Do you have to carry insurance papers with you? The answer depends on where you live and the type of insurance you have. In most U.S. states, drivers are required by law to have auto insurance and carry proof of insurance in their vehicles. However, some states, like New Hampshire, do not have this requirement. While insurance companies typically provide physical insurance cards, many now also offer digital alternatives, such as mobile apps or online accounts, that allow drivers to access their insurance information electronically. In all states except New Mexico, law enforcement officers are required to accept digital proof of insurance. Nevertheless, it is recommended to keep a physical copy of your insurance card in your vehicle as a backup in case your phone is damaged, lost, or out of battery.

| Characteristics | Values |

|---|---|

| Required by law enforcement | Yes |

| Required in case of an accident | Yes |

| Required when registering a newly purchased vehicle | Yes |

| Required when renewing a license plate | Yes |

| Required when financing a vehicle | Yes |

| Accepted formats | Physical card, digital card, printout |

| Digital card accepted by law enforcement | Yes, except in New Mexico |

| Information included | Insurance policy number, effective dates of the policy, VIN, some coverage details |

What You'll Learn

Do you need to carry proof of insurance in your car?

In most of the United States, drivers are required to have automobile liability insurance to drive a vehicle legally. Most states also require drivers to carry proof of insurance. This proof can be in the form of an insurance ID card or other documents from your insurance company. It is a good idea to keep this in your glove compartment.

The only state that doesn't require drivers to buy auto insurance is New Hampshire, although it is recommended. In Massachusetts, your insurance information is included on your vehicle's registration documentation.

If you are pulled over by the police, they can ask to see your proof of insurance along with your license and registration. You will also need it if you are in an accident. Driving without proof of insurance puts you at risk of tickets and fines.

In most states, proof of insurance is also available in electronic form. So if you are stopped by the police, you can show them a digital insurance card on your smartphone. However, New Mexico does not recognise digital proof of insurance.

If you lose your insurance card, you can download the insurance company's app, access your account online, or contact your agent and ask them to send you an updated copy.

Uber Drivers: Insured to Carry Passengers?

You may want to see also

What happens if you don't have proof of insurance?

Failing to provide proof of insurance is a serious offense and is not the same as driving without insurance. These are two separate offenses, with failure to show proof of auto insurance being less severe. If you are pulled over by the police or in an accident, you may need to show proof of insurance. This is to ensure that you have the ability to pay if you cause property damage or injuries in a car accident.

If you are stopped by the police and don't have proof of insurance with you, the officer can write you a ticket. Depending on the state, you could be subject to fines and other penalties. For example, in California, the fine is between $100 and $200, while in Massachusetts, it can be up to $5000. If you are in an accident without insurance, you can face even more severe financial consequences, as you will be responsible for the damage and medical bills for the other driver.

In some states, the law permits dismissal if you provide the court with proof of valid insurance for the citation date. You may only have to pay administrative fees, which can be as low as $25 in California. However, in other states, it is up to the court's discretion to dismiss the charge or find you guilty and fine you.

Failing to have proof of insurance can also affect your driving record and insurance rates. While it typically doesn't go on your driving record, some states may place it there, which can cause your insurance rates to increase. Additionally, you may lose your safe driver discount from certain insurers.

It is important to note that driving without insurance is a more severe offense than failing to provide proof of insurance. Driving without insurance can result in hefty fines, license and registration suspension, and even jail time. Therefore, it is always best to keep your proof of insurance with you when driving to avoid any legal consequences.

Land Insurance: Is It Necessary?

You may want to see also

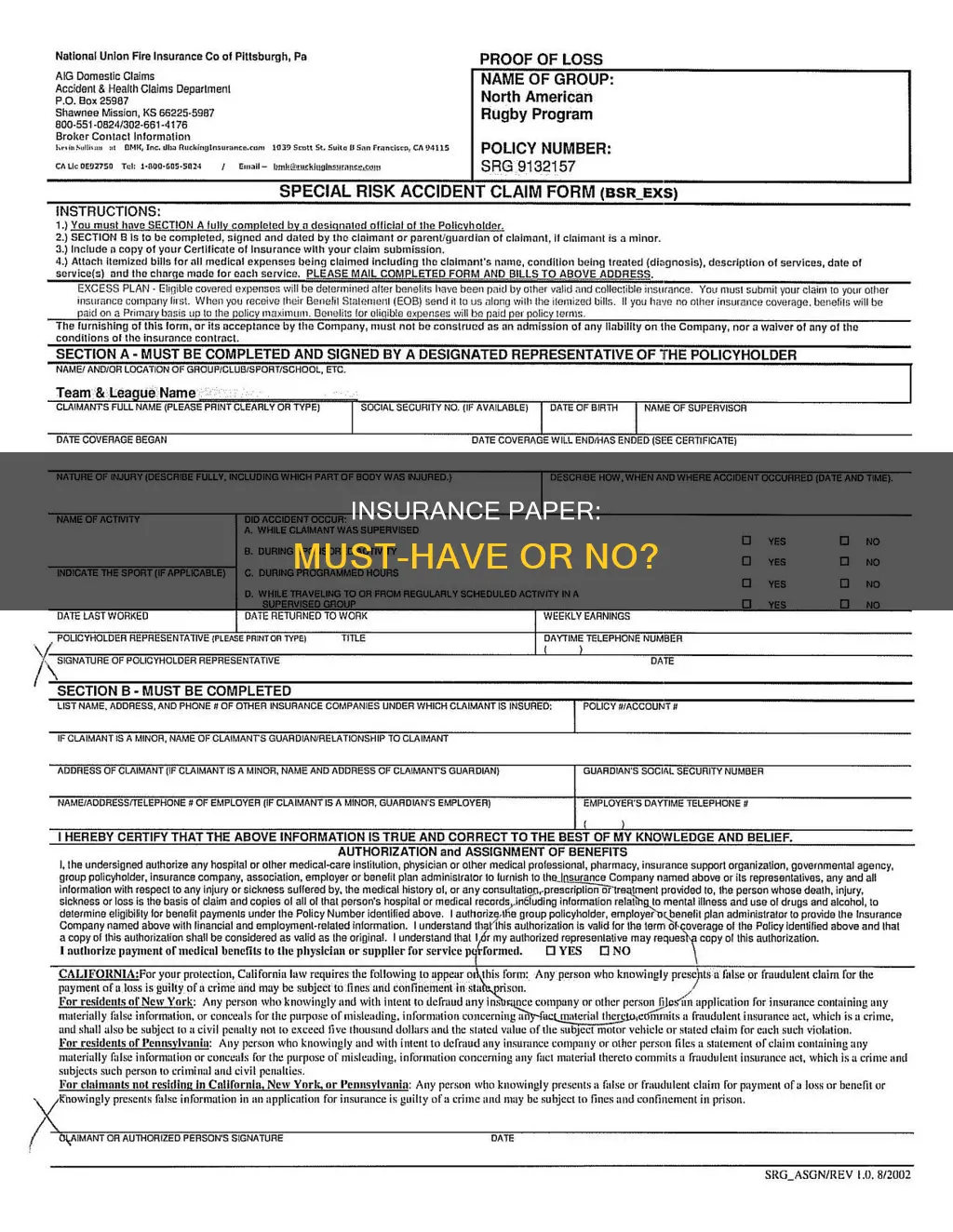

What information does an insurance card contain?

An insurance card is a document issued by your insurance company that provides proof of active coverage. The information on an insurance card may vary depending on the insurance company and type of plan chosen. However, most insurance cards include the following:

Personal Information

This includes the name of the person covered under the insurance plan. If you are covered under your spouse's or parent's plan, the card may include their name, too. The card will also have a member or policy number, which is a unique code associated with your insurance plan. This number is used by insurance providers to quickly identify the person and their insurance plan benefits.

Insurance Company Name

The name of the insurance company and plan type are usually found in the top header of the card.

Group Number

The group number identifies the group you are part of in your insurance plan. It helps to identify your benefits within that specific plan. This is especially relevant if you have insurance coverage through an employer.

Effective Date

The effective date shows when your insurance coverage begins. This information may not always be listed on your insurance card, but you can obtain it from your insurance provider if needed.

Coverage Amounts and Copays

The coverage amount refers to how much of your costs your insurance company will cover. This information may be listed as a fixed dollar amount or a percentage and can usually be found on the front of your insurance card. Copays, or copayments, refer to the fixed dollar amount you are required to pay out-of-pocket for certain types of care or treatments.

In-Network and Out-of-Network Coverage

Your insurance card may list different coverage percentages for in-network and out-of-network providers. In-network providers have a contractual agreement with your insurance company to provide lower-cost services. Out-of-network providers do not have this agreement, so you will likely pay more for their services.

Prescription Coverage

Depending on your insurance policy, your provider may cover some or all prescription medication costs. This information may be indicated by an Rx category on your insurance card, along with the dollar amount or percentage covered.

Insurance Provider Contact Information

The back of your insurance card typically includes contact information for your insurance provider. This information is useful if you need to inquire about benefits, find an in-network provider, or clarify any other questions regarding your insurance coverage.

DJ Insurance: Wedding Worry or Essential?

You may want to see also

What are the benefits of having a physical copy of your insurance card?

While digital insurance cards are becoming more common, there are several benefits to having a physical copy of your insurance card.

Firstly, it is important to note that nearly every state requires car insurance, and not having a card or other proof of coverage can be costly. While most states allow you to use electronic forms of proof of insurance, there are a few exceptions. For example, in New Mexico, law enforcement officers are not required to accept electronic proof of insurance, and drivers in other states have reported instances where repair shops only accepted physical copies for inspections. Therefore, it is always good to have a physical card as a backup.

Additionally, having a physical copy of your insurance card can save you time and hassle. While many modern practice management systems are designed to read digital copies instantly, there may be instances where staff need to hold on to your card or scan a physical copy. This can be especially important in emergency situations, such as being taken to the ER in an ambulance, where doctors will check for your insurance card. If they do not find it, you may have to deal with the bills yourself and retroactively sort out the coverage with your insurance company, which can be a lot of work.

Furthermore, having a physical card can help protect your personal belongings. For example, if you are asked to show proof of insurance to a law enforcement officer, handing over your phone may cause anxiety, as there is a risk of it being damaged or stolen.

Lastly, a physical insurance card does not rely on technology and can be easily accessed and shared with others, such as police officers or car rental companies, without the need for an internet connection or a charged phone.

While digital insurance cards are convenient and widely accepted, having a physical copy can provide peace of mind and ensure that you are prepared for various situations.

Doctors: Insured or Not?

You may want to see also

What are the benefits of having a digital copy of your insurance card?

Having a digital copy of your insurance card on your phone or device offers several benefits. Firstly, it provides easy access to your insurance information. With just a few clicks, you can access all your policy details, including coverage, premiums, and renewal dates, without having to search through piles of papers. This is especially useful when you need to provide proof of insurance to someone, such as a police officer or a car rental company.

Secondly, a digital copy can save physical storage space. Physical documents can take up space and be challenging to organise and store, especially for those living in small apartments or with limited storage space. With digital documents, you no longer need to worry about finding a place to keep your insurance papers.

Additionally, digital copies are environmentally friendly. By opting for digital copies, you reduce paper waste and contribute to a greener planet. This small step towards paperless documentation can lead to a more sustainable future.

Furthermore, digital copies eliminate the risk of losing or damaging your insurance card. Physical documents can be easily misplaced or damaged, which can be highly inconvenient, especially when you need to access your insurance information urgently. With a digital copy, you can rest assured that your insurance information is safe and easily retrievable.

In terms of convenience, having a digital copy allows you to purchase or renew your insurance policy from the comfort of your home. This is particularly beneficial for individuals with busy schedules who find it challenging to set aside time for such tasks.

Lastly, many insurance companies now offer digital policy options, making it inevitable that the future of insurance documentation is paperless. While it is always a good idea to keep a physical copy as a backup, the widespread acceptance of digital documents by authorities indicates that going digital is a practical and advantageous choice.

Trucking Insurance: Who Pays When Trucks Crash?

You may want to see also

Frequently asked questions

No, it is not necessary to carry a physical copy of your car insurance. In most states, you can show proof of insurance on your phone through an app or website. However, it is a good idea to have a physical copy as a backup in case your phone is damaged, lost, or out of battery.

Yes, in most states, you will need proof of insurance to register a car.

If you are insured but cannot show proof of insurance, follow the instructions provided by the police officer. You will typically need to prove that you are covered within a certain timeframe to avoid penalties such as fines or license suspension.

A car insurance card includes the insurance policy number, effective dates of the policy, vehicle identification number (VIN), and some coverage details. It also includes the name of the insurance company and the insured driver, as well as the state in which the insurance is held and vehicle information.

If you lose your car insurance card, contact your insurance company to request a replacement. They may email you a temporary card to print out or send you a permanent card through the mail.