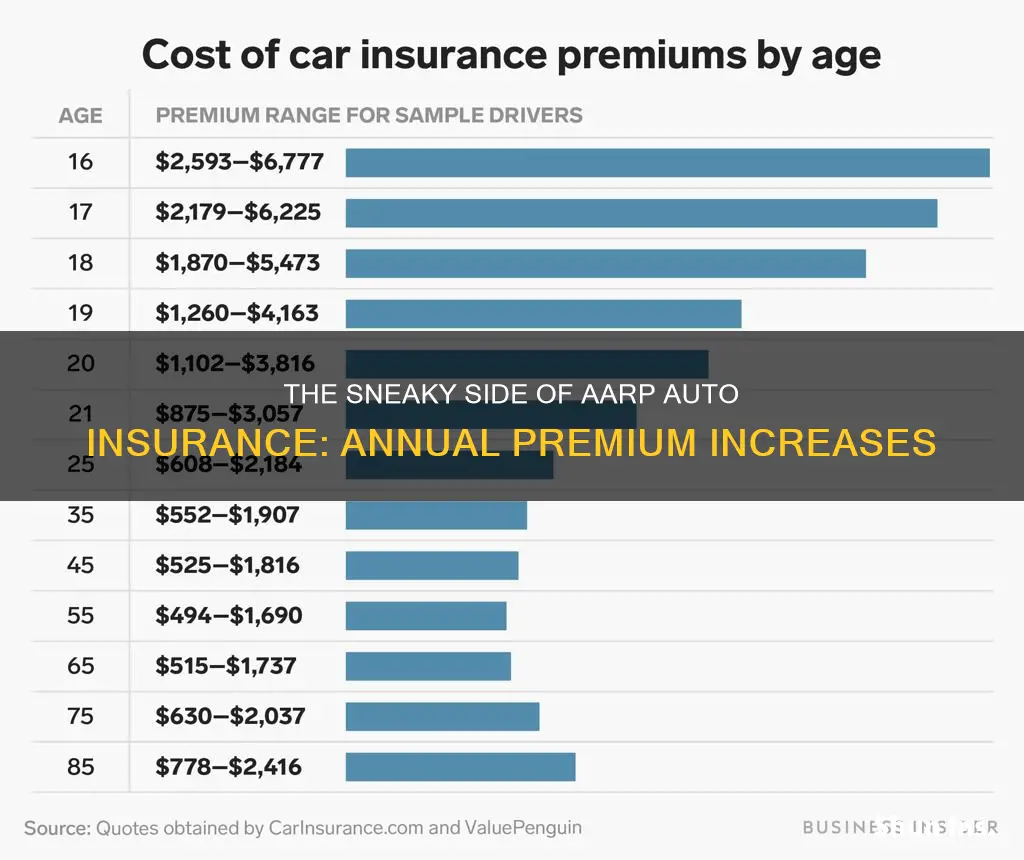

AARP auto insurance is provided by The Hartford Group and is available to AARP members and their families. While AARP auto insurance is generally affordable, with members saving an average of $577 per year, some customers have reported significant annual premium increases of up to 78.5%. However, it's important to note that insurance rates can vary based on age, location, driving record, and other factors. Customers are advised to shop around and compare rates from different providers to find the best coverage for their needs.

| Characteristics | Values |

|---|---|

| Average AARP auto insurance cost | $1,332 per year or $111 per month |

| Average annual cost of full-coverage car insurance | $2,543 in 2024 |

| Average savings from comparing insurance rates | $350-$3,000 |

| AARP membership cost | $12 for the first year |

| AARP membership age requirement | 50+ |

| AARP insurance provider | The Hartford |

| Average insurance cost for 50-year-old drivers with good driving records | $1,878 per year or $157 per month |

What You'll Learn

- AARP auto insurance is $1,332 per year on average

- AARP members can get up to a 20% discount for bundling home and auto coverage

- AARP members can get a discount for completing a driver safety course

- AARP auto insurance is provided by The Hartford

- AARP auto insurance is only available to members aged 50 and over

AARP auto insurance is $1,332 per year on average

The AARP auto insurance policy offers a range of benefits, including a unique coverage option that insures members for up to $2,500 if they are injured in an accident, covering transportation, cooking, cleaning, and other help they might require. The policy also includes accident forgiveness, meaning that the member's premium will not increase after their first accident.

In addition to these benefits, AARP members can also save up to 20% by bundling their homeowners and auto insurance policies with The Hartford Group.

While AARP auto insurance offers a range of benefits and discounts, it is important to note that insurance rates can vary depending on location and individual circumstances. Members may also experience rate increases during policy renewal.

Some AARP members have reported significant increases in their auto insurance premiums, with one member reporting a 28% increase in their policy with The Hartford Group. Other members have also shared their experiences of rate increases, with some switching to alternative insurance providers as a result.

It is always a good idea to shop around and compare rates from different insurance companies to ensure you are getting the best value for your needs.

Florida: Selling Auto Insurance with a 440 License

You may want to see also

AARP members can get up to a 20% discount for bundling home and auto coverage

AARP members can benefit from a range of discounts and perks, including up to a 20% discount when bundling home and auto coverage. This is in addition to the already discounted car insurance offered by The Hartford for AARP members, which is available to those over 50.

The Hartford offers a variety of insurance bundles, including home and auto insurance, renters and auto insurance, and condo and auto insurance. Bundling insurance coverages can help you save time and money, and it can also make it easier to manage your policies. When you bundle home and auto insurance with The Hartford, you can get up to a 5% discount on your auto insurance and up to a 20% discount on your home, condo, or renters insurance.

In addition to the bundling discount, AARP members can also take advantage of other discounts and coverage options offered by The Hartford. For example, AARP members can complete a driving safety course to be eligible for the driver safety program discount. AARP also offers lifetime renewability, meaning that as long as you're an AARP member, your car insurance policy will renew even if you've had accidents or traffic convictions.

The Hartford also provides unique coverage options, such as new car replacement coverage and recovery care coverage. With new car replacement coverage, The Hartford will replace your car with a new vehicle of the same make and model if it's totaled within the first 15 months or 15,000 miles of acquiring it. Recovery care coverage provides up to $2,500 of insurance to cover transportation, cooking, cleaning, and other help you might need after an accident.

By bundling home and auto coverage and taking advantage of the various discounts and coverage options available, AARP members can maximize their savings on insurance premiums.

AAA's Standalone Auto Gap Insurance: Filling the Coverage Gap

You may want to see also

AARP members can get a discount for completing a driver safety course

AARP members can get a discount on their auto insurance premiums by completing a driver safety course. The AARP Smart Driver™ course is available online or in a classroom and can lead to a discount on your auto insurance. The discount may vary depending on the state, age, driving record, and other factors. It is important to check with your insurance agent before taking the course to confirm the exact discount you may be eligible for.

The AARP Smart Driver course is a great way to improve your driving skills and potentially save money on your auto insurance. The course teaches proven driving techniques to help keep you and your loved ones safe on the road. In addition to the potential insurance discount, safer driving can also lead to lower insurance rates over time as you maintain a clean driving record.

Completing a driver safety course is just one way to keep your auto insurance rates low. Other factors that can affect your insurance rates include your vehicle options, driving habits, and age. Maintaining a clean driving record, driving a car with safety features, and taking advantage of discounts offered by your insurance company can also help keep your rates down.

In addition to the AARP Smart Driver course, AARP offers a variety of other benefits to its members, including discounts on hotels, dental insurance plans, and access to exclusive products and services. AARP membership also includes a subscription to AARP The Magazine and a free second membership for another household member.

Auto Insurance Agents: Can They Ask for Your License?

You may want to see also

AARP auto insurance is provided by The Hartford

The Hartford offers customizable auto insurance coverage to AARP members, including:

- New car replacement

- RecoverCare

- Lifetime car repair assurance

- Accident forgiveness

- Disappearing deductible

- 24/7 car insurance claims hotline

AARP members can also take advantage of various discounts offered by The Hartford, such as:

- Up to 10% savings on car insurance for being an AARP member

- Up to 20% discount for bundling home and auto insurance

- Discounts for paying the premium in full

- Safe driver discounts for completing an approved defensive driving course

- Discounts for installing safety features

- Discounts for having a good credit score

The Hartford also provides insurance for other types of vehicles, including classic cars, RVs, snowmobiles, and golf carts.

The average cost of AARP auto insurance through The Hartford is $1,332 per year, or about $111 per month. However, rates may vary depending on various factors such as location, coverage history, driving record, and vehicle type.

While The Hartford has received positive reviews for its customer service and claims handling, there have also been complaints about significant increases in insurance premiums, even for customers with clean driving records and no claims.

Auto Insurance Claims: Check Delivery

You may want to see also

AARP auto insurance is only available to members aged 50 and over

AARP auto insurance is provided by The Hartford and is only available to members aged 50 and over. The average cost of AARP auto insurance is $1,332 per 12-month policy, or approximately $111 per month. Members can also bundle their homeowners and auto insurance policies with AARP, via The Hartford, to earn discounts of up to 20%.

The AARP Auto Insurance Program from The Hartford offers a range of benefits and coverage options for eligible members. These include:

- Accident Forgiveness: Your first accident won't increase your premium.

- Disappearing Deductible: Your deductible will decrease every year you don't have a collision.

- TrueLane: The Hartford's telematics program, which offers a 5% discount upon signing up and allows you to lower your premium by exhibiting safe driving habits.

- Towing and roadside assistance: AARP offers two roadside assistance programs through insurance companies.

In addition to the above, AARP members can also take advantage of unique insurance options and senior driving discounts through The Hartford.

Dropping PIP Auto Insurance in Florida

You may want to see also

Frequently asked questions

Yes, AARP members are given exclusive access to auto insurance policies through The Hartford.

The average cost of AARP auto insurance is $1,332 per year or $111 per month.

Yes, AARP offers a number of auto insurance discounts to its members, including a discount of up to 10% for being an AARP member, a bundle discount of up to 20% for combining home and auto coverage, and a paid-in-full discount for paying the bill annually.

Most car insurance policies are reviewed and re-rated every six months, with prices typically increasing at renewal. AARP offers 12-month rate protection, which means prices are reviewed annually and are less likely to increase.

AARP auto insurance is generally more expensive than the national average. It is recommended to shop around and compare rates from multiple providers to find the best coverage and price.