Making a claim against your auto insurance can result in an increase in your rates, depending on the type of claim and the amount claimed, among other factors. The more claims you file, the more likely your rates will increase, as insurance companies view you as a high-risk customer. Accidents that you cause will lead to the most significant rise in premiums, especially if damages exceed a certain amount. Even if you are not at fault, your rates may still increase, although not as much. The impact of a claim on your rates can last for three to five years.

| Characteristics | Values |

|---|---|

| Number of claims filed | The greater the number of claims filed, the greater the likelihood of a rate hike. |

| Type of claim | Bodily injury, property damage, and accidents caused by the policyholder are the most significant factors affecting how much rates go up. |

| Amount of claim | The higher the amount of the claim, the higher the rate increase. |

| Insurance company | Some insurance companies charge more than others after not-at-fault accidents. |

| Driving record | A policyholder with a bad driving record could be more affected financially than someone with a good driving record. |

| Location | The state in which the policyholder lives can affect insurance rates. |

| Vehicle | Newer cars with more advanced technology are more expensive to fix, which can impact rates. |

| Policy drivers | Adding a young driver to a policy can increase rates. |

| Time | Rate increases generally stay on a policy for three to five years following a claim. |

What You'll Learn

Comprehensive claims

Comprehensive insurance is an optional addition to most car insurance policies. It covers damage caused by events other than collisions, such as vandalism, car theft, inclement weather, or hitting an animal. Comprehensive claims are less expensive than collision or liability insurance claims.

The Zebra found that a comprehensive claim increases auto insurance premiums for a standard six-month policy by an average of $36, or $5 per month. The most affordable insurance companies for drivers who have previously filed a comprehensive claim are USAA, GEICO, and State Farm.

According to WalletHub, filing a claim will increase car insurance premiums from 3% to 32% on average for three to five years. The extent of the rate increase depends on factors such as the type and amount of the claim, your insurance company, and the availability of accident forgiveness.

Spouse or Parent's Auto Insurance: Which is Better?

You may want to see also

At-fault accidents

In at-fault states, the insurers of both parties review the details and make a judgment regarding which driver is responsible. This process can be straightforward or complicated, depending on the details of the accident. To determine who is at fault, claims adjusters usually talk to witnesses, look at police reports, and review the accounts of the accident from the parties involved. Photos of vehicle or property damage can also be used, as well as a specific state's traffic laws.

If the situation is clear-cut, or one party admits fault, the at-fault driver's auto insurance should pay for any property damage and medical bills, and in some cases, compensation for other damages, such as pain and suffering. However, often it's not clear who or what initiated the accident, and a claims adjuster will need to investigate further.

If you are responsible for an accident, your insurance rate will almost always go up unless your insurer offers accident forgiveness. For example, Progressive's Large Accident Forgiveness means your rate won't increase in most states if you're at fault in an accident with a claim exceeding $500.

In some cases, both sides may be deemed at fault, and the state's negligence law will determine the amount of damages awarded to each party for injury or property liability claims.

Auto Insurance: Protecting Your Assets

You may want to see also

No-fault accidents

However, there are situations where a no-fault accident can lead to increased insurance rates. For instance, if you've previously caused an accident or made a claim, your auto insurance rates may increase after a no-fault collision. According to the Consumer Federation of America, drivers who have been involved in no-fault accidents experience an average premium increase of 10%. Additionally, uninsured motorist coverage in your insurance policy can also lead to higher rates in the event of a no-fault accident. This is because your insurance company becomes liable for your injuries or vehicle damage, increasing their cost of doing business, which is usually passed on to customers.

The impact of a no-fault accident on your insurance rates also depends on the state you live in. Some states, like California and Oklahoma, don't allow insurance companies to increase rates after a non-fault claim. On the other hand, some states have no-fault laws that require drivers to file claims with their own insurance companies, regardless of fault. In these states, your rates typically don't increase after a no-fault accident unless you have a history of frequent claims or other risk-increasing factors.

It's worth noting that a no-fault accident will show up on your driving record and can remain there for up to three years. This can influence how insurance providers view you as a driver, potentially impacting your rates or ability to get coverage.

Chevy Gap Insurance: Contact and Claims

You may want to see also

Accident forgiveness

Here's how it works: if you're enrolled in accident forgiveness and you get into an accident, you can file a claim, and your insurance rate won't go up because of that accident. This is especially useful if the accident was your fault, as at-fault accidents typically lead to a significant increase in insurance rates.

There are a couple of ways to get accident forgiveness. Some insurance companies offer it as a free loyalty perk for long-term customers with clean driving records. Other companies allow you to purchase it as an optional add-on to your policy, but this will increase your premium. In either case, you'll usually need to have a clean driving record for a certain number of years to be eligible.

It's important to note that accident forgiveness doesn't mean your rate will never go up. If you get into another accident after your first one, or if there are other factors that affect your rate, you could still see an increase. Additionally, even with accident forgiveness, you may lose any good driver or claim-free discounts you had, which could result in a higher premium.

When considering accident forgiveness, it's essential to weigh the costs and benefits. On the one hand, accident forgiveness can provide peace of mind and protect you from rate increases after your first accident. On the other hand, it may cost you more in the long run, especially if you don't end up causing an accident. It's a good idea to shop around and compare quotes from different insurance companies to find the best option for your needs.

Nevada License, California Insurance: Legal?

You may want to see also

Rate increases

Even if an accident is not your fault, filing an insurance claim can still impact your rate. The more claims you file, the more your insurance will cost. This is because insurance companies view you as a high-risk driver, someone more likely to file claims in the future. The more claims you file, the more likely your insurance company will be to raise your rates, or even cancel your policy.

The most expensive rate hike will be after an at-fault accident, as insurers will see you as a high-risk driver. However, you may still see a rate increase following an accident that wasn't your fault, such as someone hitting your parked car. The only time you wouldn't see an increase is if you had accident forgiveness protection.

Comprehensive insurance covers property damage from events other than collisions, such as vandalism, car theft, inclement weather, or hitting an animal. Insurers can increase your rates following comprehensive claims, although the increase is usually less than for at-fault accidents. Even other people in your area making comprehensive claims can increase your rates, as it implies a greater chance of car theft and vandalism.

The severity of the accident will also impact your rate increase. More severe accidents will result in higher premiums. Similarly, more expensive claims will cause higher rate increases.

Your driving record will also be taken into account. Someone with a bad driving record could be more affected financially than someone with a good driving record.

Your location can also impact your rate increase. For example, in California, the average insurance rate increase after an at-fault accident is more than 70%. In Rhode Island, increases are less than 20%.

The number of claims you file will also impact your rates. File too many claims, especially in a short amount of time, and your insurance company may not renew your policy.

How to Save on Your Policy

If you experience a rate increase after filing a claim, there are ways to lower your auto insurance costs:

- Switch carriers: Shop around and compare quotes from different providers.

- Adjust your coverage: Drop any unnecessary coverage to decrease your rates.

- Raise your deductible: Increasing your deductible will reduce your premiums.

- Check for discounts: Ask your insurance agent about any discounts you may qualify for.

- Improve your credit: In most states, insurance companies give higher rates to drivers with bad credit as they are more likely to file claims.

Occupational Licenses: Can You Get Auto Insurance?

You may want to see also

Frequently asked questions

Yes, filing a claim will increase car insurance premiums from 3% to 32% on average for three to five years. The amount your rate goes up depends on factors like the claim type and amount, your insurance company, your claims history, your location, and whether or not you have accident forgiveness.

The most significant factor is the type and amount of the claim. Accidents that you cause will lead to a higher premium, especially if the damages are over $2,000.

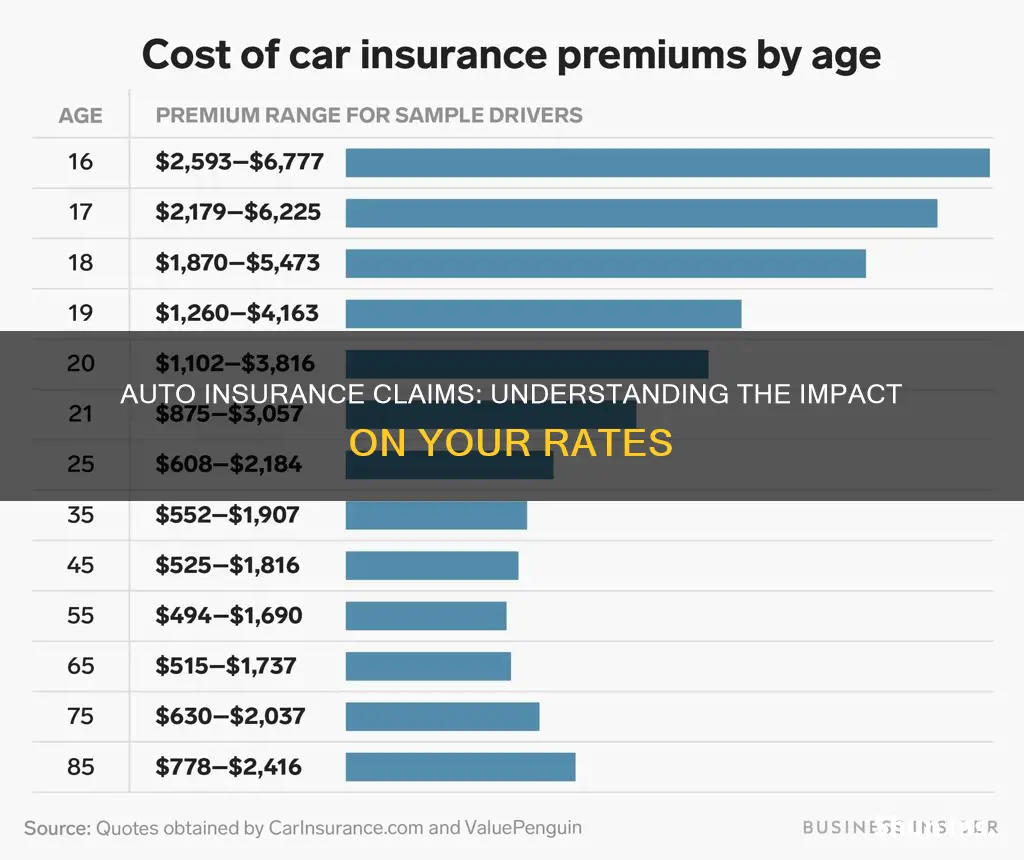

Insurance companies look at your driving record, the age of your car, and the drivers on your policy. Newer cars with newer technology are more expensive to fix, and younger drivers are more expensive to insure due to their lack of experience.

Dog bites, slip-and-fall personal injury claims, water damage, and mold are red flag items for insurers and tend to have a negative impact on your rates.

If you are the only party involved, you can compare the repair costs to your deductible and decide whether or not to file a claim. If another driver is involved, it is recommended to involve insurance to ensure financial accountability.