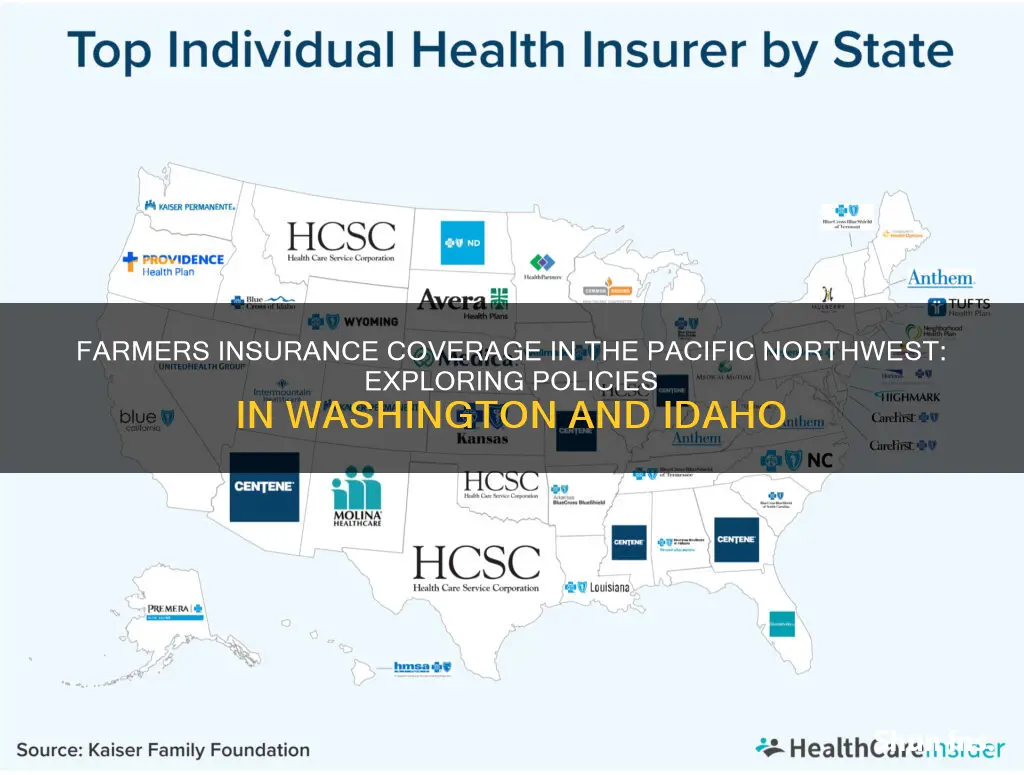

Farmers Insurance offers auto, home, and other types of insurance across the United States, including in Washington and Idaho. In Washington, Farmers Insurance offers car insurance and home insurance. Car insurance in Washington includes coverage for bodily injury and property damage liability, as well as optional collision and comprehensive coverage. Home insurance in Washington typically includes coverage for damage to the home from events such as fire, wind, lightning, or hail, as well as coverage for other structures, personal property, and additional living expenses in the event the home is uninhabitable. In Idaho, Farmers Insurance offers car insurance with coverage options designed for how you drive, including liability, collision, and comprehensive coverage.

| Characteristics | Values |

|---|---|

| Insurance Types | Auto, Home |

| States Covered | Washington, Idaho |

| Auto Insurance Requirements | Minimum liability coverage |

| Home Insurance Requirements | Not mandatory, but may be required by mortgage lenders |

| Discounts | Available in both states |

What You'll Learn

Car insurance in Washington

The average cost of car insurance in Washington is $1,574 per year for full coverage and $493 per year for minimum coverage, which is lower than the national average. However, rates can vary depending on individual factors such as age, driving history, vehicle type, and credit score.

When choosing a car insurance company in Washington, it is important to compare rates and coverage options from multiple providers. Some of the top-rated companies in the state include Geico, USAA, State Farm, Travelers, and Farmers. These companies offer competitive rates, strong customer satisfaction, and a range of coverage options.

It is worth noting that car insurance rates in Washington have been increasing. Since 2022, rates have gone up by 18% according to the Washington State Office of the Insurance Commissioner. This trend is likely to continue, so it is advisable for drivers to review their coverage and rates regularly to ensure they are getting the best value.

In summary, car insurance in Washington is mandatory and offers financial protection in the event of an accident. Rates vary based on individual factors, and it is important to compare options from multiple providers to find the best coverage at a competitive price.

The Future of Farmers' Livelihoods: AJ Farmers Union Insurance in Billings, MT

You may want to see also

Home insurance in Washington

Farmers Insurance is one of the companies that offer home insurance in Washington. With Farmers, you can choose quality coverage for your Washington lifestyle and take advantage of various savings opportunities. Their Smart Plan Home® policy allows you to customise your policy to suit your dwelling type and lifestyle.

When it comes to choosing a home insurance company in Washington, it is important to compare quotes from multiple insurers and consider the coverage options, discounts, and customer service that each company provides. Some of the top-rated home insurance companies in Washington include USAA, Chubb, Nationwide, Allstate, and State Farm. These companies offer competitive rates, excellent customer service, and a wide range of coverage options and discounts.

Unraveling the Mystery: Examining the Truth Behind Farmers' Insurance Stories

You may want to see also

Car insurance in Idaho

Farmers Insurance offers auto insurance in Idaho. A car insurance policy with a minimum amount of liability coverage is required in Idaho, as it is in almost all states. As of March 2023, the minimum liability coverage limits in Idaho are:

- Bodily injury liability: $25,000 per person; $50,000 per accident

- Property damage liability: $15,000 per accident

A typical car insurance policy in Idaho includes coverage for bodily injury and property damage liability, as well as optional collision and comprehensive coverage in case of covered damage or theft. Farmers Insurance also offers optional rental or rental alternative coverage, vehicle replacement, enhanced roadside and ride assistance, and other coverages.

The average cost of car insurance in Idaho is $1,338 per year, according to thezebra.com. However, Idaho drivers paid an average of $832 a year for full coverage in 2020, according to the National Association of Insurance Commissioners (NAIC). It's important to note that insurance premiums have likely changed since then. The cost of car insurance in Idaho will also depend on factors such as the amount of coverage, driving history, and the type of car.

When shopping for car insurance in Idaho, it's essential to consider your individual needs and compare quotes from multiple companies. Additionally, it's important to ensure that you meet the minimum insurance requirements in Idaho and any additional requirements from your lender or lessor if you're financing or leasing your vehicle.

Farmers Insurance Takes Flight: Exploring Aircraft Insurance Options

You may want to see also

Home insurance in Idaho

When choosing a home insurance policy in Idaho, it is important to consider the specific risks in the state. Idaho is at high risk for wildfires and earthquakes, and flooding is also a common problem. Standard home insurance policies typically do not cover damage from these perils, so it is important to purchase additional coverage if you live in an area that is prone to these disasters.

Several companies offer home insurance in Idaho, including Farmers, USAA, Allstate, Travelers, State Farm, American Family, Mutual of Enumclaw, Liberty Mutual, and Nationwide. When choosing a company and policy, it is important to compare rates, coverage options, and discounts to find the best value for your needs.

Roadside Rescue: Exploring Farmers Insurance's Take on Roadside Assistance

You may want to see also

Farmers Insurance products by state

Farmers Insurance offers a range of insurance products that vary by state. In Washington, Farmers Insurance provides auto and home insurance. The auto insurance policy, known as the Farmers Smart Plan Auto, offers coverage options tailored to individuals' driving needs. It includes liability, collision, and comprehensive coverage, with average annual costs of $1,115 for full coverage as of 2020. Washington state law mandates a minimum amount of liability coverage, with specific limits. Home insurance in Washington is not legally required but is often necessary to secure a home loan. The Farmers Smart Plan Home® allows customers to customize their coverage, including protection for their dwelling, personal property, and additional living expenses in the event their home becomes uninhabitable.

In Idaho, Farmers Insurance offers auto insurance through the Farmers FlexSM Personal Auto policy. This policy provides new coverage options and discounts for drivers. As of 2020, the average annual cost of full coverage in Idaho was $832. Similar to Washington, Idaho requires a minimum amount of liability coverage for all drivers. Home insurance is also available in Idaho, although specific details on coverage options and discounts are not provided on the website.

Farmers Insurance invites potential customers to learn more about their insurance requirements and explore available products and discounts by selecting their state on the website. In addition to auto and home insurance, Farmers Insurance also offers life insurance and renters insurance across the United States.

Farmers Insurance Military Discounts: Unraveling the Benefits for Service Members

You may want to see also

Frequently asked questions

Yes, Farmers Insurance offers auto, home insurance, and more across the U.S., including Washington and Idaho.

A typical car insurance policy in both states includes coverage for bodily injury and property damage liability. There is also optional collision and comprehensive coverage in case of covered damage or theft.

In 2020, Washington drivers paid an average of $1,115 a year for full coverage, while Idaho drivers paid an average of $832. Please note that insurance premiums in most states have likely changed since then.