Health insurance is not mandatory at the federal level for adults. However, a handful of states have instituted a health insurance coverage mandate, and most carry a penalty for not doing so. For instance, California, Massachusetts, New Jersey, Rhode Island, and Washington, D.C. require insurance or pay a penalty. Vermont's mandate does not include a penalty for noncompliance.

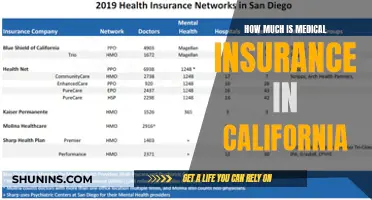

| Characteristics | Values |

|---|---|

| Health Insurance Requirement | Not mandatory at the federal level |

| Penalty for Not Having Insurance | Up to $695 per uninsured adult or 2.5% of their household income |

| States with Health Insurance Mandates | California, Massachusetts, New Jersey, Rhode Island, Washington, D.C. |

| Penalty in States with Mandates | Most carry a penalty for noncompliance |

| Vermont's Mandate | Does not include a penalty for noncompliance |

| Impact of Not Having Insurance | Can have a serious impact on your finances |

| Health Insurance Importance | Protects your health and finances in the event of unexpected medical expenses |

What You'll Learn

- Health insurance is not mandatory at the federal level for adults

- Certain states have health insurance mandates to encourage coverage

- Health insurance offers financial security and access to essential care

- The Affordable Care Act required all eligible Americans to have health coverage

- Health insurance can help avoid medical debt and protect your financial future

Health insurance is not mandatory at the federal level for adults

California, Massachusetts, New Jersey, Rhode Island, and Washington, D.C. are among the states that require insurance or impose penalties. Vermont's mandate, however, does not include a penalty for non-compliance.

The Affordable Care Act (Obamacare) made health insurance more accessible for those who couldn't afford it or didn't qualify for Medicaid. It also required all eligible Americans to have health coverage, with a penalty for those who went without insurance for more than two months consecutively.

In 2017, Congress passed the Tax Cuts and Jobs Act, reducing the penalty to zero dollars, which took effect in 2019. This act maintained the requirement for health insurance but eliminated the financial penalty for non-compliance.

Having health insurance is important for financial security and access to essential medical care. It provides peace of mind, ensures timely medical attention, and protects against unexpected expenses. While not mandatory federally, health insurance is crucial for managing healthcare costs and protecting one's health and finances.

Depression Treatment: Access Medication Without Insurance: Tips and Resources

You may want to see also

Certain states have health insurance mandates to encourage coverage

Health insurance is not mandatory at the federal level for adults. However, a handful of states have instituted a health insurance coverage mandate, and most carry a penalty for not doing so. If you live in California, Massachusetts, New Jersey, Rhode Island, or Washington, D.C., you must have insurance or pay a penalty. Vermont’s mandate does not include a penalty for noncompliance.

Health insurance is crucial because it provides financial security and access to essential medical care, helping individuals and families manage healthcare costs. It offers peace of mind, ensures timely medical attention, and safeguards against unexpected, potentially overwhelming expenses, promoting overall well-being.

The federal government no longer requires individuals to have health insurance. However, health insurance is still required, and the penalty was reduced to zero dollars in 2019. The Affordable Care Act (commonly known as Obamacare) was passed in 2010, making health insurance more accessible for people who can’t afford health insurance and don’t qualify for Medicaid. It also required all eligible Americans to have health coverage.

Having health insurance can give you peace of mind, help you avoid medical debt and protect your financial future. Whether it’s something planned (like the birth of a child) or something unexpected (like a serious accident or illness), your health plan makes health care more affordable and protects you from catastrophic financial loss.

Understanding Medical Insurance: Qualifying Life Events Explained

You may want to see also

Health insurance offers financial security and access to essential care

Health insurance is not mandatory at the federal level for adults, although certain states have health insurance mandates to encourage coverage. The federal government no longer requires individuals to have health insurance, but a handful of states have instituted a health insurance coverage mandate, and most carry a penalty for not doing so.

Health insurance offers financial security and access to essential medical care, helping individuals and families manage healthcare costs. It provides peace of mind, ensures timely medical attention, and safeguards against unexpected, potentially overwhelming expenses, promoting overall well-being.

Health insurance can give you peace of mind, help you avoid medical debt and protect your financial future. When someone accidentally bangs up your bumper at a stop sign, car insurance helps cover the cost so you don’t have to take on the full financial burden yourself. The same is true for health insurance. Whether it’s something planned (like the birth of a child) or something unexpected (like a serious accident or illness), your health plan makes health care more affordable and protects you from catastrophic financial loss.

After the Affordable Care Act (commonly known as Obamacare) was passed in 2010, it made health insurance more accessible for people who can’t afford health insurance and don’t qualify for Medicaid. It also required all eligible Americans to have health coverage. If you went without health insurance for more than two months back-to-back, you would receive a tax penalty. This requirement was known as the individual mandate. But in 2017, Congress passed the Tax Cuts and Jobs Act. While having health insurance was still required, the penalty was reduced to zero dollars. This took effect in 2019.

Each state has different guidelines with regard to the income and asset thresholds allowed for eligibility for Medicaid coverage. Most Americans with health insurance plans through their employers or a government program, like Medicare and Medicaid, could satisfy the individual mandate. But, those who didn’t have health insurance had to purchase a plan on the individual market or qualify for a government health program to avoid the penalty unless they qualified for an exemption. The penalty for not having health coverage was up to $695 per uninsured adult or 2.5% of their household income, with the IRS accessing the greater penalty of the two. The government then created a cap so that the maximum penalty amount would be the annual, national average cost of a bronze-tier health plan.

Unveiling the Medical Exam Requirement: Life Insurance Companies' Perspective

You may want to see also

The Affordable Care Act required all eligible Americans to have health coverage

The Affordable Care Act, commonly known as Obamacare, was passed in 2010 and made health insurance more accessible for people who can’t afford health insurance and don’t qualify for Medicaid. It also required all eligible Americans to have health coverage. If you went without health insurance for more than two months back-to-back, you would receive a tax penalty. This requirement was known as the individual mandate.

The penalty for not having health coverage was up to $695 per uninsured adult or 2.5% of their household income, with the IRS accessing the greater penalty of the two. The government then created a cap so that the maximum penalty amount would be the annual, national average cost of a bronze-tier health plan.

Health insurance is not mandatory at the federal level for adults. While there is no federal requirement for adults to have health insurance, it’s essential to consider the importance of having coverage to protect your health and finances in the event of unexpected medical expenses.

Certain states have health insurance mandates to encourage health insurance coverage. If you live in California, Massachusetts, New Jersey, Rhode Island, or Washington, D.C., you must have insurance or pay a penalty. Vermont’s mandate does not include a penalty for noncompliance.

Having health insurance can give you peace of mind, help you avoid medical debt and protect your financial future. Whether it’s something planned (like the birth of a child) or something unexpected (like a serious accident or illness), your health plan makes health care more affordable and protects you from catastrophic financial loss.

Medical Insurance Reimbursement: Taxable Benefits or Tax-Free Perks?

You may want to see also

Health insurance can help avoid medical debt and protect your financial future

Health insurance is not mandatory at the federal level for adults. While there is no federal requirement for adults to have health insurance, it’s essential to consider the importance of having coverage to protect your health and finances in the event of unexpected medical expenses. Certain states have health insurance mandates to encourage health insurance coverage.

Having health insurance can give you peace of mind, help you avoid medical debt and protect your financial future. When someone accidentsally bangs up your bumper at a stop sign, car insurance helps cover the cost so you don’t have to take on the full financial burden yourself. The same is true for health insurance. Whether it’s something planned (like the birth of a child) or something unexpected (like a serious accident or illness), your health plan makes health care more affordable and protects you from catastrophic financial loss.

After the Affordable Care Act (commonly known as Obamacare) was passed in 2010, it made health insurance more accessible for people who can’t afford health insurance and don’t qualify for Medicaid. It also required all eligible Americans to have health coverage. If you went without health insurance for more than two months back-to-back, you would receive a tax penalty. This requirement was known as the individual mandate. But in 2017, Congress passed the Tax Cuts and Jobs Act. While having health insurance was still required, the penalty was reduced to zero dollars. This took effect in 2019.

Each state has different guidelines with regard to the income and asset thresholds allowed for eligibility for Medicaid coverage. The federal government no longer requires individuals to have health insurance. However, a handful of states have instituted a health insurance coverage mandate, and most carry a penalty for not doing so. If you live in California, Massachusetts, New Jersey, Rhode Island, or Washington, D.C., you must have insurance or pay a penalty. Vermont’s mandate does not include a penalty for noncompliance.

Most Americans with health insurance plans through their employers or a government program, like Medicare and Medicaid, could satisfy the individual mandate. But, those who didn’t have health insurance had to purchase a plan on the individual market or qualify for a government health program to avoid the penalty unless they qualified for an exemption. The penalty for not having health coverage was up to $695 per uninsured adult or 2.5% of their household income, with the IRS accessing the greater penalty of the two. The government then created a cap so that the maximum penalty amount would be the annual, national average cost of a bronze-tier health plan.

Allstate's Medical Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

No, medical insurance is not mandatory at the federal level for adults. However, a handful of states have instituted a health insurance coverage mandate, and most carry a penalty for not doing so.

Medical insurance provides financial security and access to essential medical care. It offers peace of mind, ensures timely medical attention, and safeguards against unexpected, potentially overwhelming expenses.

Yes, there are penalties for not having medical insurance. The penalty for not having health coverage was up to $695 per uninsured adult or 2.5% of their household income.

Yes, it's important to have health insurance, even if you are young and in good health, because accidents and unexpected illnesses can have a serious impact on your finances.

The Affordable Care Act, commonly known as Obamacare, was passed in 2010 and made health insurance more accessible for people who can’t afford health insurance and don’t qualify for Medicaid.