However, there are some considerations to keep in mind. Firstly, if you choose to ignore the repairs and the problem gets worse, or additional issues arise as a result, your insurer will not pay for these subsequent costs. You will be responsible for any further repairs. Additionally, auto insurance companies will not provide coverage to repair the same issue more than once and are wary of fraud. So, if you experience the same problem again, your insurance company may investigate to ensure you are not committing fraud and could deny the claim if there is evidence that the damage was pre-existing.

If you are still paying off a loan or lease

If you are still paying off a loan or lease on your car, you will likely have certain insurance requirements, such as listing the loan or leasing company as a 'loss payee' on your policy. In this case, the insurance company will usually issue the check to both you and the loan or leasing company, and you will need their endorsement to cash it. While you are not required to use the money from the check to repair your car, you are generally obligated by the terms of your lease or loan agreement to keep your car in good condition. If you choose not to repair your car, you could be penalised or even have your car repossessed.

Extent of the damage

The extent of the damage to your vehicle is also an important factor to consider when deciding whether to repair your car or keep the insurance payout. If the damage is minimal and cosmetic, not affecting the safety or roadworthiness of your vehicle, you may decide that repairs are not a priority. On the other hand, if the damage is more substantial, you may be required to repair your vehicle to maintain your comprehensive or collision coverage. Many insurance providers will drop physical coverage from vehicles that have not been repaired, so it is important to check with your insurer to determine what is expected of you.

State laws

It is worth noting that state laws regarding insurance payouts may vary. For example, in Massachusetts, insurance companies are required to make the check payable to the person covered by the insurance policy, whereas some states require lienholders to be named on insurance policies and claim checks. Therefore, it is important to check the specific regulations in your state.

Insuring Temporary Drivers: Auto Policy Coverage

You may want to see also

When the insurance check is more than the repairs

It is also important to double-check the cost of your repairs. The final cost of repairs can exceed the initial estimate. It is best to wait until the repairs are complete before deciding what to do with any extra money from an insurance settlement.

You should also consider the full cost of your claim. The cost to repair your vehicle may not be the only cost related to your claim. If someone else was at fault for your accident, you can make a claim with the third-party insurer for diminished value, which is the amount that the resale value of a car decreases due to the car having been in an accident.

If you paid for expenses that should be covered by the insurance settlement out of pocket, the settlement check may include an amount for your out-of-pocket costs. For example, you may have paid a tow truck to tow your car to the shop.

If, after considering the above factors, you believe the insurance company overpaid your claim, contact your claims adjuster to discuss the excess payment. The adjuster will investigate your claim to determine whether you were overpaid in error and whether the insurance company expects you to keep the money or return it.

If you decide to keep the extra money without notifying the insurance company, there could be consequences. If the settlement check was from your own insurance company and it discovers you knew you received an overpayment and did not say anything, it may increase your premiums or cancel your policy, depending on the terms of your contract. This may also affect your ability to get insurance with another company.

If the insurance company asks you to return the overpayment and you do not, it could file a lawsuit. If the insurance company wins, you may end up having to pay the money back, plus legal fees and possibly interest.

If the insurance company determines that you intentionally concealed an overpayment, it may notify the government, which could result in fraud charges. An insurance fraud conviction can lead to penalties of one to 25 years in prison, depending on the severity of the offense. Additionally, databases used by insurance companies may flag you as being a fraud risk.

LLC Auto Insurance: Owner Reimbursement?

You may want to see also

When the insurance check is less than the repairs

Secondly, if you leased or financed the car, you can let the insurance company and dealership negotiate. While this may guarantee full coverage, the mechanic must be selected and approved by the insurance company, and they may use a trusted mechanic to set the claim amount. Alternatively, the dealership or repair shop will negotiate with the insurance company on your behalf, even after you receive a claim check.

Thirdly, you can begin arbitration with your insurance company. An insurance contract has an arbitration clause that lets you dispute an initial estimate if the company refuses to cover the full cost of repairs. Arbitration is a less formal, out-of-court legal proceeding that can take months to resolve, but it is legally binding and cannot be appealed.

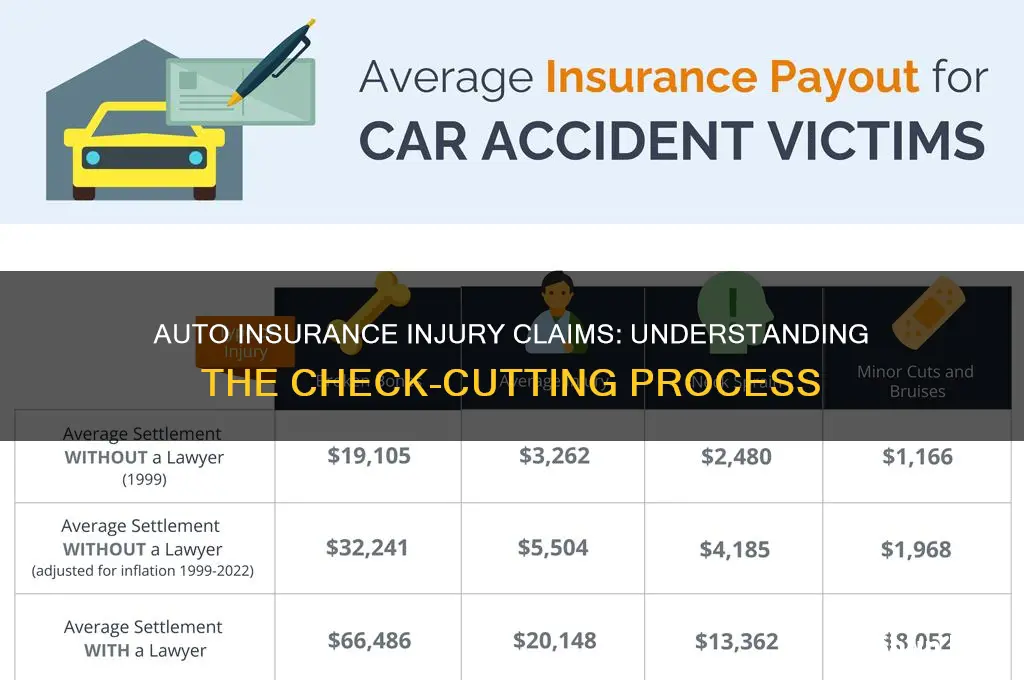

Finally, you can consult an attorney. An experienced lawyer knows the tricks insurers use to pay less or not at all, and they will represent you and fight for your rights. Even if the accident didn't involve a personal injury, legal representation can be beneficial.

If you decide to accept the insurance company's offer, you can pay the remainder of the repair cost out of pocket. It is important to note that you will be responsible for any additional costs if the vehicle's problem gets worse, as insurance companies won't provide coverage for the same claim multiple times.

Selling Auto Insurance: Work-From-Home

You may want to see also

Frequently asked questions

It is advisable to consult an attorney before cashing the check. Cashing the check may waive your right to sue or seek additional compensation for your injuries and related costs.

Cashing the insurance check is often seen as accepting a settlement, which can prevent future claims.

You can borrow money against your potential claim, but be aware that some companies may charge interest on these loans.

Every state has its own insurance regulations, including how claims are paid out. Some states, like Massachusetts, allow direct claim payments to be made to the insured in the form of a check.

A vehicle is "totaled" when the cost of repairs is more than the value of the vehicle itself. In this case, you will generally receive a claim check that is relative to the market value of the vehicle right before the accident.