If you cancel your car insurance policy, you may be entitled to a refund for the remaining time on your policy. However, this depends on several factors, including whether you have paid your premium in advance, the reason for cancellation, and the laws in your state.

If you have paid your premium upfront and cancel your policy before the end of the term, your insurance company will likely refund the remaining balance. Most insurers will prorate the refund based on the number of days your policy was in effect. However, some companies may charge a cancellation fee, which will be deducted from the refund.

On the other hand, if you pay your premium monthly, you may or may not get a refund, depending on when you cancel. If you cancel in the middle of the month or billing cycle, you may receive a small refund for the remaining days.

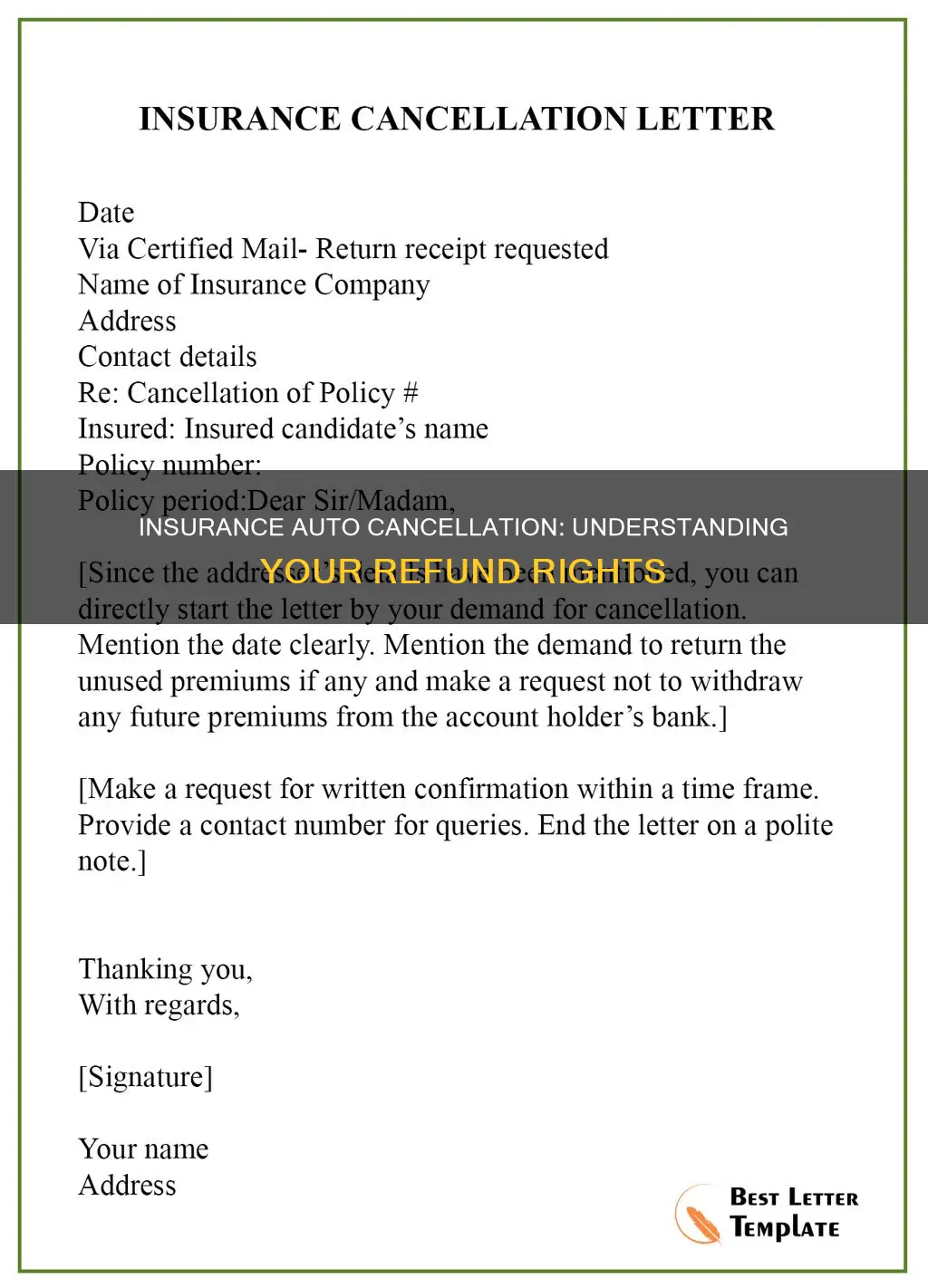

It is important to note that insurance companies typically require written notice for policy cancellations and that you should have a new insurance policy in place before cancelling your existing one to avoid a lapse in coverage, which could result in higher rates or fines.

| Characteristics | Values |

|---|---|

| Reasons for refund | Selling your car, switching insurance companies, moving to a new state, reducing coverage, cancelling before the end of the term |

| When you get a refund | If you pay in full upfront, you will get a refund for the remaining time in your policy. If you pay monthly, you may or may not get a refund depending on when you cancel. |

| How to get a refund | Contact your insurance provider by phone, mail, or in person. You may need to submit a written request. |

| Additional notes | You may have to pay a cancellation fee. If the insurance company cancels your policy for non-payment, you will not get a refund. |

What You'll Learn

- Cancelling your insurance policy can lead to higher rates if you don't have another policy in place

- You may have to pay a cancellation fee

- You will only be refunded for the money you've already paid

- If you pay monthly, you may not be entitled to a refund

- If you cancel within the 14-day cooling-off period, you will get a refund

Cancelling your insurance policy can lead to higher rates if you don't have another policy in place

To avoid this, make sure there is an overlap in coverage between your old and new policies. You can do this by setting up a new auto insurance policy before cancelling your existing one. If you're switching insurers, it's best to wait until a policy is about to expire to avoid an early termination fee. When you have the effective date of your new policy, you can ask your current insurer to cancel your existing policy effective from the first day of your new policy.

If you're selling your car, you can keep your insurance policy active until the new owner takes possession and the title is transferred to them. If you don't plan on getting a new car, you could also swap to a non-owner policy to avoid a lapse in coverage.

Mercury Insurance: Who's Driving?

You may want to see also

You may have to pay a cancellation fee

If you cancel your car insurance policy, you may have to pay a cancellation fee. This fee can vary depending on the insurance company and the specific policy you have. Some companies charge a flat fee, while others charge a percentage of the remaining cover, usually around 10%. In some cases, the cancellation fee may be equal to one month's worth of premiums. It's important to review your policy documents carefully to understand the specific cancellation fee that may apply.

Additionally, if you purchased your policy through a broker, you may be charged a separate cancellation fee by the broker on top of the insurance provider's fee. It's also worth noting that add-ons, such as breakdown cover, are often non-refundable when you cancel your policy.

If you cancel during the "cooling-off period," which is typically the first 14 days after purchasing the policy, you may still be subject to a cancellation fee. However, this fee is usually lower than the fee for cancelling after the cooling-off period.

To avoid unexpected fees, it is essential to carefully review the terms and conditions of your policy before cancelling. Understanding the potential costs involved will help you make an informed decision about whether to cancel your car insurance policy.

If you believe the cancellation fees are excessive or disproportionate compared to other providers, you have the right to dispute them. You can start by making a complaint to your insurance company and, if necessary, escalate the issue to the Financial Ombudsman Service.

Driving Risks: Auto Insurance Drop

You may want to see also

You will only be refunded for the money you've already paid

If you've paid your insurance premium in advance and cancel your policy before the end of the term, your insurance company will likely refund the remaining balance. The amount of money you get back will depend on how much time is left on your policy and how you pay.

If you pay your premium upfront, you'll get a refund based on how many months or days you have left on your policy. For example, if you pay $1,200 for a year's worth of coverage and cancel after four and a half months, you'll get a refund of $750. However, if you've been making monthly payments, your refund will be much smaller. In this case, you may only be refunded half of your monthly payment, which would be $50.

It's important to note that not all insurance companies handle refunds the same way. Some companies may keep the extra money and automatically apply it to your next bill, while others may charge a cancellation fee. This fee is sometimes called a short-rate penalty and can impact the amount of your refund. Therefore, it's crucial to carefully review the terms of your policy and contact your insurance provider to understand their specific rules regarding cancellations and refunds.

Additionally, it's worth mentioning that if your insurance company cancels your policy due to non-payment or certain violations, you may not be eligible for a refund.

SSI Recipients: Auto Insurance Options

You may want to see also

If you pay monthly, you may not be entitled to a refund

If you pay for your car insurance monthly, you may not be entitled to a refund when you cancel your policy. This is because, when you pay monthly, you are paying for insurance for that month. Therefore, if you cancel at the end of the month, you won't get a refund. However, if you cancel in the middle of the month, you may get a small refund for the remaining period.

The exact refund practice varies from company to company. Generally, insurers don't refund the last two months of cover. So, if you're six months into your policy without any claims, you'll often get four months refunded minus any admin charge.

If you cancel your insurance, you may have to pay an administration fee, and you'll forgo any no-claims bonus you'd receive if you hadn't claimed that year.

Health Insurance Claims After Auto Settlements

You may want to see also

If you cancel within the 14-day cooling-off period, you will get a refund

If you cancel your auto insurance within the 14-day cooling-off period, you will be refunded. The cooling-off period is a grace period during which you can cancel your insurance without penalty. This period begins on the day you take out your policy and lasts for 14 days. If your policy has not started when you cancel, you will receive a full refund. If your policy has started, you will be refunded for the remaining period, excluding the days of cover you have already used.

The amount of your refund will depend on how you pay for your insurance. If you pay upfront for the entire policy, you will be refunded for the remaining period. If you pay monthly, you may not receive a refund and may even have to pay additional charges.

To cancel your policy, you may need to send a written request to your insurance company. This is to cover both you and the insurance company in case of any questions in the future. It is important to note that most states require drivers to have auto insurance, so you should ensure that you have a new policy in place before cancelling your existing one.

Best Vehicle Insurance in Mexico

You may want to see also

Frequently asked questions

Yes, you can get a refund if you cancel your insurance auto, but the amount you get back depends on several factors.

The refund amount depends on when you cancel your policy, how you pay for it, and the company's rules about refunds.

If you cancel during the cooling-off period, which is typically 14 days from taking out the policy, you will get a full refund. If you cancel after this period, you may receive a partial refund, depending on how much time is left on your policy.

If you have paid for your insurance upfront, you are more likely to get a refund. If you pay by monthly instalments, you may not be entitled to a refund and may have to pay additional charges.

Some companies charge a cancellation fee or a short-rate penalty, which will reduce the amount of refund. Other companies may not provide a refund if you cancel towards the end of your policy, as they consider the initial part of the policy term more expensive due to setup costs.