Indexed whole life insurance is a type of permanent life insurance that offers lifelong coverage and the potential for cash value growth. It is a variation of traditional whole life insurance, combining the guaranteed death benefit and cash value accumulation features of whole life policies with the potential for additional returns based on the performance of a specific market index, often the S&P 500. Unlike traditional whole life insurance, which offers a fixed rate of return, indexed whole life insurance ties returns to the performance of an index representing an investment market segment or strategy. This means that returns may be higher if the market performs well, but there is also the chance of receiving a smaller credit or even a zero return in a down year. Indexed whole life insurance may be suitable for those seeking lifelong coverage and potential cash value growth but comes with higher premiums and capped growth.

What You'll Learn

Permanent coverage with interest credits tied to the stock market

Indexed whole life insurance offers permanent coverage with interest credits tied to the stock market, providing the potential for higher returns. This type of insurance combines permanent coverage with investment opportunities, making it appealing to those seeking a balance between investment growth and lower potential volatility.

Indexed whole life insurance is a type of permanent life insurance that offers level premiums for life, protecting against rising costs. A portion of the premium funds the cost of insurance (the death benefit plus administrative fees), while the remainder builds cash value, which can be accessed later in life. This cash value component is what sets indexed whole life insurance apart from traditional whole life insurance, as it offers the potential for greater growth over time.

The interest rate for indexed whole life insurance is tied to a stock or bond index, which means the returns are dependent on the performance of the market. This differs from traditional whole life insurance, which offers a fixed rate of interest. While this provides the opportunity for higher returns, there is also the risk of receiving a smaller credit or even a return of zero in a down year.

The cash value of indexed whole life insurance policies grows tax-deferred, and withdrawals and policy loans are typically tax-free as long as they do not exceed the total amount paid into the policy. This feature adds to the financial benefits of this type of insurance.

Overall, indexed whole life insurance can be a valuable option for those seeking lifelong coverage and the potential for cash value growth linked to market performance. However, it may not be suitable for everyone due to its higher premiums and capped growth potential. It is important for individuals to carefully consider their financial goals and risk tolerance before deciding if this type of insurance is the right choice for them.

Life Insurance at 70: Is It Possible?

You may want to see also

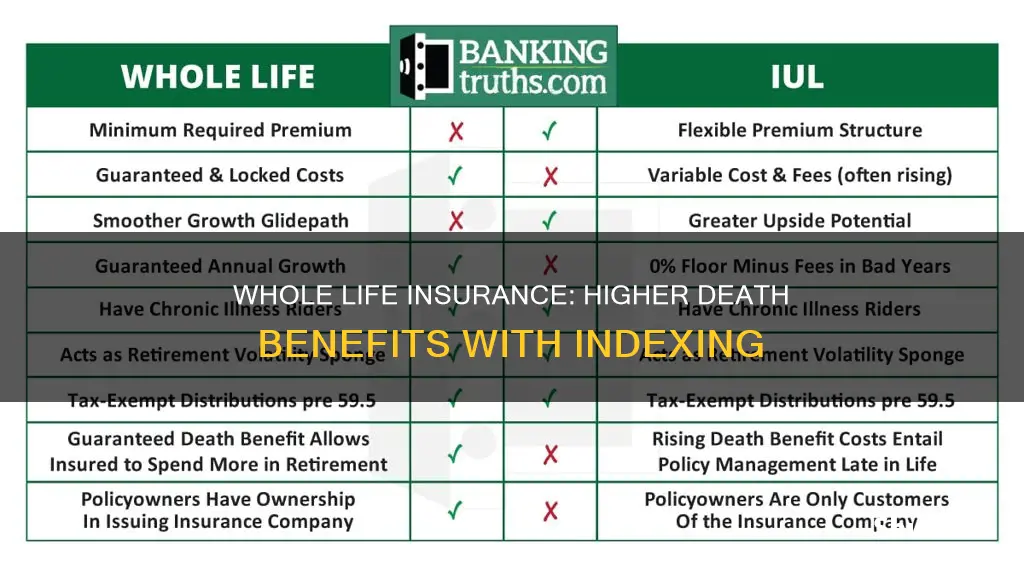

Higher returns than traditional whole life insurance

Indexed whole life insurance offers the potential for higher returns than traditional whole life insurance. This is because it combines the benefits of permanent coverage with interest credits tied to the performance of the stock market. While traditional whole life insurance offers a fixed rate of interest, indexed whole life insurance provides a variable rate of return that is dependent on the performance of a specific market index, often the S&P 500.

The potential for higher returns with indexed whole life insurance is due to its unique structure. A portion of the premium paid by the policyholder is allocated to the policy's cash value, which is separate from the death benefit. The growth of this cash value is linked to the performance of the chosen market index. If the index performs well, the cash value of the policy can increase significantly. However, it is important to note that there is also a potential for lower returns or even a zero return if the index performs poorly.

Indexed whole life insurance also offers a guaranteed minimum interest rate, ensuring that the cash value will not decrease if the index performs poorly. This provides downside protection and makes indexed whole life insurance less risky than direct investments in the stock market. Additionally, the cash value growth in indexed whole life insurance is tax-deferred, providing further financial benefits to the policyholder.

Overall, indexed whole life insurance offers the potential for higher returns than traditional whole life insurance due to its variable rate of return tied to the performance of a specific market index. However, it is important to consider the risks and potential drawbacks, such as higher premiums and capped growth, before deciding if indexed whole life insurance is the right choice for your financial goals and risk tolerance.

Variable Life Insurance: Loan Provisions and Their Benefits

You may want to see also

Cash value growth potential

Indexed whole life insurance offers permanent coverage with interest credits tied to the stock market, presenting the potential for higher returns. This type of insurance combines the guaranteed death benefit and cash value accumulation features of whole life policies with the potential for additional returns based on the performance of a specific market index, often the S&P 500.

The cash value component of indexed whole life insurance can be a strategic choice for investment life insurance, providing an opportunity for potential investment growth within the life insurance policy. The cash value is separate from the death benefit and can grow over time. This growth is linked to the performance of a chosen market index, such as the S&P 500. If the index performs well, the cash value of the policy has the potential to increase.

One of the key features of indexed whole life insurance is the guaranteed minimum interest rate. Even if the index performs poorly, the cash value won't decrease. This feature provides protection from loss, ensuring that the cash value of the policy remains stable even during market downturns.

However, it's important to note that the growth of the cash value may be capped. This means that even if the index performs exceptionally well, the increase in the cash value will be limited. Additionally, indexed whole life insurance typically comes with higher premiums compared to term life insurance.

Overall, indexed whole life insurance can be a beneficial financial tool for individuals seeking a balance between investment growth and lower potential volatility. It offers lifelong coverage, cash value growth potential, and protection from loss. However, it may not be suitable for everyone due to the higher premiums and capped growth.

Superannuation: Life Insurance Coverage and Your Options

You may want to see also

Lifelong protection

Indexed whole life insurance offers permanent coverage, providing lifelong protection for the policyholder and a death benefit for beneficiaries. This type of insurance combines the features of traditional whole life insurance with the potential for additional returns based on market performance.

Indexed whole life insurance offers the same lifelong coverage as traditional whole life insurance, but it differs in how the cash value accumulates. While traditional whole life insurance offers a fixed interest rate, indexed whole life insurance ties the cash value growth to the performance of a specific market index, such as the S&P 500. This blend of insurance coverage and investment opportunities makes it appealing to those seeking both financial protection and potential for growth.

The cash value component of indexed whole life insurance can grow over time, separate from the face amount of the policy. A portion of the premium paid goes into this cash value account, which earns interest based on the chosen market index. This interest is credited to the account based on the index's performance over a specified period, known as the index period. The insurer compares the index value at the start and end of this period and calculates the interest accordingly.

One key advantage of indexed whole life insurance is that it provides protection from market downturns. Even if the index performs poorly, the cash value won't decrease thanks to a guaranteed minimum interest rate. This feature ensures that the policyholder's financial protection remains stable.

Who Is It For?

Indexed whole life insurance may be a good option for individuals seeking lifelong coverage and potential cash value growth as part of their long-term financial planning. It is particularly suited to risk-averse investors who want exposure to the stock market but are concerned about potential losses. Additionally, high-income earners who have maximized other tax-advantaged investment opportunities may benefit from the additional tool for wealth accumulation and estate planning.

However, it's important to note that indexed whole life insurance comes with higher premiums than term life insurance. Therefore, it may not be the best choice for those on a limited budget. Individuals seeking short-term coverage or those who prefer direct market participation may find other options more suitable.

Indexed whole life insurance offers lifelong protection and the potential for cash value growth linked to market performance. It provides financial security for beneficiaries and gives policyholders the opportunity to build their cash value over time. While it may not be the right fit for everyone, it can be a valuable option for those seeking a balance between financial protection and investment growth.

Life Insurance Options for People with A-Fib

You may want to see also

Tax-free gains

Indexed whole life insurance offers permanent coverage with interest credits tied to the stock market, offering the potential for higher returns. The interest rate is tied to a stock or bond index, which offers the potential for higher returns.

The cash value of indexed whole life insurance has the potential for growth based on a market index. The cash value of indexed whole life insurance won't decrease if the index performs poorly. This is because indexed whole life insurance policies typically come with a guaranteed minimum interest rate. Even if the index performs poorly, your cash value won't decrease.

The death benefit received from an indexed whole life insurance policy is typically not taxable income. This means the policy's beneficiaries generally do not have to pay income tax on the amount received upon the policyholder's death. Loans taken against the policy are also tax-free as long as the policy remains in force.

Additionally, withdrawals and policy loans are tax-free as long as they don't exceed your "basis", which is the total amount you've paid into the policy. Any gains in excess of your basis are taxed at your ordinary rate.

Indexed whole life insurance can be a beneficial financial tool for some individuals. It combines life insurance protection and the potential for cash value growth. However, it's important to remember that it's primarily a life insurance product, not an investment vehicle.

Foreign Nationals: Getting American Life Insurance

You may want to see also

Frequently asked questions

Indexed whole life insurance is a type of permanent life insurance that combines lifelong coverage with the potential for cash value growth based on a market index.

A portion of the premium you pay goes to the cash value of the policy, which is separate from the death benefit. The growth of the cash value is linked to the performance of a chosen market index, like the S&P 500. If the index performs well, the cash value of the policy can increase.

Indexed whole life insurance offers lifelong coverage, the potential for cash value growth, and protection from market downturns. It also provides tax advantages, such as tax-deferred growth and tax-free withdrawals up to the amount you've paid into the policy.

Indexed whole life insurance typically has higher premiums compared to term life insurance. It may also have higher fees due to its complex nature. The growth of the cash value may be capped, limiting the potential returns.