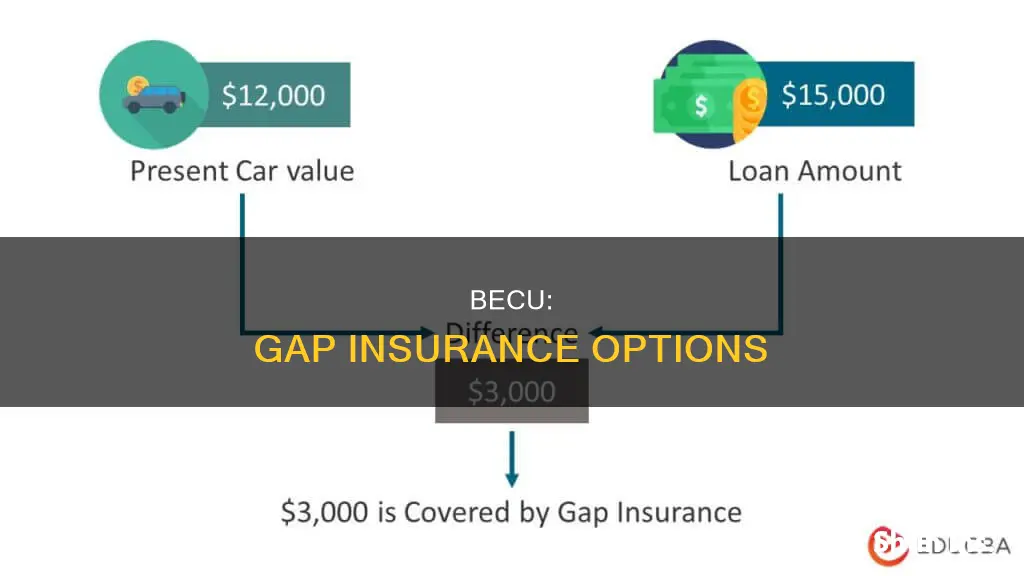

BECU offers auto loans to its members, with benefits including lower interest rates and member-only benefits. When it comes to insurance, BECU requires that any auto loan must be accompanied by collision and comprehensive coverage. Additionally, BECU recommends negotiating extended warranties or GAP insurance into the total purchase price of a vehicle. While BECU does not explicitly mention offering GAP insurance, it is advisable to consult with them directly to understand the specific insurance options available and how they can be included in your auto loan package.

What You'll Learn

BECU auto loan insurance requirements

When applying for an auto loan with BECU, it is important to know your budget and understand your credit score and report. Lenders will use this information to determine loan qualifications and interest rates. BECU offers a free credit score check for members with online banking.

Additionally, BECU provides resources to help members make informed car-buying decisions, such as comparing interest rates and loan lengths, negotiating extended warranties or GAP insurance, and understanding the total cost of ownership, including insurance rate changes, gas or electric charging, and annual licensing fees.

BECU also offers auto loan calculators to help members determine how much they can afford, estimate monthly payments, and decide between leasing or purchasing a vehicle. With these tools, members can make informed financial decisions when applying for an auto loan with BECU.

Hyundai Lease Insurance Requirements

You may want to see also

BECU's lowest allowed deductible

BECU, or Boeing Employees' Credit Union, is a credit union that offers auto loans to its members. According to sources, BECU requires borrowers to have collision and comprehensive coverage on their vehicles. While the lowest allowed deductible for BECU auto loans is not explicitly stated on their website or other official sources, some sources suggest that it could be $1000. This is based on a notice received by a BECU customer, who was asked to provide proof of insurance.

It is important to note that deductible requirements may vary depending on the specific circumstances of the loan and the borrower. Therefore, it is always recommended to contact BECU directly to obtain the most accurate and up-to-date information regarding their lowest allowed deductible for auto loans.

In the meantime, if you are in the process of purchasing a car and need to secure insurance coverage before finalising the loan, it is advisable to set up a policy with a $1000 deductible, as this should be sufficient to meet BECU's requirements. Once the loan is in place, you can contact BECU to confirm if the deductible is acceptable or if any adjustments are needed. It is worth noting that BECU will not penalise borrowers for initially having a higher deductible, as long as the coverage is adjusted to meet their requirements.

Additionally, it is worth considering other factors that may impact your insurance deductible. For instance, the age and condition of the car, as well as your driving history and credit score, can all play a role in determining the appropriate level of coverage and deductible. By taking these factors into account and consulting with BECU, you can ensure that you have the necessary coverage in place while also meeting their requirements.

In summary, while the exact lowest allowed deductible for BECU auto loans may not be publicly available, it is likely to be around $1000 based on customer experiences. By setting up a policy with this deductible and consulting with BECU, you can ensure that you meet their requirements and finalise your loan process smoothly. Remember to consider other factors that may impact your insurance coverage and deductible, and always seek official confirmation from BECU regarding their specific requirements.

When Insurance Totals Your Car

You may want to see also

BECU's Loan Payment Protection Program

BECU's LPP is a great option for those seeking peace of mind and financial security. By enrolling in the program, members can rest assured that their monthly auto loan payments will be covered in the event of unforeseen circumstances. This can be especially useful for those who are the sole breadwinners of their families or those with unpredictable income streams.

The program is easy to apply for, and members can simply call BECU to request to have LPP added to their loan. Additionally, BECU offers a range of other benefits for auto loans, such as lower interest rates, the BECU Reprice Program, and various auto loan calculators to help members make informed decisions about their vehicle purchases.

While BECU does not explicitly mention GAP insurance, they do emphasize the importance of understanding one's budget and financial options when purchasing a car. GAP insurance, which covers the difference between the amount owed on a vehicle and its current market value, can be an essential aspect of financial planning when buying a car. It is recommended that members consult with BECU to understand their specific coverage options and ensure they have the protection they need.

Overall, BECU's Loan Payment Protection Program offers valuable financial assistance and security to its members, providing coverage for auto loan payments during challenging times. By offering this program, BECU demonstrates its commitment to supporting its members and helping them navigate the uncertainties of life.

Vehicle Insurance: Active or Not?

You may want to see also

BECU's advice on buying a car

BECU recommends getting pre-approved for a loan before car shopping to know your spending limit. They offer resources like the BECU Budget Planner to help create an initial budget and calculate how much car you can afford. BECU also suggests comparing interest rates and loan lengths from different lenders, including banks, credit unions, and dealerships.

When choosing a car, BECU advises considering your needs and preferences. For example, a minivan might be ideal for a family, while a skier might prefer an SUV. Safety should be a top priority, and resources like the Insurance Institute of Highway Safety can help identify the best options. It is also worth considering the annual percentage rate (APR), trade-ins, rebates, and other incentives when deciding between a new or used car.

Before finalising a purchase, BECU recommends taking the time to inspect the car, whether from a dealer or a private owner. Check the interior and exterior for any signs of wear and tear, and take the car for a test drive to ensure it is in good working condition. A CARFAX Vehicle History Report can provide valuable information about the car's history, including accidents and previous owners.

Lastly, BECU emphasises the importance of negotiating. They suggest focusing on the total price, including tax, title, and registration, rather than just the monthly payments. Understanding the value of your new and old car, if trading in, and knowing your APR, loan length, and any prepayment penalties can help you negotiate a better deal.

Insurance Payouts: Total Loss Calculations

You may want to see also

BECU's car loan options

BECU offers a range of car loan options to its members. As a not-for-profit credit union, BECU offers great rates, fewer fees, and exclusive member benefits.

Auto Loans

BECU provides auto loans with lower interest rates, which are kept low by only offering car loans to members. The New Auto Loan interest rate is available for cars up to 2 years old. BECU also offers an auto loan calculator to help members determine how much they can afford and what their monthly payments might be.

BECU Reprice Program

The BECU Reprice Program allows members to improve their credit score and potentially lower their rates.

Loan Payment Protection Program (LPP)

The optional Loan Payment Protection Program provides financial assistance during times of hardship, such as involuntary job loss, disability, or loss of life. The monthly program cost is based on the loan balance and package options.

GAP Insurance

While it is not explicitly mentioned, BECU suggests that members negotiate GAP insurance into their total purchase price.

Dealership Financing

BECU offers on-site financing with many participating dealerships. Members can also request that their dealer finances their loan through BECU or another credit union or bank of their choice.

Other Options

BECU also provides resources to help members understand their budget and credit score, as well as compare different financing options, such as dealer financing, credit union loans, and in-house financing.

Registering and Insuring a Vehicle in Hawaii

You may want to see also

Frequently asked questions

BECU does not explicitly state that they offer GAP insurance, but they do mention that it is possible to negotiate GAP insurance into the total purchase price.

GAP insurance covers the difference between the amount you owe on your car loan and the current value of your car if your car is deemed a total loss.

If your car is in an accident or is stolen and you do not have GAP insurance, you may end up having to pay off a loan for a car that you no longer have.

You can negotiate GAP insurance into your total purchase price when buying a car through BECU.