Whether you're issued a citation or a ticket for speeding, it will show up on your driving record and may result in an increase in your insurance rates. However, this is not always the case, and there are steps you can take to keep a speeding ticket off your record.

| Characteristics | Values |

|---|---|

| How long does a speeding ticket stay on your record? | 3-5 years in most states; 10 years in Hawaii; forever in Montana |

| How much does insurance go up after a speeding ticket? | 22%-33% on average; 25% according to one source |

| When will a speeding ticket show up on insurance? | Within 6-12 months of receiving the ticket; once the policy renews |

| How can you keep a speeding ticket off your record? | Fight the citation in court; attend a driving course; don't pay the ticket straight away and explore other options |

| How can you lower your rate after a ticket? | Shop around for insurance; raise your deductible; enrol in telematics programs; lower your limits; drop coverages; ask for discounts |

What You'll Learn

- Speeding tickets may increase insurance rates by 22-33% on average

- A ticket may remain on your record for 3-10 years

- Non-moving violations, like parking tickets, usually don't affect insurance rates

- Moving violations include running red lights, not using turn signals, and driving under the influence

- You can keep a ticket off your record by fighting it in court or attending a driving course

Speeding tickets may increase insurance rates by 22-33% on average

Speeding tickets can have a significant impact on insurance rates, with the average increase falling between 22% and 33%. This range is influenced by several factors, including the driver's prior record, the nature of the offence, and the insurance company's policies.

On average, drivers can expect their insurance rates to increase by around 25% following a speeding ticket. This increase translates to roughly $380 more per year, or $1,000 over the three years that the ticket remains on the driver's record. However, it's important to note that the impact of a speeding ticket on insurance rates can vary depending on the state and the insurance company. For example, in Michigan, drivers may face a 49% increase in their insurance rates, while in Hawaii, the average increase is only 9%.

Insurance companies typically consider the severity of the offence when determining rate increases. Factors such as how far over the speed limit the driver was travelling and whether it was their first offence can influence the size of the insurance penalty. Additionally, insurance companies may offer discounts or waive increases for customers who take defensive driving courses or maintain a clean driving record for a certain period after the offence.

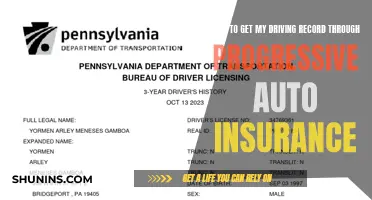

While a speeding ticket can result in higher insurance rates, shopping around and comparing quotes from multiple insurers can help drivers find more affordable coverage. It's also worth noting that insurance companies do not need to be notified about a speeding ticket, as they will find out through the driver's Motor Vehicle Report when renewing or issuing a new policy.

Is Your Vehicle Insured?

You may want to see also

A ticket may remain on your record for 3-10 years

The length of time a ticket remains on your record depends on the type of violation and the state you live in. In most states, a speeding ticket will stay on your record for three to five years, impacting your insurance rates for the duration. However, some states have different requirements. For example, in New York, a speeding ticket will remain on your record until the end of the year the violation occurred, plus an additional three years. On the other hand, in Hawaii, a speeding ticket will stay on your record for ten years, and in Montana, it will remain indefinitely.

When it comes to more serious offenses, such as alcohol or drug-related violations, these will typically stay on your record for ten years. Additionally, multiple DUI offenses will result in more severe penalties. Any suspension or revocation of your license will also be noted on your record for up to four years.

Vehicle Damage: Whose Insurance Pays?

You may want to see also

Non-moving violations, like parking tickets, usually don't affect insurance rates

Parking tickets are issued when a vehicle is not in motion and often include parking violations or faulty equipment. They are generally not considered when calculating insurance rates because they are not tied to a driver's risk in the same way that moving violations are. People who park their cars illegally are not more likely to be involved in collisions than those who don't. Even if a parked vehicle is damaged, the accident is not considered the fault of the owner of the parked car.

However, it's important to note that insurance rates are determined by a number of complex factors, and a person's driving record is typically the single greatest contributor to insurance costs. While non-moving violations may not directly impact insurance rates, they could still indirectly affect a person's driving record and potentially their insurance premiums. For example, failure to pay a parking ticket could result in the suspension of a driver's license or vehicle registration, which could then lead to higher insurance rates. Additionally, some insurance companies may review a person's driving record when determining rates, and a pattern of non-moving violations could be seen as a sign of irresponsible driving behavior.

Insuring Your New Ride

You may want to see also

Moving violations include running red lights, not using turn signals, and driving under the influence

Moving violations are typically defined as wrongs committed while a vehicle is in motion. They can be treated as infractions, misdemeanours, or felonies. Infractions are minor violations that are not considered criminal offences and usually result in a fine. Misdemeanours can result in incarceration, and felonies are the most serious type of violation and are extremely rare for moving violations.

Running a red light is a common moving violation. In California, for example, running a red light or a stop sign typically results in a fine and demerit points on your driving record. In some states, red light safety cameras are used to catch red light runners, and a ticket is issued if there is clear evidence that a vehicle ran a red light.

Failing to use a turn signal is another example of a moving violation. In most cases, this is considered an infraction and results in a fine. However, in some states, failing to use a turn signal can add points to your driving record and increase your insurance premiums.

Driving under the influence (DUI) is a major traffic violation and is typically charged as a misdemeanour or felony. It will almost always increase your auto insurance premium, and many DUI convictions result in the need for an SR-22 filing. Some insurers may even refuse to insure individuals with a DUI conviction.

The impact of a moving violation on your insurance rates depends on the type of violation, your insurance company, and your state's laws. Insurance companies typically run motor vehicle reports on their customers every six to twelve months, and any traffic violations will show up on these reports. If your insurance policy has been recently renewed, the impact of a moving violation on your rates will likely be delayed until the next renewal period.

Auto Insurance and Employment Perks: Unlocking Discounts and Benefits

You may want to see also

You can keep a ticket off your record by fighting it in court or attending a driving course

A ticket on your driving record can result in an increase in your insurance rates. However, there are a few ways to keep a ticket off your record.

Fighting the Citation in Court

One way to keep a ticket off your record is to fight the citation in court. This can involve contesting the ticket, pleading not guilty, and presenting your case to a judge. It is important to note that if you go to trial and lose, the ticket will go on your record and you will have to pay the fine and court costs.

Attending a Driving Course

Another way to keep a ticket off your record is to attend a driving course. In some states, attending and passing a defensive driving course will result in your ticket being dismissed. However, this option is usually only available once, and the specifics vary from state to state. Taking a defensive driving course may also help reduce your insurance rates.

Other Measures

There are also other measures you can take to keep a ticket off your record, such as seeking a deferral, negotiating for a lesser fine, or contacting the clerk of the court. Each state and jurisdiction have different options and requirements, so it is important to research the specific rules in your area.

Auto Accident Medical Coverage in Michigan

You may want to see also

Frequently asked questions

You can fight the citation in court, attend a driving course, or take other measures to keep a ticket off your driving record.

A speeding ticket will generally stay on your driving record for three to five years, but this can vary by state.

On average, you can expect your car insurance policy to increase by roughly 25% at renewal.

You can shop around for insurance, increase your deductible (if you can afford it), or ask about other discounts such as bundling your insurance policies.