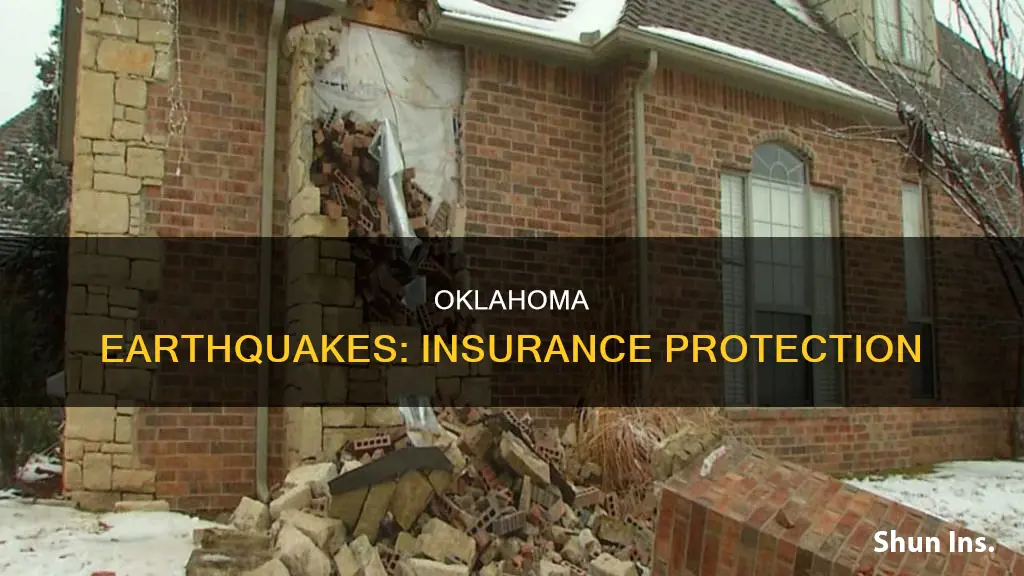

In light of the increasing frequency of earthquakes in Oklahoma, many residents are now considering earthquake insurance to protect their property. While earthquakes are a new experience for many Oklahomans, the state rests along a fault line and has always experienced seismic activity. In recent years, the number of earthquakes has surged, with a 40-fold increase in earthquake activity since 2009. This has prompted the Oklahoma Insurance Commissioner to advise residents to purchase earthquake insurance, which is available as an endorsement to existing policies or as a standalone cover. However, take-up remains low, with less than 1% of Oklahomans carrying earthquake insurance, possibly because it is an optional extra on standard homeowner policies.

| Characteristics | Values |

|---|---|

| Number of people with earthquake insurance | Less than 1% |

| Average cost of earthquake insurance | $50-$300 per year |

| Earthquake insurance covers | Home repairs, personal property, debris removal, increased costs of repair to meet current building codes, costs to stabilize the land beneath structures, extra living expenses |

| Earthquake insurance does not cover | Damage to lot or land, vehicles, external water damage, masonry veneer |

| Waiting period for new earthquake insurance policies | 72 hours to 60 days after the most recent earthquake |

What You'll Learn

- Earthquake insurance is not included in standard homeowner's insurance

- Earthquake insurance covers repairs, personal property, and debris removal

- Earthquake insurance does not cover vehicles or external water damage

- Earthquake insurance costs between $50 and $300 per year

- Earthquake insurance deductibles are a percentage of the insured value of the home

Earthquake insurance is not included in standard homeowner's insurance

In Oklahoma, earthquakes have become more frequent in recent years, and many residents are now considering earthquake insurance to protect their property. However, it is important to note that earthquake insurance is not included in standard homeowners insurance. While a standard homeowner's policy covers severe weather damage, it does not typically include coverage for earthquake damage.

The increase in earthquake activity in Oklahoma has led to a growing interest in earthquake insurance among residents. Oklahoma rests along a fault line and has always experienced earthquakes, but the frequency and intensity of these events have increased significantly. Since 2009, the state has seen a forty-fold increase in earthquake activity compared to the previous thirty years. This trend has prompted many homeowners to explore their options for earthquake coverage.

Earthquake insurance is available as an endorsement or add-on to a standard homeowner's policy or as a stand-alone policy. This type of insurance covers repairs needed due to earthquake damage to the home and may also cover other structures not attached to the house, like a garage. Some policies also cover personal property damaged by the earthquake and may include additional living expenses while the home is being repaired or rebuilt.

When considering earthquake insurance, it is essential to review the exclusions and limitations of the policy. Common exclusions include masonry (brick) veneer, vehicles, and pre-existing damage. Additionally, earthquake insurance typically does not cover water supply systems, underground structures or equipment outside the foundation wall, exterior walls and fences, satellite dishes, antennas, and personal property located outside the dwelling, among other exclusions.

The cost of earthquake insurance can vary depending on several factors, including the size, location, and age of the home, the construction type, and the cost to rebuild. In Oklahoma, residents can expect to pay between $50 and $300 per year for earthquake coverage. It is important for homeowners to carefully review their insurance policies and consider their specific needs and risks when deciding whether to purchase earthquake insurance.

The Insurance Billing Conundrum: Why Hasn't My Chiropractor Submitted Claims Yet?

You may want to see also

Earthquake insurance covers repairs, personal property, and debris removal

Earthquakes can cause a lot of damage to your home and belongings, and standard homeowners insurance does not typically cover earthquake damage. Earthquake insurance is available as an endorsement on your homeowners policy or as a separate policy. It is an important consideration for people living in Oklahoma, as the state has experienced an increase in earthquakes over the last several years.

Earthquake insurance covers repairs needed because of earthquake damage to your home and may cover other structures not attached to your house, like a garage. It may also cover increased costs to meet current building codes, costs to stabilize the land under your home, and debris removal. Some policies also cover your personal property against damage, including the contents of your home.

The coverage can also pay for extra living expenses, such as temporary accommodation, while your home is being rebuilt or repaired. This is often referred to as Additional Living Expenses (ALE) or loss of use. This coverage is bound to a reasonable time needed to repair the home or for you to move to another permanent home.

When considering earthquake insurance, it is important to review the policy carefully to understand what is and is not covered. Common exclusions for earthquake insurance include masonry (brick) veneer, vehicles, and pre-existing damage. Additionally, earthquake insurance is typically subject to a waiting period of 72 hours to 60 days after an earthquake, due to the possibility of aftershocks.

The Intriguing World of Insurance Billing: Unraveling Trade Secret Mysteries

You may want to see also

Earthquake insurance does not cover vehicles or external water damage

Earthquakes have become increasingly common in Oklahoma, with earthquake activity in the state being about 40 times higher since 2009 than in the previous 30 years. As a result, many residents are considering purchasing earthquake insurance to protect their property.

Earthquake insurance is available as an endorsement or a stand-alone policy, as it is not covered under a typical homeowners or renters policy. While earthquake insurance can cover a range of damages, it is important to note that it does not cover vehicles or external water damage. This means that any damage to vehicles or water damage to the exterior of a property resulting from an earthquake will not be covered by earthquake insurance.

Exclusions and limitations vary by policy, so it is essential for consumers to carefully review their policies to understand what is and is not covered. Some common exclusions for earthquake insurance include masonry (brick) veneer, vehicles, and pre-existing damage. It is worth noting that earthquake insurance is typically for catastrophic loss, not minor repairs.

When considering earthquake insurance, consumers should ask their insurance agents to confirm that man-made earthquakes due to oil and gas activities are covered. Additionally, they should be prepared to pay a substantial deductible, which is typically calculated as a percentage of the insured property's value.

While earthquake insurance may not cover all potential damages, it can still provide valuable protection for residents in Oklahoma and other areas prone to seismic activity.

Understanding Short-Term Insurance in South Africa: A Guide to Navigating the Essentials

You may want to see also

Earthquake insurance costs between $50 and $300 per year

Earthquake insurance is becoming an increasingly important consideration for residents of Oklahoma. The state has experienced a sharp uptick in earthquake activity in recent years, with activity since 2009 around 40 times higher than in the previous 30 years. As earthquakes become more frequent, residents are understandably keen to protect their property.

The cost of earthquake insurance in Oklahoma varies, but it is generally affordable. Earthquake insurance costs between $50 and $300 per year for an Oklahoma homeowner. This price range is confirmed by the Oklahoma Insurance Department and Oklahoma State University. The cost of earthquake insurance depends on a number of factors, including the size, location, and age of the home, as well as the type of construction and the cost to rebuild.

The deductible for earthquake insurance is a percentage of the insured property value, typically between 2% and 10%. This can make earthquake insurance deductibles quite expensive. For example, a policy on a $100,000 home with a 10% deductible would mean the homeowner has to pay $10,000.

When considering earthquake insurance, it is important to shop around and understand what is and isn't covered. Earthquake insurance typically covers repairs to the home structure and may also cover other unattached structures like a garage. Some policies also cover personal property damage and the increased costs of meeting current building codes. It is also worth noting that most companies won't sell new earthquake insurance policies for 30-60 days after a quake due to the possibility of aftershocks.

Unraveling the Insurance Billing Process Post-Practice Sale: A Comprehensive Guide

You may want to see also

Earthquake insurance deductibles are a percentage of the insured value of the home

In recent years, earthquakes have become more frequent in Oklahoma, which rests along a fault line. This has led to a growing number of consumers purchasing earthquake insurance to protect their property. A standard homeowner’s policy does not cover earthquake damage, so earthquake insurance is available as an endorsement or a stand-alone policy.

The price of earthquake insurance depends on several factors, including the property’s location, age, construction, and the cost to rebuild. Earthquake insurance deductibles are a percentage of the insured value of the home, typically ranging from 2% to 10% but can go as high as 25%. This means that for a $100,000 home with a 10% deductible, the homeowner would be responsible for $10,000 of the loss.

It is important to note that earthquake insurance policies have many exclusions and limits. For example, they typically do not cover damage to external structures such as fences or landscaping, personal property located outside the dwelling, trailers, animals, or decorative items. Additionally, there may be waiting periods of up to 60 days after an earthquake before a new policy can be purchased to account for possible aftershocks.

When considering earthquake insurance, it is essential to review the policy carefully to understand what is and is not covered. The coverage amount should also be carefully determined by considering how much of the repair and replacement costs can be paid out-of-pocket. While earthquake insurance can be pricey, it is worth considering for residents in earthquake-prone areas to protect their property.

Maximizing Coverage, Minimizing Cost: The Benefits of Extended Term Life Insurance Plans

You may want to see also

Frequently asked questions

Yes, it is recommended that Oklahomans consider purchasing earthquake insurance to protect their property. Earthquake damage is not covered under a typical homeowner's or renter's policy.

Earthquake insurance can be purchased as an endorsement added to an existing home insurance policy or as a separate stand-alone policy.

Earthquake insurance covers repairs to a home and personal property damaged by an earthquake. It may also cover increased costs to meet current building codes, costs to stabilize the land, and debris removal.

Earthquake insurance typically costs between \$50 and \$300 per year for an Oklahoma homeowner. The cost depends on factors such as the size, location, and age of the home, as well as the construction type and the cost to rebuild.

The deductible for earthquake insurance is usually a percentage of the insured property's value, typically ranging from 5 to 10 percent. This can result in high out-of-pocket costs for the policyholder.