Life insurance is meant to help your family avoid financial hardship if you die. However, you may want to cancel your life insurance policy due to financial hardship or because you no longer need it. But will you get your money back if you cancel?

The answer depends on the type of life insurance policy you have and when you cancel it. If you have term life insurance, you won't get a payout if you cancel your policy. Term life insurance does not accumulate any cash value, so there is no refund if you cancel your policy or if you outlive your term.

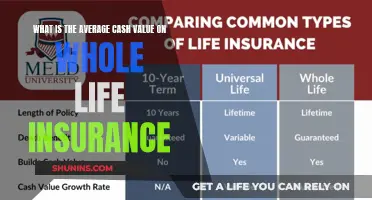

On the other hand, permanent life insurance policies, such as whole life insurance, do accumulate a cash value over time. If you cancel this type of policy, you may be entitled to a cash payout based on the cash surrender value. However, this payout may be reduced by surrender charges and taxes.

Additionally, if you cancel your policy during the free look or cooling-off period, which is typically 10 to 30 days after purchasing the policy, you may be able to get a full refund of any premiums paid.

| Characteristics | Values |

|---|---|

| Can you get your money back if you cancel life insurance? | It depends on the type of policy and when you cancel it. |

| Cancelling a term life insurance policy | No cash value is accumulated, so there is no payout when cancelling. |

| Cancelling a permanent life insurance policy | You may receive a cash payout, but surrender fees could reduce the amount. |

| Cancelling during the cooling-off or grace period | You will get a refund of the premiums paid so far. |

What You'll Learn

Cancelling term life insurance

Stop Premium Payments

The simplest way to cancel your term life insurance is to stop making premium payments. Contact your insurance company to end any automatic payments you have set up. Once you stop paying premiums, your policy will lapse, and your coverage will end.

Contact Your Insurance Provider

You can also choose to contact your insurance provider directly and inform them of your decision to cancel. You can do this by calling them or sending a written notice of cancellation. This option provides more peace of mind and ensures the policy is properly cancelled.

Understand the Implications

It is important to understand that cancelling your term life insurance means you will not receive any payout. If you cancel in the middle of a payment cycle, you may be eligible for a small refund for the unused portion of your premium. Additionally, if you decide to purchase life insurance again in the future, your rates will likely be higher due to age or changing health conditions.

Explore Other Options

Before cancelling your term life insurance, consider exploring alternative options. If you are thinking of cancelling due to affordability, you may be able to reduce the policy's face amount, which can lower your premium payments while still providing some level of coverage. You can also check with your insurance agent to discuss other cost-cutting measures or explore alternative policies that better suit your needs.

Life Insurance: Completing the Process and Securing Peace of Mind

You may want to see also

Cancelling permanent life insurance

Surrender or cash out your policy

Whole life policies have a cash value component. If you withdraw it during your policy’s surrender period, which is a few years after your policy’s inception, you may have to pay steep surrender fees or not receive any cash value. If you take out your cash value after your surrender period, you will likely still have to pay a surrender fee, but you will receive some of your funds. Your policy will be terminated once you take out your cash value.

Sell your insurance policy

An insurance policy is an asset, so you can sell it off like other assets. If the life insurance policy cancellation rules are too complex and you want a straightforward solution, you can sell it or undergo a tax-free exchange. Do some research and contact a reputable broker. Once you sell your policy, the third party will receive the death benefit upon your passing. While selling is straightforward, a tax-free exchange or 1035 exchange lets you trade your life insurance for another product of similar value without any tax implications.

Choose a reduced paid-up option

Some insurers allow you to stop payments and keep the policy in exchange for a lower death benefit. However, this will depend on the premiums you’ve paid. Contact your insurer to ask if they offer this option.

The exact process and what you can receive depend on your insurer's policies and the life insurance policy cancellation rules they adhere to.

Group Life Insurance: Covering Your Immediate Family?

You may want to see also

Getting a refund during the cooling-off period

The cooling-off or grace period is a risk-free period during which you can cancel your life insurance policy without any financial penalty. This period typically lasts 10 to 30 days from when you receive the policy, but it can vary by state and insurer. During this time, you have the right to a full refund of any premiums paid.

To cancel your policy during the cooling-off period, contact your insurance agent or insurer directly and inform them of your decision. They will guide you through the necessary steps to cancel the policy. This usually involves a phone call or written notification.

It is important to note that the cooling-off period is a limited window of opportunity. If you change your mind about the policy after this period ends, you may not be entitled to a full refund.

In addition to the cooling-off period, there are other instances where you may be eligible for a refund when cancelling your life insurance policy. For example, if you have paid premiums in advance and then cancel your policy, the insurance company should refund any early pre-payments.

You also have the option to purchase a return-of-premium rider, which ensures that all your premiums are refunded if you outlive your term policy. However, this option usually comes with higher monthly premiums.

While it is your right to cancel your life insurance policy at any time, it is important to carefully consider your options. Cancelling your policy means forfeiting your death benefit and losing life insurance protection for yourself and your loved ones.

Life Insurance: Passing Outside of the Estate?

You may want to see also

Surrender charges

In the case of mutual funds, short-term surrender charges can be applied if a buyer sells the investment within 30, 60, or 90 days. These charges are designed to discourage people from using an investment as a short-term trade.

Under the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, surrender charges do not apply to annuities held in employer-sponsored 401(k) plans. This means that if you leave your job or retire, you can transfer your annuity to another employer-sponsored plan or an IRA without having to liquidate the annuity and pay surrender charges or fees.

It is generally recommended to avoid investments with surrender charges due to the unpredictable nature of life circumstances. However, there are exceptions for good annuities and life insurance policies, depending on an individual's circumstances.

Life Coaching: What's Covered Under Sutter Health Insurance?

You may want to see also

Cancelling due to financial changes

Cancelling life insurance due to financial changes is a common reason for ending a policy. If you can no longer afford the premiums, it may be your only option. However, there are a few things to consider before cancelling your policy.

First, review your budget and cut down on any non-essential spending. You may also want to evaluate your insurance portfolio to see if you are overpaying for insurance in other areas, such as your home or auto policy, which could be causing financial strain. If you are still unable to afford the premiums, contact your broker or insurer to discuss alternative options. They may be able to suggest some cost-cutting measures, such as reducing your level of cover.

If you have a term life insurance policy, you can simply stop paying the premiums and allow the policy to lapse. However, if you cancel a permanent life insurance policy, you may be able to receive a cash payout from the cash value that has accumulated over time. This is known as "surrendering" the policy. However, this payout will likely be reduced by surrender charges and taxes.

It's important to note that cancelling your life insurance policy will result in a loss of coverage for your loved ones, and they will not receive a death benefit if you pass away. There are alternative options to consider before cancelling your policy, such as lowering your coverage amount or using the cash value of a permanent policy to cover your premiums.

Life Insurance for the President: Who Pays the Premium?

You may want to see also

Frequently asked questions

Yes, you can cancel your life insurance policy at any time. However, you will lose life insurance protection, and your beneficiaries will not receive a death benefit if you pass away.

You will not get a refund if you cancel your life insurance policy, except in the case of term life insurance policies with a return of premium rider. With this rider, you can get a refund of a portion or all of your paid premium if you outlive your term policy.

No, you shouldn't have to pay any fees or charges for cancelling your life insurance policy. However, if you have a permanent life insurance policy, you may be subject to surrender charges and taxes on the withdrawn amount.