Car insurance rates for those aged 70 and above are influenced by various factors, including age-related health changes, accident risk, and driving history. While rates typically increase for older adults, there are ways to mitigate these costs. Age-related health changes, such as declining vision, cognitive abilities, and physical fitness, alongside medications and their side effects, can impact driving skills and lead to higher premiums. Additionally, insurance companies consider seniors to be at a higher risk of accidents, resulting in more frequent and severe injuries, which contribute to increased rates. However, maintaining a clean driving record, taking advantage of discounts, and comparing insurance providers can help seniors find more affordable coverage.

What You'll Learn

- Auto insurance rates increase for seniors due to a higher accident risk

- Seniors are more prone to injuries in car accidents, leading to costly medical expenses

- Age-related factors like vision or hearing loss can increase accident risk

- Senior drivers can take defensive driving courses to reduce insurance rates

- Maintaining a good driving record can help offset rate increases

Auto insurance rates increase for seniors due to a higher accident risk

It is a sad fact of life that auto insurance rates increase for seniors due to a higher risk of accidents. While it is not the case for all insurers, and there are ways to mitigate costs, it is a trend that affects many older drivers.

The simple answer is that older drivers are statistically more likely to be involved in accidents. This is due to a variety of factors, including a higher risk of health issues such as vision or hearing loss, slower reaction times, and a greater susceptibility to injury. These factors can lead to more frequent and more severe accidents, which results in more expensive claims for insurance companies. As a result, insurance providers increase rates to offset the higher costs they may incur.

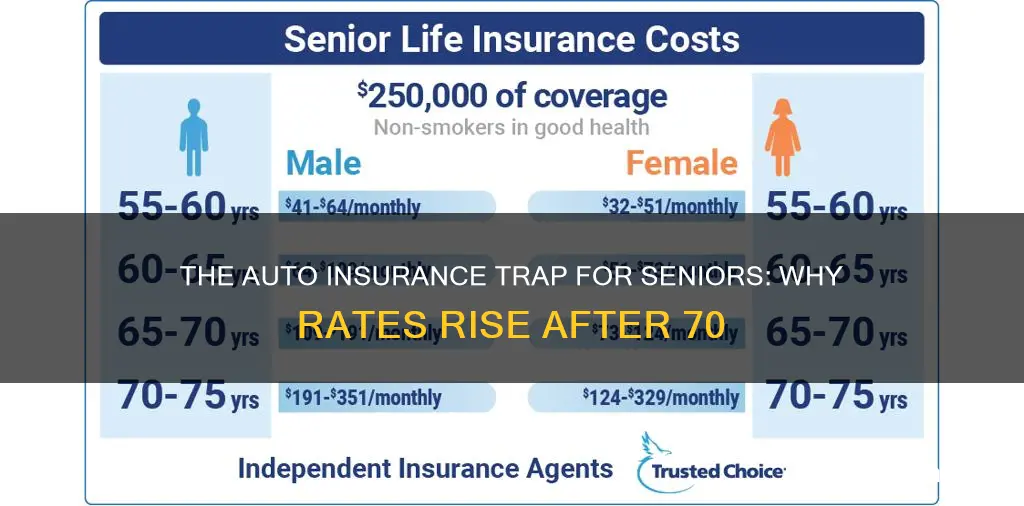

According to research, auto insurance rates typically start to increase when a driver reaches their mid-70s. While rates may vary depending on location and insurer, this is the point when accident trends and data show a notable rise. However, some sources suggest that rates can begin to increase as early as age 60 or 65.

The increase in auto insurance rates for seniors varies depending on the individual, their location, and their chosen insurance provider. On average, rates for drivers aged 65 and above can be expected to increase by around 6% compared to the rates offered to those in their early 60s. This increase is gradual, but it can become significant over time, with rates for 80-year-olds being approximately 31% higher than those for 65-year-olds.

There are several strategies that seniors can employ to keep their auto insurance rates as low as possible:

- Taking a defensive driving course: Many insurance companies offer discounts to seniors who take approved driving courses.

- Maintaining a safe driving record: Avoiding accidents, tickets, and violations will help to keep rates low.

- Reducing mileage: Driving less can lower the odds of an accident and result in a reduced rate.

- Choosing a newer, safer car: Modern safety features can reduce the risk of an accident and may lead to lower insurance rates.

- Shopping around: Comparing rates from multiple insurance providers can help seniors find the most competitive rate.

- Taking advantage of discounts: Seniors may be eligible for various discounts, such as those offered by organizations like AARP.

Maryland Auto Insurance: Tax Refund Garnish

You may want to see also

Seniors are more prone to injuries in car accidents, leading to costly medical expenses

Additionally, seniors often have a slower reaction time, which can increase their risk of injury in an accident. They may not be able to react as quickly as younger individuals, leading to more severe injuries. This reduced reaction time is also a result of the physiological changes that come with aging, such as a decrease in vision, hearing, and balance.

The consequences of car accidents involving seniors can be severe. Research shows that seniors are more likely to sustain serious to severe injuries compared to other age groups. They are also more likely to be hospitalized for prolonged periods, leading to increased costs in public health care programs.

Furthermore, seniors are often found to be at fault in car accidents. In a study of traffic accidents in Germany, it was found that 56.4% of seniors were responsible for the accident, compared to 50.7% in the control group of people under 65. This could be due to factors such as reduced mobility, impaired sensory functions, and a decline in cognitive abilities, which can impair their ability to make quick decisions and react appropriately in traffic situations.

The increased risk of injury and higher medical costs associated with senior drivers contribute to higher insurance premiums for this age group. While driving experience generally leads to lower insurance rates, seniors may find their insurance premiums increasing due to the higher accident risk behind the wheel.

Stacking Auto Insurance: What It Means

You may want to see also

Age-related factors like vision or hearing loss can increase accident risk

Age-related factors, such as vision or hearing loss, can increase the risk of accidents in older adults. This is due to a decrease in optimal driving capabilities, which can lead to a higher frequency of risky driving behaviours. As a result, auto insurance rates tend to increase for drivers around the age of 70.

The risk of causing a road crash is higher for drivers in extreme age groups, i.e., those under 25 and over 65 years old, compared to middle-aged drivers (35–44 years old). Vision and hearing loss, as well as slowed response times, can contribute to this increased risk.

In the US, auto insurance rates are determined by various factors, including age and gender. While age is a significant factor in most states, some states, such as Hawaii and Massachusetts, ban its use as a rating factor. Similarly, California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania prohibit the use of gender as a rating factor.

The cost of auto insurance for seniors varies based on several factors, including age, driving record, address, vehicle type, credit report, and coverage limits. While insurance rates do not always increase at age 65, they typically start to rise from ages 60 to 65 and continue to increase steadily. Seniors aged 70 and above may struggle to find insurers as the frequency of accidents in this age group is higher.

To mitigate the increased risk associated with age, some auto insurance providers offer mature driver discounts for those with clean records or for seniors who complete approved driving courses. Additionally, seniors can explore various ways to save on car insurance, such as taking a driving course, maintaining a safe driving history, maintaining vehicle safety, and increasing their deductible.

Postal Vehicles: Insured?

You may want to see also

Senior drivers can take defensive driving courses to reduce insurance rates

As we age, our auto insurance rates can increase due to various factors, such as increased accident risks and higher chances of injuries. Senior drivers, especially those aged 70 and above, may face challenges in finding insurers that accept them. However, there are ways to mitigate these challenges and reduce insurance rates. One effective way is for senior drivers to take defensive driving courses.

Defensive driving courses are designed to enhance driver education beyond the basic rules of the road. These courses focus on skills that help drivers anticipate and react to dangerous situations, avoid accidents, and encourage courteous and cooperative behaviour on the road. They cover topics such as collision prevention techniques, defensive driving techniques, traffic laws, and sharing the road with other road users, including pedestrians and cyclists.

Senior drivers can benefit from these courses by improving their driving skills, removing license points, and reducing their auto insurance premiums. Many states have mandated mature driver discounts for seniors who complete state-approved defensive driving courses. Organizations such as AARP, AAA, and The National Safety Council (NSC) offer these courses, which can result in multi-year discounts on car insurance policies. The discount for defensive driving for adults aged 65 and above is typically around 4.31%.

Additionally, insurance companies like Allstate, GEICO, State Farm, and USAA offer defensive driving course discounts. The discounts can range from 5% to 20%, with most insurance companies offering around a 10% reduction. These courses are generally affordable, ranging from $15 to $100, and can be completed online, in a classroom, or through other methods such as DVDs or digital cable.

It's important to note that not all defensive driving courses are equal, and insurance companies usually only accept certifications from official schools. Senior drivers should ensure that the course they choose is fully certified and recognized by their insurance provider. By taking advantage of defensive driving courses, senior drivers can improve their driving skills, maintain their independence, and reduce their auto insurance rates.

Primary vs. Secondary: Vehicle Insurance Explained

You may want to see also

Maintaining a good driving record can help offset rate increases

Maintaining a good driving record is one of the most effective ways to keep insurance rates down as you age. While age is a significant factor in determining insurance rates, a history of safe driving can help to offset rate increases.

As drivers age, they may experience a range of factors that can impact their driving abilities, such as vision or hearing loss and slowed response times. These factors can increase the likelihood of accidents and, consequently, lead to higher insurance rates for seniors. However, a clean driving record can demonstrate lower risk to insurers and help mitigate these age-related increases.

Additionally, taking a defensive driving course can be beneficial for seniors. Many states mandate mature driver discounts for individuals who complete approved driving courses. These courses are often provided by organisations such as AARP, AAA, and The National Safety Council (NSC). Completing such courses can result in significant discounts on car insurance policies, helping to offset rate increases due to age.

It is worth noting that insurance rates are also influenced by factors beyond age and driving record, such as the state of residence, address, vehicle type, credit score, and coverage limits. However, focusing on maintaining a good driving record can be a powerful tool for seniors to manage their insurance costs effectively.

Female Identity and Auto Insurance

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to increase at and after age 70.

Insurers are concerned about the rising accident risk of senior drivers. Statistics show that seniors are more accident-prone than younger drivers due to factors such as declining vision, cognitive abilities, and physical fitness.

Forbes Advisor's analysis found that auto insurance rates at age 70 are 6% higher compared to age 65. The cost of auto insurance goes up by an average of 31% from age 65 to 80 for good drivers.

Yes, there are a few strategies that may help:

- Shop around and compare rates from different insurance companies.

- Take a defensive driving course to qualify for a discount.

- Maintain a good driving record.

- Adjust your driving habits to remain a safe driver.

- Ask your insurance provider about all applicable discounts.

Yes, teenagers and young adults tend to pay the highest auto insurance rates due to their lack of driving experience and higher risk of accidents.