Auto insurance rates are typically lower for 25-year-olds than for younger drivers. This is because drivers under 25 are statistically more likely to cause accidents and file insurance claims. However, turning 25 does not guarantee a lower insurance rate, as insurance providers consider various factors when determining rates, such as marital status, location, vehicle type, driving record, and credit history. While age is a significant factor, it is important to understand that other factors also play a role in determining insurance costs.

What You'll Learn

- Auto insurance rates for 25-year-olds are lower than for younger drivers

- Drivers under 25 are statistically more likely to cause accidents

- Premiums decrease as drivers get older, until around age 75

- Insurers consider several factors when setting rates, including age, gender, and location

- Shopping around for insurance and taking advantage of discounts can help lower rates

Auto insurance rates for 25-year-olds are lower than for younger drivers

Auto insurance rates for 25-year-olds are generally lower than for younger drivers. This is because drivers under 25 are statistically more likely to cause accidents and file insurance claims. The risk of accidents decreases as drivers gain more experience, which is why insurance premiums tend to drop as drivers get older. At 25, drivers are considered more mature and responsible, and their risk of at-fault accidents is lower. This results in a decrease in insurance rates.

However, it's important to note that age is just one of many factors that insurance companies consider when determining rates. Other factors include marital status, driving history, credit history, vehicle type, and location. These factors can also significantly impact insurance premiums. For example, a 25-year-old with a clean driving record and no claims will likely pay lower premiums than a 24-year-old with multiple accidents or traffic violations.

The decrease in insurance rates at age 25 also varies depending on the insurance company and state regulations. Some companies may offer only a slight reduction, while others may provide more significant savings. Additionally, states like Hawaii and Massachusetts do not allow age to be a factor in determining insurance rates, so the decrease at age 25 may not apply in these states.

While auto insurance rates may decrease at 25, it's not guaranteed. To ensure you're getting the best rate, it's recommended to shop around and compare quotes from multiple insurance companies. Asking about discounts and bundling policies can also help lower your premium. Maintaining a good driving record and improving your credit score can also positively impact your insurance rates.

In summary, auto insurance rates for 25-year-olds are typically lower than for younger drivers due to reduced risk and increased driving experience. However, other factors also play a role in determining insurance premiums, and it's essential to consider these when seeking the best rate.

Gap Insurance: Getting a Refund

You may want to see also

Drivers under 25 are statistically more likely to cause accidents

Auto insurance rates are determined by a variety of factors, and age is one of the most significant ones. Drivers under 25 are considered a high-risk group and are statistically more likely to cause accidents. This is supported by data that shows a clear correlation between age and accident rates. The overall crash rate per 100,000 licensed drivers decreases as driver age increases, with younger drivers being over-represented in crashes.

Drivers aged 16-19, for instance, make up 3.6% of licensed drivers but account for 9.1% of drivers in all crashes and 6.1% of drivers in fatal crashes. This trend is also observed in other age groups, such as drivers aged 65-74, who represent a larger proportion of licensed drivers (13.4%) but a smaller percentage of drivers in crashes (7.1%) and fatal crashes (8.8%). The data clearly indicates that younger drivers, especially those under 25, are more prone to accidents.

The primary reason for this disparity is the lack of driving experience among younger drivers. They are still learning to recognize and respond to dangerous situations on the road. Additionally, they are more likely to engage in risky behaviours, such as speeding, texting while driving, and not wearing a seatbelt. These factors contribute to a higher accident rate among this age group.

Furthermore, research has shown that male drivers aged 21-25 are nearly three times more likely to be involved in fatal crashes than female drivers of the same age. This gender difference in accident rates is also taken into account by insurance companies when setting rates.

While age is a significant factor, it is important to note that it is not the sole determinant of insurance rates. Other factors, such as marital status, driving record, vehicle type, annual mileage, and credit history, also play a role in calculating insurance premiums. However, due to the increased risk of accidents, drivers under 25 often face higher insurance rates until they gain more experience and demonstrate safer driving behaviour.

Auto Insurance Claims: Payout Process Explained

You may want to see also

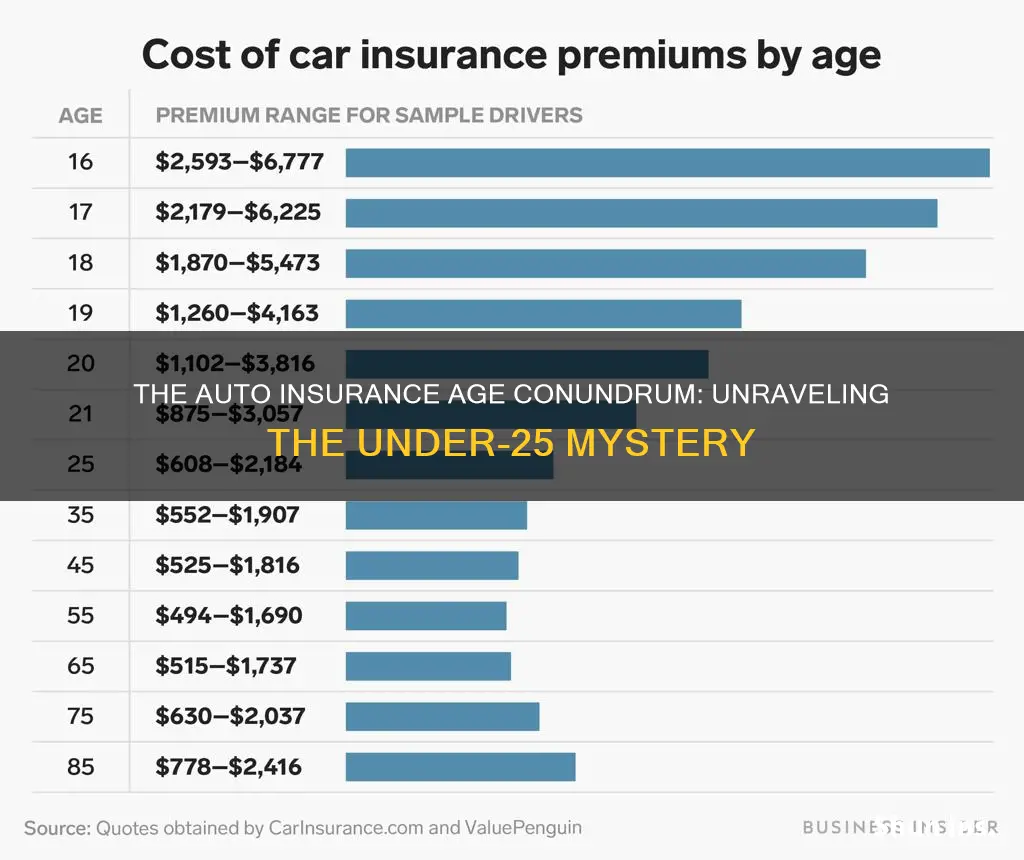

Premiums decrease as drivers get older, until around age 75

Car insurance premiums are based on a multitude of factors, with age being one of the most significant. While it may seem unfair, younger drivers are generally more likely to have accidents or take risks on the road. Therefore, they are considered riskier to insure and are charged higher premiums.

As drivers get older, they gain experience and become less likely to have accident claims, which makes them less costly to insure. This is reflected in the decrease in insurance premiums up until the driver reaches the age of 75. At Progressive, for example, the average premium per driver tends to decrease significantly from ages 19 to 34, stabilize from ages 34 to 75, and then begin to trend upward after age 75.

The decrease in premiums with age is because insurers see less risk in covering older, more experienced drivers. While driving skills may not magically improve with each birthday, data shows that older drivers are less likely to file insurance claims as they age. This decrease in claims leads to a decrease in costs for insurance companies, which is passed on to the policyholders in the form of lower premiums.

In addition to age, other factors that can influence car insurance rates include marital status, location, vehicle type, driving record, annual mileage, and credit history. It is important to note that the impact of age on insurance premiums may vary between different insurance companies, and there are other factors beyond age that can affect the cost of insurance.

Auto Accidents: Health Insurance Billing

You may want to see also

Insurers consider several factors when setting rates, including age, gender, and location

When it comes to auto insurance, age is one of the most important factors in determining your rate. Younger drivers are generally more likely to have accidents or take risks on the road, so they are considered high-risk customers and charged higher premiums. This is especially true for drivers under the age of 25, who are less experienced and statistically more likely to get into accidents. As a result, auto insurance rates tend to decrease as drivers get older, with rates dropping significantly from ages 19 to 34, and then stabilising or slightly decreasing from 34 to 75.

However, age is not the only factor that insurers consider when setting rates. Insurers also take into account:

- Gender: In most states, gender is a factor in determining car insurance rates. Men tend to have higher premiums because they are more likely to take risks while driving and get into accidents. However, there are some states that do not allow gender to be used as a factor in insurance rates.

- Marital Status: Married policyholders typically pay less on their premiums than single people. This is because insurance companies view married drivers as safer, less likely to take risks, and more financially stable.

- Location: Where you live and park your car overnight can affect your insurance rate. Motorists in large cities with higher rates of theft and vandalism, and more crowded roads, tend to pay higher rates than those in rural areas.

- Vehicle Type: The make, model, and age of your vehicle impact the cost of insurance. Luxury vehicles with new technology and advanced safety features cost more to repair or replace, so they are more expensive to insure. Insurance companies also consider the likelihood of theft when setting rates, with certain vehicles, such as the Honda Accord and Ford pickup trucks, being more expensive to insure due to their high theft rates.

- Driving History: Your driving record, including any accidents, speeding tickets, or other traffic violations, is a major factor in determining your insurance rate. A clean driving record can result in lower premiums, while a history of accidents or violations will lead to higher rates.

- Credit History: In most states, your credit history can also influence your insurance premiums. Insurance companies associate lower credit scores with a higher risk of filing a claim. However, there are a few states that do not allow credit scores to be used in setting insurance rates.

Business Auto Insurance: Tax Write-Off?

You may want to see also

Shopping around for insurance and taking advantage of discounts can help lower rates

Shopping around for insurance is a great way to lower your rates and save money. It is recommended to look for car insurance every six months to a year to ensure you are getting the best coverage. While it may be easier to renew your current policy, putting in the effort to compare prices can save you a lot in lower premiums.

When shopping around, it is important to get quotes from several insurers, making sure that the coverage amounts and deductibles are consistent. Using an aggregator site can be helpful to get multiple quotes at once. It is also worth checking if your state insurance department provides comparisons of prices charged by major insurers. It is also a good idea to ask friends and relatives for their recommendations and check consumer reviews.

In addition to shopping around, taking advantage of discounts can also help lower your rates. Here are some common discounts to look out for:

- Good driver discounts: Some companies offer discounts for motorists who have a good driving record, with no accidents or moving violations for a number of years.

- Low mileage discounts: If you drive less than the national average of 14,000 miles per year, you may be eligible for a discount. This can also apply to those who carpool to work.

- Group insurance: You may be able to get a reduction if you get insurance through a group plan from your employer, professional or alumni group, or other associations.

- Defensive driving course: Taking a defensive driving course can reduce your auto insurance rates, with discounts ranging from 5 to 20%.

- Student discounts: If there is a young driver on the policy who is a good student, they may qualify for a lower rate.

- Bundling: Buying your homeowners and auto coverage from the same insurer can often result in a discount.

- Improved credit score: In many states, insurers consider credit scores when pricing policies, so improving your credit score may lead to lower insurance costs.

Vehicle Insurance: Am I Covered?

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to decrease once a driver turns 25. This is because drivers are considered more mature and less likely to cause accidents or take risks on the road. However, this is not a guaranteed discount and rates may still be higher than for older adults.

In addition to age, insurance companies consider your claims history, marital status, location, vehicle type, driving record, annual mileage, and credit history when determining your rate.

The decrease in auto insurance rates at age 25 varies depending on the company. On average, rates drop by about 9% to 12% at age 25, but this can range from 4% to 20%.

Young drivers can take advantage of various strategies and discounts to lower their auto insurance rates. This includes shopping around for the best rate, adjusting coverage and deductibles, bundling insurance policies, and taking a defensive driving course. Maintaining a clean driving record and good credit score can also help reduce premiums.