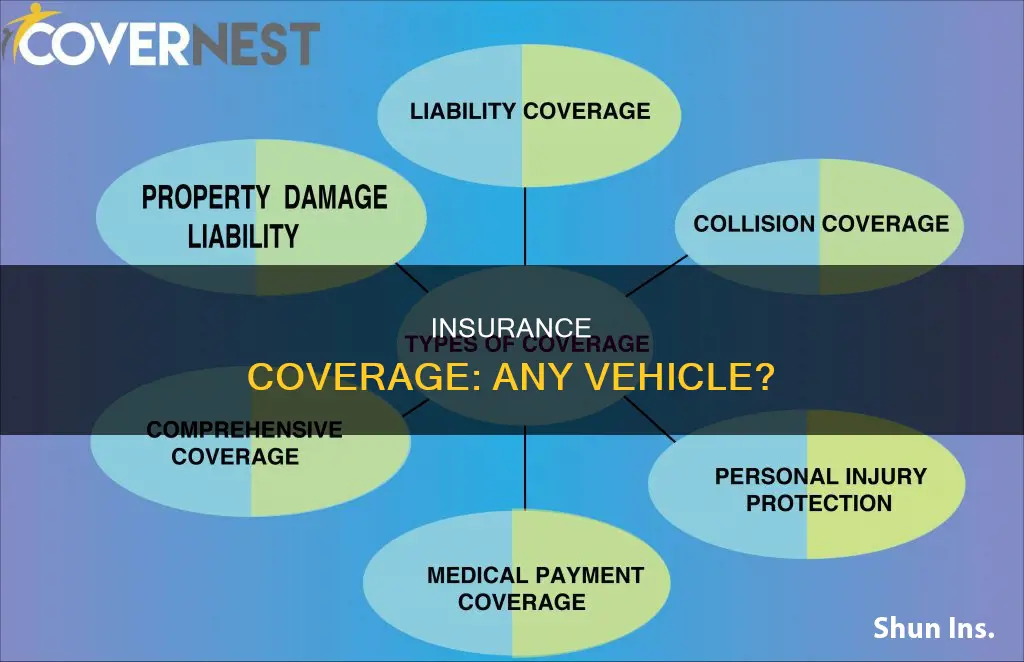

Whether your insurance extends to any vehicle depends on the type of insurance you have and the insurance company providing it. Generally, insurance coverage varies from insurer to insurer and policy to policy. If you have an active auto insurance policy, you may have a short grace period to drive a new car before adding it to your policy. During this time, your insurer will likely extend coverage to your new vehicle in good faith. This grace period typically lasts anywhere from seven to 30 days, but some insurers may not offer one at all. It's important to note that if you don't have an existing policy, you're considered uninsured and won't benefit from a grace period. In this case, you must obtain a new policy before driving your new vehicle.

What You'll Learn

Insurance for borrowed vehicles

Borrowing a vehicle or lending your vehicle to someone else is a common scenario. Whether you're letting a friend or family member borrow your car, or you're borrowing someone else's car, it's important to understand how insurance works in these situations. Here are some key things to know about insurance for borrowed vehicles:

Insurance When Borrowing a Vehicle

When you borrow someone else's vehicle, their car insurance policy typically provides primary coverage for that vehicle. This means that their insurance will be responsible for covering any damages or injuries resulting from an accident, up to the limits of their policy. This is known as "permissive use", which means the vehicle owner has given you permission to drive their car. However, it's important to note that this usually applies to irregular and infrequent borrowing. If you're borrowing a car for an extended period, you may need to be added to the owner's insurance policy.

In some cases, your own insurance policy may also provide secondary coverage if the damages exceed the limits of the vehicle owner's policy. Additionally, if you're renting a car, your insurance policy may extend to the rental vehicle, but it's important to check with your insurance provider to confirm.

Insurance When Lending Your Vehicle

When you lend your vehicle to someone else, your auto insurance policy will typically cover the driver as long as they have your permission and meet certain conditions. These conditions include:

- The driver doesn't use the car regularly.

- The driver is not specifically excluded from your policy by name.

- The type of use is not excluded (e.g., commercial use).

It's important to note that not all insurers cover permissive use, and coverage may vary depending on the driver's experience and licensing status. Additionally, if the driver is a family member who lives with you, some insurers may automatically consider them covered, while others may require them to be included on your policy.

In the event of an accident, the driver's insurance may also provide coverage if they have their own policy. This could apply if the damages exceed your policy limits or if your insurance company seeks reimbursement.

Uninsured or Underinsured Borrowers

If you lend your vehicle to someone who is uninsured or underinsured, your insurance policy will still typically provide coverage for any accidents they may have. However, if they are at fault and the damages exceed your policy limits, they may be personally liable for the additional costs.

Commercial or Business Use

It's important to note that standard auto insurance policies typically do not cover commercial or business use of a vehicle. If you or someone you lend your vehicle to uses it for commercial purposes, such as ride-sharing or delivery services, you may need additional coverage. Be sure to discuss this with your insurance provider to ensure you have the necessary coverage.

Insuring Antique Vehicles: Registration Requirements

You may want to see also

Insurance for family members

When it comes to insurance for family members, there are a few things to consider. Firstly, it's important to understand that insurance coverage can vary depending on the insurer and the specific policy. In general, car insurance will cover other drivers operating your vehicle if they are listed on the policy, such as your spouse, parents, siblings, or children. It may also extend to other household members. For family members not listed on your policy, such as friends or extended family, consent becomes a crucial factor in determining coverage. If you give permission for someone else to drive your car, they are typically covered under your policy. This consent clause also applies when borrowing someone else's vehicle; as long as you have the owner's consent, you are likely covered by their insurance.

Now, let's delve into insurance for specific family members:

Spouse:

Purchasing life insurance for your spouse is generally a wise decision. It ensures financial protection in the event of a premature death, allowing the surviving partner to replace lost income. This is especially important if your spouse is the primary breadwinner. Additionally, insuring a non-earning spouse can be beneficial, as their contributions to running the household and providing childcare have significant financial value.

Parents:

While buying life insurance for parents is less common, there are valid reasons to consider it. One reason is to ensure an inheritance for future generations. Life insurance proceeds can also cover expenses like long-term care or estate taxes, which can be substantial. If your parents require assisted living arrangements, life insurance can help fund those costs.

Children:

Most families do not rely on their children for financial support, so purchasing life insurance for them may seem unnecessary. However, some parents choose to do so as part of a comprehensive financial strategy to pass on wealth to their children. Life insurance can also ensure medical eligibility for children, especially those with pre-existing medical conditions, as they transition into adulthood.

Siblings:

Although less common, there are instances where insuring a sibling makes sense. For example, if your sibling is caring for your parents and you want to be prepared for potential elder care costs if they pass away. Additionally, if your sibling has chronic health issues or faces long-term unemployment, life insurance can help mitigate any financial burden that may fall on you.

Remember, when purchasing insurance for family members, always ensure you have their consent and verify the specific coverage details with your insurance provider.

Insurance First: Buying a Car

You may want to see also

Insurance for commercial use

Whether you need a commercial auto insurance policy depends on several factors. Firstly, consider who owns and drives the vehicle. If a business owns the vehicle, you will most likely need a commercial policy. If you are a sole proprietor, a personal auto insurance policy may suffice, depending on how often and for what purpose the vehicle is used. If the vehicle is used for business purposes, a commercial policy is generally required. However, if you are a sole proprietor who only travels to a few job sites or uses the vehicle for commuting, a personal policy might be sufficient.

The type and weight of the vehicle are also important factors. Larger and heavier vehicles, such as dump trucks, tow trucks, semi-trucks, commercial trailers, or vehicles weighing over 15,000 pounds, typically require a commercial auto policy. These vehicles can cause more damage in an accident and may need specialised insurance coverage.

If your business vehicle requires higher liability limits, you will likely need a commercial policy, as they typically offer higher limits than personal policies. Additionally, if you have specific commercial coverage needs, such as hauling special equipment, transporting goods or people, or operating an unusual vehicle, a commercial policy is necessary.

It's important to note that commercial activities are generally not covered by personal auto insurance policies. If you use your vehicle for commercial purposes, such as delivering pizzas, driving for a ride-sharing company, or operating a delivery service, you will need a separate commercial policy or supplement to insure these activities.

Collectibles: Cheaper Insurance?

You may want to see also

Insurance for new vehicles

Overview

The process of insuring a new car is similar to that of insuring any other vehicle. However, there are some key differences to be aware of. This guide will cover everything you need to know about insuring a new vehicle, from the types of coverage available to the factors that affect the cost of insurance.

When to Buy Insurance for a New Car

It is recommended that you get insurance for a new car as soon as possible, as most dealerships require proof of insurance before you can drive the vehicle off the lot. The timing of purchasing insurance depends on whether the dealer offers a grace period, which gives you time to get a car insurance policy after purchasing the vehicle. It is worth noting that some companies do offer a grace period, typically ranging from seven to 30 days, during which you can drive your new vehicle without starting a new insurance policy.

Insurance Requirements for New Cars

The insurance requirements for a new car depend on the state you live in and the requirements of your lender if you have taken out a loan to purchase the vehicle.

State Minimum Requirements

Each state has its own minimum insurance requirements, usually established by the state's department of motor vehicles (DMV) or a similar agency. These standards can vary widely, so it is important to check the specific requirements for your state.

Lender Requirements

If you have taken out a loan to purchase your new car, your lender may require you to carry additional types of insurance to protect their financial interest. This could include collision coverage, comprehensive coverage, gap insurance, or loan/lease payoff coverage.

Factors Affecting the Cost of New Car Insurance

Several factors can influence the cost of insuring a new car, including:

- The value of the vehicle: Newer cars are typically more expensive to insure because they are worth more.

- Age: Younger and less experienced drivers often pay higher premiums.

- Driving history: A clean driving record can help you access lower rates, while accidents, speeding tickets, or DUIs can increase your premiums.

- Credit score: In states where it is legal, insurance companies may charge higher rates to drivers with poor credit scores.

- Location: Insurance rates can vary significantly between states and even within different areas of the same state.

- Marital status: Some insurance companies offer lower rates to married drivers.

- Types and amounts of coverage: The more coverage you add to your policy, the higher your premium is likely to be.

- Coverage limits and deductibles: Higher coverage limits and lower deductibles will generally result in a higher premium.

Recommended Insurance Providers for New Cars

When choosing an insurance provider for your new car, it is important to consider their customer service reputation, responsiveness, and the range of coverage options they offer. Two providers that are worth considering are:

- State Farm: They offer affordable rates, a wide range of coverage options, and a large number of insurance discounts.

- Travelers: They have an ample coverage portfolio, including options specifically designed for owners of new vehicles, such as Premier New Car Replacement®.

Vehicle Removal: Insurance Coverage?

You may want to see also

Insurance for rental vehicles

When it comes to renting a car, you may be wondering if your insurance will cover you. The answer isn't always straightforward, as it depends on various factors such as your existing insurance policy, the rental company's policies, and the country where you're renting the vehicle. Here is a detailed guide to help you understand insurance for rental vehicles:

In most cases, your auto insurance policy will provide coverage for a rental car as long as you're using it for personal purposes. For example, if you have comprehensive and collision insurance, your rental car will likely be covered for damage, theft, or total loss, assuming it's of similar value to your insured vehicle. However, your regular deductible will still apply if you need to file a claim.

Liability Insurance:

Liability insurance covers injuries or property damage you cause to others in an accident, up to your policy limits. However, it's important to note that your own injuries and any damage to the rental car itself are typically not covered under liability insurance.

Rental Car Insurance Options:

If you don't have comprehensive or collision coverage, or if you're renting a luxury or exotic vehicle that your insurer won't cover, you may need to consider additional insurance. Here are some options:

Loss-Damage Waiver (LDW) or Collision Damage Waiver (CDW):

This isn't technically insurance, but a waiver sold by the rental car company stating that they won't hold you financially responsible for damage to or theft of the rental vehicle, as long as you abide by the rental agreement.

Supplemental Liability Protection:

This provides additional coverage for damage you may cause to other vehicles or property. It's useful if you only have the minimum required liability coverage or if you're travelling in a country where your current policy doesn't apply.

Personal Accident Insurance:

This covers medical costs for you and your passengers in the event of an accident, including ambulance, medical care, and death benefits. However, if you have personal injury protection or medical payments coverage through your auto policy or travel medical insurance, this may be redundant.

Personal Effects Coverage:

This type of insurance covers the theft of your belongings from the rental car, up to a certain dollar amount. However, a homeowners or renters insurance policy may already provide this coverage, even when travelling abroad.

Credit Card Rental Car Coverage:

Many credit cards offer rental car insurance if you use the card to pay for the rental and the rental is in your name. This coverage is usually secondary, meaning it kicks in after your personal auto insurance pays out. However, some cards offer primary coverage, which pays out first, allowing you to bypass your regular insurer.

Standalone Rental Car Insurance:

If you don't want to rely on your existing insurance or credit card coverage, you can purchase standalone policies from third-party companies. These policies can provide primary coverage, so you won't need to involve your regular insurer in the event of a claim.

International Rentals:

It's important to note that your personal auto insurance policy may not cover you when renting a car outside of your home country. In such cases, credit card rental car coverage or standalone policies can be particularly useful, as they often provide coverage for international rentals.

In summary, while your auto insurance policy may provide some coverage for rental vehicles, it's important to carefully review your policy and understand its limitations. In some cases, purchasing additional insurance from the rental company, using a credit card with rental car coverage, or buying a standalone policy may be necessary to ensure you're adequately protected.

Insurance Valuation of Totaled Cars

You may want to see also

Frequently asked questions

Your car insurance typically covers other drivers operating your vehicle if they are listed on the policy. This may include your spouse, parents, siblings, or children.

Whether the policy provides coverage in these situations typically depends on consent. If other people drive your car with your permission, then they should be covered under the terms of your policy.

If you are specifically listed on the car owner's insurance policy, you'll be covered when driving that car – even if it's not your own. If you're not on the owner's policy, applicable coverage will again depend on consent.

If you choose not to renew your policy at the end of its term, inform your insurer before the renewal date. If you've set up an automatic payment plan, be sure to contact your insurer and cancel before the first payment of the renewal term.