Life insurance is meant to help your family avoid financial hardship in the event of your death. However, you may want to cancel your life insurance policy for a number of reasons, such as no longer needing coverage, changing your investment strategy, or not being able to afford the premiums. While you can cancel your life insurance policy at any time, the process and outcomes vary depending on the type of policy and when you cancel it. For example, term life insurance policies can be cancelled by simply stopping premium payments, while permanent life insurance policies may involve cashing out the policy's accumulated cash value, which could be subject to surrender charges and taxes. It's important to carefully consider the consequences of cancelling life insurance and explore alternative options, such as reducing coverage or switching to a different policy, to ensure you and your loved ones remain protected.

| Characteristics | Values |

|---|---|

| How to cancel | Contact your life insurance company with a written notice, stop paying premiums, wait until the term ends, or sell your policy |

| Timing | Cancel during the "free look" period (10-30 days) for a full refund |

| Policy type | Term life insurance: stop payment or cancel anytime; Permanent life insurance: surrender policy for cash value, perform a tax-free exchange, or take a life settlement |

| Reasons for cancelling | Financial changes, policy no longer needed, finding a better-suited policy |

| Considerations before cancelling | Financial impact on dependents, loss of paid premiums, cost of cancellation |

| Alternatives to cancelling | Lower coverage amount, use cash value to cover premiums, retake medical exam, sell policy |

What You'll Learn

Cancelling a life insurance policy: the steps

Cancelling a life insurance policy is a significant decision that can arise due to various reasons. It's important to understand the steps involved in the process, which can vary depending on the type of policy you hold and how long you've had it. Here are the key steps to effectively cancel your life insurance policy:

Understand the Type of Policy You Have:

Recognize whether you have a term life insurance policy or a permanent life insurance policy. Term life insurance provides coverage for a specified term, such as 10, 20, or 30 years, while permanent life insurance is designed to provide lifelong coverage and often includes a cash value component.

Review Your Policy Documents:

Your policy documents will outline the specific steps required to cancel your insurance. Review the underwriting terms and conditions, as these will provide information on the process and any necessary details you need to provide to your insurer.

Contact Your Insurance Company:

Get in touch with your insurance company to inform them of your intention to cancel. You can do this by phone or in writing. They may have specific forms or online options to finalize the cancellation. Stopping your premium payments will also result in policy cancellation, but confirming directly with the insurance carrier ensures a proper understanding of any further obligations.

Consider the Timing:

If you've recently purchased the policy, you're likely within the "free look" period, which typically lasts 10 to 30 days and allows for cancellation without financial penalty and a full refund of premiums paid. Cancelling outside this period might involve more steps, especially with permanent policies, where you'll need to consider the impact on cash value and any surrender charges.

Explore Alternative Options:

Before cancelling, explore alternative options available to you. These may include converting your term policy to a permanent one, reducing the policy's face amount to lower premiums, or using the cash value of a permanent policy to cover premiums.

Understand the Financial Implications:

Cancelling a permanent life insurance policy may result in a payout from the cash value, but this is often reduced by surrender charges and taxes. Weigh the financial consequences before proceeding.

Consult Experts:

Cancelling or changing your life insurance policy can be complex, especially with permanent policies. Consult a financial advisor, accountant, or insurance expert to fully understand the tax implications and ensure you're making the best decision for your situation.

Life Insurance: Covering Parents and Siblings

You may want to see also

Cancelling term life insurance

How to Cancel Term Life Insurance

Term life insurance can be cancelled by simply stopping premium payments. However, it is recommended that you also contact your insurance company directly to confirm the cancellation and ensure there are no outstanding obligations. Most insurers have forms or online options to finalise the cancellation. You can also choose to notify them of your intent to cancel via phone call or mail.

When to Cancel Term Life Insurance

You may want to cancel your term life insurance policy if your financial situation has changed, making the premiums unaffordable, or if you have found a better policy. You may also want to cancel if you have reached a stage in life where the coverage is no longer necessary, for example, if your spouse or partner is financially independent, your children are grown up, or you have paid off your mortgage.

Considerations Before Cancelling Term Life Insurance

Before cancelling, it is important to consider the financial impact on your dependents, as they will no longer receive a death benefit if you pass away. You may also want to review your policy to see if there are any fees or penalties for cancellation. Term life insurance policies do not usually offer a refund, but if you are still within the "free look" period (typically 10-30 days after purchasing the policy), you can cancel without penalty and receive a full refund of any premiums paid.

Alternatives to Cancelling Term Life Insurance

If you are considering cancelling your term life insurance policy, there are a few alternative options to explore:

- Lower your coverage amount: If premiums are becoming difficult to manage, you may be able to reduce the policy's face amount, which can lower your payments while still providing some level of coverage.

- Retake your medical exam: If your health has improved since your last medical exam (for example, if you have quit smoking or lost weight), you may qualify for lower-risk premiums.

- Switch to a different policy: You may be able to find a more affordable policy with a different insurer, or switch to a permanent policy if you decide you need lifelong coverage.

Reasons to Cancel Term Life Insurance

- Financial changes or constraints: If you can no longer afford the premiums, or your financial situation has changed and you need to reallocate your budget.

- Policy is no longer needed: If your major obligations have ended (e.g. paying off your home or finishing your children's education), you may decide that you no longer need the coverage provided by a term policy.

- Dissatisfaction with the policy or provider: If you are unhappy with the service provided by your current insurer, or you find a more competitive rate with another company.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

Cancelling permanent life insurance

Consider the timing:

Before deciding to cancel your permanent life insurance policy, it is important to evaluate the timing. Cancelling a policy during the "free look" period, which typically lasts 10 to 30 days from receiving the policy, allows you to terminate it without any financial penalty and receive a full refund of any premiums paid. Cancelling after this period may involve more steps and potential financial implications.

Evaluate your reasons:

It is important to carefully consider your reasons for cancelling your permanent life insurance policy. Some common reasons for cancellation include no longer needing coverage, unaffordable premiums, fully paying off debts, or changing your investment strategy. Weigh the pros and cons of cancellation based on your specific circumstances.

Understand the financial implications:

When you cancel a permanent life insurance policy, you may receive a payout from the cash value that has accumulated over time. However, this amount may be reduced by surrender charges, especially if you haven't held the policy for many years. Surrender fees can significantly reduce or even eliminate the cash value you receive, so it is important to understand the potential financial impact before proceeding.

Contact your insurance provider:

Once you have considered the timing, evaluated your reasons, and understood the financial implications, it is time to contact your insurance provider. Inform them of your decision to cancel the policy and inquire about any requirements or forms that need to be completed. They will guide you through the specific steps and provide you with the necessary information.

Fill out the necessary forms:

Your insurance provider will likely require you to fill out a cancellation or surrender form to finalize the process. Provide any supporting documentation that may be necessary. Once you submit the forms, wait to hear back from the insurance company regarding the status of your cancellation request.

Consider alternatives:

Before cancelling your permanent life insurance policy, it is worth exploring alternative options. Some alternatives include reducing your coverage amount, withdrawing or borrowing from your cash value, requesting a new medical exam, or shopping for a new policy with more competitive rates. These alternatives can help you maintain some level of coverage or adjust your premiums to better suit your needs.

Remember that cancelling permanent life insurance is a significant decision that can have financial implications. Carefully consider your reasons, understand the consequences, and explore alternative options before proceeding with the cancellation.

Universal Life Insurance: Lapses and How to Avoid Them

You may want to see also

Surrendering a permanent life insurance policy

Reasons for Surrendering

People may choose to surrender their permanent life insurance policy for various reasons, including:

- Adult children are financially independent: If the policyowner took out the policy to protect their young children, they may find that their adult children no longer need financial support upon the insured's death.

- The spouse of the policyowner has passed away: Typically, the breadwinner of the family takes out a life insurance policy to protect their spouse. If the spouse passes away before the family breadwinner, the policy may be unnecessary.

- Financial constraints: Policyowners may experience decreased financial stability and find it challenging to pay premiums. Surrendering the policy allows them to collect any accrued cash surrender value.

- Better investment opportunities: Some people use their life insurance policy as an investment vehicle. They may find that the returns on the policy's cash value are not as favourable as alternative investments.

- Immediate cash needs: Unexpected expenses, such as healthcare bills, retirement living expenses, or long-term care costs, may arise. Policyowners may choose to surrender their policy to pay for these obligations rather than wait for the death benefit.

Process of Surrendering

The process of surrendering a permanent life insurance policy is relatively straightforward:

- Contact your insurance company: You can usually initiate the surrender process by contacting your insurance company over the phone. They will guide you through the necessary steps and documentation.

- Submit documentation: You will likely need to provide a surrender request form or a similar document to your insurance provider.

- Receive cash surrender value: After processing your request, the insurance provider will send you the cash surrender value via check or electronic transfer.

- Obtain policy termination confirmation: You should receive a confirmation of policy termination from your insurance provider. If they do not provide this, you can request it.

Understanding Cash Surrender Value

It's important to understand the difference between cash surrender value and cash value. Cash surrender value is the amount of money you receive when you surrender your policy, which is the accrued cash value minus any applicable fees, outstanding loans, or interest owed. Cash value, on the other hand, is the total sum in the savings component of permanent policies, which grows tax-deferred and can be accessed through loans or withdrawals.

Consequences of Surrendering

There are several consequences to consider before surrendering your permanent life insurance policy:

- Loss of coverage: Once you surrender your policy, your life insurance coverage ends, and your beneficiaries will not receive the death benefit upon your death.

- Financial loss: The cash surrender value may be lower than the total premiums paid, resulting in a financial loss. Additionally, you may be responsible for paying surrender fees and taxes on the surrendered amount.

- Tax implications: Surrendering your policy could result in a tax bill, especially if you have an outstanding loan from the policy. Consult a tax professional to understand the potential tax consequences.

Alternatives to Surrendering

Before surrendering your policy, consider the following alternatives:

- Sell your policy: You can sell your policy through a life settlement or a viatical settlement, depending on your health and financial needs. A life settlement is typically for those over 65 who no longer need or can afford the policy, while a viatical settlement is for those with a terminal illness.

- Use the cash value to pay premiums: If you have a permanent policy, you may be able to use the accumulated cash value to cover your premium payments. However, this could reduce the death benefit and potentially cause the policy to lapse if the cash value is depleted.

- Explore other options: Consult a financial advisor or insurance expert to discuss other options, such as reducing the coverage amount or switching to a different policy.

Hartford Supplemental Life Insurance: What You Need to Know

You may want to see also

Cancelling life insurance: the reasons

Cancelling life insurance is a significant decision that can arise for various reasons. Here are some common reasons why one might want to cancel their life insurance policy:

- Financial constraints or changes: If you can't afford the premiums, cancelling your life insurance policy may be your only option. Financial hardship is a valid reason to let a policy lapse. Before cancelling, consider cutting down on non-essential spending or evaluating your insurance portfolio to see if you are overpaying in certain areas.

- The policy no longer meets your needs: Your goals and financial situation may have shifted since purchasing your policy. For example, you may have initially bought a policy to replace lost income as the primary earner, but your family may no longer be dependent on your income. Alternatively, you may have taken out a policy to pay off a mortgage, but you've managed to pay it off earlier than expected.

- Dissatisfaction with the policy or provider: Some providers may have poor customer service or charge premiums that are higher than what you can get elsewhere. Life insurance is a competitive market, so it's worth shopping around for a better provider if you're unhappy.

- Changing your investment strategy: You may realize that the investment options of your permanent life policy are not as good as other financial vehicles for long-term savings. A financial advisor can help you determine if alternative investments, such as annuities or mutual funds, would be a better fit for your goals.

- Switching policies or insurance companies: You may have found a new policy that better suits your needs. In this case, it's important not to cancel your existing policy until the new one is fully in force to avoid gaps in protection.

- You no longer need coverage: If your family is grown and financially independent, life insurance may no longer be necessary. This could be the case if your spouse or partner can manage financially on their own, or if your children are adults and no longer dependent on you.

It's important to carefully consider the reasons for cancelling your life insurance policy and explore alternative options before making a final decision. Cancelling your policy will leave your loved ones unprotected and may result in financial losses, especially if you need to take out a new policy in the future.

Life Insurance: Can Weight Impact Your Application?

You may want to see also

Frequently asked questions

It is best to call your insurer to verify the address you should mail your cancellation notice to.

Only the policyholder, who is the person that owns the policy, can cancel it.

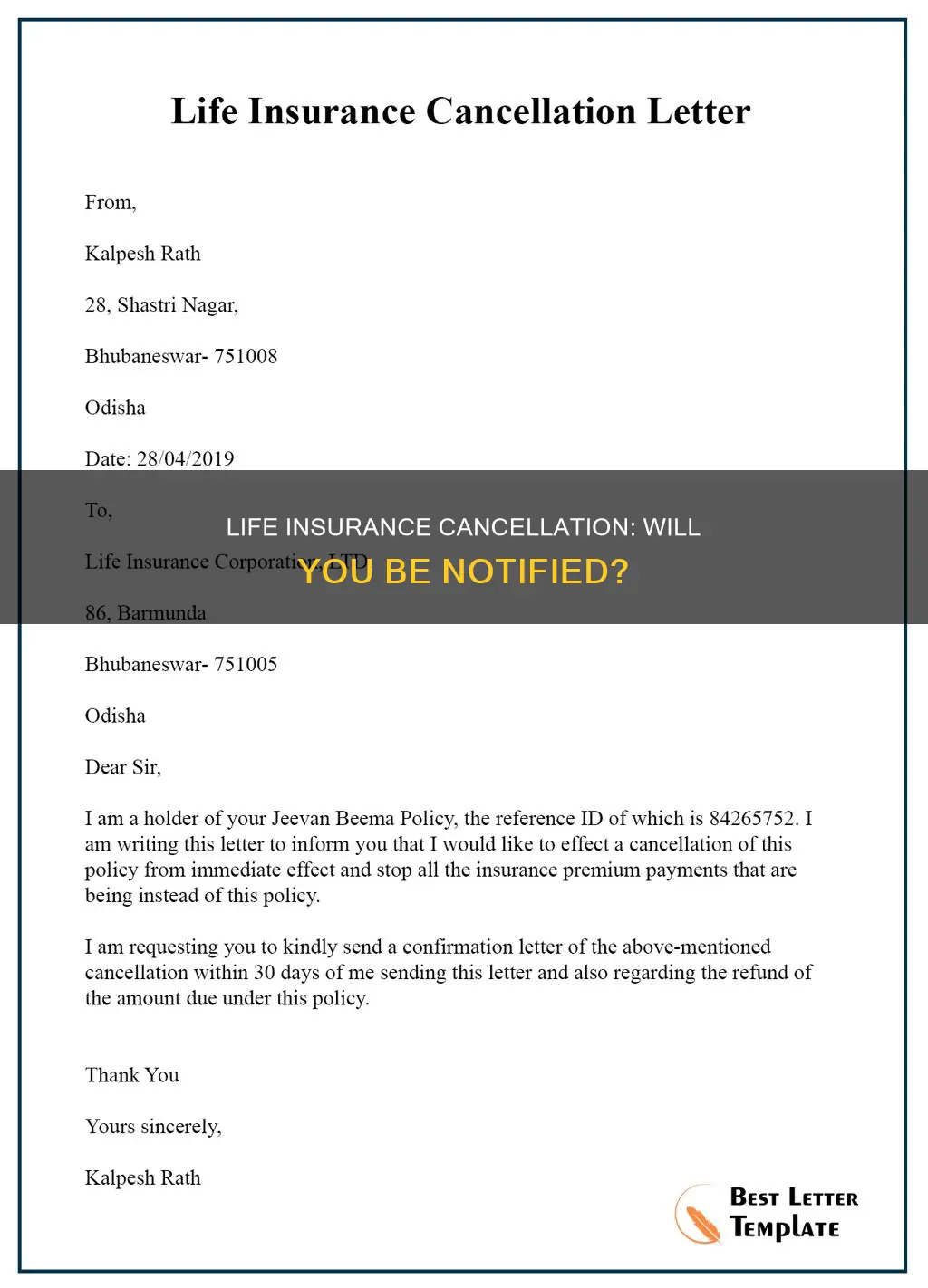

Cancelling a life insurance policy must be done in writing, as policies are contracts. You can send a letter to your insurer, providing written notice of cancellation. Alternatively, you can simply stop paying your premiums, which will result in your policy lapsing.

In most cases, there are no fees or penalties for cancelling a term life policy. However, if you cancel a whole life policy, you may have to pay a surrender fee.

In general, you will not get a refund if you cancel your life insurance policy. However, if you cancel during the "free look" period, which typically lasts 10-30 days, you can get a full refund of any premiums paid.