Gerber Life Insurance offers whole life insurance policies that build cash value over time. After the initial policy years, each time a premium payment is made, Gerber Life sets aside a small amount of money, which grows over time and becomes the policy's accumulated cash value. This money can be borrowed against or used to pay premiums. The longer the policy is held, the more cash value it accumulates.

| Characteristics | Values |

|---|---|

| What is the "cash value"? | After the initial policy years, each time you make a premium payment, the insurance company sets aside a small portion, which grows over time. This is the policy's accumulated cash value. |

| How can I benefit from the cash value of a whole life policy? | The cash value of a whole life policy can be used in several ways and could help during life's ups and downs. |

| How much is the cash value? | How much it can grow depends on how long you've owned the policy, your age when you bought the policy, the policy's coverage amount, and whether there's any outstanding debt from loans against the policy. |

| Who can access the cash value? | As a policy owner, you can access the available cash value of your whole life insurance policy at any time. |

| How can you use the cash value in your policy? | Borrow against it, temporarily use it to pay your premiums, let it accumulate until you need it, or turn in your policy and get it all. |

What You'll Learn

Gerber Life Grow-Up® Plan

The Grow-Up® Plan is a cost-effective way to ensure your child has life insurance protection from an early age. The rates are based on your child's age and are guaranteed never to increase during the life of the policy, so it is more affordable to purchase coverage for a younger child. For example, a $10,000 policy for a healthy child under one year old costs approximately $6.35 per month. The plan allows you to purchase a wide range of coverage for your child, with options ranging from $5,000 to $50,000.

One of the key benefits of the Grow-Up® Plan is that the coverage amount doubles when your child turns 18 years old, with no increase in the premium. This means that a $10,000 life insurance policy would double to $20,000, and a $15,000 policy would increase to $30,000, providing even greater value for your money.

The Grow-Up® Plan is a whole life insurance policy, which means it provides permanent coverage for your child's entire life, as long as the premiums are paid. It also guarantees your child the option to purchase additional life insurance coverage as an adult, regardless of their future health or occupation. This is especially valuable if your child develops a serious illness or chooses a hazardous occupation, as they may be priced out of life insurance otherwise.

The cash value of the Grow-Up® Plan works as follows: after the initial policy years, each time you make a monthly premium payment, Gerber Life sets aside a small portion of that money. Over time, this accumulates and becomes the cash value of your policy. This cash value can be borrowed against if you need immediate cash, or it can be left to grow and provide a nest egg for your child in the future. If you decide to cancel the policy, you will receive the accumulated cash value minus any outstanding debt.

In summary, the Gerber Life Grow-Up® Plan is a valuable tool for parents and grandparents who want to provide financial protection and security for their children or grandchildren. It offers affordable, lifelong insurance coverage that builds cash value over time, providing flexibility and peace of mind.

Fidelity's Ladder Life Insurance: What You Need to Know

You may want to see also

Borrowing against cash value

Borrowing against the cash value of your life insurance policy can be a quick and easy way to get cash in hand when you need it. However, it's important to understand the risks and implications before making a decision. Here are some key points to consider:

Understanding Cash Value

Gerber Life Insurance offers both whole life insurance and term life insurance. Whole life insurance policies, including the Gerber Life Grow-Up® Plan, accumulate cash value over time. After the initial policy years, each time you make a premium payment, Gerber Life sets aside a small portion of that money. This money grows over time and becomes the policy's cash value. The longer you hold the policy and consistently make payments, the larger the cash value.

Borrowing Options

As a policy owner, you have the option to borrow against this cash value. Gerber Life allows policyowners to borrow against the cash value by taking a policy loan with an interest rate of 8%. This gives you access to immediate cash without sacrificing your life insurance protection. It's important to note that loans may impact the cash value and death benefit of your policy.

Weighing the Benefits

Borrowing against your policy's cash value has several advantages. There is usually no approval process, credit check, or strict repayment schedule associated with these types of loans. The interest rates are typically lower than those for personal loans or credit cards, and the loan does not affect your credit score. Additionally, you can use the money for any purpose without restriction.

Managing Risks

While borrowing against your life insurance policy can provide quick access to funds, it's important to be aware of the potential risks. If you pass away before repaying the loan, the outstanding loan balance and any interest owed will be deducted from the death benefit that your beneficiaries receive. This will result in a lower payout for your loved ones.

Another risk to consider is the possibility of policy lapse. If you fail to make regular interest payments, the interest will accumulate and may eventually exceed the cash value of your policy. This could cause your policy to lapse, leaving you without insurance coverage. In such cases, you may also owe income tax on the amount you borrowed.

Important Considerations

Before deciding to borrow against your life insurance policy, carefully review the terms and conditions of your policy. Understand the minimum cash value required to borrow, the interest rates, and any repayment terms. Additionally, consider discussing your options with a financial advisor or estate planning attorney to fully grasp the tax implications and potential impact on your beneficiaries.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

Surrendering the policy

Surrendering your Gerber Life Insurance policy means cancelling it and receiving the accumulated cash value that has built up over time, minus any outstanding debt against the policy. This is true whether you are cancelling a policy for yourself or your child.

If you are the policy owner, you can access the available cash value of your whole life insurance policy at any time. However, if you are thinking of surrendering your policy, it is important to note that the longer you hold the policy, the larger the cash value. This is because, after the initial policy years, each time you make a premium payment, Gerber Life sets aside a small portion of that money, which grows over time.

If you are thinking of surrendering your child's Grow-Up® Plan, it is important to note that you are the policy owner until your child reaches the age of 21. At that time, your child becomes the policy owner and has the option to surrender the policy and receive the available cash value.

If you are considering surrendering your Gerber Life Insurance policy, you can contact Gerber Life and one of their representatives will be happy to assist you.

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

Whole life insurance vs term life insurance

Gerber Life Insurance offers both term life insurance and whole life insurance. Term life insurance is more affordable but only lasts for a set period, whereas whole life insurance tends to have higher premiums but never expires. Here is a detailed comparison of the two types of insurance:

Coverage Length

Whole life insurance provides coverage for the entire life of the policyholder, as long as premiums are paid. On the other hand, term life insurance offers coverage for a specific period, typically between 10 and 30 years, which can be chosen based on the policyholder's unique situation.

Cost

Whole life insurance usually has higher premiums than term life insurance. Whole life insurance is more expensive because it serves as an investment and accumulates cash value over time. Term life insurance, on the other hand, is more affordable because there is only a payout if the policyholder passes away during the specified term.

Cash Value

Whole life insurance has a cash value component that grows over time, tax-free, and can be borrowed against or withdrawn. Term life insurance, however, does not accumulate cash value like an investment account.

Complexity

Whole life insurance coverage is more complex than term life insurance. The death benefit amount in whole life insurance can change if there is an outstanding loan against the policy's cash value. Term life insurance coverage is straightforward, with fixed premiums and a death benefit.

Pros and Cons

Whole life insurance offers the advantage of lifelong coverage and the ability to build cash value. However, it is typically more expensive and may be more complex. Term life insurance, on the other hand, is more affordable, simpler, and customizable, but it has an expiration date and does not include a cash value feature.

Life Insurance: Empire Records' Employee Benefits Explored

You may want to see also

Policy loan interest rate

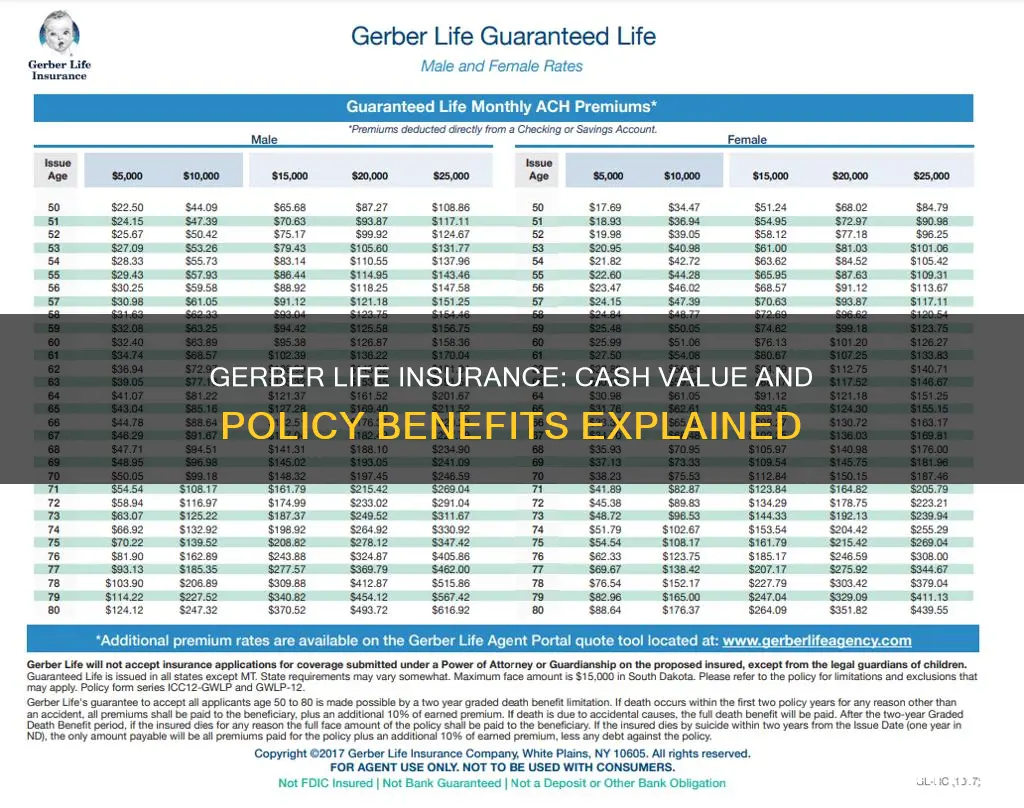

Gerber Life Insurance offers a range of insurance products with cash value benefits. The interest rate on policy loans is 8% and may impact the cash value and death benefit. This rate is applicable across all Gerber Life Insurance products, including the Grow-Up® Plan, Whole Life Insurance, and Guaranteed Life Insurance.

Gerber Life Grow-Up® Plan

The Grow-Up® Plan is a whole life insurance policy designed for children, offering lifelong coverage as long as premiums are paid. It provides financial protection that can last into adulthood. One of the benefits of this plan is the ability to build cash value over time. After the initial policy years, each premium payment contributes a small amount towards the policy's cash value. This cash value can be borrowed against to meet immediate financial needs without sacrificing the life insurance protection. The policyowner, either the parent or the child once they reach adulthood, has access to the cash value at any time.

Gerber Life Whole Life Insurance

Gerber Life Whole Life Insurance is a permanent life insurance policy that provides coverage for the entire life of the policyholder, as long as premiums are paid. It offers financial protection for individuals and their families, along with the ability to build cash value. Similar to the Grow-Up® Plan, a portion of each premium payment is set aside to accumulate cash value. This cash value can be borrowed against to cover unexpected expenses or used to pay premiums. The policyowner has the flexibility to choose how to utilize the cash value.

Gerber Life Guaranteed Life Insurance

Gerber Life Guaranteed Life Insurance is a whole life insurance policy designed for adults aged 50 and above, offering guaranteed acceptance regardless of health. This policy also builds cash value, which can be borrowed against to manage unexpected expenses. The cash value accumulates over time, and the longer the policy is held, the greater the cash value becomes. The policyowner has the option to borrow against the cash value or surrender the policy to receive the accumulated amount.

Epilepsy and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

After the initial policy years, each time you make a premium payment, the insurance company sets aside a small portion, which grows over time. This is the policy's accumulated cash value.

The cash value of Gerber Life Insurance can be used in several ways. For example, you can borrow against it, turn in the policy and receive the cash value, or use it to pay your premiums.

The amount of cash value in a Gerber Life Insurance policy depends on how long you've owned the policy, your age when you bought the policy, the policy's coverage amount, and whether there's any outstanding debt from loans against the policy.