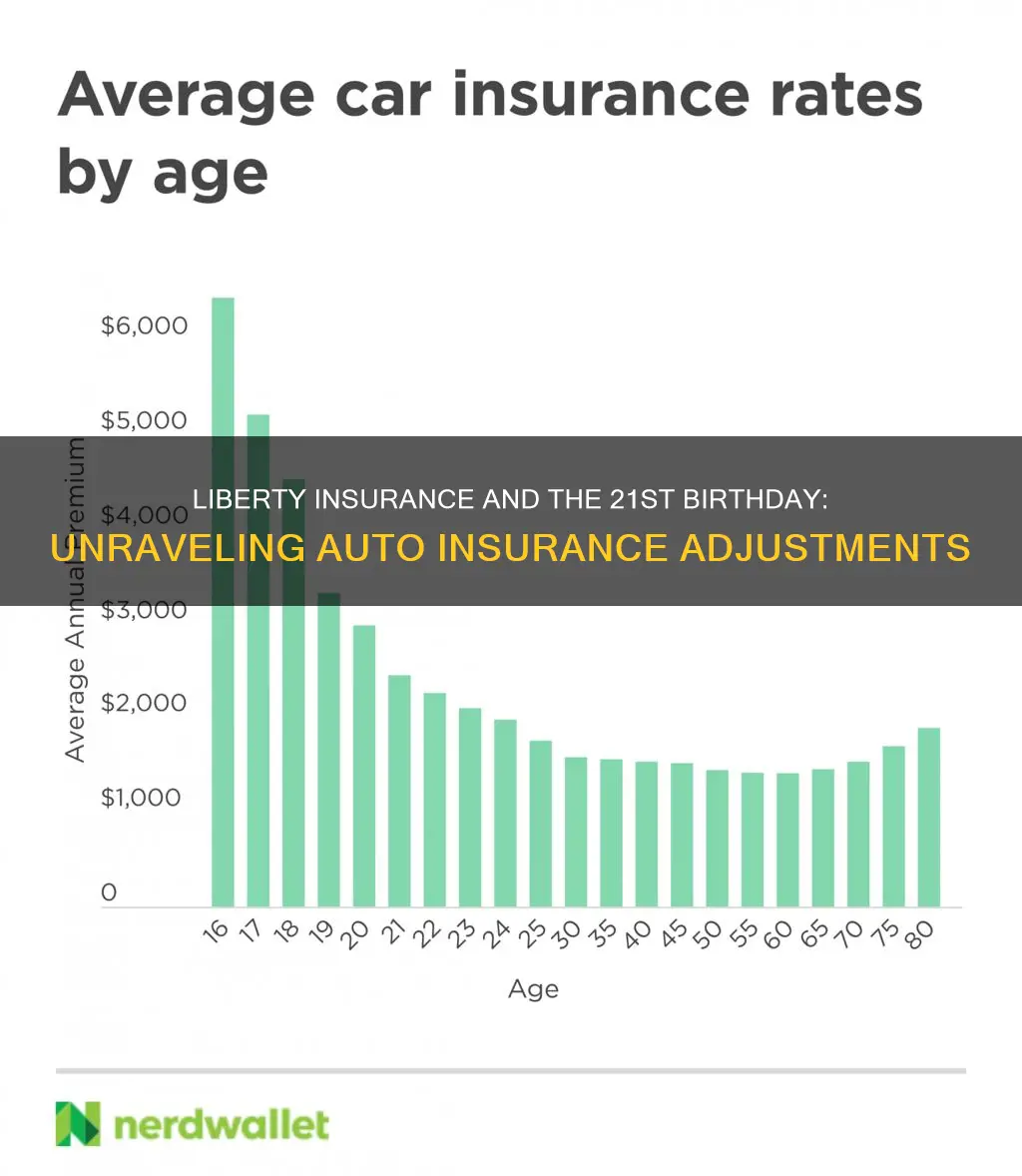

Car insurance rates typically decrease with age, and a person's 21st birthday can see a significant drop in their premiums. However, this is not guaranteed and depends on various factors, such as gender, location, driving record, and credit history. Young drivers are considered higher risk due to their lack of experience, and insurance companies compensate for this increased risk by charging higher premiums. While Liberty Mutual offers auto insurance for teens and young drivers under 25, it is unclear if their rates automatically decrease when the insured turns 21.

| Characteristics | Values |

|---|---|

| Average annual car insurance cost for an 18-year-old | $7,396 |

| Average annual car insurance cost for a 21-year-old | $4,453 |

| Average annual car insurance cost for a 24-year-old | $3,597 |

| Average annual car insurance cost for a 25-year-old | $3,207-$3,348 |

| Average decrease in car insurance rates at age 21 | 17% |

| Average decrease in car insurance rates at age 25 | 9%-11% |

| Average decrease in car insurance rates each year for drivers between 16 and 25 | 13% |

| Average cost of car insurance for a 25-year-old with full coverage | $1,402 |

| Liberty Mutual's discount for adding a new teen driver to an existing policy | New Teen Driver Discount |

| Liberty Mutual's discount for students under 25 with a GPA of B or higher | Good Student Discount |

| Liberty Mutual's discount for drivers under 21 who complete a qualified program | Teen Driving Program Discount |

What You'll Learn

- Auto insurance rates decrease with age, a clean driving record, or by switching insurance companies

- Car insurance rates are higher for young drivers

- Car insurance rates decrease the most at ages 19 and 21

- Car insurance rates are influenced by gender, with male drivers paying more than female drivers

- Car insurance rates can be lowered by taking a defensive driving course

Auto insurance rates decrease with age, a clean driving record, or by switching insurance companies

Auto insurance rates can be influenced by a variety of factors, including age, driving record, and the insurance company. Here are some insights into how these factors can impact your insurance rates and strategies to decrease your premiums:

Age and Auto Insurance Rates

Age is a significant factor in determining auto insurance rates, with younger and older drivers often facing higher premiums. Teenagers and young adults under 25 are generally considered higher-risk drivers due to their lack of driving experience. As a result, insurance companies often charge higher rates to offset the increased likelihood of claims. However, as young drivers gain more experience behind the wheel and maintain a clean driving record, their insurance rates typically decrease incrementally each year until they reach their mid-20s.

For example, according to Liberty Mutual, the average annual car insurance cost for a 25-year-old in the United States is $3,348, which is 55% less than the average premium for an 18-year-old, which stands at $7,396. This decrease in insurance rates with age assumes a good driving record and no serious violations.

As drivers reach their senior years, around age 70, insurance rates may start to increase again due to aging-related factors such as vision or hearing loss and slowed response time, which can contribute to a higher risk of accidents. However, seniors with a clean driving record are unlikely to pay the same high rates as teenage drivers.

Clean Driving Record and Auto Insurance Rates

Maintaining a clean driving record is crucial in obtaining lower auto insurance rates. Insurance companies view drivers with a history of accidents, moving violations, or traffic infractions as high-risk, leading to higher premiums. Even minor infractions can result in increased insurance rates, as insurers consider drivers with imperfect records more likely to file claims.

By contrast, a clean driving record demonstrates safe driving behaviour and can result in substantial savings on insurance premiums. Many insurance companies offer safe-driver discounts to individuals with no or minimal violations or accidents on their record. Additionally, avoiding accidents and moving violations is essential to keeping insurance costs low.

It is worth noting that the impact of a driving record on insurance rates varies by insurer, and some companies may still consider a record with one or two minor violations over a three-year period as "clean." Therefore, it is advisable to shop around for insurance quotes and compare rates to find the most favourable terms.

Switching Insurance Companies

Switching insurance companies is another strategy to decrease auto insurance rates. While price is an essential factor, it is not the only consideration when choosing a new insurer. It is crucial to research and compare companies, considering factors such as customer complaints, coverage options, and perks or freebies offered.

When considering switching, it is recommended to communicate with your current insurer to see if they are willing to match a lower offer. If not, inquire about cancellation policies and potential fees, and ensure your new policy starts the same day the old one ends to avoid a coverage gap, as insurers charge higher rates after a lapse in coverage.

Additionally, shop around for auto insurance at least once a year to ensure you are getting the best deal and keep up with changing rates and offerings. Switching insurance companies can be a straightforward process and can result in significant savings or improved customer service and coverage options.

Unmarried Females: Higher Auto Insurance Rates?

You may want to see also

Car insurance rates are higher for young drivers

Lack of Driving Experience:

Young drivers, especially teens, are considered inexperienced and are more prone to driving errors. This lack of experience leads to higher insurance rates as insurers view them as riskier clients. The risk of motor vehicle crashes is statistically higher among teens aged 16-19 than any other age group.

Higher Risk of Accidents:

Younger drivers are more likely to be involved in accidents due to their inexperience and tendency to engage in risky behaviors like street racing, driving under the influence, or other reckless activities. This results in more insurance claims, which increases the cost of insurance for this age group.

Distracted Driving:

Distracted driving is a significant issue among young drivers, with technology-related distractions like texting while driving increasing the risk of accidents. This makes insuring young drivers more expensive.

Lower Credit Scores:

Young drivers, especially teens, may not have extensive credit histories, and insurers consider their history of paying bills and handling debt when determining insurance rates. Lower credit scores can indicate higher insurance risks, leading to higher premiums.

Higher Claims and Costs for Insurance Companies:

The higher accident rates among young drivers lead to more insurance claims. Insurance companies compensate for these increased costs by charging higher premiums to younger, higher-risk drivers.

While age is not the only factor influencing insurance rates, it plays a significant role in determining the cost of car insurance for young drivers. Young drivers are encouraged to practice safe driving habits, maintain good grades, and compare insurance quotes to find the most affordable coverage options.

Allstate Vehicle Service: Insurance or Contract?

You may want to see also

Car insurance rates decrease the most at ages 19 and 21

Car insurance rates are primarily determined by the likelihood of the insured making a claim. As younger drivers are statistically more likely to be involved in accidents, they are considered higher-risk and therefore pay higher premiums.

According to ValuePenguin, car insurance rates decrease the most at ages 19 and 21. The average annual cost of car insurance for an 18-year-old is $7,179, which drops by 16% when the driver turns 19 and a further 17% when they turn 21.

While Liberty Mutual does not specify the extent to which rates decrease at age 21, they do state that car insurance costs for new drivers typically decrease incrementally each year up to age 25, assuming a good driving record.

In addition to age and driving history, other factors that influence car insurance rates include gender, credit score, location, vehicle type, driving history, and elected coverage.

Auto Insurance Claims: Can You Get Paid?

You may want to see also

Car insurance rates are influenced by gender, with male drivers paying more than female drivers

Liberty Mutual offers affordable car insurance for teens and young drivers under 25. They also offer discounts for students under 25 who achieve at least a B average.

In certain states, it is illegal for insurers to include gender in their rate calculations. These states include California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. In these states, insurance rates are unisex.

The cost of car insurance decreases as drivers gain more experience. While insurance rates for young drivers are high, they will decrease incrementally each year, assuming the driver maintains a clean record. By the time drivers reach their 50s and 60s, they will typically enjoy the best rates, assuming they have a good driving record.

Auto Insurance: Can Employers Reimburse?

You may want to see also

Car insurance rates can be lowered by taking a defensive driving course

Liberty Mutual offers affordable car insurance for teens and young drivers under 25. They also offer several auto insurance discounts for young drivers. While the company doesn't specify whether car insurance rates automatically reduce when a driver turns 21, they do offer a Teen Driving Program Discount for drivers under 21 who complete a qualified program.

Most car insurance companies offer discounts to customers who complete a defensive driving course, and many states legally require defensive driver discounts. These discounts can range from 5% to 20% off the premium cost, and they usually last for three years. The courses are generally affordable, ranging from $15 to $100, and can be completed online or in-person.

In addition to potential insurance savings, defensive driving courses offer several other benefits. They can help get a ticket or citation dismissed, remove points from a driver's license, and teach good driving habits to teenage drivers. They also contribute to safer roads and can lead to long-term savings by reducing the risk of traffic violations, which can result in fines, increased insurance premiums, and potential license suspensions.

To qualify for a defensive driving course discount, individuals should first check with their insurance provider to ensure they offer such a discount and that the specific course they plan to take is recognized by the insurance company. Once they have completed the course, they will receive a certificate of completion, which they can then submit to their insurance provider to claim their discount.

Auto Insurance: Turo Covered?

You may want to see also

Frequently asked questions

Yes, Liberty Insurance offers a Teen Driving Program Discount for drivers under the age of 21 who have completed a qualified program.

The Teen Driving Program Discount is a discount offered by Liberty Insurance to drivers under 21 who have completed a qualified program. Liberty Insurance also offers a Good Student Discount for students under 25 who achieve a B average or higher.

The cost of car insurance typically decreases by about 17% when you turn 21. However, the reduction in cost depends on factors such as your driving record, gender, and location.