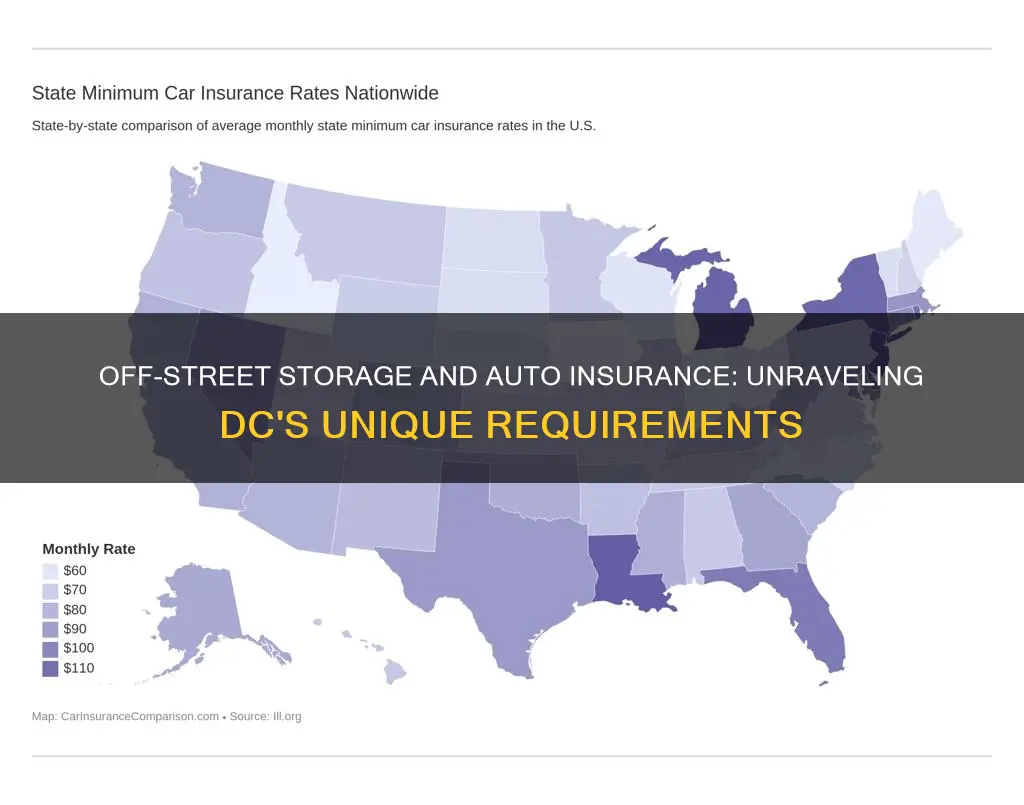

In Washington, D.C., drivers are required by law to carry a valid auto insurance policy and must show proof of insurance if stopped by the police or pulled over for a traffic violation. D.C. has a no-fault insurance system, meaning that your insurance provider will cover your medical bills following an accident, regardless of who is at fault. Vehicle owners in D.C. are also required to carry uninsured motorist coverage for both bodily injury and property damage. This means that if you are in an accident caused by someone who doesn't have insurance or can't cover all your losses, your insurance will cover your medical bills and property damage.

The minimum insurance requirements in D.C. include liability auto insurance for bodily injury and property damage, as well as uninsured motorist coverage. The specific minimums are $25,000 per person and $50,000 per accident for bodily injury liability, $10,000 per accident for property damage liability, and $25,000 per person, $50,000 per accident, and $5,000 per accident (with a $200 deductible) for uninsured motorist coverage.

While D.C. requires auto insurance for all vehicles, there are options for those who won't be driving for a while or who plan to store their vehicles. This type of insurance is often called parked car insurance or car storage insurance, and it typically involves reducing your coverage to comprehensive-only insurance, which covers damage caused by animals, weather, theft, vandalism, fire, natural disasters, and falling objects. This can lower your insurance rates significantly, sometimes by up to 80%. However, it's important to note that comprehensive-only insurance does not include liability, collision, or uninsured motorist coverage, so you won't be insured if you cause an accident or damage someone's property while driving. Therefore, it's crucial to revert to your previous policy's coverage before driving your vehicle again.

| Characteristics | Values |

|---|---|

| Location | Washington D.C. |

| Requirement for Auto Insurance | Mandatory for vehicles that are driven, as well as those parked on public roads |

| Minimum Insurance Requirements | $25,000 bodily injury coverage per person, $50,000 total bodily injury coverage per accident, and $10,000 property damage coverage per accident |

| Uninsured Motorist Coverage Requirements | $25,000 bodily injury coverage per person, $50,000 total bodily injury coverage per accident, and $5,000 property damage coverage per accident |

| Insurance System | No-fault insurance system |

| Proof of Insurance | Required when stopped by the police |

What You'll Learn

DC's no-fault insurance system

Washington D.C. has a unique no-fault auto insurance system. This means that if you are injured in an auto accident, you must first file a claim against your own auto insurance. Specifically, your "personal injury protection (PIP)" insurance covers your medical bills and lost wages up to the limits of your coverage, even if the accident was not your fault.

The disadvantage of a no-fault system is that you can't bring a claim against the at-fault driver to recover for injuries like pain and suffering unless your injuries meet a specified severity threshold. These thresholds are:

- Your medical bills must exceed your PIP coverage limit

- Your injuries must result in substantial permanent scarring or disfigurement, or a qualifying impairment as described in the law

D.C.'s no-fault rules only apply to personal injuries, not to vehicle damage claims.

The District of Columbia’s Compulsory/No-Fault Motor Vehicle Insurance Act requires every person applying for vehicle registration or a reciprocity sticker in the District to have valid DC vehicle insurance. You must maintain your vehicle insurance as long as your vehicle is registered. If you no longer have or intend to drive your vehicle, do not cancel your vehicle insurance until you return your vehicle tags to DC DMV. If you let your vehicle insurance lapse, you will be fined.

Dual-Address Auto Insurance: Possible?

You may want to see also

Minimum insurance requirements

In Washington, D.C., motorists are required by law to show valid proof of insurance if they are stopped by the police. The District of Columbia's Compulsory/No-Fault Motor Vehicle Insurance Act mandates that anyone registering a vehicle or applying for a reciprocity sticker in the District must have valid D.C. vehicle insurance.

The minimum insurance requirements in Washington, D.C., are as follows:

- Liability insurance: This covers the other person's damages (medical bills, lost wages, pain and suffering, etc.) if you cause an accident. The minimum liability coverage required by District law includes:

- Bodily injury coverage of $25,000 per person and $50,000 total per accident.

- Property damage coverage of $10,000 per accident.

- Uninsured motorist coverage: This covers your damages if you are hit by a driver with no insurance. The minimum requirements for this coverage are:

- Bodily injury coverage of $25,000 per person and $50,000 total per accident.

- Property damage coverage of $5,000 per accident, with a $200 deductible.

It is important to note that these are the minimum requirements, and you may want to consider purchasing additional coverage for more protection. Additionally, you must maintain this minimum, continuous insurance liability coverage while you own and drive your vehicle. If you no longer plan to drive your vehicle, you must not cancel your insurance until you return your vehicle tags to the D.C. DMV.

Insuring a Vehicle: Ownership Flexibility

You may want to see also

Insurance for vehicles in storage

If you're planning to store your vehicle for an extended period, you may be considering cancelling your auto insurance to save on costs. However, it is recommended to keep your vehicle insured even when it's not in use. In Washington, D.C., there are specific requirements and options for insurance on stored vehicles that you should be aware of.

D.C. Requirements for Vehicle Insurance

In Washington, D.C., motorists are required to have valid auto insurance and provide proof of insurance if stopped by the police. The District of Columbia's Compulsory/No-Fault Motor Vehicle Insurance Act mandates that anyone registering a vehicle in D.C. must have valid D.C. vehicle insurance. This insurance must be maintained as long as the vehicle is registered, and failure to do so will result in fines.

The minimum insurance requirements in D.C. include:

- $25,000 bodily injury coverage per person and $50,000 total bodily injury coverage per accident.

- $10,000 property damage coverage per accident.

Additionally, D.C. law requires uninsured motorist coverage for both bodily injury and property damage. This includes:

- $25,000 per person and $50,000 per accident for bodily injury.

- $5,000 per accident with a $200 deductible for property damage.

Insurance for Stored Vehicles

When storing your vehicle, it is advisable to keep your insurance policy active to avoid a lapse in coverage, which could affect your rates in the future. Most states, including D.C., do not allow you to cancel your insurance completely, but you may be able to reduce your coverage to comprehensive-only insurance, also known as "car storage insurance."

Comprehensive-only insurance covers your vehicle against various types of damage that can occur when it's not being driven, such as theft, vandalism, fire, or damage from falling objects. This type of insurance is typically much cheaper than a full coverage policy, so you can reduce your insurance costs while keeping your vehicle protected.

Before making any changes to your insurance policy, consult your insurance agent or carrier to understand the specific requirements and options for your situation. They can guide you through the process and ensure you have the necessary coverage for your stored vehicle.

Important Considerations

When reducing coverage for a stored vehicle, it is crucial to remember to revert to your previous policy when you plan to drive the vehicle again. Driving with only comprehensive coverage is not permitted and can result in legal and financial consequences if an accident occurs.

Additionally, if you are still paying off a loan on your vehicle, your lienholder may require you to maintain certain types of insurance coverage. It is important to check with them before making any changes to your policy.

By understanding the requirements and options for insurance on stored vehicles in D.C., you can make informed decisions about your coverage and ensure your vehicle is adequately protected during its storage period.

Auto Insurance and SR-22: Separate Purchases?

You may want to see also

DC's Compulsory/No-Fault Motor Vehicle Insurance Act

The District of Columbia's Compulsory/No-Fault Motor Vehicle Insurance Act requires all motorists to carry valid DC vehicle insurance. This means that every person applying for vehicle registration or a reciprocity sticker in the District must have insurance. This insurance must be maintained for as long as the vehicle is registered. If a vehicle owner no longer intends to drive their car, they must not cancel their insurance until they have returned their vehicle tags to the DC DMV.

The Act also requires motorists to carry a minimum level of insurance liability coverage. This includes:

- $25,000 per person and $50,000 per accident for third-party liability and property damage liability.

- $25,000 per person and $50,000 per accident for uninsured motorist bodily injury.

- $5,000 subject to a $200 deductible for uninsured motorist property damage.

Valid proof of insurance must be shown when registering or renewing a vehicle registration. If insurance is terminated, vehicle tags and registration must be returned or surrendered to the DC DMV immediately. Failure to do so will result in fines and penalties.

The Act also requires insurance companies to notify the DC DMV of any insurance cancellations or terminations. When this happens, the DC DMV sends the vehicle owner an insurance verification notice, allowing them to provide proof of insurance.

If a vehicle owner fails to maintain continuous, valid insurance, their DC DMV vehicle registration or reciprocity sticker will be suspended, and they will be fined.

Auto Body Shop Secrets: Reporting to Insurance Companies

You may want to see also

Insurance options for making a claim after an accident

In Washington, D.C., motorists are required to have vehicle insurance and to be able to show proof of insurance when stopped by the police. The District of Columbia's Compulsory/No-Fault Motor Vehicle Insurance Act requires every person applying for vehicle registration to have valid D.C. vehicle insurance.

If you've been in an accident, you'll want to file a police report and an insurance accident claim with your insurer and the insurer of the responsible party as soon as possible. Here are some insurance options for making a claim after a vehicle accident:

First-Party Claim

A first-party claim is filed with your insurance company. For example, if you caused an auto accident while driving, you should file a first-party claim with your auto insurance provider.

Third-Party Claim

A third-party claim is filed with the insurance provider of another person or business. For instance, if you were hit by a car while crossing the street or were involved in an accident as a passenger in someone else's car, you should file a third-party claim with the driver's auto insurance provider. Even if you weren't at fault, it is helpful to notify your insurance company as well.

No-Fault Insurance Claim

In a no-fault insurance system, if you're injured in an auto accident, you must first file a claim against your own auto insurance. Your "personal injury protection (PIP) insurance" covers your medical bills and lost wages up to the limits of your coverage, regardless of who caused the accident. The disadvantage of a no-fault system is that you can't bring a claim against the at-fault driver for injuries like pain and suffering unless your injuries meet a specified severity threshold.

D.C. has a unique no-fault system where your auto insurer must offer you the option to buy no-fault PIP coverage. If you bought PIP coverage and are hurt in an accident, you have 60 days to choose between filing a claim for PIP benefits or filing a claim against the at-fault driver's liability insurance.

Underinsured Motorist Coverage

If the driver who caused the accident doesn't have enough insurance to cover the injuries they caused, you could sue them for the remainder. However, if they don't have any assets, it may not be worth it. In this case, you could turn to your own underinsured motorist coverage, if you have it, to cover your medical bills.

Collision Insurance

If you have collision insurance, you can use it to cover car damage caused by someone else. However, your insurance check will be reduced by your collision deductible amount. You may get this amount back later if your insurance company pursues reimbursement from the other person's insurer.

Gap Insurance

If your vehicle is totaled in an accident, insurance should compensate you for the value of the car at the time of the accident. However, if you owe more on a car loan or lease than the car is worth, gap insurance can provide the difference between the insurance payment and the loan/lease balance.

Auto Insurance: Understanding Additional Driver Coverage

You may want to see also

Frequently asked questions

Yes, it is illegal to drive without insurance in Washington, DC.

The minimum insurance requirements in Washington, DC, include bodily injury to others, property damage liability, uninsured bodily injury liability, and uninsured property damage liability. The specific limits for each category are outlined in the District of Columbia's Compulsory/No-Fault Motor Vehicle Insurance Act.

If you fail to maintain continuous insurance coverage on a registered vehicle in Washington, DC, your vehicle registration or reciprocity sticker will be suspended, and you will be subject to fines that increase over time.

While some insurance companies offer "storage coverage" or "car storage insurance" for vehicles not in use for an extended period, you typically cannot pause or suspend your auto insurance coverage. Cancelling your coverage altogether is also not recommended as it can lead to increased premiums and create issues when purchasing insurance in the future. Instead, consider reducing your coverage to the minimum required or opting for a car storage insurance policy.

Car storage insurance, also known as comprehensive-only coverage, is a type of insurance for vehicles that are stored or parked for an extended period. It covers repair or replacement costs for damages caused by events such as theft, natural disasters, fire, or vandalism while your car is in storage. It does not include liability, collision, or uninsured motorist coverage, so you won't be insured if you drive your vehicle during the policy period.