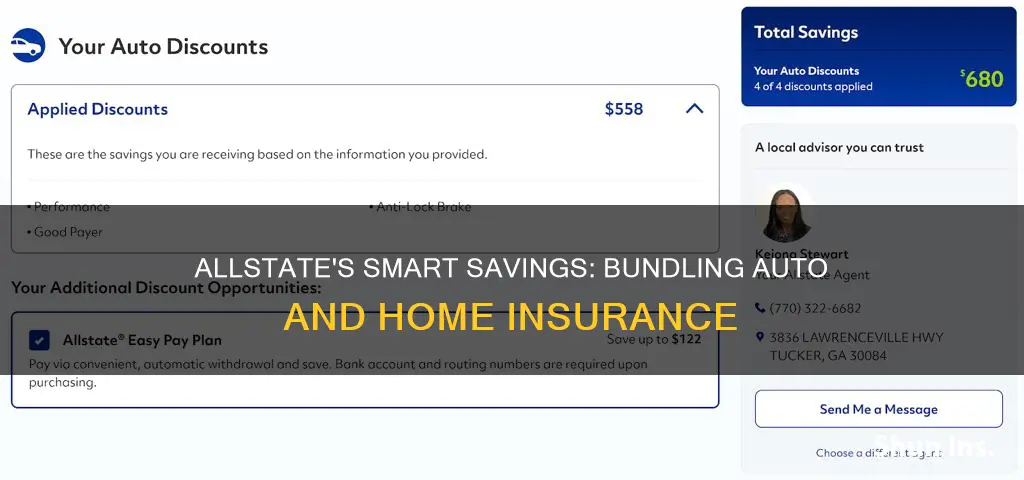

Allstate offers a range of discounts for auto insurance, including for safe driving, having anti-lock brakes, anti-theft devices, and early signing. One of the most significant discounts Allstate offers is for customers who bundle their auto insurance with a home, life, or renters policy. This multi-policy discount can provide notable savings for those who utilise it. In addition to these, Allstate also provides other ways to save money, such as through their pay-per-mile program, Allstate Milewise, which offers low-mileage drivers substantial annual savings.

| Characteristics | Values |

|---|---|

| Number of car insurance discounts | 12 |

| Discount categories | Driving history, car safety, loyalty, and payment |

| Discount eligibility | Almost anyone who buys an Allstate car insurance policy |

| Notable discounts | Safe driving club, Multi-policy discount, New car discount, Anti-lock brakes discount, Anti-theft device discount, EZ pay plan discount, FullPay discount, Smart student discount |

| Discount amounts | Not disclosed publicly |

What You'll Learn

Allstate offers 12 car insurance discounts

Almost anyone who buys an Allstate car insurance policy will be eligible for some kind of discount. Safe drivers and people who consistently pay their entire Allstate bill on time are especially likely to benefit from substantial savings.

- Allstate eSmart discount: Save by going paperless and receiving all your documents online.

- Anti-lock brakes discount: Save if your car has anti-lock brakes.

- Anti-theft device discount: Save if your car has an anti-theft device.

- Early signing discount: Save if you purchase your policy at least a week before its start date.

- EZ pay plan discount: Save when you pay your premium via automatic withdrawal.

- FullPay discount: Save when you pay for your entire policy at once.

- Multi-policy discount: Save when you bundle auto insurance with a home, life, or renters policy.

- New car discount: Save if you are the first owner of a car from this year or last year.

- Passive restraint discount: Save if your car is equipped with a passive restraint system, such as automatic seatbelts.

- Responsible payer discount: Save if you did not receive a cancellation notice due to non-payment during the last 12 months.

- Safe driving club: Earn a safe driving bonus every six months you drive without accidents, plus get $100 off your collision deductible for each year without accidents (up to $500 total).

- Smart student discount: If you're under 25 and unmarried, you can save if you attend school more than 100 miles away from the car, successfully complete the teenSMART program, or maintain a GPA of 2.7 or above.

Vehicle Insurance: Is It Mandatory in Massachusetts?

You may want to see also

Discounts include safe driving, anti-lock brakes, anti-theft devices

Allstate offers a range of discounts for auto insurance, including those for safe driving, anti-lock brakes, and anti-theft devices. These discounts can help customers save money on their insurance premiums and encourage safer driving practices.

The Safe Driving Discount rewards customers for their safe driving habits, offering up to a 45% discount on car insurance. This significant savings opportunity highlights Allstate's commitment to incentivizing and recognizing safe driving behaviours.

The Anti-Lock Brake Discount provides a 10% discount for vehicles equipped with anti-lock brakes. This safety feature helps prevent wheel lock-up and maintains driver control during sudden braking, making it a valuable addition to any car.

Allstate also offers an Anti-Theft Device Discount, which can save customers up to 10% on their insurance. This discount applies to vehicles installed with anti-theft devices, deterring potential thieves and providing added security for your car.

In addition to these discounts, Allstate provides various other ways to save on car insurance. For example, the Passive Restraint Discount offers up to a 30% discount for cars with factory airbags and motorized seat belts, enhancing safety in the event of a collision. The New Car Discount rewards customers who are the first owners of vehicles less than two years old, offering up to a 30% discount.

By offering these comprehensive discounts, Allstate demonstrates its dedication to rewarding customers for their safe driving practices and vehicle safety features. These discounts not only help customers save money but also promote safer driving and vehicle ownership.

Michigan: Auto Insurance and Lawsuits

You may want to see also

Allstate customers can save by going paperless

Allstate customers can indeed save money by going paperless. Enrolling in paperless billing is one of several ways that Allstate customers can save on auto insurance. With inflation and consumer prices on the rise, Allstate has shared a number of tips to help customers keep costs down.

One way to save money is by switching to a usage-based insurance (UBI) plan. For example, with Allstate's Milewise plan, you pay based on the number of miles you drive. This can save low-mileage drivers up to 50% compared to traditional policies. Another way to save is with a telematics-based program like Allstate's Drivewise. This offers savings of up to 40% with combined discounts for maintaining a safe driving record and keeping safe speeds, stops, and driving hours. You can also save 10% just for activating Drivewise in the Allstate mobile app.

Another way to save money is by bundling insurance policies. Many insurers offer significant savings to customers who purchase more than one policy. With Allstate, you can save up to 25% by bundling your auto and home insurance policies.

Finally, you can save money by going paperless. Enrolling in paperless billing and setting up automatic payments can reduce your costs. This is an easy way to save money on your insurance policy without having to change your driving habits or insurance plan. Paperless billing is also a more environmentally-friendly option, reducing waste and saving on resources.

Allstate makes it simple to go paperless with easy paperless enrollment. Customers can access and manage their policy information online and review their coverage to identify potential discounts.

Uninsured Vehicle? Here's What to Do

You may want to see also

Discounts for students, including for good grades

Allstate offers a good student discount, also known as the Smart Student discount, for eligible students. This discount is available to unmarried students under the age of 25 who have a B- average or a 2.7 GPA. Additionally, eligible students must attend school more than 100 miles away from where their car is garaged. Completing the Allstate teenSMART driver education program also qualifies students for this discount.

The good student discount from Allstate is a great way for eligible students to save money on their car insurance coverage. Young drivers are usually expensive to insure due to their lack of driving experience. However, Allstate recognizes that good grades demonstrate responsibility, which can translate to safer driving habits. Therefore, students with good grades may be considered lower-risk drivers and may be rewarded with a discount on their car insurance.

It's important to note that Allstate's good student discounts vary by state, so it's always a good idea to check the availability and specific requirements in your location. The discount may also have additional eligibility criteria, such as being a full-time high school or college student.

In addition to the good student discount, Allstate offers other discounts for students, including the student away-at-school discount. This discount is designed for students who do not have a car with them at college and attend school more than 100 miles away from home. By staying on a family policy, students can often benefit from lower rates and avoid the need for a separate insurance policy.

By combining the good student discount with other discounts and shopping around for the best rates, students can significantly reduce their car insurance costs. It's always beneficial to explore multiple insurers and compare their offers to find the most suitable option.

Vehicle Insurance: Extended Validity or Not?

You may want to see also

Allstate offers pay-per-mile and safe driving programs

Allstate offers a range of discounts for auto insurance, including for safe driving. While the company doesn't offer a "good driver discount" like most other major insurers, safe drivers are typically charged lower rates for coverage. Allstate also has a safe driving club, which offers bonuses and reduced collision deductible for every six months or year driven without accidents.

Allstate also offers a pay-per-mile program called Allstate Milewise, which calculates your price based on a daily rate plus a small charge per mile driven. This program can save low-mileage drivers an average of 72% annually.

Allstate Drivewise is another program that monitors your driving via a smartphone app and provides safe driving discounts.

Allstate offers 12 car insurance discounts that fall under four main categories: driving history, car safety, loyalty, and payment. Almost anyone who buys an Allstate car insurance policy will be eligible for some kind of discount. Safe drivers and people who consistently pay their entire Allstate bill on time are especially likely to benefit from large savings.

Allstate also offers discounts for bundling auto insurance with a home, life, or renters policy.

Grandchild on Your Auto Insurance

You may want to see also

Frequently asked questions

Yes, Allstate offers a multi-policy discount for customers who bundle auto insurance with a home insurance policy.

Allstate offers 12 car insurance discounts that fall under four main categories: driving history, car safety, loyalty, and payment. Some of the specific discounts include:

- Anti-lock brakes discount

- Anti-theft device discount

- Early signing discount

- FullPay discount

- New car discount

- Safe driving club

Allstate does not disclose exact discount amounts publicly. You can check with their customer service department or your Allstate agent to get more information about potential savings.

In addition to the specific discounts mentioned above, Allstate offers programs such as Allstate Milewise and Allstate Drivewise that can provide additional savings. Allstate Milewise is a pay-per-mile program that calculates your price based on a daily rate plus a small charge per mile driven, which can save low-mileage drivers an average of 72% annually. Allstate Drivewise monitors your driving through the Allstate smartphone app and provides safe driving discounts accordingly.

Yes, Allstate offers a teenage driver discount for safe drivers, as well as for those who have good grades or take a certified driver's education course.