Adding multiple drivers to a single insurance policy can increase your premium, but it won't necessarily have a negative impact. In fact, it's often cheaper than buying separate policies for each driver. The increase in premium reflects the additional risk of having multiple drivers use one vehicle. However, a multiple-driver policy is usually more cost-effective than purchasing individual auto insurance policies.

Most insurers allow up to four drivers and four vehicles on a single policy. Non-resident drivers who don't live in the same household can also be added to the policy. If one of the drivers has a poor driving record, it's possible to name them as an excluded driver, but any accidents they cause won't be covered by the insurance company.

| Characteristics | Values |

|---|---|

| Can multiple drivers share a car insurance policy? | Yes, under certain conditions. |

| Number of drivers allowed on a policy | Depends on the company, usually up to four drivers and four vehicles. |

| Cost of adding a driver | Depends on factors like the driver's age and their motor vehicle record. |

| Adding a driver with a poor driving record | May increase the premium. |

| Adding a driver with a good driving record | May decrease the premium. |

| Adding a teenage driver | May increase the premium significantly. |

| Adding a spouse to the policy | May result in savings. |

| Multi-car policy | Covers more than one vehicle at the same address, usually cheaper than separate policies. |

| Driver exclusion | Can be activated if a driver has a poor driving record. |

What You'll Learn

Adding multiple drivers increases insurance costs

Adding multiple drivers to your car insurance policy will almost certainly increase your premium. This is because insurance companies view multiple drivers as an increased risk. However, it is usually still cheaper than buying two individual policies.

The cost of adding a driver depends on factors such as their age, driving history, and any previous insurance claims. For example, a driver with a history of insurance claims and traffic violations will increase the cost of your policy. On the other hand, some insurance companies offer discounts for teen drivers or good students.

How to Add a Driver to Your Policy

Most insurance companies allow you to add another driver to your policy if they live at the same address or drive your car regularly. You can usually add a driver by calling your insurance company or logging into your account online. You will need to provide the driver's name, date of birth, driving history, license information, and vehicle identification number (VIN) if you plan to share a policy.

Best Practices for Multiple Driver Insurance

If you share vehicles with multiple drivers, it's important to list all drivers on your policy and ensure that someone pays the bills. While your premium will reflect the added risk, a multiple-driver policy is usually more cost-effective than separate policies. You can also look for insurance companies that offer discounts for multiple drivers or vehicles.

How to Save on Insurance with Multiple Drivers

To save money on insurance with multiple drivers, consider shopping around for the best rates and comparing quotes from different insurers. You can also take advantage of discounts offered by different companies, such as good driver or safe driver discounts. Additionally, consider bundling your auto insurance policy with other personal insurance policies to save money.

Insured Savings: Vehicle Protection

You may want to see also

Non-resident drivers

Most insurers allow up to four drivers and four vehicles on the same policy. However, some short-term insurance providers do not offer insurance for non-residents, and those who do not hold a driving licence for the country in question.

If a non-resident driver has their own insurance policy, they may not need to be added to the policyholder's insurance. However, if they will be driving the policyholder's car frequently, it is worth checking with the insurance company to see if they need to be added to the policy as a non-resident driver.

In the UK, a foreign driver with a foreign licence can drive for up to 12 months, after which they need to transfer their licence to a UK one.

In the US, non-US citizens can drive with an International Driving Permit, which is valid for a year, or until their driver's licence from their home country expires. Most US states do not require a person to be a citizen to issue a driver's licence, but they may need to be a resident.

If a non-resident driver on a policy gets a ticket or is involved in an accident, the entire premium will increase. This is because insurance companies cannot discern between drivers on a shared policy, so they apply a blanket rate increase.

GEICO Vehicle Storage: Insured?

You may want to see also

Motor Vehicle Report (MVR)

A Motor Vehicle Report (MVR) is a record of a person's driving history. It includes information about traffic citations, vehicular crimes, accidents, driving under the influence (DUI) convictions, and the number of points on the driver's license. MVRs may also contain personal information such as age, date of birth, gender, eye colour, hair colour, weight, and height. Insurance companies use MVRs to determine insurance rates, with those with clean records getting lower rates. Generally, insurance companies can look back at the previous five years of an individual's MVR.

MVRs are also used by employers to determine the viability of a prospective employee, especially in jobs involving commercial motor vehicles. In the United States, the Drivers Privacy Protection Act (DPPA) was enacted in 1994 to protect the privacy of personal information assembled by State Department of Motor Vehicles (DMVs). The DPPA prohibits the release or use of personal information without the driver's permission and sets penalties for violations.

When multiple drivers are insured on the same vehicle, insurance companies will pull everyone's MVRs and claims history to determine the overall risk and calculate a total premium. This means that adding a driver with a history of violations or accidents will increase the premium, as it reflects the increased risk presented by the policy as a whole.

Red Cars: Insurance Premiums Higher?

You may want to see also

Discounts for multiple drivers

While having multiple drivers for one vehicle will likely increase your insurance premium, there are still ways to save money. Many insurance companies offer discounts for multiple drivers, and you can also benefit from other discounts, such as those for safe driving, low mileage, or insuring multiple cars.

Multiple drivers can share a car insurance policy, and many insurance companies provide a "multiple drivers" discount for doing so. This is because it adds an extra line of business to your policy. However, your monthly premium will reflect the added risk of multiple drivers using one vehicle, so you'll likely pay more than you would for a single-driver policy.

Most insurers let you combine up to four drivers and four vehicles on the same policy. If one driver doesn't live in the same household, you can add them as a "non-resident driver". This typically means they don't live in the listed residence but use the vehicle frequently (more than 12 times per year).

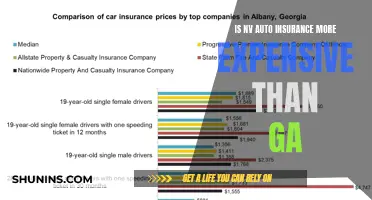

If you have multiple drivers, it's worth shopping around for the best deal. Some companies offer substantial discounts for multiple drivers, such as:

- Geico: Up to 25% off

- Progressive: Up to 10% off

- State Farm: Up to 20% off

- Travelers: Up to 8% off

Other companies that offer multi-car discounts include Allstate, Farmers, Liberty Mutual, Nationwide, and USAA, although they don't specify how much of a discount they offer.

Other Discounts

As well as discounts for multiple drivers, you can also benefit from other savings. For example, you can often get a discount for:

- Insuring multiple cars: Many insurance companies offer a multi-car discount, which can be a great way to offset the cost of insuring multiple vehicles. This usually applies when vehicles are garaged at the same address.

- Bundling insurance policies: You can often save money by bundling your auto insurance with other policies, such as homeowners or renters insurance.

- Safe driving: Some companies offer good driver or safe driver discounts, which can help offset the additional costs of adding a teen driver to your policy.

- Low mileage: Some companies offer discounts for low annual mileage.

Electric Cars: Cheaper Insurance?

You may want to see also

Adding a teen driver

Timing is Important

Firstly, it's crucial to talk to your insurance provider before your teen gets their driver's permit or license. While there is no standard rule, insurance companies have varying requirements, and some may charge you as soon as your teen gets their permit, while others may wait until they have a full license. It's essential to understand your insurer's guidelines to avoid unexpected costs or gaps in coverage.

The Impact on Premiums

Discounts and Cost-Saving Strategies

To offset the high costs of insuring a teen driver, there are several discounts and strategies you can explore:

- Good Student Discounts: Most insurers offer discounts for teens who perform well academically, typically requiring a GPA of 3.0 or above.

- Low Mileage Discounts: If your teen drives infrequently, you may be eligible for a low-mileage discount, especially if they drive less than 7,000 or 5,000 miles annually.

- Driver Training Discounts: Some insurers provide discounts for teens who complete driving training courses, usually ranging from 5% to 15% off the premium.

- Monitor Your Teen's Driving: Signing up for a pay-as-you-drive (PAYD) telematics program can help you save. These programs monitor your teen's driving behaviour and offer discounts for safe practices.

- Student Away Discount: If your teen attends school away from home and doesn't drive your vehicle often, you may be eligible for this discount.

- Multi-Vehicle Discount: Adding another car to your policy can result in a multi-vehicle discount, which can help offset the costs of insuring your teen.

- Choose the Right Car: Insuring a safe and modest car for your teen can help keep costs down. Older, mechanically sound vehicles with safety features like airbags and anti-lock brakes are ideal.

- Share a Car: Instead of adding a new car to your policy, make your teen a secondary driver on an existing vehicle. This usually costs less than having them as the primary driver.

- Delay Licensing: If possible, consider postponing your teen's licensing. The younger the driver, the higher the insurance costs. Waiting until your teen is 17 can result in significant savings.

- Raise Deductibles: Increasing your comprehensive or collision deductible can lower your monthly premium, but keep in mind that your out-of-pocket costs will be higher in the event of an accident.

- Shop Around: Compare quotes from multiple insurance companies, as rates and discounts vary. You may find a more affordable option with a different insurer.

The Bottom Line

While insuring a teen driver can be expensive, it's crucial to ensure they are adequately covered. By exploring discounts, choosing the right vehicle, and practising safe driving habits, you can help keep costs down. Remember to consult your insurance provider and understand the specific requirements and discounts available to you.

Gap Insurance: Vehicle Protection

You may want to see also

Frequently asked questions

Yes, multiple drivers can share a car insurance policy. However, all drivers must be listed on the policy and there may be a limit on the number of drivers and vehicles that can be covered under a single policy.

If one driver on the policy gets a ticket or is involved in an accident, the entire premium will increase. This reflects the increased risk presented by the policy as a whole.

According to The Zebra, Geico and Progressive offer the cheapest rates for multiple drivers.

To add a driver to an existing policy, you will need their driver's license number, Social Security number, and information about their driving history, including any recent accidents or traffic violations.

Yes, if the person drives your car regularly, you should add them to your insurance policy. If they don't live with you and only drive your car occasionally, you probably don't need to include them on your policy.