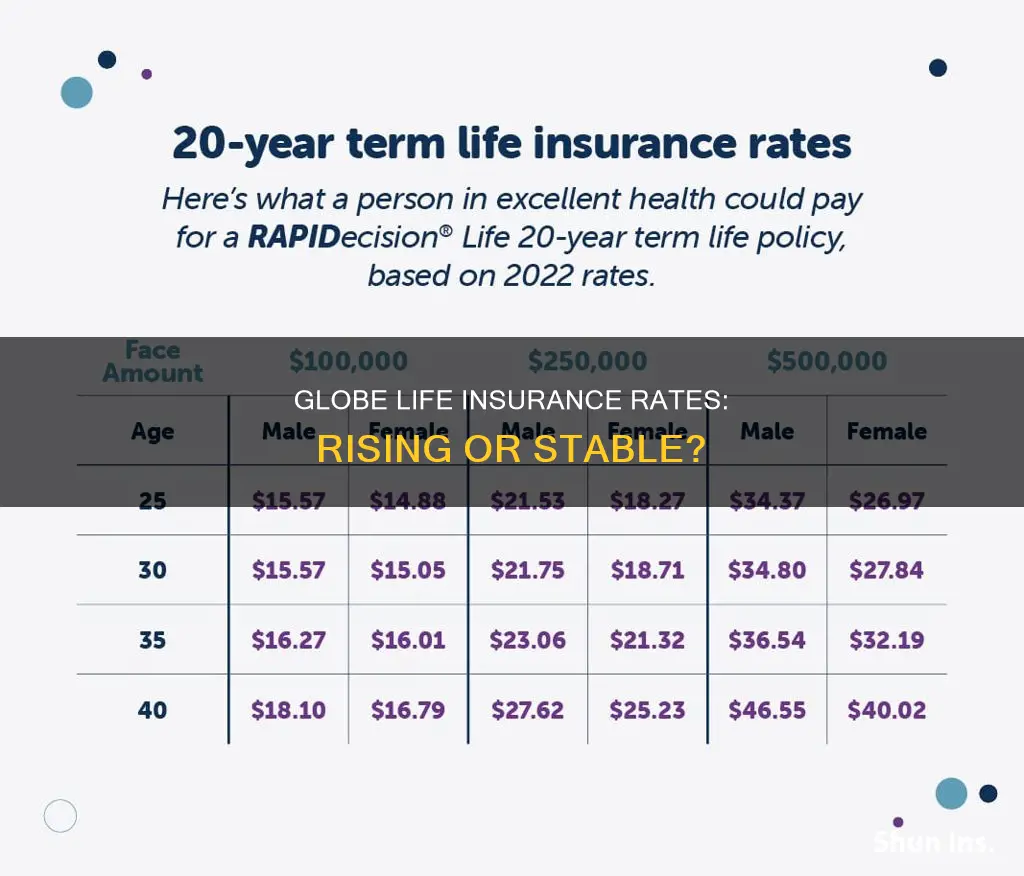

Globe Life Insurance offers both term and whole life insurance policies. The company's term life insurance rates are based on the policyholder's gender, age, and state. While the rates are low initially, they increase as the policyholder enters each five-year age bracket. Whole life insurance rates, on the other hand, are locked in at the time the policy is issued and remain the same for life.

| Characteristics | Values |

|---|---|

| Initial rates | Low |

| Renewal rates | High |

| Renewal frequency | Every 5 years |

| Medical exam required | No |

| Application process | Online, phone, mail |

| Customer satisfaction | Low |

What You'll Learn

Globe Life's rates for term life insurance

Globe Life offers term life insurance policies with rates that vary depending on several factors, including age, health, occupation, habits, and military status. The company advertises that its term life insurance rates start at $3.49 per month for adults, but the actual rates may differ based on individual circumstances.

Term life insurance provides coverage for a specific period, typically ranging from one to 30 years. These policies are often purchased to provide financial protection during significant life events, such as buying a new house, getting married, or starting a family. One of the advantages of term life insurance is its flexibility, as policyholders have the option to renew, cancel, or convert the policy to permanent coverage upon expiration.

Globe Life's term life insurance rates are designed to be affordable, with the company promising $50,000 worth of coverage for just a few dollars a month. The rates are available for less than $2 per month, and the policies do not require a medical exam, making them accessible to a wide range of individuals.

However, it is important to note that Globe Life's term life insurance rates are subject to change over time. When a term life insurance policy expires, individuals have the option to renew it, but the rates will generally be higher due to the increase in age. As a result, rates may increase every ten years or so.

Additionally, Globe Life's term life insurance policies are considered final expense insurance, which means their payouts are designed to cover end-of-life costs rather than provide comprehensive income replacement. The coverage amounts offered range from $5,000 to $100,000, with rates increasing with each renewal.

In summary, Globe Life's term life insurance rates offer affordable coverage starting at $3.49 per month for adults, but the rates may vary and are subject to increase upon renewal. The company provides flexible options for individuals seeking financial protection during specific periods of their lives, making it a viable choice for those looking for budget-friendly insurance options.

Life Insurance and Suicide: What Families Need to Know

You may want to see also

Globe Life's rates for whole life insurance

Globe Life's whole life insurance rates are based on the customer's age and remain the same for life. The rate is locked in when the policy is issued.

For adults, $1 buys $50,000 of whole life insurance for the first month. After that, the rates are based on the customer's age and remain the same for life. The rates start from less than $2 per month and go up to almost $400 per month, depending on the customer's age. For example, for a $30,000 policy, a customer can expect to pay between $10/month and over $200/month.

For children, whole life insurance is available and can be a beneficial investment for their future. The policy grows in cash value over time, and the child can cash it out once they reach adulthood.

It is important to note that Globe Life's whole life insurance is not available in New York. The company offers whole life insurance for adults and children in all other states.

Drunk Driving and Life Insurance: What's the Verdict?

You may want to see also

Globe Life's rates for children's life insurance

Globe Life offers whole life insurance policies for children, which are available at a starting rate of $1 for the first month and $2.17 per month thereafter. The monthly rate is based on the child's age and will remain the same throughout their life. The company's whole life insurance policies for children have a maximum coverage of $30,000, although some sources state that coverage can go up to $50,000.

The application process for Globe Life's children's life insurance does not include a medical exam, and applicants are not required to furnish copies of their medical records. However, applicants must answer a few health-related questions. Coverage begins as soon as the first payment is made, and the policy builds cash value over time.

Compared to other children's life insurance providers, such as Mutual of Omaha and Gerber Life, Globe Life's rates are competitive, but their coverage maximum is lower. Additionally, Globe Life does not offer any free add-on riders, and the company has received a higher number of customer complaints.

Elon Musk's Life Insurance: Does He Need It?

You may want to see also

Globe Life's rates for final expense insurance

Final expense insurance, also known as burial insurance, is a type of life insurance that is specifically designed to cover outstanding expenses and funeral costs after a loved one passes away. Unlike pre-paid funeral plans, final expense insurance can be used by the beneficiary as and where needed, rather than being limited to specific funeral services and providers.

Globe Life offers final expense insurance with no medical exam. This means that, while you won't have to undergo a medical exam, you will have to answer questions about your health during the application process. The death benefits are limited, but this can be sufficient if you're looking for final expense or funeral coverage.

Funeral costs typically reach about $10,000; Globe Life offers payouts between $5,000 and $50,000, mostly in increments of $10,000. You pay $1 for the first month, and after that, your rates won't change for the duration of the policy. However, because you aren't required to get a medical exam, your rates as a healthy person will be significantly higher than if you purchased a policy from an insurer with full underwriting. This means that no-medical-exam whole life insurance is only a good option if you know a medical exam would disqualify you from coverage with another insurer.

In New York, Globe Life's whole life insurance payouts are more limited. They range from $1,000 to $25,000, depending on your age and gender.

Globe Life's term life insurance also has no medical exam and offers a limited set of death benefits. You can purchase coverage of $5,000, $10,000, $20,000, $30,000, $50,000, $75,000 or $100,000. While Globe Life advertises that its premiums stay level for the entire policy term, you can only get coverage for a maximum of five years. Globe Life puts policyholders into five-year-long age brackets; once your initial term ends, you move into a new age bracket, and each time you renew, your rates increase.

Before getting term life insurance from Globe Life, ask about age restrictions. The company only offers coverage through a certain age, typically 80 or 90. Several consumers have complained that they paid for policies but once they lived past 80, they discovered they no longer had coverage. You also need to pay attention to coverage limits. Globe Life only offers coverage up to $50,000 in New York and to customers over the age of 50.

Genworth Life Insurance: What You Need to Know

You may want to see also

Globe Life's rates for accidental death insurance

Globe Life offers a range of insurance products, including term life insurance, whole life insurance, and accidental death insurance. Accidental death insurance is a type of policy that provides financial protection in the event of an accidental death or loss. This can include deaths resulting from car crashes, choking incidents, or other types of accidents. While Globe Life does not offer any riders, including accidental death insurance, it does provide accidental death coverage as a separate insurance product.

The rates for Globe Life's accidental death insurance are quite competitive. For just $1 for the first month, you can get up to $250,000 in accidental death coverage. After the initial month, the rates remain locked in for the life of the policy and will never increase. This means that you can have peace of mind knowing that your coverage will not change, regardless of your age or any other factors.

In addition to the base coverage, Globe Life's accidental death insurance includes several additional features at no extra cost. These features provide benefits for specific situations, such as an education benefit for dependent children, a seat belt benefit for accidents while wearing a seat belt, a common disaster benefit for accidents involving the insured and their spouse, and dismemberment and paralysis benefits for loss of mobility.

It's important to note that accidental death insurance has limitations on the instances in which claims can be made. As the name suggests, it only covers accidental deaths and not deaths resulting from illnesses or medical conditions. According to statistics, accidents accounted for only a small percentage of deaths in recent years. Therefore, while the rates may seem attractive, it's important to consider the limited scope of coverage offered by accidental death insurance.

Overall, Globe Life's accidental death insurance can be a good option for individuals or families seeking additional financial protection in the event of an accident. The guaranteed acceptance for individuals between the ages of 18 and 69, regardless of health, makes it an accessible choice. However, it's always recommended to carefully review the terms and conditions of any insurance policy before making a decision.

Does Globe Life Insurance Offer Cash Value Benefits?

You may want to see also

Frequently asked questions

No, Globe Life only offers whole life insurance for children.

The first month of Globe Life insurance coverage costs $1, and after that, your rate is based on your age.

Globe Life doesn't require a medical exam, but underwriters will look at your health history when determining your rate and whether you qualify.

Yes, Globe Life offers term life insurance with rates starting at $3.49 per month for adults.