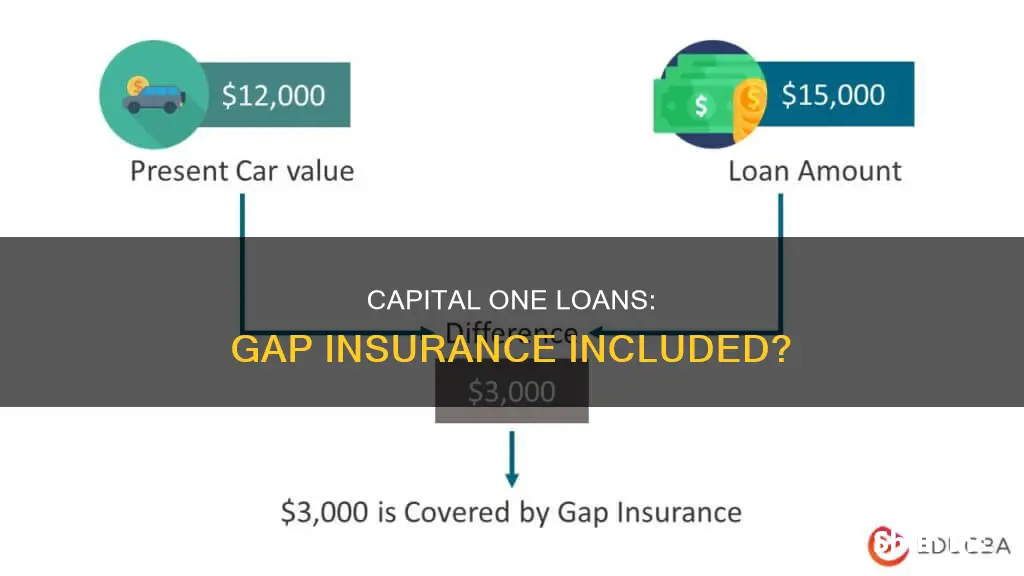

Capital One offers Guaranteed Asset Protection (GAP insurance) to individuals financing their vehicles with a car loan through Capital One Bank. GAP insurance is an optional type of coverage that can be purchased through your regular car insurance provider, dealership, or added to your loan agreement when financing with a bank or credit union. If you choose Capital One Auto Finance as your lender, you will be offered the opportunity to purchase GAP insurance and add the price to your total loan amount. This type of insurance covers the difference between the amount paid by your insurer and your remaining car loan balance if your car is stolen or totaled.

| Characteristics | Values |

|---|---|

| What is GAP insurance? | Guaranteed Asset Protection (or "GAP" insurance) is intended to protect you if your car is totaled or stolen and you still owe money on your car loan. |

| Who offers GAP insurance? | Capital One offers GAP insurance to individuals financing their vehicles with a car loan through Capital One Bank. |

| How does GAP insurance work? | GAP insurance helps cover the difference between the amount paid by your insurer and your remaining car loan balance. |

| When is GAP insurance useful? | GAP insurance is useful if your down payment was smaller than 20% of the total vehicle price, your financing term was for 50+ months, you leased your vehicle, you purchased a vehicle that's known to depreciate quickly, or you rolled over negative equity from an old car loan into the new loan. |

| When is GAP insurance not useful? | GAP insurance is not useful if you have very little left to pay on your auto loan. |

| How much does GAP insurance cost? | It costs a few dollars a month to add GAP insurance to a full-coverage insurance policy. According to the Insurance Industry Institute, you can secure this type of coverage for just $20 a year, or 5% to 6% of your full-coverage premium. |

| Can you get a refund on GAP insurance? | Yes, you may be able to qualify for a GAP insurance refund on an existing policy if you cancel your GAP policy early. The amount of the refund will depend on factors such as the value of the vehicle, the amount of the auto loan, the vehicle's current mileage, and the loan repayment term. |

What You'll Learn

Capital One Gap Insurance Cost

Capital One offers Guaranteed Asset Protection (GAP) insurance to individuals financing their vehicles with a car loan through Capital One Bank. This insurance is optional and can be purchased through your regular car insurance provider, your dealership, or added to your loan agreement when financing with a bank or credit union. If you choose Capital One Auto Finance as your lender, you can purchase GAP insurance and add the price to your total loan amount.

The cost of GAP insurance varies depending on factors such as your age, driving record, state, credit history, and the model and model year of your vehicle. According to the Insurance Industry Institute, you can expect to pay around $20 per year or 5% to 6% of your full-coverage premium for this type of coverage. If you purchase GAP insurance through a dealership or lender, you will likely pay interest on the coverage.

GAP insurance provides valuable protection if your car is totaled or stolen and you owe more on your auto loan than the insurance payout. It covers the "gap" between the depreciated value of your car and the amount you still owe on your loan. This type of insurance is especially useful if you have a low down payment, a long financing term, a leased vehicle, or a car that is expected to depreciate quickly.

It's important to note that GAP insurance does not cover missed payments, interest accrued on late fees, or any damage that doesn't result in a total loss of the vehicle. Before purchasing GAP insurance, it's recommended to consider your unique financial situation and risk tolerance to decide if it aligns with your needs.

Tennessee Vehicle Insurance Requirements

You may want to see also

When to Get Gap Insurance

Gap insurance is a valuable form of protection for car owners, but it is not always necessary. Here are some scenarios where you should consider getting gap insurance:

- When You Have a Small Down Payment: If you make a small down payment on your car, such as less than 20%, you may benefit from gap insurance. A small down payment means you will owe more on the car than its current value, creating a "gap" that gap insurance can cover if the car is totalled or stolen.

- Long Finance Period: If you choose a long payoff period for your car loan, such as 60 months or more, consider getting gap insurance. The longer the finance period, the more likely it is that you will owe more than the car's value at some point during the loan term.

- Quickly Depreciating Vehicles: Some vehicles depreciate faster than others. Luxury sedans and SUVs, for example, may lose value at a faster rate. If you purchase a vehicle that depreciates quickly, gap insurance can protect you from owing more than the car's value.

- Negative Equity: If you have rolled over negative equity from an old car loan into a new loan, gap insurance can help protect you. This is especially important if the negative equity puts you in a position where you owe more than the car's current value.

- Leasing a Vehicle: Gap insurance is generally required when leasing a vehicle. This is because you don't own the vehicle outright, and there may be specific requirements in the lease agreement regarding gap insurance.

On the other hand, there are also situations where you may not need gap insurance:

- Large Down Payment: If you made a substantial down payment of 20% or more on your car, you may not need gap insurance. This is because you are less likely to owe more on the car than its current value, even in the early years of ownership.

- Short Loan Repayment Period: If you plan to pay off your car loan in less than five years, gap insurance may not be necessary. In this case, you will likely build equity in your vehicle faster, and the risk of owing more than its value is reduced.

- Vehicles That Hold Their Value: Some makes and models of vehicles historically hold their value better than others. If you own a car that is known for retaining its value over time, you may not need gap insurance.

In general, gap insurance is designed for situations where you owe more on your car loan than the car's current value. This type of insurance can help cover the "gap" between the insurance payout and the remaining loan balance if your car is totalled or stolen. However, it is not a requirement and may not be necessary for all car owners.

Vehicle Insurance: Property Damage Explained

You may want to see also

Gap Insurance Benefits

Gap insurance, or Guaranteed Asset Protection (GAP) insurance, is an optional insurance coverage that is intended to protect you if your car is totaled or stolen and the remaining balance on your account is larger than the insurance proceeds received for the car. In other words, it covers the difference between the depreciated value of the car and the loan amount owed. This type of insurance is especially useful if you owe more for the car than what the auto insurance company determines its worth to be.

Peace of Mind

Gap insurance provides peace of mind in knowing that you are protected financially if your car is totaled or stolen. It helps cover the difference between the insurance payout and the remaining loan balance, so you don't have to pay out of pocket to make up for the shortfall.

Protection Against Depreciation

Cars depreciate quickly, often losing a significant portion of their value in the first year of ownership. Gap insurance helps protect you from the financial impact of depreciation by covering the difference between the insurance payout, which is based on the car's current value, and the remaining loan amount.

Suitable for Various Scenarios

Gap insurance is beneficial for those who have taken out a loan that is greater than the value of their vehicle, made a small down payment, or chosen a long payoff period. It is also useful for those who lease vehicles, as it can be required by law in certain states and is often included in lease pricing.

Potential for Refund

In some cases, you may qualify for a gap insurance refund if you cancel your policy early, typically after repaying your loan or selling/trading in your vehicle before the loan is paid off. The amount of the refund will depend on factors such as the value of the vehicle, the amount of the auto loan, and the loan repayment term.

Cost-Effectiveness

Gap insurance is relatively inexpensive, with policies typically costing less than $1 per day or even as low as $1 per month for the duration of the loan. It can be added to your comprehensive auto insurance policy for a small additional cost, and some insurers offer it for as little as $20 per year.

Calculating Vehicle Insurance Costs

You may want to see also

Gap Insurance Drawbacks

While gap insurance can be a great way to protect yourself financially in the event of your car being stolen or totaled, there are some drawbacks to consider.

Firstly, gap insurance does not cover missed or late payments. If you fall behind on your car payments or accrue interest on late payments, gap insurance will not provide any reimbursement for these costs. This means that you will still be responsible for covering these expenses out of pocket, even with gap insurance in place.

Secondly, gap insurance is not necessary if you have enough savings to cover the difference between the fair market value of your vehicle and the remaining loan balance in the event of a total loss. If you have sufficient savings to cover this potential gap, purchasing gap insurance may be an unnecessary expense.

Additionally, gap insurance is only useful while you owe more on your car loan than the car is worth. Once your loan balance is equal to or lower than the value of your vehicle, gap insurance becomes unnecessary. It is important to monitor your loan balance and cancel your gap insurance when it is no longer needed to avoid paying for coverage you don't require.

Another drawback to consider is the cost of gap insurance. While it is generally affordable, typically costing around $20-$60 per year, if you choose to purchase it through a dealership or lender, you may end up paying significantly more. Dealerships often charge a flat rate of $500 to $700 for gap insurance, and if this cost is rolled into your car loan, you will also pay interest on it, making it even more expensive.

Finally, gap insurance does not cover every expense related to your vehicle. It specifically covers the difference between the insurance payout and the remaining loan balance in the event of a total loss. It does not cover your insurance deductible, extended warranties, overdue payments, lease penalties, or credit insurance charges, among other things. As such, it is important to understand exactly what is and isn't covered by gap insurance before purchasing it.

Vehicle Teardown: Pre-Insurance Inspection Essential?

You may want to see also

Gap Insurance Refunds

Gap insurance covers the difference between what you owe on your car loan or lease and the depreciated value of your car if it is totaled due to a problem covered by your policy, like a car accident. It is intended to protect you if the remaining balance on your account is larger than the insurance proceeds received for the car.

If you pay for your gap insurance annually, you can get a refund for any unused coverage if you pay off your loan early, switch insurance providers, or sell or trade in your vehicle. This is because you have paid for coverage that you will no longer need. However, if your insurance provider has paid out on your gap insurance policy, you will not be eligible for a refund for the remaining months of coverage.

The amount of your refund depends on how you pay your insurance bill. If you pay monthly, you won't get a refund as you have only paid for the coverage you've received so far. If you pay your insurance in one lump sum, the amount of your refund will depend on how far into your coverage you were when you canceled your policy.

To get a refund, you will need to contact your gap insurance provider to begin the cancellation process and submit the necessary paperwork, which may include gap insurance cancellation forms, a copy of an odometer disclosure statement, and a copy of your auto loan payoff showing the date your vehicle was paid off.

The timing for refunds can vary, but they typically occur within a month.

U.S. Car Insurance: Address Change Guide

You may want to see also

Frequently asked questions

Yes, Capital One offers Guaranteed Asset Protection (GAP insurance) to individuals financing their vehicles with a car loan through Capital One Bank.

GAP insurance helps cover the difference between the amount paid by your insurer and your remaining car loan balance. Your regular car insurance policy will cover the fair market value of the car, not the amount you still owe on an auto loan.

Generally, it only costs a few dollars a month to add GAP insurance to a full-coverage insurance policy. According to the Insurance Industry Institute, you can secure this type of coverage for just $20 a year, or 5% to 6% of your full-coverage premium.