Car insurance rates are influenced by several factors, including age, gender, driving history, and location. While auto insurance rates typically decrease as drivers gain experience and age, there is conflicting information regarding rates for drivers over 55. Some sources indicate that insurance rates stabilise or decrease slightly for drivers between the ages of 34 and 75, while others suggest that rates begin to rise again after age 55, as senior drivers are considered slightly riskier to insure. This increase is attributed to potential impairments in vision and hearing, as well as slower response times. However, it's important to note that insurance rates for seniors may also be influenced by factors such as driving frequency and safe driving practices, which can lead to savings through programs like Progressive's Snapshot initiative.

What You'll Learn

Auto insurance rates decrease for drivers with more experience

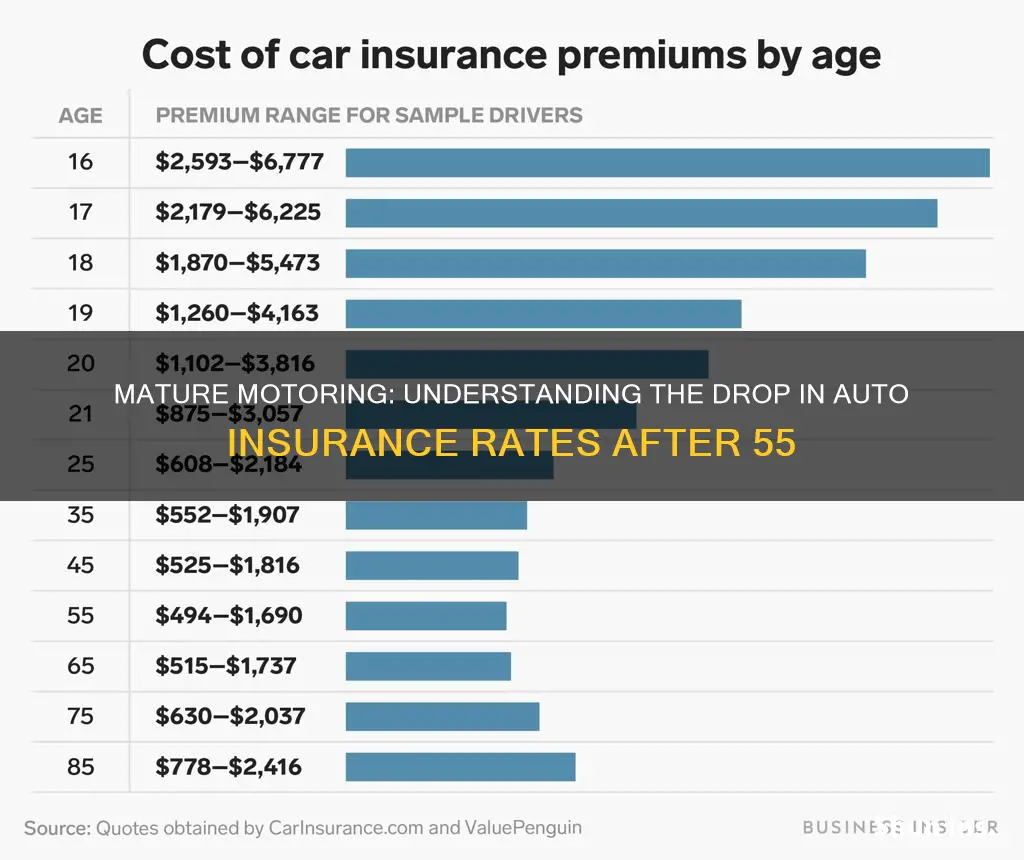

Auto insurance rates are primarily determined by the level of risk a driver poses. Younger drivers are considered high-risk due to their inexperience, higher accident rates, and unsafe driving behaviours. As a result, they pay the highest insurance premiums.

As drivers gain experience and age, their insurance rates tend to decrease. This is because older drivers are considered less risky to insure. They are less likely to be involved in accidents, exhibit safer driving behaviours, and have lower insurance claims. The decrease in insurance rates is most significant between the ages of 18 and 19, with smaller reductions continuing into the driver's twenties. Rates stabilise around the age of 30 to 34 and may decrease slightly from 34 to 75.

However, it is important to note that insurance rates may increase again for senior drivers, aged 65 to 75, due to factors such as slower response times and potential impairments in vision and hearing.

In addition to age and experience, other factors that can influence insurance rates include driving history, credit score, gender, marital status, vehicle type, and location. Maintaining a clean driving record, improving credit scores, and taking advantage of discounts offered by insurance companies can also help lower insurance rates.

Affordable Insurance: Cheaper Alternatives to Safe Auto

You may want to see also

Rates are lowest for drivers in their 50s

Auto insurance rates tend to be lowest for drivers in their 50s, with an average six-month policy costing $703. This is because insurers see older, more experienced drivers as less risky to cover. As drivers age, they are less likely to file insurance claims, and so rates continue to decline as drivers pass the age of 25.

The cost of auto insurance is highest for teen drivers, as younger drivers are more likely to get into car accidents and commit traffic violations. Rates then decrease sharply as drivers age into their 20s and develop more reliable driving habits. By the time drivers reach their 30s, they can expect their insurance rates to have dropped significantly.

Rates level off between the age groups of 35 and 55, as senior drivers are seen as slightly riskier to insure. This is due to age-related factors such as vision or hearing loss and slowed response times, which can make seniors more prone to accidents. However, even with the slight increase in rates, senior drivers are still unlikely to pay the high rates of teen drivers, provided their driving record is clean.

In addition to age, other factors that can influence auto insurance rates include gender, credit score, driving record, and the state in which the driver lives. In most states, men pay higher rates than women due to a greater propensity for risky driving. Drivers with poor credit scores also tend to pay more for insurance, as do those with a history of accidents, speeding tickets, or other violations.

It's worth noting that not all states permit age as a rating factor. Hawaii and Massachusetts, for example, ban the use of age as a factor when determining insurance rates. Additionally, California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania prohibit the use of gender as a rating factor.

Renewing Vehicle Insurance: Saudi Arabia Guide

You may want to see also

Drivers over 55 are seen as safer and less likely to take risks

The biggest drop in car insurance rates typically occurs when drivers hit 18 or 19 years old, as this is when they are seen as less risky to insure. Rates continue to decline as drivers age, especially once they pass 25. This is because younger drivers are more likely to get into car accidents and commit traffic violations, so they pose a higher risk to insurance companies.

In addition to age, other factors that can influence car insurance rates include driving history, location, credit score, and the type of car driven. For example, drivers with accidents or violations on their record may see higher rates for a period of time, typically three years. On the other hand, drivers who maintain a clean driving record may be eligible for discounts or lower rates.

It's worth noting that rates may also vary depending on the insurance company, as each insurer uses different rating factors to determine premiums. As such, it's always a good idea to shop around and compare quotes from multiple providers to ensure you're getting the best rate.

Overall, while car insurance rates may decrease as drivers age, it's important to remember that other factors can also impact premiums. By maintaining a clean driving record and shopping around for the best rates, drivers over 55 can take advantage of the lower insurance costs that come with their increased experience and perceived lower risk.

Rider Insurance: Vehicle Add-Ons Covered

You may want to see also

Premiums can be lowered by increasing your deductible

Car insurance premiums can be lowered by increasing your deductible. A deductible is the amount you pay before your insurance policy kicks in. For example, increasing your deductible from $200 to $500 could reduce your collision and comprehensive coverage costs by 15 to 30%. Going to a $1,000 deductible can save you 40% or more. However, it is important to ensure you have enough money set aside to pay the deductible in the event of a claim.

When it comes to health insurance, a high-deductible plan is often paired with a lower premium. This means that while you'll be paying more out of pocket before your insurance coverage kicks in, your monthly payments will be lower. This can be a good option for those who are generally healthy and don't have pre-existing conditions. However, for those with unique medical concerns or chronic conditions that require frequent treatment, a lower deductible plan may be preferable, despite the higher premiums.

In the context of auto insurance, increasing your deductible can be a strategic way to lower your overall insurance costs. By opting for a higher deductible, you're reducing the amount that the insurance company has to pay out in the event of a claim, which results in lower premiums for you. This approach can be particularly advantageous if you don't anticipate filing frequent claims.

It's worth noting that the relationship between deductibles and premiums is inverse. Lower deductibles typically lead to higher premiums, while higher deductibles result in lower premiums. Ultimately, the decision of whether to increase your deductible depends on your individual circumstances, including your financial situation, driving record, and expected insurance needs.

Vehicle Insurance: Am I Covered?

You may want to see also

Insurance companies reward safe driving with lower rates

Many insurance companies offer safe driving discounts, which can lead to significant savings on auto insurance premiums. These discounts are usually based on maintaining a clean driving record, with no accidents, claims, or violations. Some companies may offer additional incentives, such as cash-back rewards or loyalty programs, to further promote safe driving.

In addition to safe driving discounts, insurance companies may also offer telematics or usage-based insurance programs. These programs involve monitoring a driver's behaviour through apps or plug-in devices, allowing the insurance company to more accurately assess the risk and offer discounted rates to safe drivers.

Some specific examples of safe driving rewards and discounts offered by insurance companies include:

- Allstate's "Allstate Rewards" program, which allows drivers to earn points for good driving habits, redeemable for various rewards.

- GEICO's Accident-Free Good Driver discount, offering savings of up to 26% for drivers who have been collision-free for five years.

- Progressive's Snapshot program, which customises insurance rates based on driving behaviour and can lead to average savings of $146 annually.

- State Farm's Drive Safe & Save program, offering discounts of up to 30% for practising certain driving habits.

- USAA's SafePilot program, offering a 20% discount for safe driving.

It is important to note that insurance rates are based on various factors, including age, driving experience, and location, in addition to driving record. Therefore, it is always a good idea to compare quotes from multiple insurance companies to find the best rates and rewards programs for safe drivers.

Auto Financing and Loan Insurance: Understanding the Connection

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to be lower for drivers over 55. This is because older drivers are considered less risky to insure due to their driving experience and lower likelihood of exhibiting unsafe driving behaviours.

In addition to age, auto insurance rates are influenced by several factors, including driving history, credit score, vehicle type, ZIP code, and insurance history.

Here are some ways to get cheaper auto insurance:

- Shop around for the best rates and switch insurers.

- Increase your deductible.

- Install an anti-theft device in your vehicle.

- Reduce your coverage if you have an older vehicle.

- Improve your credit score.

- Move to a less populated area with a lower crime rate.